Urupong/iStock via Getty Images

Investment Thesis

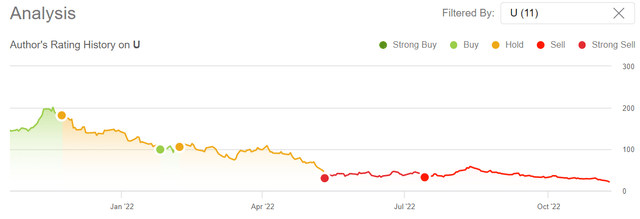

Unity Software (NYSE:U) reported Q3 2022 results that don’t live up to expectations. As we headed into these results I was bearish, as I could see that Unity was struggling to retain traction given that the advertising sector is in such deep turmoil.

Unity Software author’s work

On the one hand, keep in mind that prior to Unity reporting its results, Roblox (RBLX) had reported its results, so investors were bracing for bad news with Unity too.

Hence, in the very short term, as long as Unity’s results were not horrendous, the market most likely be inclined to give its stock a pass.

However, what you’ll see here is that Unity’s near-term prospects are dim. Consequently, I keep my sell rating on the stock.

What’s Happening Right Now?

The tech space is undergoing a massive rerating of its multiples across the board. Concurrently, the advertising space is showing material weakness.

Countless advertising companies have noted how the economic activity was strong at the start of Q3, but as the quarter progressed and moved into Q4, the economic activity deteriorated.

Unity’s platform allows developers to buy advertising to garner new users. Unity is at the forefront of the creative content industry.

Unity Q3 2022

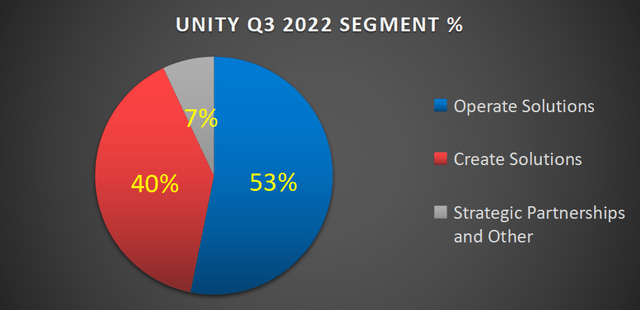

Unity has two products, Create Solutions and Operate Solutions. Unity’s Create Solutions is its flagship product. However, Create Solutions is slightly smaller than its Operate Solutions.

Unity’s Create Solutions unit allows users to create, edit, and deploy 2D, and real-time 3D content. While its Operate Solutions is aimed at engaging and providing the tools to monetize users.

The idea is that developers would come to Unity for its Create Solutions, and be cross-sold its Operate Solutions.

During the call, Unity sought to put as much attention as possible on its Create Solutions segment, which accounts for less than half of its business,

Revenue Growth Rates Post Merger

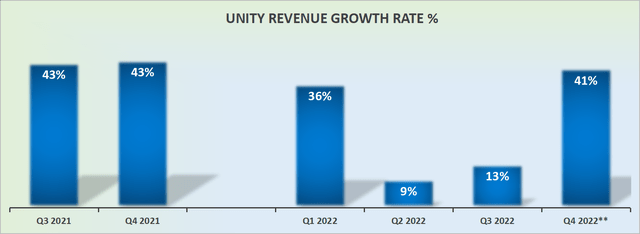

Unity revenue growth rates

As you can see above, Q4 2022 is expected to see revenues grow by 41% y/y. However, keep in mind that this includes its IronSource acquisition. Without this acquisition, its organic growth rates would be substantially lower.

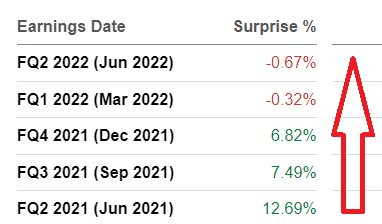

And to be clear, Unity is not lowballing estimates to allow for an easy beat. The days when Unity was handily beating revenue estimates are now gone, as you can see below.

Unity’s consensus revenue estimates

During the earnings call, Unity states,

We expect Unity to sustainably grow at a 30% growth rate. As we have said in the past, this will not be the case every single year, but is the compounded growth rate that we expect to deliver.

And while Q4 is expected to grow substantially faster than 30%, once ironSource’s revenues are added together, I believe that this one-off boost isn’t going to get investors’ confidence to return to Unity.

The Non-GAAP Margins Issue

Unity is a leading platform for creating and operating interactive, real-time 3D content. But operating in a cookieless world is creating a struggle for performance-based advertising companies where their business model is to acquire new users. And investors are coming around to realize that this new reality is dramatically impacting the company’s ability to acquire new users.

Moving on, let’s look back to Q4 of last year.

U Q4 2021

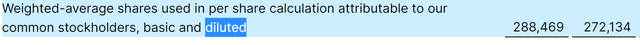

At the time, Unity had 288 million diluted shares outstanding. Now, Unity heads into Q4 2022 expecting to have 562 million fully diluted shares at the end of Q4.

That means that for Unity to grow its inorganic growth rate by 41% y/y, it has to dilute shareholders by 95% y/y.

U Stock Valuation – 3x Forward Sales

Unity acquired ironSource in an all-stock deal for $4.4 billion. This figure is nearly the same as Unity is presently being valued at. Does this mean that Unity overpaid for ironSource? Yes.

But did Unity have a lot of other options? Yes. It was offered a deal by AppLovin (APP) to be acquired for $20 billion.

So, a knowledgeable buyer was willing to pay $20 billion for Unity? And now, Unity plus ironSource together are being valued at less than $8 billion, surely there’s a bargain here?

One part of me wants to price anchor to AppLovin’s valuation. While another part of me recognizes that we are in a very different environment.

And in this new environment, investors are not interested in companies with non-GAAP margins that are profitable. Investors now understand that management teams don’t work for free. And that stock-based compensations are a real cost.

With that in mind, until Unity has a clear path toward GAAP profitability, I believe that this stock is overvalued at 3x next year’s revenues.

The Bottom Line

The one-line takeaway is this, Unity’s stock remains overvalued relative to its near-term prospects.

Unity is highly acquisitive. And while it’s acquiring business at a rapid rate and empire-building, it’s rapidly diluting shareholders. And investors have until now been willing to accept this business strategy.

But slowly, investors are starting to recognize that perhaps this means that there may not be a viable business model in Unity.

Be the first to comment