Olemedia

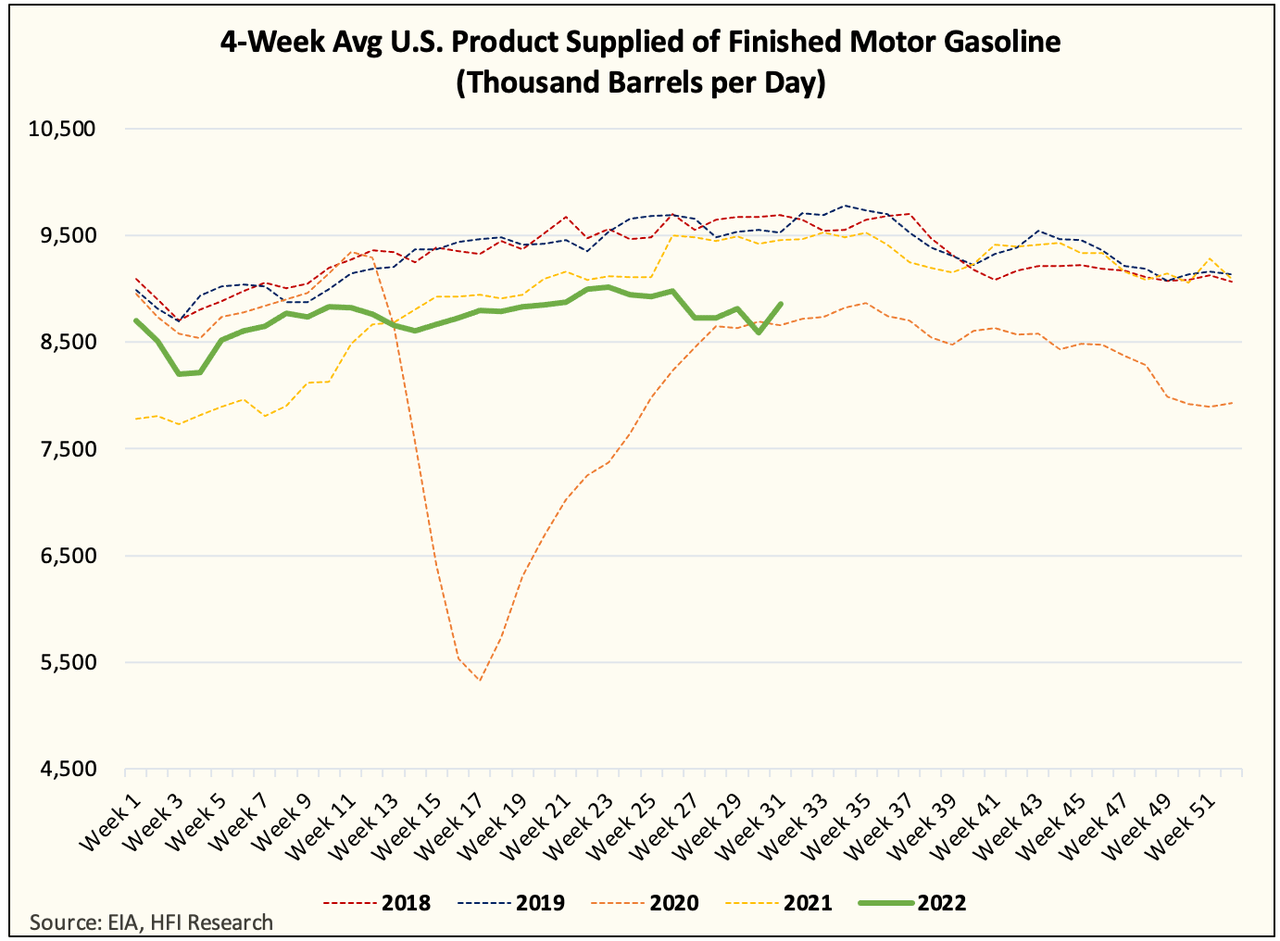

A lot of commotion was made last week after the U.S. Energy Information Administration (“EIA”) reported on a 4-week average that the US implied gasoline demand fell below July 2020. But as we wrote in our OMF previous week, EIA implied demand data has been nothing but volatile since the data outage, and this week was no different. While the EIA had implied gasoline demand rebound to 9.123 million b/d or an increase of 582k b/d, this was still ~400k b/d lower than the implied gasoline demand from GasBuddy.

Following additional research into this implied demand issue, we suspect this is likely the result of EIA overstating gasoline exports, and thus lowering the implied gasoline demand here domestically. This usually happens when there are large fluctuations week-to-week on gasoline exports, and since EIA takes the data from the customs database, this could be volatile relative to real physical movements in exports/imports.

We know this well since we track EIA crude exports/imports versus the physical movements. The monthly (EIA PSM) usually captures this well, so we are likely to see EIA show significantly higher gasoline demand for July in the monthly report.

Nonetheless, we estimate that US implied gasoline demand is ~250k to ~300k b/d higher than what EIA reported. On aggregate, the implied gasoline demand chart for 2022 should be closer to 2021 than implied below:

EIA, HFIR

In addition to our analysis that the U.S. implied gasoline demand is higher than what the weekly suggests, we also believe that U.S. demand is starting to bottom.

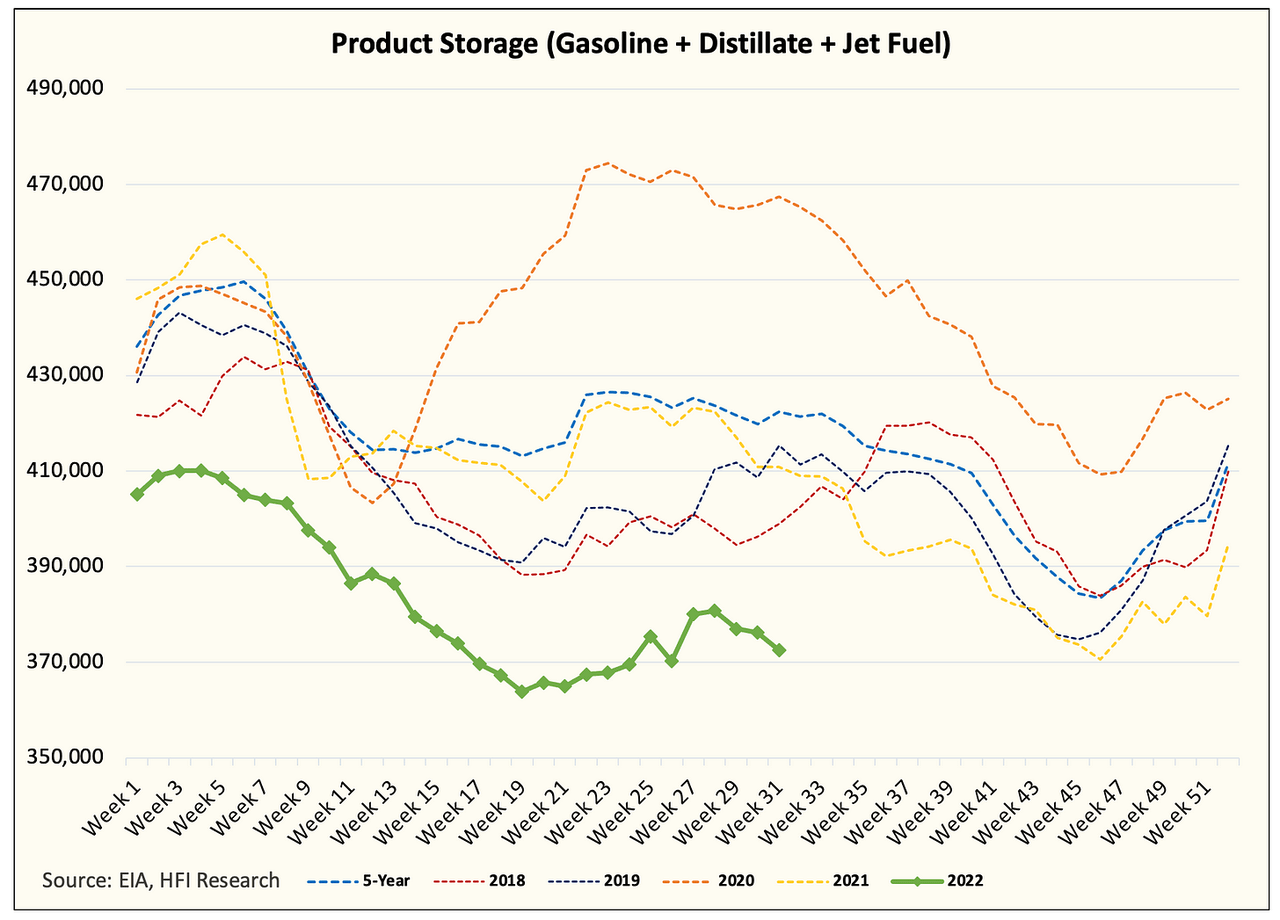

As we enter the refinery maintenance season, we are likely to see product storages trend lower from an absolutely low base.

EIA, HFIR

One way we could tell if demand is indeed bottoming is by watching refining margins. All summer, we have said that refining margins would need to fall, now we believe refining margins are likely to start taking crude higher. If our analysis is correct and demand is really bottoming, this would be first reflected in refining margins.

Some readers may think that refining margins are moving higher because refineries are entering maintenance. This is true, however, without demand responding to the upside, we have seen instances of margins remaining under pressure. As a result, a higher refining margin will be another proxy for how we know demand is starting to improve.

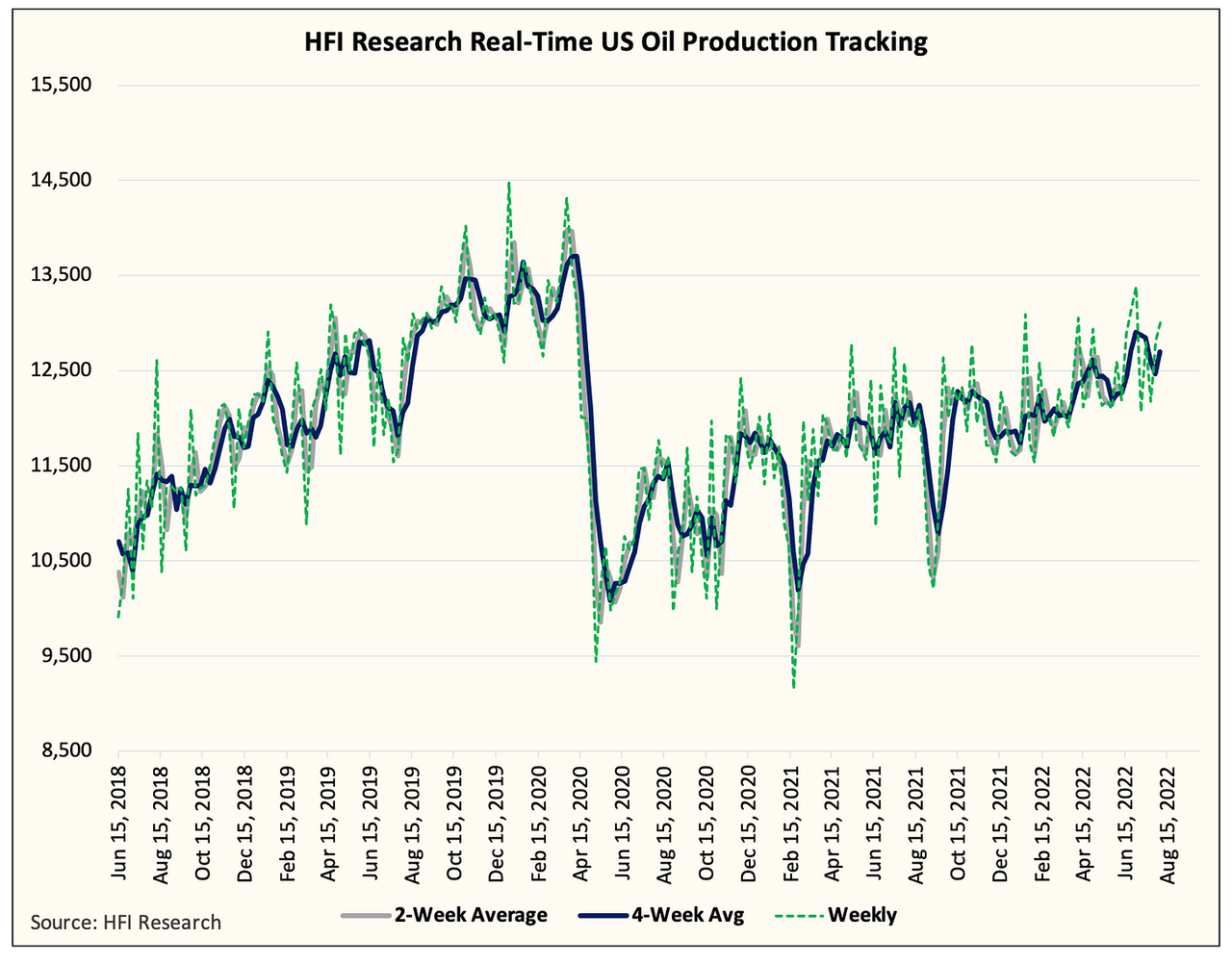

As for the other segments of the EIA report, we are noticing an uptick in US oil production. It’s not as fast as what the weekly reports are suggesting (~12.2 million b/d), but we are definitely somewhere around ~12 million b/d now.

HFIR

Based on our real-time proxy, you can see a clear uptrend in the 4-week average since May 2022. We think U.S. oil production is trending higher and that’s a fact.

Conclusion

We believe U.S. oil demand is bottoming. The recent volatility in implied gasoline demand is likely due to EIA’s tracking error on the gasoline import/export side. This will all be resolved once the monthly data comes out. Our analysis suggests that EIA underestimated implied gasoline demand by as much as ~300k b/d for July, but this will still suggest that demand was below 2021. Nonetheless, with the recent price correction, we are starting to see signs of demand bottoming. One good proxy for readers will be to watch refining margins pick up. If so, this is another good indication that demand is bottoming.

Be the first to comment