JJFarquitectos

In light of the recent macroeconomic challenges, here at the Lab, we are looking once again to Unilever’s (NYSE:NYSE:UL) investment thesis and how the latest development might affect the consumer giant.

Ukraine/Russian conflict, energy shock, and rising transportation expenses have increased food costs. On one hand, our internal team has already pointed out that farmers are facing higher fertilizers and fuel costs; on the other hand, food producers are paying higher prices to buy agricultural products and packaging solutions. (In Mare Evidence Lab’s universe of coverage, the former is represented by LSB Industries (LXU), Corteva (CTVA), and Yara International (OTCPK:YARIY), while the latter are Mondi (OTCPK:MONDY), Packaging Corporation of America (PKG), WestRock (WRK), and International Paper (IP)).

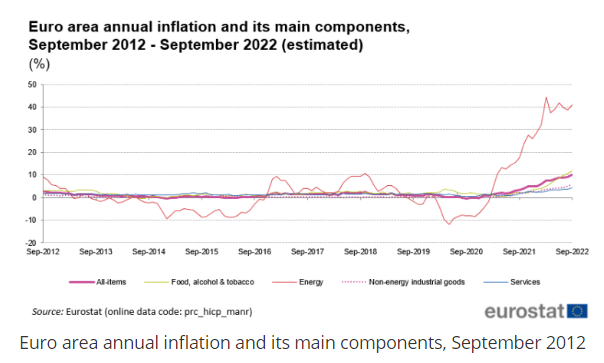

Eurostat data show that general inflation reached 10% in September; however, according to estimates, it should drop to 6% in 2023. This downward trend will not affect the food sector – indeed, the World Bank showed that on average food & beverage sector prices will rise by 23%.

EU Inflation

Source: Eurostat EU

In addition, since wages have essentially remained unchanged, the purchasing power of European households is under pressure and is also affecting consumers’ expectations.

Some large food players have already implemented strategies to reduce their exposure to higher raw material and energy costs, but they would not be able to do the same with higher production costs. At the aggregate level, consumer giants such as Unilever, Danone (OTCQX:DANOY) and Nestlé (OTCPK:NSRGY) are predicting their input costs to grow by 10-15% this year, as a result they are trying to protect themselves by passing the differential on to their customers.

Western countries are certainly more sheltered from food inflation, whereas emerging market inflation is more critical. This is due to the food income share which is considerably greater than in the developed markets. As a rule of thumb, individuals spend in F&B in EM representing almost 30% of their earnings. This might represent a negative development for Unilever’s exposure. For this reason, there are clients who save by buying substitute products. However, we should also note that rising prices do not affect equally all products, this is because consumer price sensitivity is more remarkable for some items such as fruit, vegetables, meat, and dairy products rather than cooking oil and cereals. Even if this price elasticity generally represents a reliable guide for making estimates on customer behavior, we still recommend a cautious attitude, especially in a situation of rising costs in almost all food categories. For this reason, changes in demand may be less strong since substitute products have probably also increased in price. A recent survey shows that in some European countries, including Germany and Belgium, about 40% of consumers are trying to save on daily purchases, opting for their substitutes. Indeed, sales of discounted items or private labels are outperforming the market and we expect such a change to intensify in Europe in the coming months.

Price is not the only critical factor for the sector. Supply chain interruptions and export restrictions are not guaranteeing the availability of most essential food items. Russia and Ukraine are not just two million-hectare granaries, but also exporters of 28% of the flour and 69% of sunflower oil worldwide, and more importantly, potash is produced in Ukraine and it is a fundamental ingredient for fertilizers.

What are we pricing for Unilever?

Long story short, we are forecasting higher sales versus Wall Street expectations. More in detail, our forecast includes Underlying Sales Growth (‘USG’) at 9.5% in the third quarter against Vara’s forecast at +7.8%, with just a volume decline of 0.5% versus consensus estimates at almost minus 3%. Unilever is implementing a series of actions to protect margins from cost pressures. In the short term, they are renegotiating contracts with resellers and implementing promotional activities. At the central level, they are opting for cheaper ingredients to make manufacturing processes more efficient. In the long term, Unilever is already investing in technologies that help relieve cost pressures and opt for divestment of less performing businesses. A weak euro could positively alleviate some pressure on the consumer giant.

As we recently mentioned, thanks to the activists’ involvement combined with an interesting growth rate backed by Unilever’s market penetration in the emerging markets, the company is to be considered a buy target. Unilever’s valuation is compelling as the consumer giant is trading at a 17x P/E on 2023 numbers versus the European Staples (excluding Tobacco) at more than 21x. Looking at its recent Q2 results, production costs weighed on the operating margin which fell to 17%, while earnings per share increased by more than 1% with a positive impact of 4.9% from currency effects. The Group also completed the first tranche of a €750 million buyback and will repurchase a similar amount during the year. This coupled with the dividend should support Unilever’s stock price.

Be the first to comment