Talaj/iStock via Getty Images

The U.S. dollar will remain Number 1.

Megan Greene, senior fellow at the Harvard Kennedy School and Chief Economist at the Kroll Institute, writes in the Financial Times,

“King Dollar is in no danger of losing its world financial crown.”

She writes that,

“the reality is the dollar can’t be avoided and it will remain the dominant currency in trading and transactions.”

There are three major points that Ms. Greene makes.

First, China is not really ready for the yuan to take over for the dollar.

Two, no other reserve currency is close to taking over for the dollar.

And, three, digital currencies are not going to replace the dollar.

So, what is going on?

Movement In The U.S. Dollar

Since the beginning of January 2021, the value of the U.S. dollar has been on the upswing.

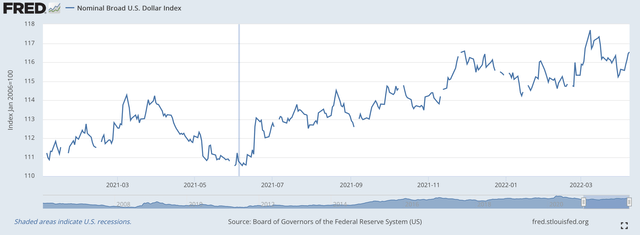

Note here the movement in the Nominal Broad U.S. Dollar Index.

U.S. Dollar Index (Federal Reserve)

The early low in the dollar value comes on January 6, 2021.

Is it merely a coincidence that the low came about on this date?

After rising for a couple of months, the dollar was around this low in the middle of June 2021 before beginning its climb up to where it is now.

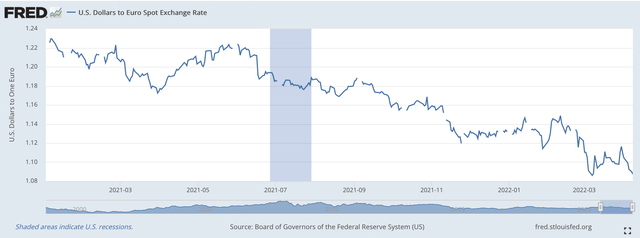

We get the same picture when we look at the exchange between the U.S. dollar and the Euro.

Euro/U.S. Dollar Exchange Rate (Federal Reserve)

The Euro cost $1.2300 on January 6, 2021. The cost of the Euro declined for a while but then rose again into the middle of June 2021.

Then, the U.S. dollar strengthened against the Euro, right up to the present time.

Wednesday morning, April 13, 2022, it took only $1.0825 to acquire one Euro.

Since the Biden administration came into office the value of the U.S. dollar has only gotten stronger.

This is in spite of the “mess” that the U.S. economy and the U.S. financial markets presently seem to be in.

In other words, investors throughout the world seem to be saying that even though the Federal Reserve and the U.S. government seem to be in a real dilemma right now, the U.S. dollar appears to be the best place to put your money.

What About The Alternatives?

So, the dollar is doing well, but what about the alternatives that Ms. Greene raises in her opinion piece?

China is doing some very interesting things when it comes to the yuan and the digital yuan. And, these actions certainly have broad implications for the future.

But, for now, China has many micro-issues that its leaders have to deal with, issues like control of its people and its businesses, and issues pertaining to world relationships that keep it from acting totally on economic reasoning.

Ms. Greene argues that for the Chinese renminbi to become a global reserve currency, the Chinese would have to move to full convertibility along with promoting an open capital account.

Ms. Greene writes that

“As China tries to balance longer-term goals such as financial stability, common prosperity, and climate change with shorter-term economic growth, it is unlikely to relinquish control over the financial system and the capital account.”

And, what about the other reserve currencies in the world?

“The dollar’s share in foreign exchange reserves has fallen from 71 percent in 2000 to 59 percent in the third quarter of 2021. But this is still roughly triple that of the second-placed euro.”

In other words, well over half of the world still relies on the U.S. dollar, and, the other countries that are a part of this picture have moved closely with the dollar in recent international situations, and posed no challenge to the dollar.

Not counting China, these other countries joined in sanctions against Russia and Mr. Greene states that it would be difficult to imagine these countries creating a split with the U.S. in some future geopolitical split.

Furthermore, “in an emergency, all these currencies are ultimately protected by U.S. dollar swap lines.”

What About The Digital?

Finally, what about the uptrending digital currencies?

Right now, cryptocurrencies, as a whole, are worth somewhere around the $1.5 trillion to $2.0 trillion value level.

Ms. Greene responds that this amount is only around 15 percent of global foreign exchange reserves.

And, cryptocurrencies are very volatile in value…the total worth of the cryptocurrencies in early November 2021 was around $3.0 trillion,

“Digital wallets are cumbersome and still can’t be used to buy groceries or pay taxes, let alone a tanker full of oil.”

Stable coins are a possible substitute, for they now have significant market caps linked to the dollar.

But, this just supports the dollar, for the stable coins are backed by dollars, and as their use grows so does the need for dollars increases.

The Importance Of The Dollar

Paul Volcker, former Chairman of the Board of Governors of the Federal Reserve System, has written that

“A nation’s exchange rate is the single most important price in its economy.”

He continues that the exchange rate

“will influence the entire range of individual prices, imports and exports, and even the legal of economic activity.”

“So it is hard for any government to ignore large swings in its exchange rate.”

Well, what does this tell us?

The value of the U.S. dollar has been increasing in value for almost a year now.

But, I have claimed that the U.S. economy is in a ‘mess’ right now.

Well, if the U.S. economy is in a ‘mess,’ what does that tell us about most of the rest of the world?

The rest of the world must be in a pretty tough place as well.

The U.S. is doing what it can to keep the “trust’ of the rest of the world because that is what confidence in the dollar is all about right now.

The problem is that relative to the rest of the world, the U.S. is doing better, policy-wise. Thus, the dollar remains on top.

This conclusion, however, just reinforces my basic thought at this particular period in time…that the world seems to be very messed up and there are few, if any, leaders around that are prepared to get us out of this condition.

As I have stated before, the world is in disequilibrium and the radical uncertainty that accompanies this situation only adds to the dilemma that the policy-makers face. But, we must find a way to muddle through.

Be the first to comment