Tactical outlook for US equities is bullish niphon

At Successful Portfolio Strategy part of our investment process involves developing and constantly updating two separate market outlooks: Our “strategic” market outlook and our “tactical” market outlook. Our current strategic outlook is that, within the next six months, the S&P 500 will decline substantially below the June 16, 2022 low of 3666. However, it is currently our tactical outlook that US equity prices may stage a substantial short-term “relief rally” in the next few weeks. In this article, we will outline our case for a bullish tactical outlook, encompassing a multi-week timeframe.

Our current tactical outlook can be summarized as follows: The S&P 500 index experienced a sharp decline of 10.1% from the intraday high on August 16 to the intra-day low on September 6, but nonetheless managed to hold on to a crucial technical support region around the 3900 level. After successfully holding support, the S&P 500 index has subsequently bounced above a key short-term resistance, suggesting that the US equity market may have established a short-term bottom. During this Aug 16-Sept 7 sell-off, stocks became significantly oversold from a technical perspective and sentiment became very bearish from a behavioral perspective. The combination of these technical and behavioral conditions creates a propitious environment for a potential relief rally in stocks. In this regard, we believe that in the next few weeks, the flow of US economic data will be supportive of a bullish “soft landing” narrative which – in combination with the propitious technical and behavioral conditions referenced above – will likely provide the basis for a substantial relief rally in US equities.

The Technical and Behavioral Set-Up

In this section, we will review the current technical and behavioral set-up which we believe is propitious for a substantial relief rally in US equities.

Market Held Technical Support & is Emerging from a Short-Term Oversold Condition

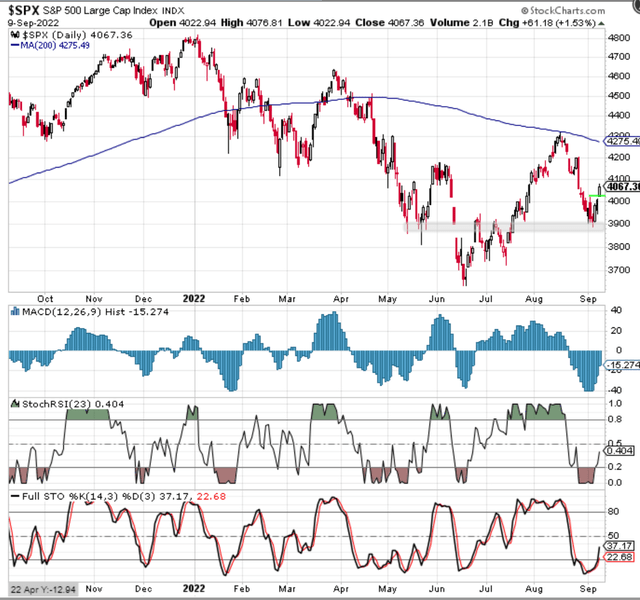

Based on several of short-term “oscillator” indicators utilized in technical analysis, the S&P 500 index became quite oversold during the sharp sell-off that took place between August 16 and September 6.

S&P 500 Chart & Oscillators (Stockcharts)

As can be appreciated above, after holding key technical support around the 3900 area (grey), the S&P 500 index has broken above a key short-term resistance level around 4020 (green) and presently appears to be emerging from deeply oversold conditions according to MACD, Stochastic RSI and Full Stochastics technical indicators.

Sentiment Reached Bearish Extremes: A Bullish Behavioral Set-Up

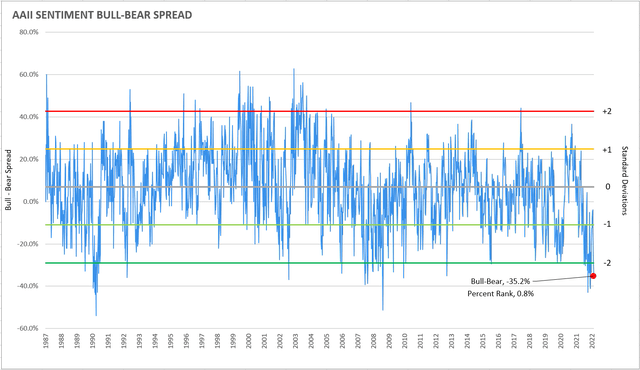

Various indicators of risk sentiment became quite bearish during this aforementioned sell-off. For example, the American Association of Individual Investors (AAII) Bull-Bear spread registered an extremely low reading of -35.2, which ranks below the 1st percentile (0.8%) since the inception of the indicator in 1987.

AAII Sentiment Bull – Bear Spread (AAII)

The AAII Bull-Bear indicator has registered below this level on only 15 other occasions in 35 years. The majority of these instances preceded substantial rallies in US equities.

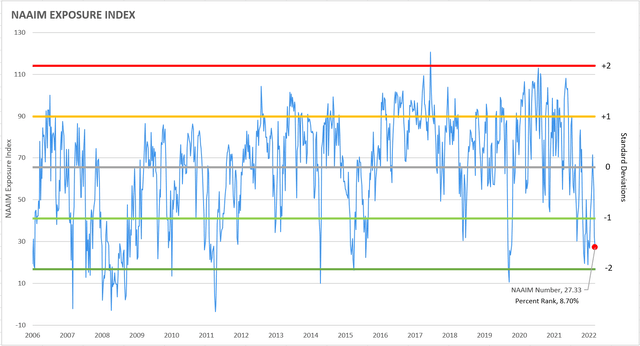

Numerous other sentiment and positioning indicators have signaled that the US equity market reached negative extremes, from a behavioral perspective. One such indicator, the National Association of Active Investment Managers (NAAIM) Exposure Index, fell to a reading of 27.33, which ranks in the 9th percentile (8.7%) since the inception of the indicator in 2007.

Technical analysis and behavioral analysis are two of seven different types of factors that we incorporate into our tactical outlook in Successful Portfolio Strategy. These two factors have converged to create a propitious set-up for a significant relief rally in US equities.

US Economic Environment Supports a Soft-Landing Narrative

When a market is significantly oversold and sentiment is unusually bearish, the slightest bit of good news can spark a substantial “relief rally.” In this regard, the macro environment in the US during coming weeks may provide a propitious environment for kindling and sustaining such a rally.

For the US equity market there have been three main categories of concerns that have negatively impacted prices in recent months: Economic growth, inflation and the fear of Fed hawkishness. After several months of fretting about these three issues, we believe that near-term future developments on each of these various fronts are likely to be supportive of a relief rally in equities.

Economic Growth: Not Too Hot, Not Too Cold

Let us first address the matter of US economic growth. Market participants in the US have alternatively been concerned with growth being too hot and/or growth slowing too quickly. In this regard, a variety of coincident economic activity indicators such as non-farm payrolls, weekly jobless claims, industrial production, real retail sales and real personal consumption expenditures have recently shown signs of “goldilocks” type conditions. On the one hand, growth in economic activity has clearly been moderating from red-hot levels. However, on the other hand, all of these indicators are currently registering positive growth and, taken as a whole, they are not at all indicating recessionary conditions in the US economy. All of these indicators of economic activity are, therefore, currently supportive of a “soft landing” narrative.

One sector which has shown signs of a significant slowdown is the housing sector. This sector has quite naturally cooled off due to a sharp increase in mortgage rates. However, given that the CPI categories of Rent and Owner’s Equivalent Rent have been among the most important categories leading overall inflation higher, the cooling off in the housing sector may be plausibly interpreted by many as a positive development for the overall economy.

Inflation Appears to Have Peaked and is Falling

With regards to inflation risk, recently released data support a narrative that inflation has peaked and is slowing substantially. For example, last month both All Items CPI and Core CPI decelerated significantly and registered levels that were below market expectations. Recent purchasing managers surveys indicate that prices paid are rapidly falling and that overall supply chain pressures are easing. According to both regional and national PMI surveys, pressures on inventories are being relieved and supplier delivery times are shortening.

Therefore, there is gathering evidence to support a bullish narrative on the evolution of inflation.

If CPI figures released on September 13th turn out soft – and I personally expect that they will – then the bullish inflation narrative will gain further momentum for at least several weeks.

It should be noted that even though we expect the flow of inflation-related news to be relatively benign and even encouraging for markets in the short term, it is our view that by late 2022 or early 2023, the US economy may face another wave of inflationary pressures from some combination of surging food prices, increased energy costs and the reemergence of global supply chain issues.

The Market Is No Longer Scared of the Fed

With regards to the fear of Fed hawkishness, it is likely that the market has fully absorbed the recent hawkish messaging by the Fed. This was evidenced by the price action in US equities this past Thursday, September 8, 2022: The S&P 500 index, after briefly falling early in the session in reaction to Chair Powell’s hawkish messaging, reversed course intra-day and finished the session up strongly. This intra-day reversal was followed up by strong gains on Friday.

Further evidence that the market has fully absorbed the Fed’s hawkish messaging is the fact that, as of Friday, the market was pricing in a 91% probability of a 75 basis-point increase in the Fed Funds rate at the next FOMC meeting. In our view, further near-term tightening of monetary policy – beyond that which has already been signaled by Fed officials – is unlikely. Therefore, the market will have a “window” of time, during the next few weeks, in which concerns about the Fed will likely recede into the background, providing bullish conditions for US equities.

A Goldilocks Macro Set-Up for A Relief Rally

Let’s review the technical, behavioral and fundamental set-up:

1. After a sharp sell-off, the S&P 500 index appears to have held technical support at the 3900 area.

2. After bouncing off of support and breaking out strongly through short-term resistance at around 4020, the S&P 500 index is emerging from deeply oversold territory, based on numerous indicators. These three sets of technical factors – holding support, oversold conditions, breaking out above resistance – contribute to a bullish set-up from a technical perspective.

3. The US equity market is emerging from the aforementioned sell-off after having evinced extremely bearish sentiment. This constitutes a bullish-set up from a behavioral perspective.

4. Fundamentally, various factors have become increasingly supportive of a strong narrative regarding a potential “soft-landing”. First, growth appears to be not too hot and not too cold. Second, inflation appears to have peaked and is falling at a significant pace. Third, after fully absorbing hawkish Fed policy and rhetoric, market concerns surrounding Fed policy are likely to recede into the background for some period of time.

All of the above constitute a propitious overall set-up for a relief rally in US equities.

We should note that at Successful Portfolio Strategy, as part of our disciplined process, our tactical outlook is developed on the basis of eight main factors. Economic growth momentum and expectations; inflation dynamics; financial conditions; profit fundamentals and expectations; event analysis; technical analysis, behavioral backdrop and valuation. A summary of our assessments regarding six out of eight of these factors has been highlighted in this article.

US Market Risks are Mainly from International Sources

In our view, the most important risks to the US equity market currently derive from international sources. It is our view that the US market is unlikely to anticipate and “price in” these internationally sourced risks until crisis conditions have already materialized.

For example, in our most recent article entitled, “Nord Stream Shut-Down: A European Crisis with Global Implications ” we explained in considerable detail why it is our base case that Europe will enter a severe recession. This recession in Europe could have major consequences globally – including for the US economy and financial markets. However, it is our view that the US equity market will not substantially discount these risks in an anticipatory manner. We believe that US markets, as has historically been the case, will only begin to seriously price in these types of macro risks when major damage to the global and US economies has become both unavoidable and obvious to informed observers.

We are also closely monitoring ongoing developments in China on a variety of fronts. Examples: Drought-induced food shortages, energy shortages, a real-estate crisis, adverse capital investment and financial flows, weakening exports and COVID-19 lockdowns due to Zero-COVID policy. These factors, individually and collectively, have the potential to morph into major problems with very serious global repercussions. However, we do not believe that US markets will substantially discount these types of internationally sourced risks unless and until a major crisis or crises are already underway.

But make no mistake: It is our view that US market participants will quite soon be forced, the hard way, to become educated on various international issues, including the ones referenced above, in the next few months.

Conclusion

At Successful Portfolio Strategy, we analyze risks and opportunities on different time horizons on both a strategic and tactical basis. Although we believe that the strategic cyclical outlook for the US equity market over the next 6-12 months is quite bearish, we are tactically bullish on US equities on a shorter-term time horizon (20-80 days) given the considerations outlined above.

Be the first to comment