Unilever PLC (NYSE:UL) is navigating this inflationary environment fairly well, trading at 13x EV/EBITDA or 19x forward earnings. It is a stable, dividend-paying consumer staples company with an activist presence on the board (Nelson Peltz) that’s fairly attractive to me in this market. Unilever is a strange beast in that it’s not just strong in the food space with brands like Ola, Magnum and Hellman’s, but also a contender in the health and personal care category. Here its prime brands are Dove and Rexona. I’m mentioning this because it is one of the reasons I’m feeling pretty good investing in Unilever at multiples that are somewhat average for the consumer staples space.

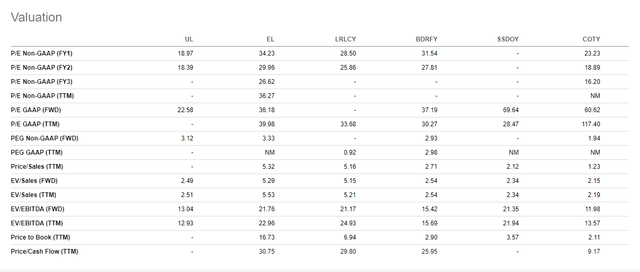

If I pull up Seeking Alpha’s peer statistics, Unilever gets comped against Estée Lauder (EL), L’Oréal (OTCPK:LRLCF), Beiersdorf, Coty (COTY) and Shiseido (OTCPK:SSDOY). Placed in this peer group (see below), Unilever’s valuation immediately stands out:

Seeking Alpha valuation personal health and care (Seeking Alpha)

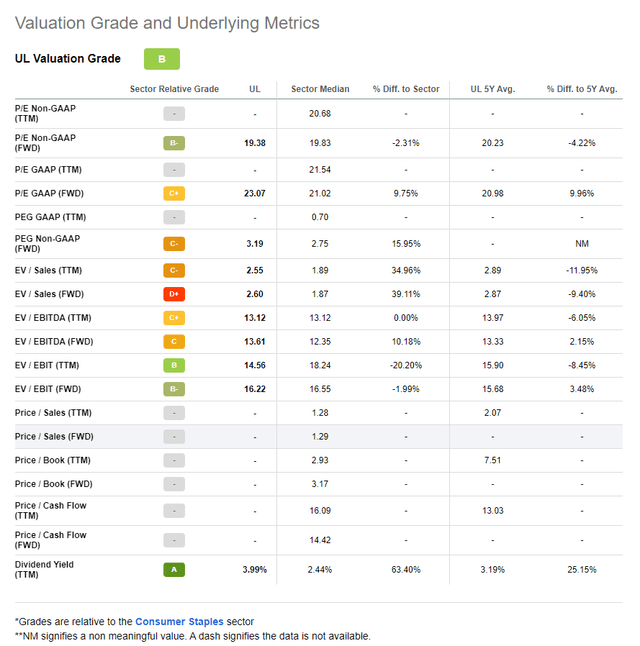

While if you compare Unilever to a more traditional field of consumer staples companies (see below):

Valuations consumer staples (Seeking Alpha)

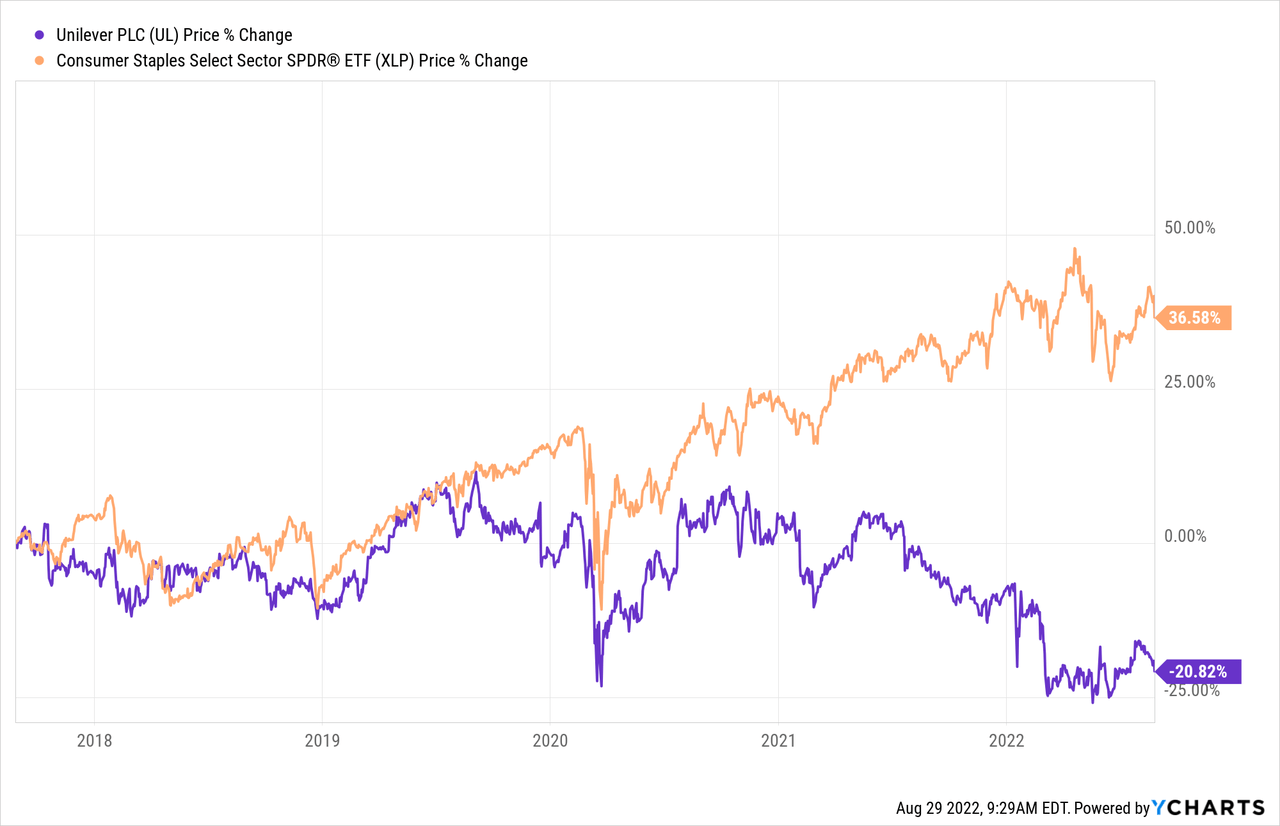

Unilever is valued at the sector median on forward P/E and EV/EBITDA. That’s after a meaningful period of underperformance when measured against that same sector:

In 2017, Kraft Heinz (KHC) approached the company with a $143 billion takeover offer. In turn, Unilever attempted to acquire GSK’s consumer healthcare business for ~$70 billion. The latter trades as Haleon (HLN) now, with a market cap of some $30 billion.

Ultimately, Unilever dropped plans for the large acquisition, likely pressured by several major shareholders. Instead, Unilever sold off its tea division and acquired Nutrafol. Nutrafol is the #1 dermatologist-recommended hair growth brand in the United States. The sequence of event is exemplary for the way Unilever seems to be pivoting strategically, away from food and towards health. As the percentage of HPC increases and the perception of Unilever as a traditional consumer staple changes, the market may start awarding it a higher multiple.

At the same time, Peltz is likely pressuring the company to improve its margins (this is the standard playbook for activists showing up at successful consumer staple companies that often have bloated cost structures). Management indicated this is a target on the last earnings call:

Looking beyond 2022, we expect to improve margin in ’23 and ’24 through pricing, mix, volume leverage, and savings delivery, and as market conditions normalize. And as I said before, we will not be setting a margin target. That concludes our prepared remarks. And with that, let me hand you back to Richard for Q&A.

If in the coming years, margins are improving and a greater amount of revenue can be attributed to HPC, we could see a double whammy. Increased EPS is attributed an improved multiple.

Analyst estimates are in the $2.40-$2.50 range. At an 18x multiple (Unilever’s currently) that’s $43 per share (current share price ~$45). But at a 30x multiple, that looks like $72. Analysts aren’t pricing much margin improvement or growth because current EPS is $2.37. Meanwhile, the company is executing a $3 billion buyback program.

If inflation gets ugly, that could result in deteriorating margins, but so far Unilever has been able to deal with inflation reasonably well. The firm has a long history of being active in inflationary geographies like Turkey, South America, and even China. It has the systems in place to front-run inflation. Management acknowledges it takes turnover hits because it leads on pricing but argues this is preferable to strong margin deterioration. As competitors become better at dealing with inflation, any market share losses should lessen.

Conclusion

Unilever is executing an interesting strategy that could result in a re-rate over time. Meanwhile, a successful activist with a track record of success at similar companies (Nelson Peltz) is on the board. Analysts are pricing in very little EPS growth while the company is buying back $3 billion shares, working on margins, and reasonably managing inflation. Both the activist and Kraft-Heinz approaches suggest room for margin improvements. The market did not like Unilever’s GSK approach and is suspicious of management making a big bet-it-all type of bet. This also seems less likely with Peltz on the board. Unilever’s valuation is very middle-of-the-pack for consumer staples.

Meanwhile, it is halfway there to becoming an HPC company. I like the shares around $46 as there appears to be a good bit of upside if things turn out well. If things don’t turn out so well, this is still a defensive name and should continue to command a reasonable multiple. As Unilever restructures, it pays a sizeable dividend. This is not my top position, but I’m putting money to work in worse spots in this market.

Be the first to comment