Christopher Furlong/Getty Images News

Today we are doing an update on a stock which we started covering not too long ago at the Lab, but in the time being we’ve seen some interesting developments in the shareholding structure. Naturally we’re talking about Unilever PLC (NYSE:UL) (OTCPK:UNLYF) (OTCPK:UNLVF) and the arrival of activist investors Trian Fund Management, with its outspoken founder Nelson Peltz.

The news that Trian’s head had taken a place on Unilever’s board broke on the 31st May and the stock price immediately reacted with a +7% gain. Peltz’s group’s stake, which they have been building up this year, is worth 1.5% of Unilever’s share capital and Unilever have said that he will join as a non-executive director on the 20th of July. In this article we’re going to take a look at Trian’s history in this sector and what the arrival of Peltz on the board could entail for the Anglo/Dutch consumer goods giant.

Who are they?

Trian Fund Management is by its own admission a “highly engaged shareowner, bringing a private equity mindset to the public markets”. The Group seeks to “invest in high quality but undervalued and underperforming public companies and to work collaboratively with management teams and boards to help companies execute operational and strategic initiatives designed to drive long-term sustainable earnings growth for the benefit of all shareholders.” Looking at their portfolio of past and current investments, aside from the financials and asset managers, we can see a plethora of consumer goods companies such as: PepsiCo (PEP), Cadbury’s, Kraft Heinz (KHC), Danone (OTCQX:DANOY), and most importantly in this case, Procter & Gamble. Being a direct competitor to Unilever, we will be looking at Trian’s past with P&G as an indicator to what could happen with Peltz on the board at Unilever.

Why Unilever?

“High quality but undervalued” is what Trian are looking for. Unilever has come under fire from its shareholders over mediocre stock performance as well as a failed attempt to purchase the consumer health division from GlaxoSmithKline (GSK). Under the tenure of current CEO Alan Jope in January 2019, Unilever shares have lost 12% compared to a FTSE100 index return of 2% over the same period. Despite the lackluster performance, we at the Mare Evidence Lab are fans of Unilever thanks to the strength of its brands and subsequently its pricing power, which was on show in Q1 of this year. Also, we see the stock as a key value play and noted an important stock buyback.

What can we expect?

Unilever chairman Nils Andersen released the following statement after the announcement:

We are pleased to be welcoming Nelson to the Unilever Board. We have held extensive and constructive discussions with him and the Trian team and believe that Nelson’s experience in the global consumer goods industry will be of value to Unilever as we continue to drive the performance of our business. We look forward to working closely together to create long term sustainable value for our shareholders and wider stakeholders.

Trian don’t have a specific playbook and have adopted many strategies in the past, however, here at the Lab, we are placing internal wagers over what Peltz might do: One of the possibilities which we see is a Cadbury-Schweppes style split – where the investors championed the spin-off of the fizzy drinks division to focus on the higher margin gum and confectionary division (which also led to the eventual takeover of Cadbury by Kraft) – This could make sense for Unilever as it has three key product groups in food, beauty, and household products.

At Procter & Gamble however, they did not actually take Peltz’s advice to split the company into separate units, but compared to Unilever, their product range is a lot more concentrated.

What does this mean for shareholders?

Aside from our internal valuation of the stock where we assigned a buy rating last month, we want to take a look at Trian’s past involvement in consumer goods or food companies and see what kind of performance they have achieved.

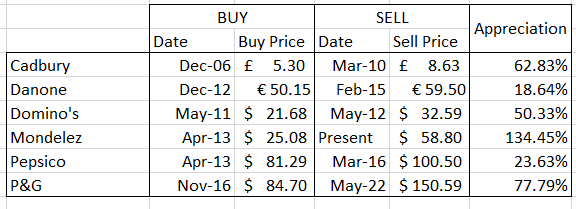

Mare Evidence Lab

In these cases, we took the median prices in the months where Trian entered or exited the stocks. Naturally this relatively basic comparison only takes into account stock appreciation and does not consider any dividends that these stocks pay. We remain confident in Trian’s ability to generate stock price appreciation, considering the appealing dividend and the EV/EBITDA valuation discount compared to peers, we maintain our buy rating.

Be the first to comment