MOZCO Mateusz Szymanski/iStock Editorial via Getty Images

Investment Thesis

Uber Technologies, Inc. (NYSE:UBER) stock has fallen close to 50% YTD, significantly underperforming the market. We cautioned in our previous article in late October 2021 that its weak profitability didn’t justify its valuation, despite its rapid revenue growth. Therefore, the quality of its revenue growth has been questionable.

Notwithstanding, Uber is projected to post free cash flow (FCF) profitability for the first time in FY22 and improve through FY24. Therefore, it augurs well to underpin its valuation, which has been justifiably battered.

Our price action analysis suggests that UBER remains well entrenched in a bearish bias, without a bear trap to help reverse its downward momentum. However, it seems to be consolidating at a near-term bottom.

We revise our rating on UBER from Hold to Speculative Buy, given much-improved valuation metrics. However, the lack of a bear trap remains a critical risk to our thesis, as the market could force another steep sell-off before reversing its bearish bias.

The Market Eviscerated UBER Due To Its Weak Profitability

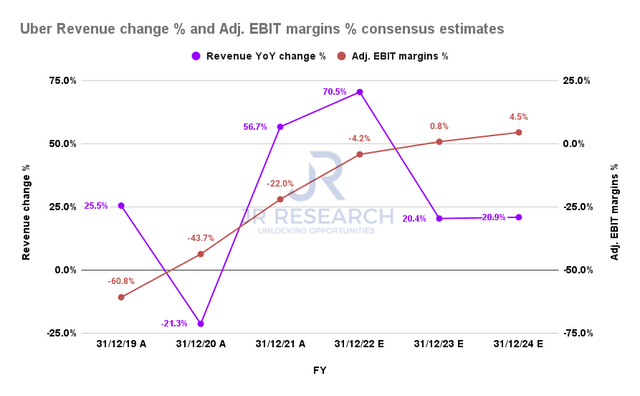

Uber revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The consensus estimates suggest that Uber is projected to increase its revenue by 70.5% in FY22, after FY21’s 56.7% growth. However, its growth is expected to decelerate dramatically to 20.4% in FY23, even though management remains confident in its outlook, even as CEO Dara Khosrowshahi prioritizes profitability moving ahead.

Wall Street is also optimistic that the worsening macro headwinds could impact Uber less than its smaller and less well-capitalized rivals. Barclays emphasized (edited): “Uber could be a major beneficiary if the economy were to contract, as driver supply could ease and it could lose some of its competition, as private market funding dries up.”

Needham also articulated recently that bookings are expected to remain robust, driven by positive user growth metrics.

However, we think the market has gotten its battering of Uber stock on point. As a result, despite its massive growth, Uber is still expected to post negative adjusted EBIT margins in FY22.

But, Uber’s Improving FCF Margins Could Support Its Valuation

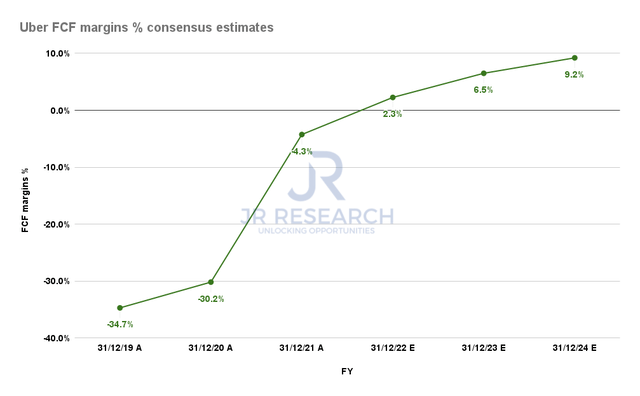

Uber FCF margins % consensus estimates (S&P Cap IQ)

Given Uber’s renewed focus on driving bottom-line growth, we believe the revised consensus estimates indicating Uber could reach FCF profitability from FY22 seems credible.

As seen above, Uber is estimated to post an FCF margin of 2.3% in FY22 and improve to 9.2% by FY24. As a result, we believe it’s constructive to help undergird UBER’s valuation.

| Stock | UBER |

| Current market cap | $41.9B |

| Hurdle rate (CAGR) | 20% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 4.5% |

| Assumed TTM FCF margin in CQ4’26 | 7.5% |

| Implied TTM revenue by CQ4’26 | $57.11B |

UBER reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our reverse cash flow model indicates that UBER could outperform the market at its current valuation.

We applied an above-market hurdle rate of 20%. Using an average 4.5% FCF yield (given Uber’s slowing topline growth), we assumed a blended TTM FCF margin of 7.5%. We factored in an appropriate discount from the consensus estimates in deriving our FCF margin assumption. However, we caution that given Uber’s weak FCF profitability, these estimates could be subjected to significant uncertainty.

Our TTM revenue target of $57.11B by CQ4’26 indicates that Uber seems reasonably valued and could potentially outperform at our hurdle rate.

However, if investors are looking for a more considerable margin of safety, they should consider layering in at even lower levels.

UBER – Bearish Bias Without A Bear Trap

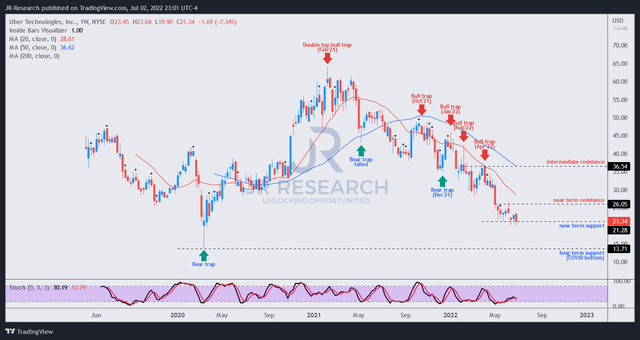

UBER price chart (TradingView)

UBER remains in a dominant bearish bias since its October bull trap (significant rejection of buying momentum) decisively reversed its momentum to the downside. Notably, the double top bull trap in February 2021 flipped its bullish bias around as the market astutely distributed the stock through October.

Furthermore, the series of lower-high bull traps after October corroborated UBER’s downside bias, as the market consistently drew in dip buyers before forcing it lower.

We believe it’s likely at a near-term bottom ($21), but the selling pressure has consistently forced it below its near-term resistance ($26). However, it has attempted to consolidate along with its near-term support since early May, which is constructive.

However, we have not yet observed a bear trap (significant rejection of selling momentum) price action that could help reverse its bearish momentum. Therefore, it’s a critical risk that investors must consider if they choose to add at the current levels.

Is UBER A Buy, Sell, Or Hold?

We revise our rating on UBER from Hold to Speculative Buy.

Its valuation has improved tremendously. As a result, we believe that investors can potentially outperform the market if Uber executes accordingly. But, investors should layer in over time, as we think UBER is not undervalued.

Our price action analysis indicates that UBER has been consolidating at its near-term support since May. However, there’s no bear trap to help sustain its bottom, which remains the most critical risk to our thesis.

Notably, UBER remains mired in a bearish bias. Therefore, investors should consider setting up appropriate risk management strategies to protect against steep drawdowns.

Be the first to comment