fatido/iStock via Getty Images

Can you believe it?

Monday morning, September 26, 2022, one British Pound costs only $1.0715 and one Euro costs only $0.9625.

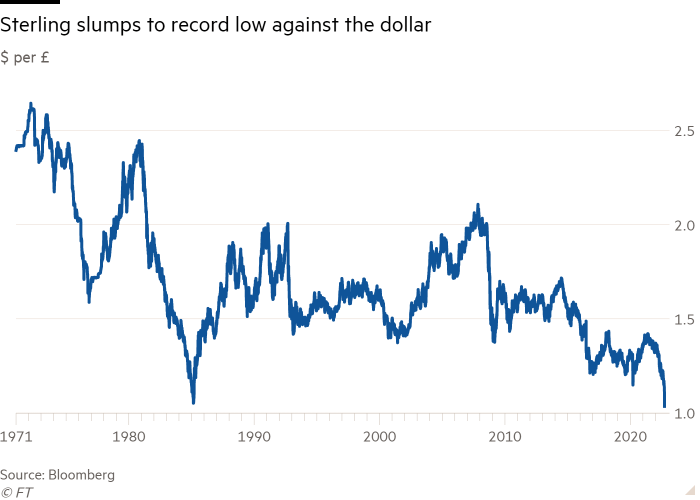

Look at this chart, believe it or not.

Dollar Per Pound (Bloomberg)

Reading the Financial Times on Monday morning:

“The pound tumbled to a record low on Monday while government bonds extended heavy losses, stirring expectations of an emergency rise in UK interest rates in the wake of Chancellor Kwasi Kwarteng’s package of tax cuts last week.”

“The currency lost as much as 4.7 percent to trade as low as $1.035 early in the morning before stabilizing around $1.07, after Kwarteng vowed at the weekend to stick with his tax-cutting drive, prompting warnings that the UK is entering a currency crisis.”

“The early fall took the pound to its lowest level ever recorded.”

Wow!

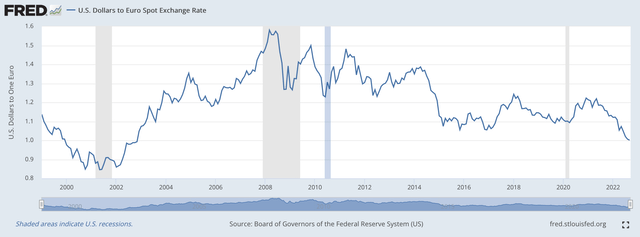

And, on Monday morning, the Euro also dropped down toward historical lows.

Euro/Dollar Exchange Rate (Federal Reserve)

Up to now, we had been arguing that the strength of the U.S. Dollar was not coming from the strong actions of the Federal Reserve System, but because of the lack of action being taken by the European Central Bank and by the Bank of England.

That picture has now changed, especially in the case of England, where the newly elected “Conservative” government seems to be pumping on the gas pedal to accelerate economic growth and fight a stagnant economy.

Parity?

Several months ago, some analysts began to talk that the U.S. Dollar was on the verge of achieving parity with both the Euro and the Pound.

Then the U.S. Dollar hit parity with the Euro.

Now, more analysts are jumping on the possibility that it won’t be long before the U.S. Dollar hits parity with the Pound.

Things seem really “out of sync.”

Can I say once again that markets really seem to be in disequilibrium?

And, for the time being, it appears as if all the players seem to be moving in different directions.

But, the United States seems to have its monetary policy together and, for the time being, it seems as if the United States is the only major country to be settled on a path to do what it needs to do to fight inflation.

The new government in England is looking at an England in recession, and the recession looks as if it could be a pretty severe one…but with inflation around.

Europe is having its own political issues.

A new government has just been elected in Italy, one that is substantially different from the last one in power, led by Mario Draghi, bringing the economy around.

Now, analysts are even talking about an “arch-conservative” government, or a “neofascist” movement, taking power.

Germany is having its problems, along with the consequences hitting Europe from the battle going on in Ukraine.

And, even in France, President Macron is having his problems.

Looking among all these disrupted states, the United States looks like it is pretty much in control.

At least, the money from around the world thinks that the U.S. looks pretty good to them when compared with all these other countries.

And, the value of the U.S. Dollar continues to rise.

The Federal Reserve

In the United States, the Federal Reserve has had very little to say about the rising value of the dollar.

In fact, I have argued in many posts that the Federal Reserve…and the U.S. government…actually may be in favor of the U.S. Dollar’s current strength.

For one, it has been fighting the rising position of China in the world, and one of the things that China wants most is to have its currency become a reserve currency that is fully competitive with the U.S. dollar in global markets.

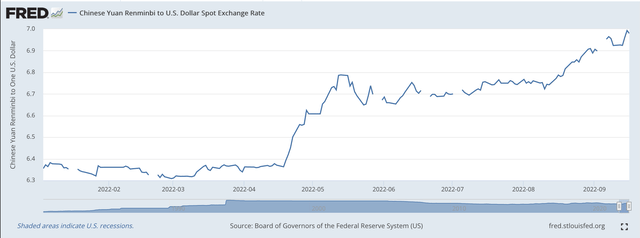

Currently, the Chinese Yuan is suffering a price setback with the Pound and the Euro.

As can be seen in the next chart, the Chinese Yuan has fallen in value against the U.S. dollar since April 2022.

U.S. Dollar Versus Chinese Yuan (Federal Reserve)

This puts the U.S. Dollar in a much more favorable position, worldwide, when considering the position of the Chinese Yuan in the competitive challenge to be the leading reserve currency in the world.

Secondly, the stronger dollar puts the United States in a much better position to engage in discussions about central bank digital currencies and the whole cryptocurrency transition that is engulfing the world.

As I have argued repeatedly, the world is becoming digital and the United States must play a major role in the evolving structure.

The United States appears to be lagging a little in putting together its plans for the new world. It must accelerate its efforts.

But, the much stronger position of the U.S. dollar puts the United States in a very important position as the world transitions into this new era.

The Future

For now, it appears as if the United States will be able to stabilize its dollar-leadership position.

But, we must remember that the world right now is in a very disrupted state.

Many, many markets, financial or other, are in disequilibrium.

These disequilibrium states do not remain static. They move to another solution.

And, what these solutions will be, no one really knows.

We are in a state of radical uncertainty, and very few people have any real answers to the questions being asked.

So, that is also where the policymakers at the Federal Reserve find themselves.

This is what the market must live with as it reacts to the movements in markets that attempt to relieve the disequilibrium that exists.

For right now, that is the future.

The foreign exchange markets are just exhibiting some of this uncertainty.

Be the first to comment