jetcityimage/iStock Editorial via Getty Images

UnitedHealth Group (NYSE:UNH) appears to be a great pick for upcoming times of uncertainty. Due to the company’s inelastic demand, it can outperform many other companies in other sectors during inflationary periods and recessions. In fact, the company was able to continue improving its fundamentals during the Great Recession and this would likely happen again in the future. UNH also offers a great dividend that has been consistently rising quickly over the past decade, giving investors a stable and predictable source of income during uncertain times. However, many investors are concerned with the company’s current valuation multiples being so high, as well as the stock appearing to be overvalued. Nonetheless, UNH will likely be a great hold during upcoming uncertainty.

Healthcare Companies Thrive During And After Inflation

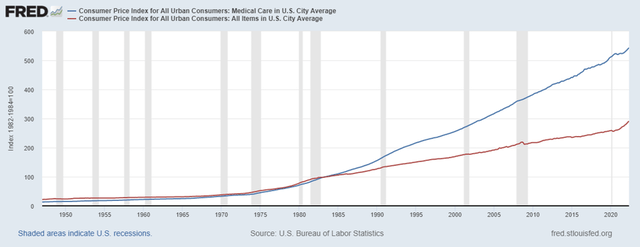

Healthcare companies like UNH are great hedges against inflation. This makes the stock a very attractive pick during current times when the CPI continues to rise to 4-decade highs. Since healthcare has an inelastic demand, prices can continue to rise even when consumers have less buying power than normal. In fact, the price of healthcare in the United States has risen far quicker than general inflation over the past 75 years. Since 1947, the healthcare CPI has increased by about 41x while the overall CPI has only increased by about 14x. To put this into further perspective, the healthcare CPI has had a 75-year CAGR of about 5.1% while overall inflation calculates to 3.5%. With inflation continuing to rise, UNH can continue to raise prices and continue to resist the effects of inflation.

Healthcare CPI vs. Overall CPI (“FRED”)

Even after times of extreme inflation, healthcare companies can continue to raise prices. Take the years after 2008 as an example. During this time, overall inflation slowed to nearly nothing while healthcare prices continued to grow by 2%-3% per year. This allows UNH to see higher fundamentals despite inflation calming down from higher interest rates. Therefore, when other companies are keeping prices stable after this inflationary period is finished, UNH can continue to raise prices and return value to shareholders.

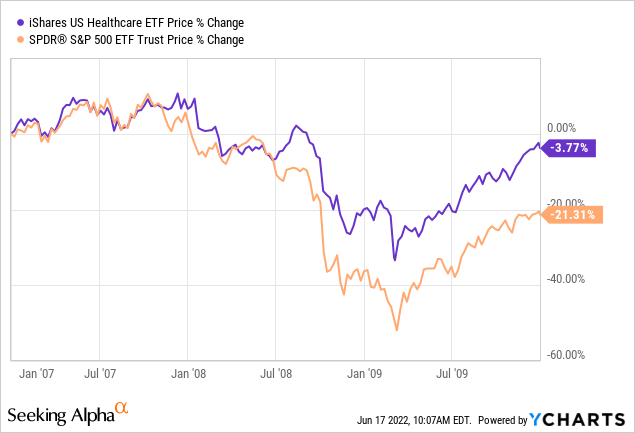

UNH Performed Exceptionally During The Great Recession And Will Likely Do So Again

With a recession likely coming soon, healthcare companies like UNH are becoming a favorite pick among investors. UNH is a fairly recession-resistant company because of the previously mentioned inelastic demand the company’s services have. This was proven during the Great Recession when the company and other healthcare companies thrived while others fell. From 2007-2008, UNH increased its revenue from $68.8 billion to $73.6 billion. This continued to increase throughout 2009 when the company generated $79.3 billion in revenue. Furthermore, the company was able to maintain a consistent net margin which hovered between 4%-7% in the same period.

The company’s balance sheet also saw great strength during the Great Recession. Many other companies were seeing their balance sheets lose strength to stay alive in 2008. Many companies started spending lots of cash and issuing lots of debt during these years. This caused over 60,000 companies to file for bankruptcy soon after. On the other hand, UNH was able to actually increase its total assets by about 10% from 2007-2008. While the company did increase its debt by about $2 billion in 2008, it eventually decreased back down to normal levels in the year after. Since it is very likely that UNH will easily survive and thrive through another upcoming recession, investors may want to look to the stock for protection similar to 2008.

The biggest risk of a recession to UNH is rising unemployment. When consumers get laid off, they lose their employer-sponsored benefits. This would lead to UNH collecting less premiums, therefore, harming the company’s fundamentals. Furthermore, consumers change their healthcare habits during a recession due to having less money to spend. This could also hurt UNH’s top line. However, it is important to note that rising unemployment in 2008 did not affect the company. Unemployment reached as high as 10% in 2009 but, as stated before, UNH continued to improve its fundamentals. This likely means the company will continue to thrive despite future rises in unemployment.

The Company Recently Raised Its Dividend And Has Been Doing So For Over A Decade

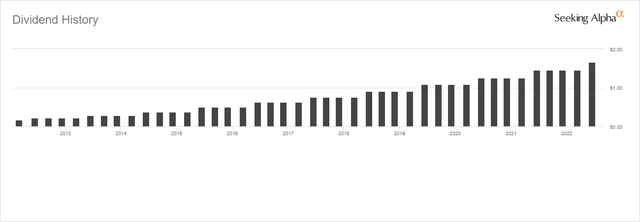

With the vast amount of uncertainty surrounding the market and economy, many investors are looking for safe bets. This is leading more people to search for companies with strong dividends for a stable income and growth. This is one of UNH’s shining aspects. Recently, the company increased its quarterly dividend from $1.45 per share to $1.65 per share. This calculates to a 13.8% dividend hike.

UNH Dividend History (Seeking Alpha)

This follows the company’s trend over the past decade of consistently increasing its dividend. In the past 10 years, the company has increased its quarterly dividend from $0.16 per share to $1.65 per share. This calculates to a CAGR of about 26% and is great for investors who want to see stable income during a recession.

The Acquisition Of EMIS Group Will Allow UNH To Diversify And Capitalize On NHS Investments

Optum UK, an affiliate of UNH, acquired U.K.-based health technology company EMIS Group for $1.51 billion in cash. This will allow UNH to expand its operations outside of the United States and especially with the United Kingdom’s National Health Service, or NHS. Furthermore, it will help the company diversify its revenue for protection against possible downturns. Currently, the UnitedHealthcare segment accounts for 59.3% while OptumRX, OptumHealth, and OptumInsight combine to account for the other 40.7% of revenue. The CEO of EMIS Group, Andy Thorburn, said this about the acquisition:

We believe this combination will have the resources and expertise to enable us to better support the NHS and clinicians through technology innovations. EMIS’s long-standing track record of delivering effective technology solutions and strong financial and operating performance combined with UnitedHealth Group’s resources and expertise will enable us to accelerate our development.

The U.K. announced in late 2021 that £36 billion will be invested into NHS and Social Care over the next three years. This is meant to increase capacities to allow citizens to have much shorter wait times. The reasoning behind this is the serious pressure NHS faced during the COVID-19 pandemic. This large investment will help NHS offer more appointments, operations, and treatments to people in need. With the acquisition of EMIS Group, UNH will be able to benefit greatly from this large investment and further improve its fundamentals.

In FY21, EMIS Group generated about $227 million in revenue and $39 million in net income. The company also has very little debt at only $8 million and recorded a Net Debt/EBITDA ratio of -1.4 due to the company having a negative net debt.

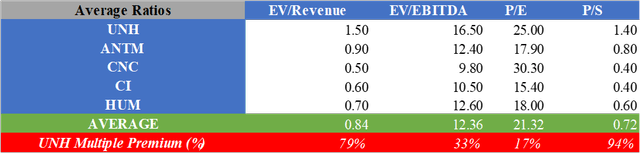

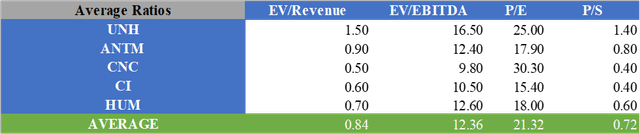

UNH Has Much Higher Valuation Multiples Than Competitors, But It Could Be Justified

One of the biggest concerns many investors have about UNH is its high valuation multiples compared to many of its competitors. All of the most popular valuation multiples for UNH are above the average of the company’s competitors. Currently, the company’s P/S ratio is nearly double the average of the company’s competitors. Furthermore, the company’s EV/Revenue is about 79% higher than the average. While the stock’s EV/EBITDA and P/E ratios are higher than the listed averages, they do not appear to be too high for investors to be very concerned.

UNH Multiples vs. Competitors

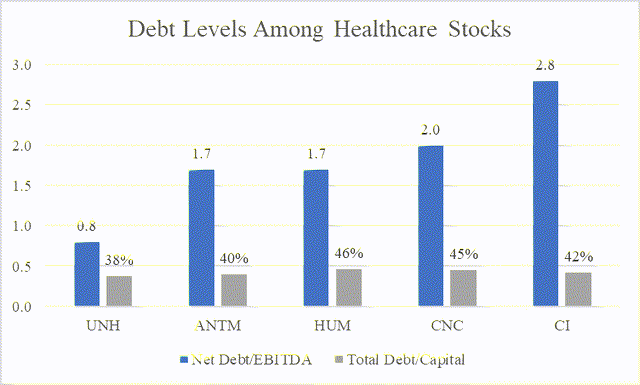

It is important to note that UNH has consistently had higher valuation multiples than other healthcare companies over the past decade, so the company’s currently higher multiples are not a new trend. A reason for this could be because of the much lower debt UNH has than its competitors. Currently, UNH has the lowest Net Debt/EBITDA ratio of any of its competitors at 0.8. Also, the company has the lowest Total Debt/Capital ratio of about 38%. This gives investors more confidence in the company’s valuation as the expected future enterprise value is not brought down by a high net debt. Therefore, the higher valuation multiples UNH experiences may be justified.

Healthcare Debt Levels

Valuation Of UNH Stock

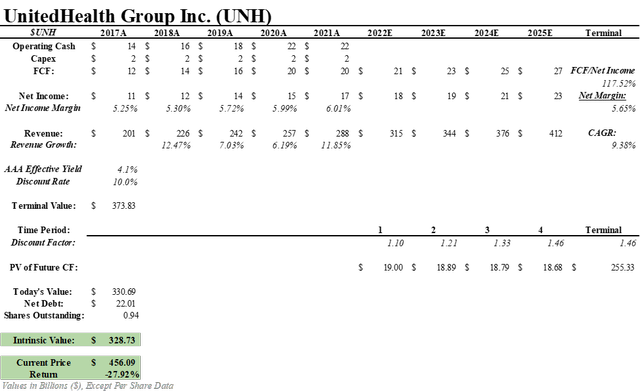

For valuing UNH stock, I decided to do both a DCF and relative valuation. Both of these methods tell the same story that UNH is likely overvalued. For the DCF, I found the company’s average annual growth rate in revenue of 9.38% and applied it by UNH’s most recent revenue to come to future revenue projections. I then calculated the company’s average net income margin of 5.65% and multiplied this by the projected revenue to find future net income. After this, I calculated the company’s average FCF/Net Income margin of 117.52% and applied this to the net income projections to find future free cash flow. For the discount rate, I used 10% to give a good premium over current AAA corporate bonds. After applying this discount rate, adjusting for net debt, and dividing by the shares outstanding, a fair value of $328.73 can be calculated. This means the stock could fall by roughly 27.92%.

UnitedHealth Group DCF with 10% Discount Rate

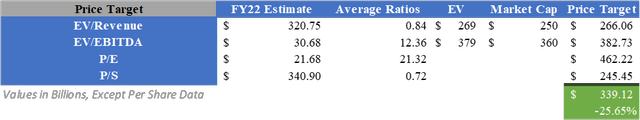

For a relative valuation, I multiplied consensus analyst estimates for FY22 by the average valuation multiples of EV/Revenue, EV/EBITDA, P/E, and P/S of UNH and its competitors. After adjusting for the company’s net debt, a fair value of $339.12 can be calculated. This means the stock could drop by roughly 25.65%. Although UNH’s multiples are higher than the average multiples of its competitors, I believe it is best to be conservative and use the average multiples in this valuation despite if UNH’s multiples are justified.

Relative Valuation of UNH

What Does This Mean For Investors?

UNH appears to be a great pick for upcoming times of uncertainty as healthcare companies outperform during times of inflation due to having inelastic demand. Even after inflationary periods of over and other companies do not raise prices, UNH can follow the industry trend of continuing to raise prices and improve its fundamentals. Also, a recession is likely coming soon and leading to investors looking for safe bets. UNH performed exceptionally well during the Great Recession despite rising unemployment causing risks to collecting premiums. This would likely happen again if a future recession occurs. The company also returns great shareholder value during a recession through its ever-increasing dividend. However, the stock appears to be overvalued and getting in at the right time is crucial for an investment. Therefore, I will apply a Hold rating at this time.

Be the first to comment