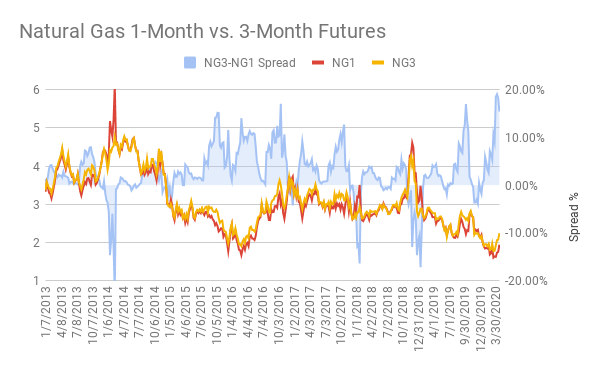

Without a doubt, the stunning nosedive in crude oil below zero (USO) has been the center of attention for the past few weeks. On the other hand, natural gas has been enjoying a period of calm and steadily recovering off the multi-year lows of just above $1.5. Meanwhile, the natural gas ETF (UNG) surged 20% off the lows, though has resumed underperforming its futures counterpart since the beginning of the year due to increasingly negative roll yield:

As of 4/22/2020. Source: WingCapital Investments

Indeed, price erosion caused by rolling of futures positions when term structure is in contango has been extensively discussed on UNG as well as other futures-based ETF products, particularly USO and VXX. In the case of natural gas, with the spread between 3-month and 1-month futures rising from negative to almost +20%, UNG is expected to underperform by roughly 10% over the next 4 weeks based on a regression analysis in the previous article:

Source: WingCapital Investments

Source: WingCapital Investments

Short Covering by Large Speculators Offsets Weak Fundamentals

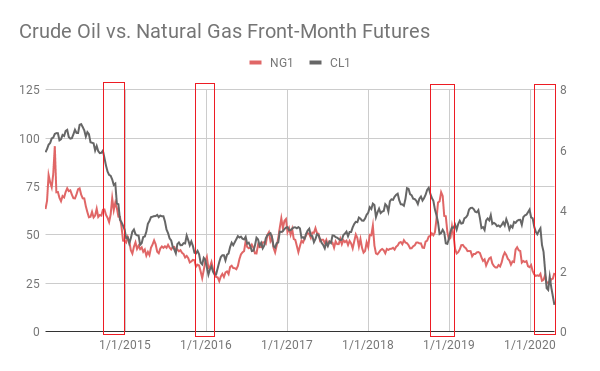

Natural gas rising in the face of the crude oil collapse certainly raised few eyebrows. History suggests such price action is not necessarily bullish for natural gas, as there were actually multiple instances in the past 5 years during which natural gas diverged positively from crude oil but would eventually decline to lower lows.

Source: WingCapital Investments

Source: WingCapital Investments

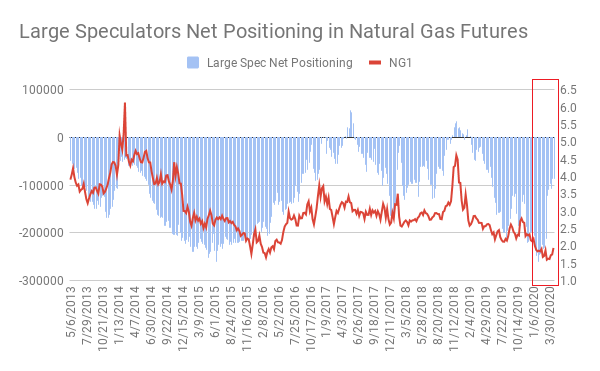

Another possible explanation for the divergence is that liquidation by large speculators, who were caught wrongfooted with the lopsidedly long positions in crude oil futures, may have been forced to close out the equally lopsided short positions in natural gas as well. Indeed, we observe that net positioning in natural gas futures shrank substantially over the past few weeks in the midst of the wild action in crude oil:

Source: Commitment of Traders

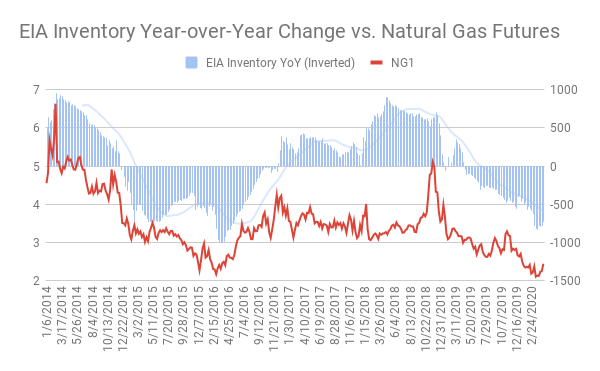

Fundamentally, the buildup in natural gas inventories continues unabated. Based on EIA’s latest report released on Thursday, total stocks rose by 43 Bcf and now stand at 2.140 trillion cubic feet, which is up 827 Bcf from a year ago. While cooler weather has supported near-term demand, long-term fundamental picture remains bleak with year-over-year change in stockpiles on a persistently rising trend:

Source: Energy Information Administration

Looking back during 2015-2016, we notice that the uptrend in year-over-year change in inventories would consolidate for multiple months before the ultimate bear market bottom in natural gas.

Improving Long-Term Technicals Could Be A Bull Trap

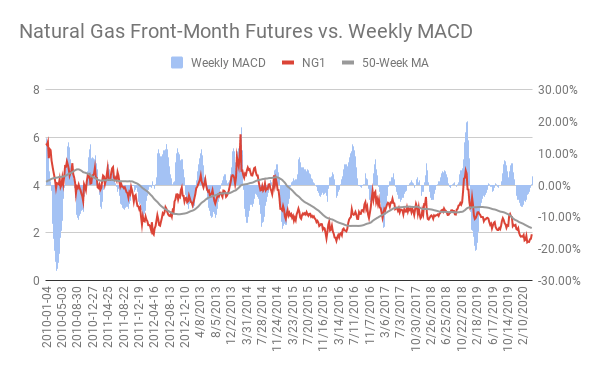

After consolidating and bouncing off the swing lows, momentum has finally shifted back to positive for natural gas after 17 straight weeks on the negative based on the MACD indicator. That said, long-term trend remains firmly on the downside with its price still trading below the 50-week moving average:

Source: WingCapital Investments

Historically, chasing momentum on UNG in a bear market has tended to be a losing proposition. To be specific, we notice that natural gas more often than not would decline to lower lows after the MACD turned positive for the first time in more than 10 weeks while trading below the 50-week moving average:

| Date | UNG | NG1 | NG3-NG1 % | # Straight Weeks MACD < 0 | UNG Forward Chg | 4-Week | 8-Week | 12-Week |

| 12/29/2008 | 793.92 | 5.971 | 1.06% | -24 | -26.92% | -30.19% | -38.90% | |

| 11/8/2010 | 176.32 | 3.799 | 5.32% | -13 | 10.53% | 9.44% | 6.35% | |

| 9/22/2014 | 86.32 | 4.029 | 3.92% | -28 | -10.29% | 4.17% | -17.98% | |

| 3/16/2015 | 56.40 | 2.786 | 2.23% | -13 | -6.10% | 5.53% | -5.11% | |

| 1/4/2016 | 36.84 | 2.472 | 1.01% | -15 | -18.13% | -35.61% | -28.23% | |

| 9/11/2017 | 26.92 | 3.024 | 7.01% | -15 | -3.27% | -1.78% | -17.83% | |

| 5/20/2019 | 22.32 | 2.598 | 0.89% | -20 | -16.26% | -13.04% | -14.43% | |

| 4/13/2020 | 13.20 | 1.75 | 18.29% | -17 | ||||

| Average | -10.06% | -8.78% | -16.59% | |||||

| Median | -10.29% | -1.78% | -17.83% | |||||

| % Positive | 14.29% | 42.86% | 14.29% |

Statistically, there is a more than 85% chance of a double-digit % decline in UNG over the next 12 weeks after the technical condition is triggered. Combined with the fact that contango is much wider today than the other instances, we expect downside potential to be larger than average in UNG due to a substantially more negative roll yield.

To summarize, although natural gas has shown relative strength during the negative crude oil debacle, technicals and fundamentals suggest a long-term bottom is not in. Indeed, historical analysis points to another leg lower in natural gas over the next 3 months. Meanwhile, UNG will most likely continue to underperform the front-month futures due to term structure in deep contango. We expect selling call spreads on UNG to remain a favorable trading strategy as suggested in the previous article.

Disclosure: I am/we are short UNG CALL SPREADS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We may have options, futures or other derivative positions in the above tickers mentioned.

Be the first to comment