JJFarquitectos

Unilever PLC (NYSE:UL) just released its three-month numbers. Here at Mare Evidence Lab’s tower, we have covered the consumer staple giant twice year to date and we encourage our readers to check up on our previous publications so that they are well acquainted with the story up to now:

- May. 16th – ‘Magnum’ sales is a not so ‘comfort’ environment, but we remain ‘Sure’

- Jun. 21st – What does the arrival of Trian mean for the stock?

Our Buy Case Recap

After the failed attempt to buy GSK’s (GSK) consumer health division and the consequent stock price fell-off, we initiated to cover Unilever with a buy rating based on the following five considerations:

- A compelling valuation compared to its peers coupled with a competitive growth rate thanks to Unilever’s exposure to Emerging Markets; in numbers, we estimated a volume growth at more than 4% per year;

- Portfolio rotation towards Prestige Beauty brands over Food production;

- Despite the negative track record on market share over the last five years, our internal team believes that the company is prioritizing margins and we positively looked at this development. Q2 performance just confirmed our assumption;

- CAGNY presentation with a new cost savings target (almost €600 million) and a new organizational structure;

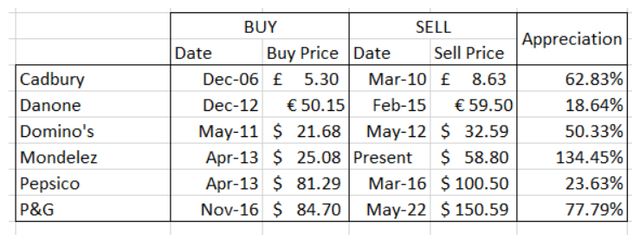

- Activist involvement with a strong track record in the staples sector and superb stock price past performances; here below Trian’s past involvement snap:

Q2 Results

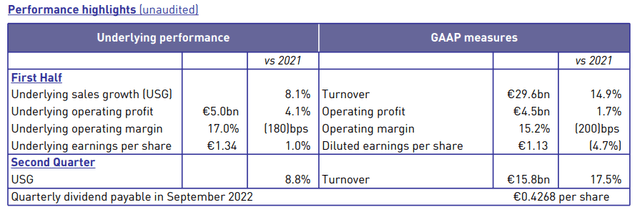

Looking at the results, we expect a positive price reaction. We like to report some of the CEO’s comments that explained how Unilever “despite the challenges of high inflation and slower global growth has delivered sales growth of 8.1% thanks to strong pricing power”. Double checking with Wall Street consensus, we can clearly say that the consumer staple giant delivered a good set of numbers. Top-line revenue growth increased by 8.8% ahead of analyst estimated at +7.1%, whereas volume slightly missed and posted a decline of -2.1% in Q2 versus an -1.75% estimated, but it was well compensated by pass through actions. Indeed, the price increased by +11.2% well ahead of consensus which forecasted a plus 8.5%.

Despite a lower operating profit margin versus 2021 performance, the company delivered a great quarter thanks to the Home Care and Food division. Looking at the geographical area, the Americas and Europe were ahead of analyst estimates. But, we should note that a lower volume was recorded due to the prolonged Chinese lockdown.

Conclusion & Valuation

Portfolio rotation is in progress with interesting bolt-on acquisitions, a pension fund in surplus, a great dividend yield compared to its closest peers, a strong balance sheet, and a superb FCF generation. Unilever says that they “continue to expect to improve margin in 2023 and 2024, through pricing, mix and savings” and in the meantime, the company increased its growth rate 2022 guidance. Thus, adjusting our model with the latest company update, we reaffirm our valuation with a target price of $52 per share. This is based on a 2023 EV/EBITDA forecast of €12.5 billion and a multiple in line with its peer’s average.

Be the first to comment