style-photography

Uniti Group Inc. (NASDAQ:UNIT) is a real estate investment trust (“REIT”) that is principally focused on the acquisition and construction of fiber optic, copper, and coaxial broadband networks and data centers.

The business was formed via a spin-off from Windstream Holdings, Inc (“Windstream”) in 2015. In connection with the spin-off, UNIT entered into a long-term exclusive master lease arrangement with Windstream. Following Windstream’s emergence from bankruptcy in 2020, the master lease was bifurcated into two structurally similar leases. At present, a substantial portion of UNIT’s revenues are derived from these two master leases.

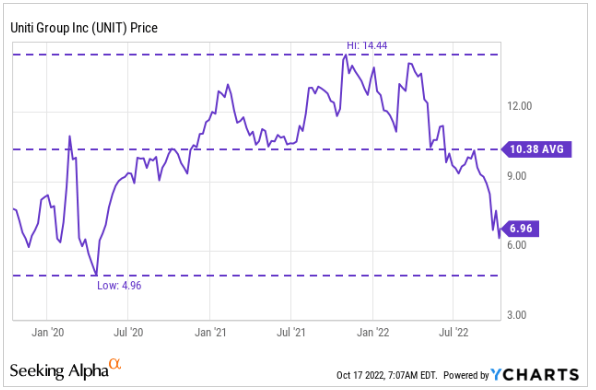

Over the past three years, the stock has traded at a low of about $5 in the middle of 2020 at a forward multiple of adjusted funds from operations (“FFO”) of about 3.0x to a high in the $14 range at the beginning of 2022 at a forward multiple of approximately 8.0x. Currently, shares are trading at the back end of their 52-week range at 4.0x

YCharts – Recent Share Price History Of UNIT

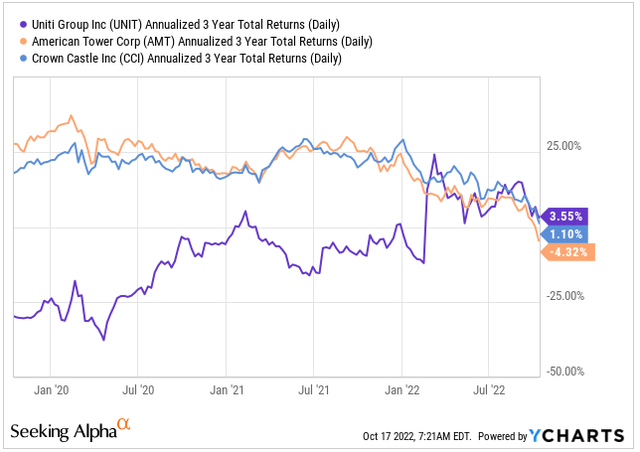

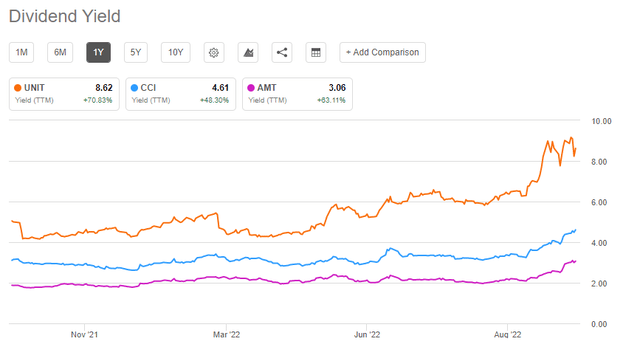

Prior to 2022, UNIT’s performance lagged those of two other peers in the REIT infrastructure sector, American Tower (AMT) and Crown Castle (CCI), but they caught up significantly in the current year, resulting in overall 3-YR annualized outperformance. Granted, UNIT is significantly smaller, and this is reflected in the differential in their pricing multiple, with AMT and CCI both fetching about 15x forward FFO.

YCharts – 3-YR Returns Of UNIT Compared To AMT And CCI

Though shares have rebounded from their lows in recent days, they are still down nearly 50% YTD. The company, however, generates high margins in a mission-critical industry that is resistant to recession. Their renegotiated master lease agreement with Windstream also provides a greater level of stability and predictability to their cash flows than was present in the past. And for income investors, UNIT offers a high-yielding dividend payout that is fully covered by forward-adjusted FFO. While a return to their earlier highs may not be likely in the current market environment, a reassessment of their current trading levels is well-warranted.

A High Margin Business In A Mission-Critical Industry

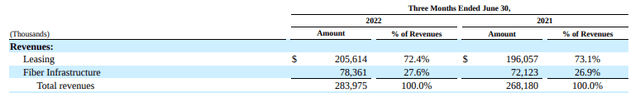

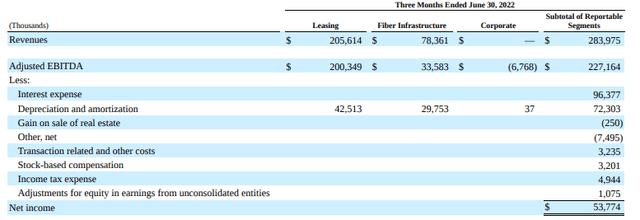

UNIT manages their operations in two primary reportable business segments, Leasing and Fiber Infrastructure. Of the two segments, leasing is the mainstay, representing over 70% of total revenues. Fiber, however, continues to be a growth engine for the company and is likely to represent a greater share of revenues in later years.

2022 Q2FY22 Form 10-Q – Total Revenues By Segment

Currently, the company is a top 10 fiber provider in the U.S. with a network of over 130K route miles. And over the near-medium term, capital intensity is expected to increase as the segment is further expanded to become a more meaningful portion of total revenues. Already, the segment is contributing favorably to monthly reoccurring revenues (“MRR”) through continued lease-ups, which drove MRR to their 5th consecutive quarter of elevated bookings in Q2.

Though EBITDA margins will likely compress in subsequent periods as UNIT grows their fiber network, the overall business still operates on high margins. Most recently, consolidated margin came in at 80%, led by the leasing segment, which posted an adjusted margin of 97% for the quarter. And while margins on fiber are lower, at 43%, it was still up 200 basis points (“bps”) from last year.

2022 Q2FY22 Form 10-Q – Net Income Summary

Predictable cash flows from contracted revenues and high operating margins, combined with the enhanced revenue diversification from their fiber segment mitigates some of the concentration risk resulting from UNIT’s outsized exposure to Windstream, their single largest tenant.

Renegotiated Master Lease Agreement Provides Increased Cash Flow Stability

Though UNIT’s dependence on Windstream remains a credit challenge, the company strengthened their master lease terms with their primary tenant following their exit from Chapter 11 bankruptcy protection in September 2020.

Under the revised agreement, UNIT continues to receive the same contractual lease payments as originally stated within the original payment terms. But in addition to that, the company obtained guarantees from the subsidiaries of Windstream, which greatly minimizes the risk of losses in any future potential bankruptcy proceedings.

In return for these benefits, UNIT is now contractually committed to provide up to +$1.75B in growth capital improvements (“GCI”) through the expiration of the agreements, which will be in 2030. Though the company should earn an appropriate yield on these payments, the contractual commitments now more firmly link the two company’s credit profile, which can be a net negative for ratings purposes. On the other hand, the payments could also be seen as beneficial as they are serving as an accelerant to Windstream’s focus on fiber investments.

The bifurcation of the agreement into two separate network leases also is a net benefit as it could facilitate the future sale of these businesses that are focused on different end networks. With M&A activity a focal point of management’s strategy, this could come into play in later periods.

UNIT Has A High Yielding Dividend Payout That is Fully Covered

UNIT’s current annualized dividend payout is $0.60/share. At current prices, this represents a yield of over 8%, up significantly from just over 4% at their 52-week highs. At these yields, questions regarding safety are likely to be at the top of the list from any income-focused investor.

Seeking Alpha – Dividend Yield Of UNIT Compared To CCI And AMT

In the full year ended December 31, 2021, the company generated +$499M in operating cash flows and paid out +$141M in dividends. The payout, therefore, represents just 28% of operating cash flows. And even when considering the company’s investing activities, which totaled +$321M, they still had about +$36M left over after paying the dividend.

Returning to the present, UNIT is currently generating a run-rate of approximately +$470M in operating cash flows for the full 2022 year and about +$170M in free cash flows, which would indicate free cash flow coverage of about 1.2x.

Dividend safety also remains supported by adjusted FFO, which is expected to come in at about $1.74/share for the full 2022 fiscal year. At its current payout, the annual dividend represents just 34% of total adjusted FFO, suggesting a high degree of safety.

While the current payout appears safe for the foreseeable future, growth from present levels remains less certain due to rising capital intensity in the near-medium term as the company continues building out their fiber infrastructure segment. This may pressure their liquidity profile in a capital environment that is currently challenged, especially for smaller names, such as UNIT.

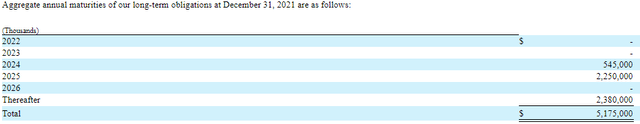

Though the company has adequate liquidity at present with an accommodative debt ladder, resources may be prioritized for capital expansion and/or deleveraging as opposed to dividend growth.

2021 Form 10-K – Debt Maturity Schedule

A Reassessment Of Current Trading Levels Is Warranted

UNIT operates mission-critical communications infrastructure in an industry that provides predictable reoccurring cash flows and downside protection against recessionary forces due to its essential nature. Multi-year investments being made by wireless carriers on 5G network densification also provides a viable runway for continued growth.

As one of the top 10 largest fiber providers in the U.S., with over 130K fiber route miles, the company is well-positioned to capitalize on the strong demand for communications infrastructure. While additions to their fiber infrastructure segment is likely to compress overall EBTIDA margins, UNIT still benefits from high overall margins that are in the 80% range.

Though exposure to Windstream poses significant customer concentration risks, the renegotiated master lease agreement with them provides an enhanced level of predictability to the reoccurring revenue stream. Not only did UNIT retain the same annual lease payments under the original agreement, but they also obtained strengthened lease terms, which includes the addition of guarantees from Windstream’s subsidiaries, thereby minimizing losses in any potential future bankruptcy proceedings.

For income investors, shares present an attractive dividend payout that is currently yielding over 8%, which is over 400bps higher than the yield at their 52-week highs. From a safety perspective, the annual payout of $0.60/share is just 34% of adjusted FFO, which indicates a high degree of coverage.

While shares have rebounded from their lows in recent days, the stock may have further embedded upside. Though a return to their highs is unlikely in the near-medium term due to current market sentiment, a modestly stepped-up multiple is reasonable, given continued EBITDA and cash flow strength, which will likely increase further in later years as capital intensity ultimately peaks.

At $10 a share, UNIT would trade at about 5.7x forward AFFO. This would be 35% above its current price but still 30% below its highs. Combined with the high-yielding payout on cost, this would provide investors with sizeable returns in excess of current risk premiums.

Be the first to comment