filmfoto/iStock via Getty Images

Note: This article was first published to HFI Research subscribers on April 4th.

Oil markets got hit by a slew of bearish events last week: Shanghai COVID lockdown and a record-setting SPR release of ~180 million bbls from the US. But the oil market’s cousin, natural gas, won’t be so easily tamed this year as there is no strategic petroleum reserve.

EIA, HFIR

Natural gas is an interesting commodity because unlike oil, where countries hold an ample amount of reserve, natural gas is highly susceptible to boom and bust periods. Because it’s one of the few commodities that exhibit pure supply and demand dynamics at play in real time, the only way for supply and demand to change rapidly is for the market to force it (e.g. price increase or decrease).

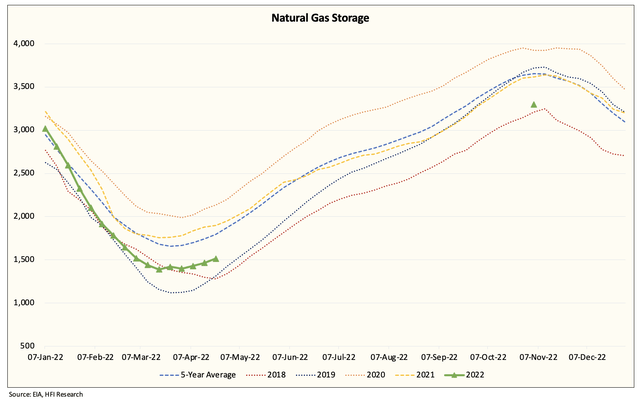

In this case, natural gas is going to be the first energy crisis signal. As we wrote last week in our NGF, natural gas prices by this summer are in for a rude awakening. Global natural gas storages are low with Europe unlikely to get the adequate amount of gas it needs for this upcoming winter. If the summer proves to be warmer than normal, then demand for LNG cargoes will dramatically increase. US LNG exports are largely fixed, but a small portion of LNG exports are influenced by the marginal cargo. As a result, given the low levels of storage in the US and the marginal pricing from global LNG prices, US gas prices are likely to go even higher than we expect.

For US refineries, this is going to be somewhat of a headache as this increases the cost of operation. It’s a good thing then that refining margins are at record highs. Nonetheless, we see a scenario where US gas prices go to $8 or even $10/MMBtu. This is because the market is going to be forward looking and with EOS expected at just ~3.3 Tcf, the market is going to wonder how we are going to fill storage during winter.

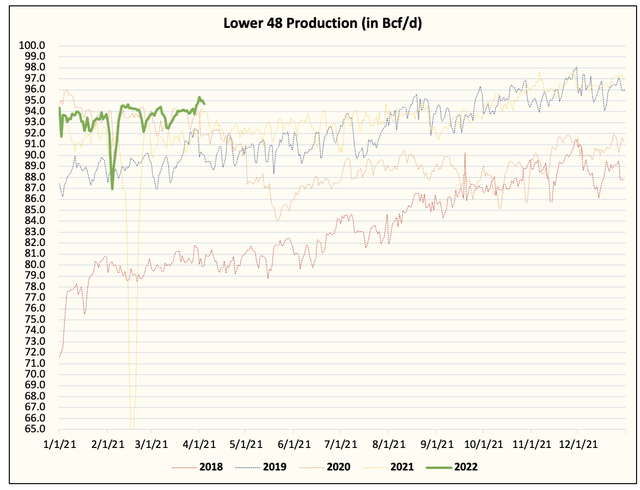

Now again, a large part of the price trajectory is going to be dependent on where Lower 48 gas production is headed. We saw a small increase in production over the weekend back to ~95 Bcf/d, but this is still well below the 97-98 Bcf/d needed to balance this market.

HFIR

We think given both the labor and supply shortages we are hearing about in the US shale patch, the supply increases this year will likely be disappointing. If so, natural gas will be the first energy crisis signal. Stay long Antero Resources (AR), this price increase will likely help push the shares to a multi-year high.

Be the first to comment