Noam Galai

Investment Thesis

UiPath (NYSE:PATH) guidance leaves a lot to be desired, with H2 2023 being substantially weaker than many expected.

Going into the quarter I had issued a sell rating. I said,

As far as tech businesses go, you have to adapt or die. What kills the investor is that middle ground when the stock is expensive but the growth rates are slowing.

I rate the stock a sell.

Author’s sell rating

While I question how long until shareholders see $18 per share again, I nevertheless believe that there are enough problems under this hood to keep my sell rating on this stock.

The company wants investors to acknowledge that FX is one key problem. And while that’s certainly true, the fact remains that sales cycles are getting longer for PATH and that is going to plague its fiscal Q4 2023 (ending January 2023) exit rate.

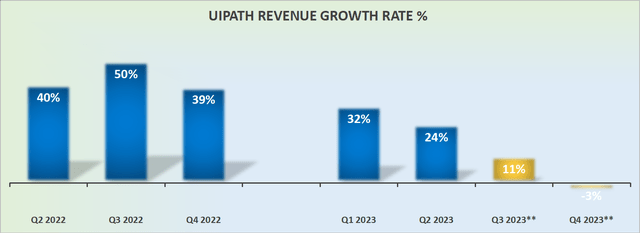

Alluring Revenue Growth Rates Fully Gone

As you can see above, today there’s no question that PATH’s strongest growth days are now in the rearview mirror.

What’s particularly challenging for investors is that its Q4 guidance is pointing towards negative 3% to 5% revenue growth rates.

For a disruptive business that this time last year was reporting more than 40% topline growth, and was guiding for 50% y/y growth for the quarter ahead, today it appears to be two different companies.

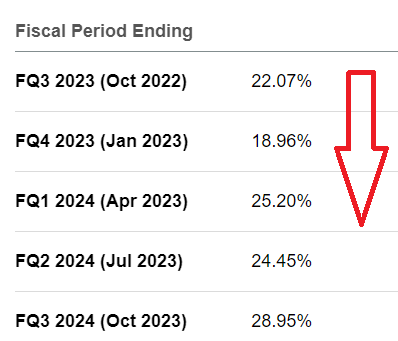

Path’s analysts’ revenue expectations

Even if we allow for the fact that PATH is lowballing its guidance to allow for an easy beat later on, there’s simply no way that its fiscal Q4 2023 guidance is in any way commensurate with analysts’ expectations.

Indeed, consider the fact that even if Q4 2023 ultimately ends up reporting positive 10% y/y revenue growth, this is still a huge gap down from the 19% y/y expected from sell-side analysts and its now expected exit rate.

Even if we factor in approximately $10 to $15 million for currency headwinds, there’s still a huge discrepancy between the above downwards revised guidance and analysts’ expectations.

There’s no way the stock was pricing in this level of negative surprise.

UiPath’s Near-Term Prospects

UiPath is a robotic process automation (“RPA”) software vendor.

During its earnings call, UiPath highlights its near-term opportunities. UiPath notes how the company delivers against high expectations despite currency headwinds plaguing its results.

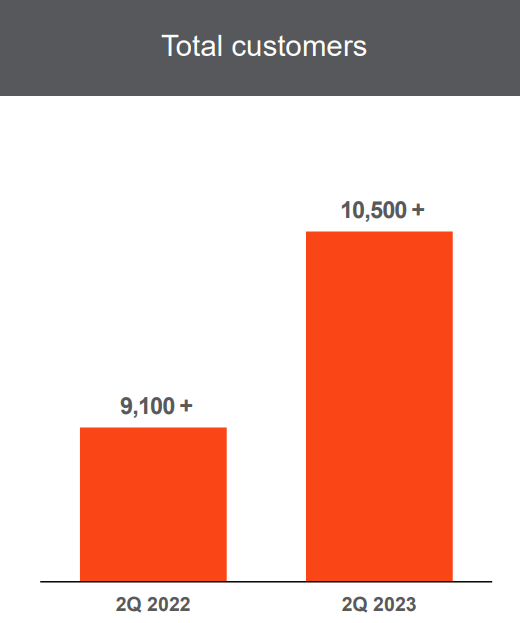

PATH Q2 2023 presentation

That said, its total number of customers was up 15% y/y in the quarter. This compares with a 22% y/y increase witnessed in fiscal Q1 2023.

That being said, UiPath charges that excluding the impact of Russian sanctions dollar-based net retention was 135% in the quarter.

So even if there’s a slowing down in customer adoption rates, dollar-based retention remains a key bullish consideration.

Profitability Profile Leaves Much to be Desired

Consider the following trend in UiPath’s non-GAAP operating margin:

- Q2 2022: 3%

- Q3 2022: 4%

- Q4 2022: 14%

- Q1 2023: -4%

- Q2 2023: -5%

- Q3 2023*: -10%

There’s simply no way that the company is making the right moves to get its bottom line profitability moving in the right direction.

Even if UiPath seeks to reassure investors that fiscal 2024 will be reporting positive free cash flows, between now and then a lot can happen.

That being said, one positive aspect to keep in mind is that UiPath has a remarkably strong balance sheet with approximately $1.7 billion of cash and equivalents and nil debt.

This means that more than 25% of its current market cap is made up of cash; after adjusting for the after-hours drop in the share price.

PATH Stock Valuation — 6x Next Year’s Revenues is Punchy

The main problem with growth companies that suddenly go ex-growth, is that it’s difficult to get comfortable with what the company’s near-term growth rates will normalize to.

If we were to assume that PATH rights its ship so that in fiscal 2024 it can now return to growing at 15% CAGR, that would put next year’s revenues in the ballpark of $1.2 billion.

This means that the stock is now priced at 6x next year’s revenues.

The Bottom Line

The bull case will be focused on two key elements.

The first one that will play a front and center role will be a discussion that the stock is down more than 80% in the past year. That’s called price anchoring.

Where the stock was provides no insight into where the stock is headed.

One could even go so far as to declare that these are now two different companies in two very different macro environments. PATH of 2021 and PATH of 2022 are really very different setups.

And while I was bullish on the company in 2021, that does not mean that I am forced to be bullish on the company in 2022. When things change, you have to change and embrace new ideas. In the investment game, you have to adapt or die.

The second aspect that investors can look to build a bull case is that more than 25% of its market cap is made up of cash.

With those two aspects in mind, I don’t believe there’s enough here for me to do anything but assert a sell rating on this stock.

Be the first to comment