Kevork Djansezian

Thesis

Ubisoft (OTCPK:UBSFY) stock lost as much as 30% since I downgraded the game developer to ‘Hold’, as I voiced concerns that the Tencent deal might be designed to shield Ubisoft from any M&A activity. Although I still believe that M&A activity for Ubisoft is unlikely, the company’s valuation has derated to such an extent that it is almost impossible to not consider opening a speculative ‘Buy’ position in Ubisoft stock.

I would like to point out that Ubisoft’s Q2 2023 results and near-term guidance were better than expected.

On the backdrop of EPS updates, I upgrade Ubisoft to ‘Buy’; I now calculate a fair implied base case target price of €63.63/share (UBSFY reference).

Ubisoft’s H1 2023

Ubisoft reported results for Q2 2023/1H 2023 on October 27, and results were better than expected (or feared). During the September quarter, the game developer generated net bookings of €406.1 million, which represents a 3.6% increase versus the same period one year earlier. Interesting, the company itself has previously guided markets to only expect €270.0 million.

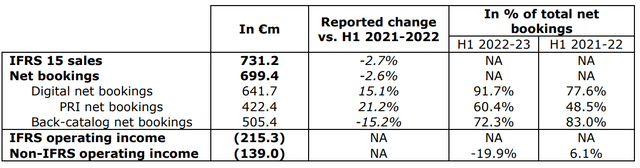

For the 1h 2023, Ubisoft generated €699.4 million of net bookings, and operating income of negative €139 million. The net loss, according to the company, was mainly driven by corporate restructurings and accelerated R&D amortization, as CFO Frédérick Duguet commented: (emphasis added)

The higher than anticipated H1 performance was supported by much stronger revenues from our back-catalog as well as, to a greater extent, by faster revenue recognition phasing for the mobile licensing partnership.

The H1 bottom line notably reflects accelerated R&D depreciation, including for the previously announced cancelled projects as we pivot our focus towards our biggest opportunities.

Ubisoft 1H 2023 results

For the FY 2023, Ubisoft reiterated guidance of about €400 million in operating income, which according to the company will be achievable thanks to Mario + Rabbids Sparks of Hope being a ‘major critical hit’, and thanks to a highly value-accreditive mobile licensing partnership (arguably with Tencent (OTCPK:TCEHY) and Netflix (NFLX)).

Game Updates

Ubisoft highlighted a strong 1H 2023 for Assassin’s Creed and Tom Clancy’s Rainbow Six Siege. According to the company, Tom Clancy’s Rainbow Six Siege reached 85 million unique registered players and the title achieved a 18% revenue growth versus the same period one year earlier. Similarly, the Assassin’s Creed franchise grew to a new record of active players, with Assassin’s Creed Valhalla crossing 20 million unique players. Assassin’s Creed Mirage and (hopefully / perhaps) Assassin’s Creed Red will be launched in early 2023 and late 2023 respectively.

After being delayed in September, Skull and Bones should now be expected to release on March 9. Ubisoft said that game development is ‘finished’, and added:

we are polishing and balancing the game to provide players a gritty and unique pirate captain experience with our dynamic action-packed naval combat multiplayer proposition.

Unfortunately there has not been a major update with regards to the highly expected Avatar: Frontiers of Pandora game. Ubisoft only stated:

We continue to work collaboratively with our strategic partners at Lightstorm Entertainment and Disney as we pave the way to release Avatar: Frontiers of Pandora, led by Massive, in 2023-24. We are thrilled to see this global entertainment brand back in theatres and we remain committed to offering our players another cutting-edge point of entry into the breathtaking world of Pandora.

Valuation: New Price Target

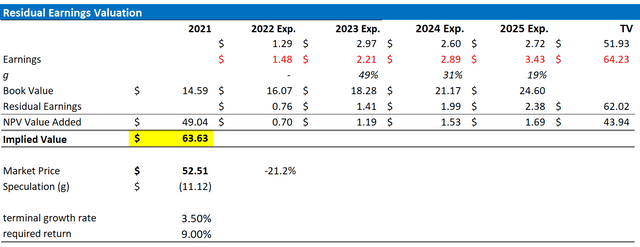

Following Ubisoft’s H1 2023 results, I update my residual earnings model for UBSFY to account for preliminary consensus EPS adjustments. Moreover, I raise the cost of equity to 9% (to reflect higher risk premia for gaming/tech stocks in general), and I lower the terminal growth rate to 3.5%, which I feel is more reasonable than the 4% prior.

Given the EPS updates as highlighted below, I now calculate a fair implied share price for UBI of €63.63, as compared to €65.66/share prior. (UBSFY reference)

Analyst Consensus EPS; Author’s Calculation

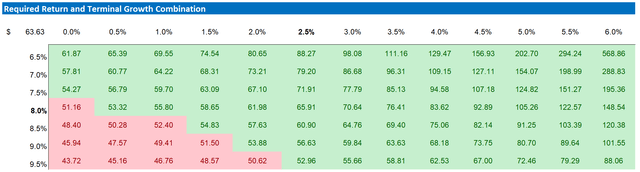

Below is also the updated sensitivity table.

Analyst Consensus EPS; Author’s Calculation

Risks

As I see it, there has been no major risk-updated since I have last covered Ubisoft stock. Thus, I would like to highlight what I have written before:

First, a worsening macro-environment could negatively impact Ubisoft’s business operations. On the demand side: including inflation, rising interest rates and falling asset prices might negatively impact consumer sentiment and entertainment spending. If challenges turn out to be more severe and/or last longer than expected, the company’s financial outlook should be adjusted accordingly.

Second, while high brand-equity companies such as Ubisoft, with quality franchises (e.g., Assassin’s Creed, Far Cry), see relatively little impact from direct price competition or competitive cannibalism, Ubisoft’s competitive positioning and future success are deeply intertwined with the company’s ability to successfully innovate and market new games. Ubisoft’s ability to innovate and launch industry-leading entertainment solutions must further be analyzed in a relative context versus competitors such as EA, Take-Two Interactive and Activision Blizzard.

Moreover, investors should consider that Ubisoft has a ‘unique’ track-record of game delays. And as markets are especially excited for the launch Avatar: Frontiers of Pandora (even though scheduled for late 2023/ early 2024, a delay of said game could easily pressure Ubisoft’s valuation another 10% – 15% lower (personal estimation).

Conclusion

As Ubisoft’s continued success with Assassin’s Creed and Rainbow Six Siege highlights, the Montreuil-headquartered game studio still captures gamers interests and passions. And with the expected release of Avatar: Frontiers of Pandora (even though in some distant future) and new Assassin’s Creed titles, it is unlikely that this ‘magic’ will be lost.

I understand that Ubisoft has troubles keeping promised ‘launch schedules’ for game titles, and I also understand that Ubisoft might appear less shareholder friendly than peers (reference, see Tencent deal to block M&A activity). But reflecting on Ubisoft’s current valuation of only slightly more than €3 billion, I cannot stop thinking that shares are trading near confidence capitulation.

As a function of valuation, I upgrade Ubisoft stock to ‘Buy’; I calculate a fair implied base case target price of $63.63/share.

Be the first to comment