Janoka82/iStock via Getty Images

UMH Properties, Inc. (NYSE:UMH) is a small-cap residential real estate investment trust (REIT) with a market capitalization of $2.4 billion. Non-healthcare REITs aren’t my usual fare, but given the current market situation, I am expanding my horizons a bit.

UMH owns, operates and leases multiple properties in manufactured home communities. Manufactured homes are built in a factory and assembled on site, thus they are less costly and more environment friendly. This specific segment of the business is recession-resistant and provides reliable income streams and has enough growth potential in the long term. Besides manufactured home communities, UMH also owns utility connections, common area amenities, lighting, streets, driveways, and other capital improvements. It earns income from leasing, brokerage, and appreciation.

Manufactured homes cost an average of $70,600 compared with $287,000 for a single-family site-built home. Manufactured homes require lower construction cost, and may be up to 50 percent lower than site-built homes. Manufactured homes are sometimes less costly than renting an apartment. And these homes are not small by any means, as today’s new homes average over 1,400 square feet of interior space. Also, these manufactured homes are built to a standard of safety comparable to, and in some cases exceeding, standards for site-built housing.

Many manufactured home communities also consist of social or activity clubs, fitness amenities, basic medical facilities. “Sense of belonging” is an important plus point in such land-leased communities. “The construction of a manufactured home, from factory to finish, can actually yield up to 90% less waste and environmental impact than site-built housing, owing to the efficiency of factory construction and the high standards of the HUD code”. Manufactured housing communities are thus far more green, energy-efficient and eco-friendly than site-built communities.

UMH has been paying a steady quarterly dividend with a decent yield since 1991, i.e., for the past 30 years. It has generated an average annual yield of 4 percent, 5 percent, and 5.7 percent over the past three years, five years, and ten years, respectively. As the current price is quite low (below $24), this REIT serves as a very good investment option for income-seeking investors.

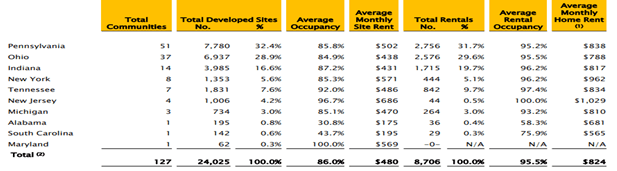

UMH operates in multiple key locations in the United States – New Jersey, New York, Ohio, Pennsylvania, Tennessee, Indiana, Michigan, and Maryland. UMH owns and operates a portfolio of 127 manufactured home communities with approximately 24,000 developed homesites. Through a joint venture with Nuveen Real Estate One community, the company also owns and operates One community with 219 sites in Florida. In addition, this REIT has a land bank of approximately 1,800 acres.

UMH has an average rental occupancy of 95.5 percent and it’s almost the same in all the ten cities that it operates. An average monthly rent on its 8,706 rental units creates enormous revenues considering the small size of this firm. And this REIT is fast expanding its rental portfolio. In the past 12 months, UMH’s rental portfolio has increased by 454 homes during the same period. Anticipating an additional 800-900 homes per year, this REIT is well poised to achieve a huge growth. With 3,400 existing vacant lots to fill and approximately 7,300 future lots to be built in 1,800 vacant acres, it is in a very strong position to generate steady sales and value growth in the future.

UMH Properties (UMH Investor Presentation)

A major positive for UMH is that its collections are consistent with pre-pandemic levels. UMH also acquired 5 communities and 800 sites in the past two calendar years – 2020 and 2021. These surely have impacted UMH. This REIT has been a standout performer during the past one year, with over 28 percent return. When most other REITs failed to match the S&P 500 return, UMH has surpassed it by more than 10 percent. That’s an awesome record in this bear market.

Going forward, UMH Properties, Inc. is thus well-positioned for future growth, due to various factors such as a) consistent value growth and high occupancy rates, b) proven ability to add value through acquisitions and expansions, c) greenfield development initiative that enhances acquisition pipeline, d) significant upside potential due to fast addition of rental units, e) potential demand growth from the expanding energy sector investments near some of its major markets, f) strong land bank and sufficient capital generating capability.

During the past three years, UMH’s growth was 73 percent as compared to 71 percent of S&P. Over the past five and ten years, UMH’s growth was 60 percent and 107 percent, respectively. Looking at its past historical data, where it has been able to generate consistent double-digit growth, this REIT also serves as a good option for growth-seeking investors. Considering the fact that manufactured housing is one of the most affordable options for achieving the American dream of homeownership for everyone, companies like UMH will always be benefitted from the macroeconomic growth. Moreover, all the long-term moving averages are placed considerably below its short-term moving averages. This implies that momentum is on its side. This REIT can also be considered as a star dividend payer. I don’t find any reason why this REIT will not deliver growth towards investors’ wealth in the medium and long term. It is also poised for high return in the short run, unless some macroeconomic uncertainties cripple its outstanding progress.

Be the first to comment