UFP Technologies (UFPT) is a small innovative company with stable results and great growth potential. In recent years management decided to focus on the medical market, and, therefore, its business figures have had a steady improvement. Since the US population is aging, healthcare demand is expected to outpace supply in the future, which is beneficial for UFP. The company is well-positioned to weather this crisis due to its high cash flow generation and its debt-free balance sheet. Its current stock price offers an entry opportunity with a high return potential for long-term investors and a limited downside risk due to its low valuation and its strong financial position.

Activity and description of the company

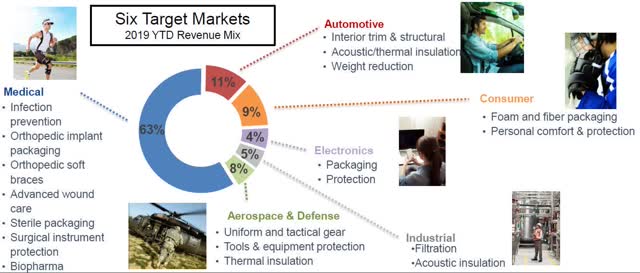

UFP Technologies is a small-cap company listed on the NASDAQ. The company mainly deals in the design and manufacture of specialized solutions in the form of components, subassemblies and products, primarily for the medical market. The company utilizes plastic or foams and through a specific manufacturing process, they provide single-use and single-patient devices and components used in a wide array of products. The company also offers solutions for companies in the automotive, aerospace and defense, consumer, electronics and industrial markets.

Business model

The business model is a significant pillar of the company’s success. UFP business is about giving specific and innovative solutions to its clients. This type of service is quite challenging to replicate since it requires, among other things, precise knowledge, engineering resources and access to a broad range of materials. Most of UFP’s competitors are small companies with limited access to these resources. Thus, it is a business with significant barriers to entry. If UFP can provide efficient solutions, customers would be willing to maintain a strong relationship with the company, which increases its pricing power.

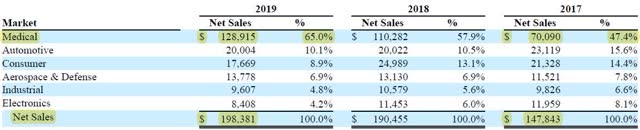

The company has six target markets. However, in recent years, UFP decided to focus primarily on the healthcare sector. Management thought the company could add more value to this sector and therefore make the business more profitable. Since then, its revenue and margins have been improving considerably, as I will show further on. As a result, its medical sales grew from $70M in 2017 to almost $129M in 2019, and nowadays represent 65% of the business.

Organic growth

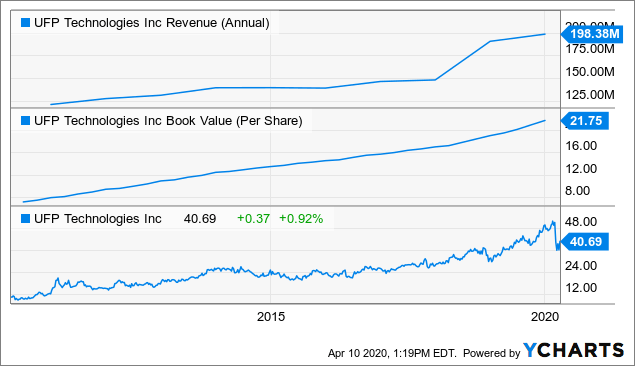

As a result, UFP has achieved a constant organic growth of the business. The recent decade has evidenced a highly positive trend, resulting from an increase in sales and book value per share at a CAGR of 7% and 12.7%, respectively. During the same period, the share price increased 13% annually. Remember that when a company increases its book value and can reinvest the retained profits successfully year after year, it makes the shareholder equity cake larger. Stocks usually reflect this increase in book value by a similar increase in price.

Data by YCharts

Data by YCharts

Future growth opportunities appear promising since the global medical device market is expected to grow at a CAGR of 5.4% and reach $613B by 2025. Moreover, the elderly population is expected to surge in the US and, therefore, increase healthcare demand in the future. This can be beneficial for the company since it almost certainly will increase the demand and price of its products and services.

The company expects to expand the business with existing customers by offering complementary products and services — 85% of new projects are generated from current customers and referrals. Before the current coronavirus pandemic, UFP’s target growth rate was between 5% and 7%.

Successful growth through acquisitions

One important aspect, which is very rare to find, is the proven management skills in expanding its business through successful acquisitions. UFP can generate significant cash flows through its operating activities, and management has been using that capital to invest in other companies and acquiring them when finding an attractive investment opportunity. UFP took advantage of the low prices offered by the financial crisis and expanded its business by purchasing three different companies in 2009. More recently, in 2018, UFP announced the acquisition of Dielectrics Inc., a leader company in the design of medical devices. Such significant investment enabled the company to increase the capacity to meet the rising demand and transfer know-how from Dielectrics to UFP.

Another thing I like about UFP is that it only operates in the US. The American market is very fragmented and no single company holds a significant market share. UFP’s management considers there are more than 500 small companies as potential targets for acquisition, which creates plenty of opportunities to add scale and market share.

Financial Health

Despite its recent acquisitions, the company was able to maintain a solid balance sheet. UFP paid off its debt of $56M borrowed to purchase Dielectrics and it has again a strong borrowing capacity to finance new acquisitions. If the current crisis deepens or lengthens, the company will survive due to its high cash flow generation and its debt-free balance sheet. UFP conservative approach is highly valued during uncertain times. Moreover, the company is reliable in terms of liquidity. A quick ratio above one is already good, and this company has a quick ratio of 2.14, which means the company has plenty of cash to meet its obligations.

Operating performance

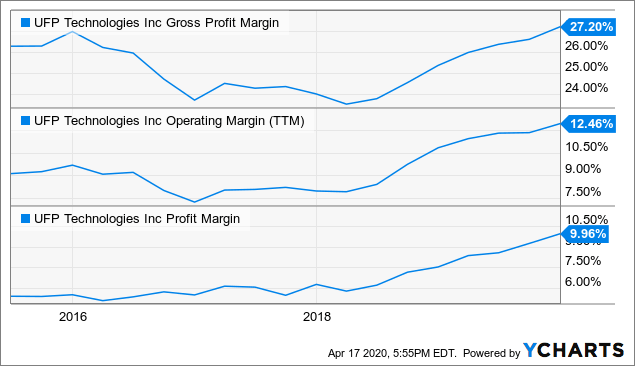

UFP’s return on equity has also improved in the last five years, from 8% to more than 13%, with barely any debt. Although this ROE is not too high, the company has been able to reinvest its benefit and achieve higher profits. On the other hand, the company has managed to improve all margins in recent years — gross, operating and net margins. Its engineering resources and greater access to materials led to an operating margin increase from 7% to 12.5% in the last three years.

Data by YCharts

Data by YCharts

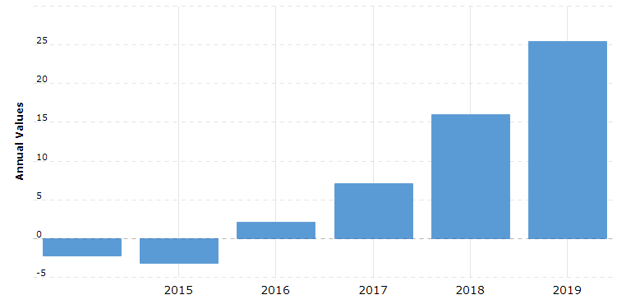

Moreover, its free cash flow generation has been increasing at an annualized growth rate of 65% in the past four years. Of course, it is not possible to maintain such a high rate over the long term, yet it gives an idea of how well the company is doing in terms of cash flow generation. Additionally, positioned the company in a much stronger financial position to let its managers make new acquisitions in the future, as long as they find an attractive investment opportunity.

Weaknesses

UFP is a small company and size matters at crisis times. Small companies tend to be less liquid and more volatile during a bear market, and if the results go sour, stock prices can abruptly fall. The same would indeed happen if things go well, as there is less liquidity, its market cap may also spike. Moreover, UFP depends on a small number of customers for a large percentage of our revenues. The loss of any such customer could have a material adverse effect on its results. Yet, the company has been able to improve its level of diversification of the customer portfolio, and no one customer’s sales exceeded 10% of total sales by the end of 2019.

Although it is not a weakness per se, it is important to mention that UFP does not distribute a dividend. The dividend is significant to me, mainly when I invest in mature companies. However, UFP is a small company that has been able to increase shareholder equity by more than 12% on an annualized basis for the last ten years. It is far better for shareholders if the company retains the profits and reinvest them rather than distribute them as a dividend since it can generate higher returns in the long term.

Valuation

The company is trading at a discount to most of its historical average ratios and much cheaper than just a few months ago. By the end of 2019, all valuation measures were much higher than current ones. UFP is trading at a P/E ratio of 15.47, leading to an earnings yield of 7.62%. An earnings yield above 7.5% for a small company is worthy of investors’ attention, and if the company can keep up with its uptrend in results, the returns obtained can be substantial by buying at this price. The current Price/Book and Price/Sales ratios are not at its lowest level of the past five years, yet, are considerably lower than just a few months ago. Consider the profits and cash flow; there has never been a better time to buy this company than now. Given the significant market growth opportunities, the company seems undervalued under current valuation.

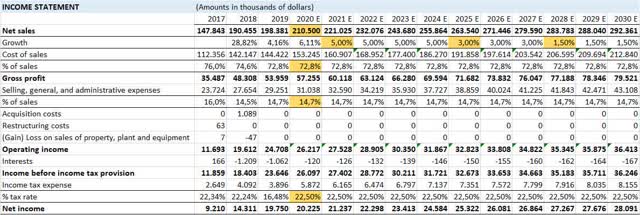

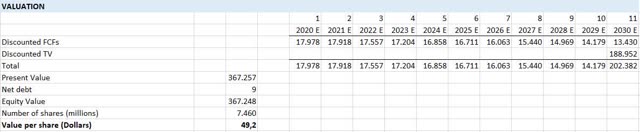

The same is true if we use the free cash flow valuation model to price the company. Considering UFP’s growth target of 5% – 7%, I estimated future sales growth. Although the cost of sales and SG&A expenses are decreasing as a percentage of sales, I assumed these items to remain constant over the projection horizon. Moreover, to discount the free cash flow I used a WACC of 7.2% and to calculate the Terminal Value I used an exit multiple of 14 times net income. Despite my revenue growth expectations are based on a conservative projection, I got a value of almost $50 per share — 20% higher than the current price. Remember that the UFP’s CAGR of sales over the last decade was 7%. If the company can maintain a similar average annual growth rate, the FCF model would give a much higher valuation.

Source: Created by the author using data from UFPT 10-K

Source: Created by the author using data from UFPT 10-K

Conclusions

UFP Technologies offers a great investment opportunity at current prices. Due to the previously mentioned reasons, the company seems well-positioned to maintain its performance and keep up its growth potential. Given the surge in volatility, it is not possible to know what is going to happen in the short term, and the stock price may range between 30 and 50 dollars in the coming months. Despite that, the company maintains a steady growth trend because of its conservative and constant management’s approach to the growing of the business organically and through timely acquisitions. Furthermore, the company is expected to benefit from a tailwind resulting from an increase in demand in the global medical device market. Its downside risk seems limited because of its low valuation and its strong financial position. Given its appealing risk/reward profile and long-term prospects, my recommendation for UFP is a “Buy” at the valuation of $40.7/share and 15.5 P/E, with a more bullish approach if the price drops below $40.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in UFPT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment