Daria Nipot/iStock Editorial via Getty Images

Investment Thesis

Unibail-Rodamco-Westfield (OTCPK:UNBLF), which I will refer to as URW hereafter, is caught in the crosshairs between higher rates and the need to deleverage. The premium in terms of market implied yield the company has historically commanded over largest peer Klepierre (OTCPK:KLPEF) has eroded this year. Nevertheless, I think that the strong liquidity position and long average debt maturity at around 8 years will allow URW to downsize its US portfolio in a timely manner. US and German 10-year yields are up about 150 bps this year, which is quite substantial against the 4.2% net initial yield URW uses for valuations. Nonetheless, the market implied yield of about 6.43% gives a good margin of safety.

I reckon the stock is a buy despite the uncertainties surrounding the US disposal, with a possible long call position a very interesting risk-reward opportunity at current prices given the recent price drop. If you are worried about a capital increase in the event of a failed US exit, you may opt for a long straddle. I think both options strategies are great given the debt-heavy capital structure of the company.

Company Overview

URW operates in four main segments with a total portfolio value of 54.5B EUR as of December 31, 2021, namely retail properties (86% of total), offices (6% of total), convention & exhibition centers (5% of total) and services (2% of total). URW is active in a total of 12 countries.

Operational Overview

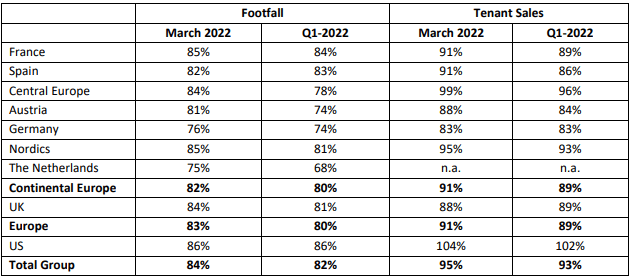

URW continues its recovery to 2019 operating levels, with tenant sales at 93% of 2019 levels in Q1 2022. March figures were already at 95% of 2019 levels, boding well for Q2 2022 and beyond. The company also confirmed its guidance for AREPS (Adjusted Recurring Earnings Per Share) of 8.2-8.4 EUR/share for 2022, which was a bit of a disappointment given that some peers lifted guidance. Looking under the surface however, the company is still disposing small assets in Europe such as Almere Centrum in the Netherlands for 155M EUR, in line with the last appraisal value, and Gera Arcaden in Germany for 116M EUR, above latest appraisal value, which will weigh on AREPS. In essence, I think that, absent these disposals, a guidance lift would have been on the table. Lastly, footfall recovery relative to 2019 continues to lag tenant sales:

Footfall and tenant sales, 2022 relative to 2019 (URW Q1 2022 Trading Update)

The elephant in the room of course is the US downsizing, which is still an open question. Year-to-date 10-year yields on US government bonds are up about 150 bps, which is pretty substantial given that US assets are in the books at a net initial yield of 4.2% as of 31 December 2021. On the flip side, the Consumer price index for urban consumers (CPI-U) stood at 278.8 in December 2021 before rising to 292.3 in May 2022. A 0.7% month-over-month rise in June would push it to about 294.4. In essence, URW’s appraisers in June 2022 will have to weigh a rise in yields, normalizing post-COVID operational performance and year-to-date inflation of about 5.6%.

A parallel shift of 150 bps in net initial yield for US assets (i.e., from 4.2% to 5.7%), which I think is very unlikely given expectations for normalization of inflation going forward, would hit valuations by some 26%, or 20% accounting for year-to-date inflation. Obviously, this would be a huge problem for URW given the debt-heavy capital structure. My base case for H1 2022 US valuations is flat to down 5%.

Market-Implied Net Initial Yield Valuation

To calculate the market-implied net initial yield I will use the EPRA Net Disposal Value (NDV) which I estimate stood at 114.5 EUR at the end of Q2 2022:

Market-implied net initial yield = Valuation net initial yield / Division factor where:

Division factor = Price/NDV Ratio * (1 – Loan-to-value ratio) + Loan-to-value ratio

Substituting with my estimates for Q2 2022, namely:

1. EPRA NDV = 114.5 EUR

2. Loan-to-value = 42%

3. Valuation net initial yield = 4.4%

4. Closing price at the time of writing = 52.02 EUR

You get a Price/NDV Ratio of 52.02 /114.5 = 0.45, a division factor of 0.683 (0.45 * (1-0.42) + 0.42) and a market implied net initial yield of roughly 6.43%. Curiously, this is very similar to where I think Klepierre is currently trading, which looks like a buying opportunity given the historic premium URW has commanded over Klepierre.

The market implied cap rate of around 6.43% is also above the 5.7% outlined above in an adverse parallel shift in net yields scenario. To get to a 5.7% yield, the stock would have to recover to about 70 EUR/share, or 34.6% higher than current levels.

Higher Rates Sensitivity

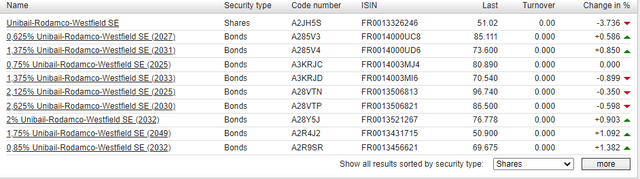

Net debt in H1 2022 should end up around 21.5B EUR after operational results and disposals are factored in. I think the company did a great job locking in lower rates for extended periods given that all bonds trade well below par, sometimes substantially so:

URW Bond prices (Boerse Berlin)

Furthermore, URW is in a very comfortable liquidity position, as per the 2021 Universal Registration Document:

As a result, the Group has a very strong liquidity position with €2.3 Bn of cash on hand and €9.9 Bn of undrawn credit facilities(1) as at December 31, 2021, covering its financing needs for the next 36 months, even without any further funds being raised or disposals being completed. The Group average cost of debt amounted to 2.0% in 2021 and average debt maturity stood at 8.6 years.(2)

Source: URW 2021 Universal Registration Document

To illustrate interest rate sensitivity, I will use the 1.375% May 2033 bond, which currently trades around 70.54% of par. The yield to maturity is around 4.9% which is quite a move given that the bond was trading at par as recently as December 2021. To be fair, the maturity of 11 years is quite long and given the recent uptick in yields corporate treasurers may think twice before locking in such a high rate.

All in all, in my scenario analysis, URW has to absorb a 2.9% rise in yields over 8 years as the current average cost of debt is 2%. Taking my net debt estimate of 21.5B EUR and the share count of 138,594,416:

| Year | AREPS | Impact on AREPS from refinancing |

| 2022 | 8.20-8.40 | – |

| 2023 | 7.74 | -0.56 |

| 2024 | 7.18 | -0.56 |

| 2025 | 6.62 | -0.56 |

| 2026 | 6.06 | -0.56 |

| 2027 | 5.5 | -0.56 |

| 2028 | 4.94 | -0.56 |

| 2029 | 4.38 | -0.56 |

| 2030 | 3.82 | -0.56 |

Source: Author’s calculations based on a total impact on AREPS of 4.5 EUR/share and no rent indexation

Obviously, if rates do stay at elevated levels, you would have to factor in rent indexation of 2% over the period:

| Year | AREPS | Impact on AREPS from refinancing | Impact on AREPS from indexation |

NET impact |

| 2022 | 8.20-8.40 | – | – | – |

| 2023 | 7.97 | +0.23 | -0.33 | |

| 2024 | 7.64 | -0.56 | +0.23 | -0.33 |

| 2025 | 7.32 | -0.56 | +0.24 | -0.32 |

| 2026 | 7.00 | -0.56 | +0.24 | -0.32 |

| 2027 | 6.69 | -0.56 | +0.25 | -0.31 |

| 2028 | 6.38 | -0.56 | +0.25 | -0.31 |

| 2029 | 6.08 | -0.56 | +0.26 | -0.3 |

| 2030 | 5.78 | -0.56 | +0.26 | -0.3 |

Source: Author’s calculations based on a total impact on AREPS of 4.5 EUR/share, partially offset by 2% annual rent indexation (2 EUR/share)

As you can see from the table above, the net impact of higher rates is cut to about 2.5 EUR/share thanks to indexation and long debt maturities.

Investor Takeaway

US valuations will be a focus area in the H1 2022 results given the need to deleverage. That being said, I think the recent price drop creates a buying opportunity, be it an outright long position, a long call position or alternatively a long straddle position in the event US disposals do not materialize, and the company needs to raise equity. Personally, I will continue to monitor the shares and may initiate a position in the coming weeks.

Thank you for reading.

Be the first to comment