da-kuk/E+ via Getty Images

Results season is finally over, which means it’s time for the first quarterly review of the year.

I’ll start with short-term performance and then move on to long-term performance, strategy tweaks, recent trades and my outlook for 2022.

So far, 2022 has been a pretty miserable year

The first quarter of 2022 will not go down in history as a period of irrational exuberance.

The FTSE 100 has gained about 2% since the start of the year, which is actually not bad, but that’s about as positive as it gets.

The FTSE 250 is down about 11% year-to-date, the FTSE Small-Cap index is down 7%, the AIM 100 is down 14% and even the S&P 500, which is currently in a superbubble, is down 5%.

The UK Dividend Stocks Model Portfolio, which holds exactly the same stocks as my real-world portfolio and is split fairly evenly between the FTSE 100, 250 and Small-Cap indices, is down 9% year-to-date.

Overall then, I would not call this a great start to the year.

But fear not; short-term performance should be largely irrelevant to long-term investors whose investment time horizons span five or ten years at the very least.

So don’t be too upset if your portfolio’s recent performance leaves much to be desired. What really matters is long-term performance, so let’s zoom out and look at the bigger picture.

Investing goals: High yield, high growth and a progressive dividend

Goals are important because if you aim at nothing, that’s what you’ll get.

In my case, I’m a dividend investor so I want a good dividend yield and I want that dividend to grow consistently ahead of inflation.

More specifically, my goals for the portfolio are:

- High growth: Higher total returns than the FTSE All-Share over ten years and ideally higher than 10% annualised

- High yield: A higher yield than the FTSE All-Share and ideally higher than 5%

- Progressive dividend: The portfolio’s dividend should be at least as robust as the FTSE All-Share’s and should ideally grow every year ahead of inflation

- £1 million by 2041: The real power of compound growth occurs over decades, so my long-term goal is for the portfolio to grow from its starting value of £50,000 in 2011 to £1 million and an annual dividend of £50,000 within 30 years (by the end of 2041).

I should also mention that I’ve dropped my goal for the portfolio’s overall value to be less volatile than the FTSE All-Share’s. That goal sounded reasonable, but it’s hard to achieve in practice as share prices can be volatile even if the underlying company is defensive.

So rather than focus on reducing risk in terms of share price volatility (over which I have little control), I’ve replaced that goal with the goal of having a progressive dividend (over which I should have more control).

Of course, the occasional dividend cut is inevitable, but I still think aiming for progressive dividends is a worthwhile goal, even if it may prove elusive in reality.

Here’s a quick review of how my portfolio performed against each of those goals:

High growth: Ahead of the FTSE All-Share, but only just

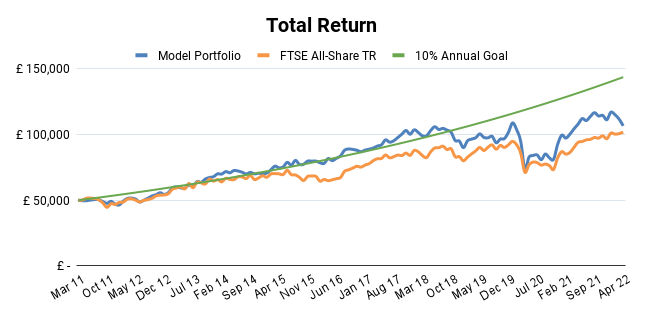

In my 2021 year-end portfolio review, the model portfolio had returned 9.7% annualised over the previous ten years, which I was reasonably happy with as it’s very close to my 10% annual return target.

Fast forward three months and the negative backdrop and related share price declines have pushed that annualised return figure down to 7.5%.

Initially, I was a bit fed up with that figure because it’s only marginally ahead of the FTSE All-Share’s 7.1% annualised return. But after further reflection, I don’t think it’s a big deal.

We’ve just been through a two-year pandemic and now there’s a war in Europe, so obviously investors are pessimistic. This is reflected in low valuations and many of my holdings are trading 50% or more below my estimate of fair value.

When you look back at history, periods of pessimism and low prices have almost always been the best time to invest. Prices tend to be lower relative to fair value, dividend yields tend to be higher and when optimism returns, share price gains can be spectacular (just look at the returns that came after the lows of 2003, 2009 and 2020).

So yes, as things stand today I’m a little bit disappointed in a 7.5% annualised return over ten years. But when I look at the improving quality of the companies in my portfolio and the increasingly depressed valuations that many of them are trading on, I’m confident that the portfolio can get back on track to hit its 10% annualised return target over the next decade and beyond.

High yield: Recovering strongly and should exceed 5% this year

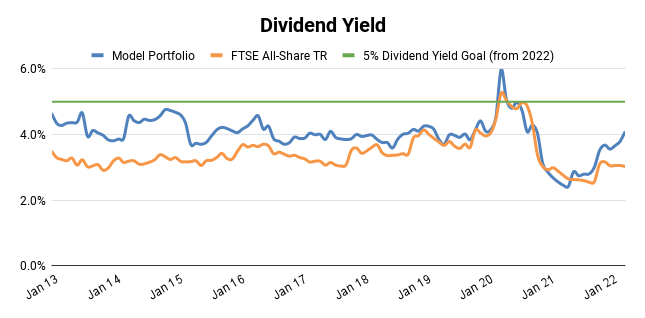

Over the last few months, the portfolio’s yield has really started to recover and is now back to 4%, which is materially ahead of the 3% yield you’ll get from a FTSE All-Share tracker.

Obviously, this has been partly driven by falling share prices, but I’ve also materially re-shaped the portfolio over the last couple of years to focus on:

- Quality: Any holdings that don’t meet my increasingly stringent quality standards have been ejected

- Defensiveness: The portfolio is now actively tilted towards defensive stocks by giving them a larger target position size

- Value: I now use discounted dividend models to value companies and the most attractively valued holdings are given larger target position sizes

For example, companies like Photo-Me (OTC:POMOF) (now Me-Group), PayPoint (OTC:PYPTF), Petrofac (OTCPK:POFCF), abrdn (OTCPK:SLFPF), Mitie (OTCPK:MITFY), N Brown (OTCPK:NBRNF) and Hyve (OTCPK:ITEGY) have all been ejected as they didn’t meet my updated quality criteria.

Note: To find out more about why I sold those companies and what lessons were learned, have a look at the portfolio’s results page.

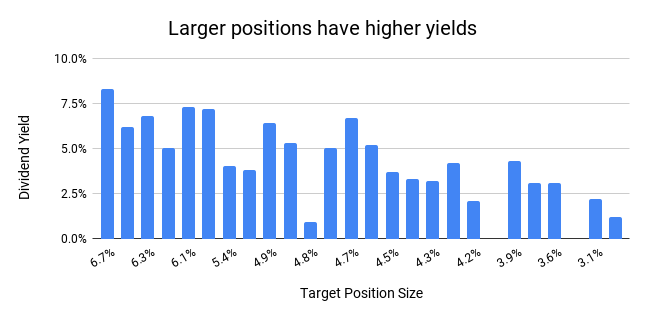

One major addition to my strategy over the last year or so is active position sizing, which involves adjusting position sizes based on each holding’s quality, defensiveness and valuation.

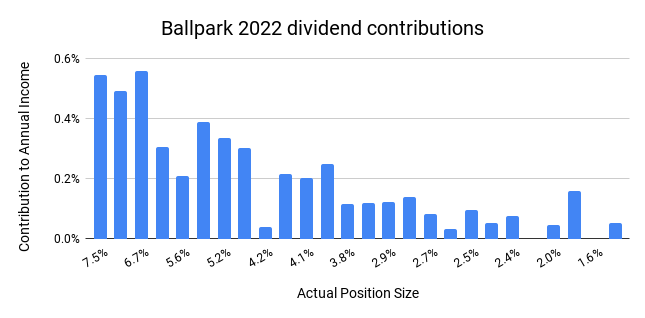

The chart below shows how active position sizing has tilted the portfolio towards higher yield holdings as they tend to have the most attractive valuations.

Of course, dividends are never guaranteed, but personally, I think putting more money into the most attractive opportunities makes a lot of sense.

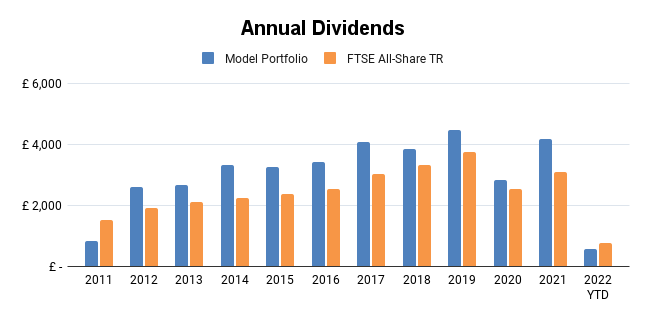

Progressive dividend: Returning to progressive dividends as the pandemic ends

This goal is slightly harder to measure because the model portfolio is an accumulation portfolio, so dividend growth is boosted as dividends are regularly reinvested.

Even so, I think it’s pretty clear from the chart above that the portfolio’s dividend has been close to progressive over the years, with the obvious exception of 2020.

In 2021, the dividend rebounded strongly and although it’s very early days for 2022, I expect the portfolio to generate a record income this year by a comfortable margin.

To get a very rough idea of what your total income for the year might be, you can multiply the position size and dividend yield of each holding, sum the results and you’ll have a reasonable ballpark figure.

The chart below shows how much each position should contribute toward the model portfolio’s total 2022 dividend. For example, the largest holding (with a 7.5% position size) is expected to contribute about 0.53% towards the total 2022 dividend.

Adding all those expected dividends up gives an estimated dividend income in 2022 of 4.9%. If that comes through, then the portfolio will produce dividends totalling almost £5,300, which is comfortably ahead of the previous high of £4,462.

In reality, I expect the dividend to be even higher as these figures are based on 2021 dividends and, hopefully, most of them will be increased in 2022 (although given the current economic backdrop, that remains to be seen).

Also, some of the holdings, such as WH Smith, didn’t pay a dividend in 2021 for obvious reasons, and there’s a chance that those zero dividends will be non-zero in 2022.

Long-term goal: £1 million with a £50,000 dividend by 2041

This goal requires a near-10% annualised return over 30 years, and if I achieve that I’ll be very happy.

If the portfolio was perfectly on course for that goal, it would have a value of £143,793 today compared to an actual value of £106,674. So the portfolio is about 35% behind its target, which means it needs to produce returns of more than 10% per year to catch up.

I certainly don’t want to start taking on a lot more risk just to achieve that goal, but I don’t think I’ll have to. 35% may sound like a lot, but in January the gap was 23% and given that I have 20 years to get back on track, I’m not overly concerned yet.

But I do want to close that gap, and I’m adjusting the portfolio accordingly.

Tweaking my investment strategy: Fewer trades and fewer holdings

When it comes to managing a portfolio, I like the gardening analogy: Overgrown plants need to be trimmed back, undersized plants need to be topped up (with plant food) and weeds need to be removed.

As part of that process, I always used to make one buy or sell decision every month to replace unattractive weeds with something more attractive. It also gave me something to do (because idleness may be sweet but its consequences are cruel).

But now I’m willing to be more flexible. These days, I’ll only buy or sell when it’s clearly in the best interests of the portfolio and if I don’t buy or sell anything for several months, that’s fine by me.

I’ve also started trimming and topping up holdings over the last year or so, as part of the active position sizing process.

Although this only amounts to one or two trim or top-up trades each month, I’m beginning to feel that this is more activity than I’d like. And, of course, every trade incurs broker fees which I would rather not pay.

So I’m introducing some new rules this month:

- Trim Rule: Only trim positions that are more than 2% above their target size

- Top-up Rule: Only top up positions that are more than 2% below their target size and where the total amount invested in this position (its book value in broker-speak) is below the target size

In other words, if a position’s target size is 5%, then I’ll only trim it when it exceeds 7% and I’ll only top it up when it falls below 3% (and as long as the total amount invested so far is below 5%).

This should give each holding enough wiggle room so that random share price movements don’t trigger repeated trims and top-ups, but it should also keep each position reasonably close to its target size.

As for the “fewer holdings” part of my strategic tweak, this is something I’ve been doing over the last year and a bit.

For most of the last decade I held 30 stocks, but now that my company analysis is materially more detailed than it was a few years ago, I just don’t have the time to keep up to date with 30 companies.

Also, as Buffett has pointed out, why would you want to put money into your 30th best idea?

So I’m boiling the portfolio down to its best 20 or so holdings, so I’ll have more invested in the best ideas and the portfolio will be easier to manage as well. It’s a win/win.

So far this year I’ve removed two holdings, leaving the portfolio with 26.

Selling Domino’s Pizza Group and Photo-Me

I still like Domino’s (DPZ) as it’s a high-quality dividend payer, but I sold it in February because I didn’t think the valuation was especially attractive. Also, it has more debt than I’d like, thanks to relatively long store leases.

Here are the original buy and sell reviews from my monthly newsletter:

- August 2017 – Domino’s Purchase Review (PDF)

- February 2022 – Domino’s Sale Review (PDF)

I also sold Photo-Me (now known as Me-Group), which is the world leader in photobooths and a major supplier of other vending machines.

I bought this business a few years ago when I was still willing to invest in “value” stocks that were transitioning away from declining core businesses.

In Photo-Me’s case, its core photobooth business is at risk from regulatory change, as the UK now allows selfie photos to be used in driving licences and passports. If other countries follow suit, photobooth usage could be relegated to parties and other events, which is obviously a much smaller market.

Fundamentally, I don’t want to invest in a company where its future prospects hang on a single decision made by unpredictable regulators.

- August 2019 – Photo-Me Purchase Review (PDF)

- March 2022 – Photo-Me Sale Review (PDF)

Outlook for 2022

The future is always uncertain, but under the current circumstances, the uncertainty level is extraordinarily high.

We have a major war in Europe, inflation levels we haven’t seen for decades and we’re still seeing significant aftershocks from the pandemic in supply chains, government debts and health services.

The old saying of hoping for the best but preparing for the worst seems particularly apt, so my plan is to stick to my plan.

That means holding a diverse basket of high-quality dividend growth companies that have attractive valuations, attractive dividend yields and the ability to take market share from their weaker peers during downturns.

Feel free to add a review of your own portfolio to the comments section below and we can all learn from each other’s successes and failures.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment