pupunkkop

Investment Thesis

United Parcel Service, Inc. (NYSE:UPS) has obviously rallied, given its stellar performance in the past two years. Nonetheless, the stock had also struggled to break the $220 resistance level in the past year, thereby triggering an evident sideways price action thus far. As a result, we could be seeing an end to the UPS rally, since the stock had remained in the sideways range in the past three months, despite the excellent FQ1’22 earnings call in April 2022.

Ultimately, we believe the stock is still trading at a premium compared to its pre-pandemic levels, with a potential moderate retracement on the horizon. Many big tech companies had plunged since November 2021, with the S&P 500 Index also falling by 21.8% in H1’22, the most it had plunged in the past fifty years ( discounting the COVID-19 pandemic ). Therefore, we reckon that the bear could be coming for the logistics ( and energy ) industries soon, given the apparent decoupling of UPS’ financial and stock performance at the moment. We shall see.

UPS Had Evidently Benefited During The Global Supply Chain Issues

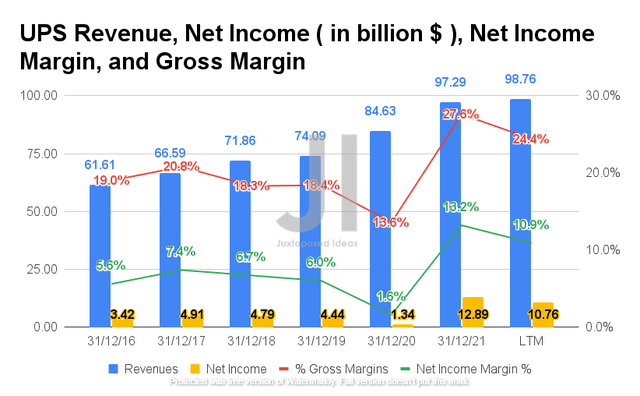

Despite the devastating effects of the COVID-19 pandemic in FY2020, it is evident that UPS had made up for its lost net income in FY2021. By the last twelve months (LTM), the company reported impressive revenues of $98.76B and gross margins of 24.4%, representing a massive growth of 33.2% and 6 percentage points from FY2019 levels, respectively. In addition, UPS had also improved its profitability with net incomes of $10.67B and net income margins of 10.9% in the LTM, representing an increase of 242.3% and 4.9 percentage points from FY2019 levels, respectively. Thereby, justifying the rally in its stock prices in the past two years.

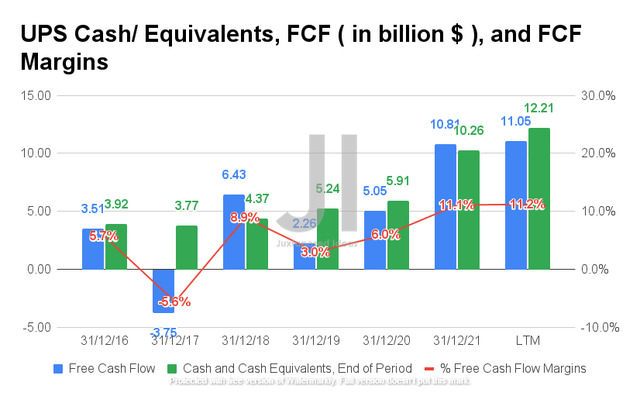

Given its massive net income profitability, UPS also generated robust Free Cash Flow (FCF) in the past year, with an FCF of $11.05B and an FCF margin of 11.2% in the LTM. It represented a remarkable increase of 488.9% and 8.2 percentage points from FY2019 levels, respectively. Since UPS is still expected to report elevated revenue and net income profitability for the next three years, we may expect to see an excellent FCF generation moving forward, speculatively holding its stock price steady during the potential recession.

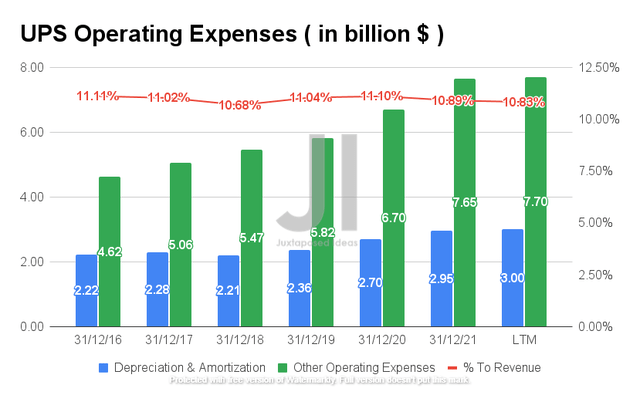

Despite the apparent increase in UPS’ operating expenses, it is also evident that the company had managed to keep the ratio steady to its growing revenues. By the LTM, it reported total operating expenses of $10.7B, representing a massive increase of 30.8% from FY2019 levels, given the global supply chain issues and rising oil/ gas prices. However, we are not concerned, since this only accounts for 10.83% of its growing revenues in the LTM. Moving forward, we expect to see UPS continue outperforming in this segment, since the company continues to pass on additional fuel surcharges to its customers, thereby ensuring its profitability in the short and intermediate term.

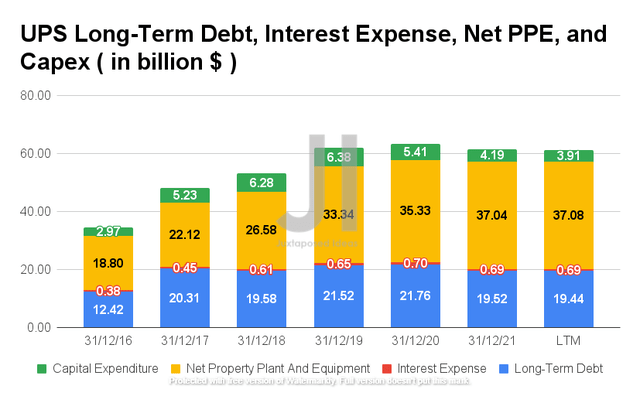

In the meantime, UPS continued to expand its capabilities by increasing its net PPE assets to $37.08B by the LTM, representing an increase of 11.2% from FY2019 levels. Additionally, the company continued to invest $3.91B of capital expenditures in the LTM to ensure its relevance in a highly competitive commodity market. In contrast, it is also evident that UPS has been prudently deleveraging with total long-term debts of $19.44B, representing a decrease of 10.6% from FY2019 levels, given its robust FCF generation. Assuming that the recession does not occur/ affect its operations, we expect these investments to reward UPS handsomely in its top and bottom lines, triggering a massive rally then.

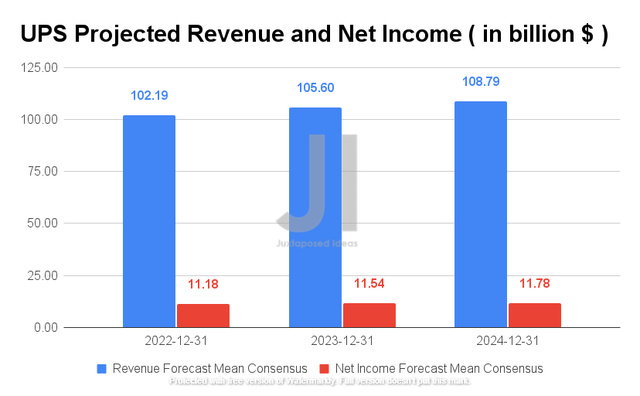

Over the next three years, UPS is expected to record revenue growth at a CAGR of 3.8% while also reporting a normalized net income growth of 21.55%. It is also essential to note that its net income margins will decline from 13.2% in FY2021 to 10.8% in FY2024, though it still represents a massive improvement from pre-pandemic levels of 6% in FY2019. For FY2022, consensus estimates that UPS will report revenues of $102.19B and net incomes of $11.18B, representing an increase of 5% though a decline of 13.2% YoY, respectively.

Analysts will also be closely watching its FQ2’22 performance, given consensus revenue estimates of $24.58B and EPS of $3.16B, representing YoY growth of 4.95% and 3.12%, respectively. Assuming that the company continues to smash consensus estimates as it did in the past consecutive nine quarters, it will be great to see a meaningful stock recovery of 14%, as witnessed in FQ4’21. Nonetheless, given that Mr. Market is rather bearish now, realistically, we may see further sideways action instead as the UPS stock had been in the past three months. We shall see.

The UPS Stock Yields A Decent Dividend

UPS 10Y Share Price and Dividend Yield

The UPS stock has had a relatively steady uptrend behavior in the past decade, further boosted by the global supply chain issues in the past two years. Despite the perceived fall in its dividend yield to 2.74% at the same time, the company has kept its dividend payouts steady through 2020 and 2021, before the eventual 49% increase in 2022. In addition, long-term UPS investors would have had a robust 10Y Price Total Return of 215.7%, highlighting the stock’s excellent long-term investment.

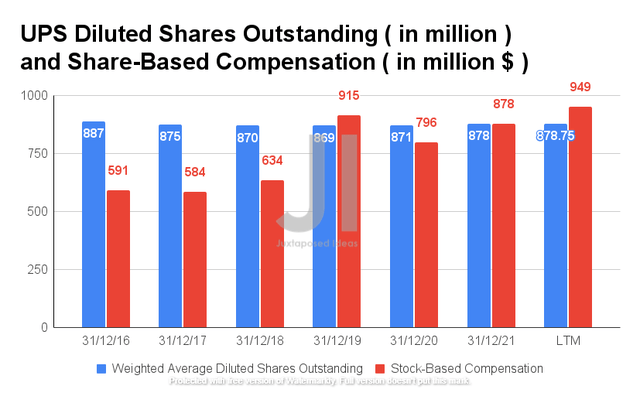

Therefore, despite the apparently elevated Stock-Based Compensation (SBC), it is evident that UPS has managed its diluted shares outstanding well thus far. By the LTM, the company reported SBC expenses of $949M, representing massive increases of 19.2% from FY2020 levels. Nonetheless, UPS’ share count had remained relatively stable in the past two years, with a total of 878.75M by the LTM, representing a minimal increase of 1.1% from FY2019 levels, despite the apparent stock price appreciation of 92.8% at the peak.

In addition, UPS had doubled its FY2022 share repurchase program to $2B, thereby returning additional value to its long-term investors, on top of a 49% growth in its dividend payout for the year. As a result, the stock remains a relatively decent dividend stock for those who had accumulated before the pandemic.

So, Is UPS Stock A Buy, Sell, or Hold?

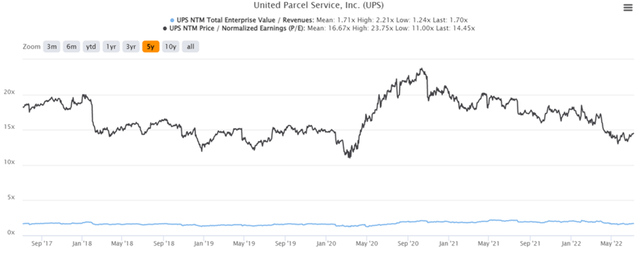

UPS 5Y EV/Revenue and P/E Valuations

UPS is currently trading at an EV/NTM Revenue of 1.7x and NTM P/E of 14.45x, in line with its 5Y EV/Revenue mean of 1.71x though a decline from its 5Y P/E mean of 16.67x. The stock is also trading at $184.64, down 20.76% from its 52 weeks high of $233.72, though still at a premium of 12.1% from its 52 weeks low of 165.34. Nonetheless, if we were to observe UPS’ historical price chart, it is evident that the stock has been struggling to break the $220 resistance level, on top of being over-valued based on pre-pandemic standards.

UPS 5Y Stock Price

Therefore, we are unconvinced of the consensus estimate’s price target of $224.79 with a 21.25% upside, given the reduced margin of safety. In addition, we may also see a potential downside similar to the previous recession in 2008 and 2009. At that time, the UPS stock had fallen by 53.5%, from $74.25 in March 2008 to $39.49 in March 2009, while also reporting a -12% fall in revenues and -41.1% in net incomes YoY in FY2019. As a result, we prefer to wait out a little, since UPS is expected to report FQ2’22 earnings on 26 July 2022, which would provide investors with better clarity on its financial performance and operating metrics.

Speculatively, we expect a moderate retracement to $160s levels, given the fears of a potential recession. Those with a higher tolerance for volatility could potentially enter the market at that point. Even then, the UPS stock would still seem somewhat over-valued.

Therefore, we rate UPS stock as a Hold for now.

Be the first to comment