The economic data is catching up with reality, although the gap between the formal reports and what’s unfolding in the real world remains huge. For the high-frequency numbers that capture the blowback from the coronavirus in close to real time, the results are painfully clear. In particular, the soaring applications for jobless claims in recent weeks speak volumes about the economic rampage that’s unfolding across America. In the past four weeks, more than 22 million workers have lost jobs – a loss that reverses all the employment gains in the past decade.

This week’s retail sales report for March offered a sign of how the blowback is affecting consumer spending. Not surprisingly, the Covid-19 pandemic drove spending down by an unprecedented 8.7% last month.

It’s been clear for over a month that the US has been destined for a recession – a recession that was obvious to all even though the signs weren’t showing up in the official economic reports. In a twist that’s unique to this downturn, as noted by CapitalSpectator.com in mid-March, “the standard modeling techniques have become worthless for estimating current conditions and estimating the near-term.”

Normally, recessions don’t fall out of the sky with lightening speed with overwhelming shock and awe. But this time was different, on many fronts. The business-cycle indicators that typically offered relatively reliable, quasi-real-time profiling of the macro trend were left hopelessly out of date as economic collapse swept across the US in recent weeks at record speed.

One exception: the Philly Fed’s ADS Index, which has reacted relatively swiftly to the economic slide. A key reason: weekly jobless claims data is a critical component of the index.

By contrast, the monthly updates of the Chicago Fed National Activity Index (CFNAI) have been hopelessly slow to react. The latest report for February reflects moderate growth. Presumably the upcoming release for March will catch up with reality in some degree.

To be fair, CFNAI and a number of other business-cycle benchmarks weren’t designed to monitor the current crisis. That includes CapitalSpectator.com’s proprietary economic-trend metrics. The standard challenge for estimating recession risk in real time is balancing the conflicting need for timely signals against reliability. Until recently, there was no history in the modern era of recessions arriving with lightening speed, much less a recession that’s as deep and wide as anything on record. Indeed, the Great Depression in the 1930s unfolded in slow motion by comparison, taking a toll over several years.

The Great Recession of 2008-2009 was speedy by comparison, although next to the current crisis the previous downturn was a gradual descent.

The downturn that’s gripping the US and the world will inspire rethinking how recession risk is measured and monitored in real time. Every contraction is different, but no one was expecting a difference that’s orders of magnitude above what history has dished out previously.

Meanwhile, let’s run through the numbers to see where we stand across a broad set of indicators for the US economy. As the March column shows in the table below, the trend has taken a sharp turn lower in several areas.

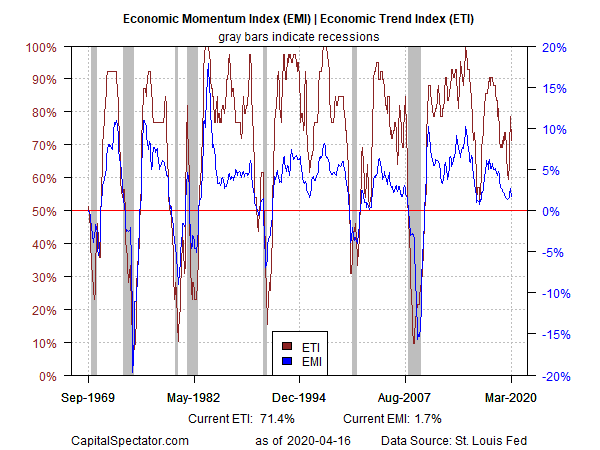

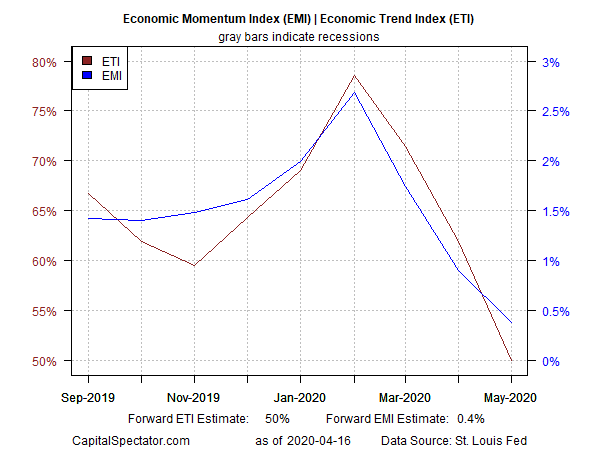

Despite the sharp slide last month for employment and consumer spending, along with dramatic declines in the stock market, the Economic Momentum Index (EMI) and the Economic Trend Index (ETI) have yet to fully reflect the blowback. That’s not surprising since these indicators aren’t designed to react quickly to the latest data points – a reasonable design rule in the interest of balancing timeliness with reliability, or at least it was a reasonable idea before the current crisis upended longstanding assumptions for economic analysis.

Using a modeling application to project near-term results for EMI and ETI starts to show the effects of recent history on the trend, but here too the adjustments pale next to what’s actually unfolding.

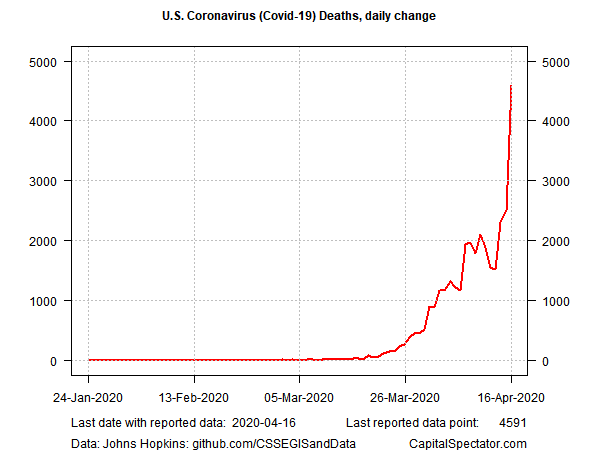

With no question that economic pain is already deep and wide, the econometric challenge now turns to estimating the recession’s trough and the timing of the subsequent rebound. Alas, that happy turning point is still nowhere on the horizon, although the standard business-cycle metrics will once again be useful for this task. But once again, this time will be different. Key variables on this front will be convincing signs that Covid-19 infections and deaths in the US have peaked. Unfortunately, that apex remains is at some unknown future date. Indeed, the rate of change in US reported fatalities for Covid-19 spiked higher on Thursday (Apr. l6), reaching a new high.

Meanwhile, the economic deterioration rolls on. It’s debatable if the US will experience a ‘V’ recovery that delivers an upside that’s swift and strong. But a rebound is coming. Exactly when and in what degree is still shrouded in a high degree of uncertainty. All the more reason to monitor the incoming numbers for developing perspective on the eventual peaking process.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment