RiverNorthPhotography

Sometimes the best investment prospects are some of the most boring companies. And what could be more boring than food? Given these difficult times, where inflation is running rampant, you might think that the food space would be rather risky. But one company that happens to be thriving in this market is industry giant Tyson Foods (NYSE:TSN). With a market capitalization of $24.19 billion as of this writing, the firm truly is a large player in the space. This should come as no surprise then that the enterprise owns a significant portfolio of brands that should be recognizable to most Americans. Add on top of this the fact that shares are not only cheap but also that management has done well to grow financial performance over the past few years, and I do believe that a solid ‘buy’ rating is appropriate at this time, reflecting my belief that the stock should meaningfully outperform the broader market for the foreseeable future.

Tyson Foods – A great business

Operationally speaking, Tyson Foods is a large and diverse company. The company owns a broad portfolio of products and brands, including its namesake Tyson brand, as well as Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, ibp, State Fair, and more. But to best understand the company, we should dig into each of its operating segments. The first of these is the Beef segment, which processes live feed cattle and fabricates dressed beef carcasses into primal and sub-primal meat cuts and case-ready products. These products are then sold domestically to food retailers, food service distributors, restaurant operators, and a variety of other establishments. The company conducts these operations through the 14 beef processing facilities that it has that, collectively, have capacity of 155,000 heads of cattle per week. This is the largest of the company’s segments, accounting for 36.8% of revenue during the 2021 fiscal year.

Next in line, we have the Pork segment. Through this, the company acquires live hogs from independent producers on a daily basis for the purpose of processing. They also raised a small number of swine to sell to independent finishers and supply a minimal amount of market hogs and live swine for their own processing needs. As the smallest of the four key segments that the company has, this unit also has the smallest physical footprint, with only seven facilities that handle, collectively, 469,000 heads per week. This segment accounted for 12.8% of the company’s revenue last year. The second largest of the company’s segments is the Chicken segment, through which the company contracts with independent farmers for the purpose of processing. This segment is also involved in the operation of feed mills that are used to produce scientifically formulated feeds. Operations here are driven by the 186 chicken facilities the company has that, collectively, can handle 47 million heads per week. Last year, it accounted for 28.1% of the company’s revenue each year. And finally, we have the Prepared Foods operations of the company, which are focused on taking raw materials like beef, pork, chicken, turkey, flour, vegetables, cheese, eggs, seasonings, and other related offerings and producing a wide range of products with them. The company accomplishes this through 34 different facilities that it has an operation that collectively can handle 73 million pounds worth of product every week. This segment accounted for 18.1% of the company’s revenue in 2021.

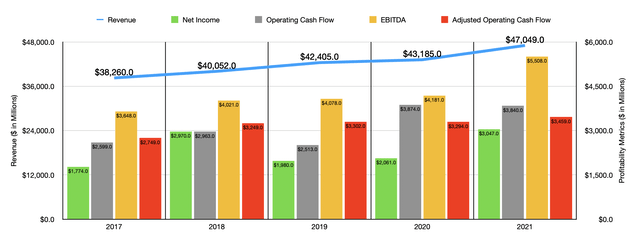

Over the past few years, the management team at Tyson Foods has done a really good job growing the company’s top and bottom lines. Between 2017 and 2021, revenue the company expanded from $38.26 billion to $47.05 billion. The biggest chunk of that increase came from 2020 to 2021, with sales jumping 8.9% from $43.19 billion to the aforementioned figure for 2021. To be fair though, 2021 was a rather intriguing year that likely won’t be repeated that often. You see, actual volume sold by the company decreased year over year, dropping by 2.8%. The rise in sales then came from a 13% increase in price. By comparison, in 2020, volume rose by 0.7% while price increases added 1.1% to the company’s top line. The unusual 2021 fiscal year is a testament to inflationary pressures and supply chain issues.

Regardless of the reason for the sales increase, management also posted attractive bottom line growth in recent years. Though unlike revenue, the path here is rather volatile. For instance, net income rose from $1.77 billion in 2017 to $2.97 billion only one year later. Then, in 2019, profits dropped to $1.98 billion before inching up to $2.06 billion in 2020. In 2021, the strong pricing actions of the company were instrumental in pushing profits up to $3.05 billion. Other profitability metrics have followed suit over the years. Operating cash flow went from $2.60 billion in 2017 to $3.84 billion last year. If we adjust for changes in working capital, it would have risen from $2.75 billion to $3.46 billion. Meanwhile, EBITDA also improved, climbing from $3.65 billion in 2017 to $5.51 billion last year.

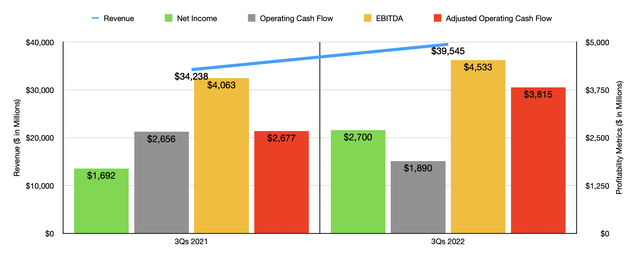

Growth for the company has so far continued into the 2022 fiscal year. For the first three quarters of the year, sales came in at $39.55 billion. This stacks up favorably against the $34.24 billion in revenue generated only one year earlier. Once again, price increases were instrumental in this regard, affecting sales positively to the tune of 14.7%. These increases were offset to some degree by a modest 1% decline in sales volume. Naturally, this increase in revenue brought with it further improvements in profits. Net income rose from $1.69 billion in the first nine months of the 2021 fiscal year to $2.70 billion the same time this year. Operating cash flow fell from $2.66 billion to $1.89 billion. But if we adjust for changes in working capital, it would have risen from $2.68 billion to $3.82 billion. And over that same window of time, we also saw EBITDA improve, climbing from $4.06 billion to $4.53 billion.

It will be interesting to know what happens when management reports financial results covering the final quarter of the 2022 fiscal year. These results are expected to be announced on November 14th before the market opens. Heading into the earnings release, analysts anticipate revenue of $13.49 billion. That would compare against the $12.81 billion in revenue generated in the final quarter of 2021. Earnings per share, meanwhile, should be $1.75, with adjusted earnings of $1.72. To put this in perspective, earnings per share in the final quarter of last year came in rather strong at $3.71. But after making certain adjustments, including a rather significant gain on the sale of business operations, profits per share in the final quarter last year totaled $2.30.

Investors should most certainly be cautious heading into this earnings release. Although the company has done incredibly well in recent months, the soft guidance on the bottom line could be reflective of difficult times ahead. You can only see volume drop so much before margin contraction becomes an issue. When it comes to the 2022 fiscal year in its entirety, management has provided some guidance. They currently anticipate revenue of between $52 billion and $54 billion. At the midpoint, this would imply revenue in the final quarter of $13.46 billion. In terms of profitability, the company has not really provided any guidance for the year. However, management has said that they remain committed to targeting $1 billion in productivity savings by the end of 2024, with $400 million worth of those savings expected to occur this year. So it wouldn’t be a surprise to see the company outperform from an earnings per share perspective.

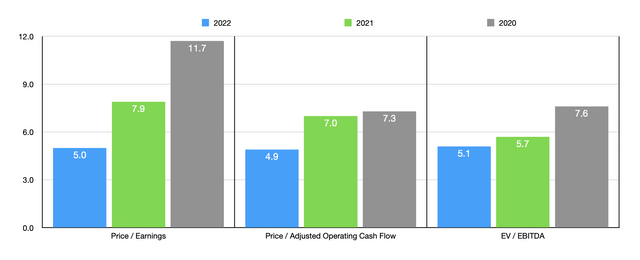

If we simply annualize results experienced so far this year, we would anticipate net income of $4.86 billion, adjusted operating cash flow of $4.93 billion, and EBITDA of $6.15 billion. Using these figures, we can calculate that the company is trading at a forward price to earnings multiple of 5, add a forward price to adjusted operating cash flow multiple of 4.9, and at a forward EV to EBITDA multiple of 5.1. It would be a mistake, I believe, to assume that higher pricing like what we have seen will remain permanent for the company. Eventually, the chickens will come home to roost and margins will contract. But as the table above illustrates, even a return to the levels of profitability seen in 2020 would have shares trading at some pretty low multiples. Also, as part of my analysis, I compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 6.2 to a high of 31. using the price to operating cash flow approach, the range was between 7.4 and 30.4. And when it comes to the EV to EBITDA approach, the range was between 4.9 and 22.9. In the first two cases, Tyson Foods was the cheapest of the group, while in the final only one firm was cheaper than it. Even if we compare current trading multiples to how shares of Tyson Foods were priced using the data from 2020, it would still be cheaper than all but one of its peers in two different scenarios, while being the cheapest when it comes to the other.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Tyson Foods | 5.0 | 4.9 | 5.1 |

| Kellogg Co. (K) | 16.4 | 14.0 | 12.1 |

| Hormel Foods Corp. (HRL) | 25.8 | 19.4 | 17.8 |

| McCormick & Co. (MKC) | 31.0 | 30.4 | 22.9 |

| Conagra Brands (CAG) | 29.9 | 13.2 | 18.8 |

| Pilgrim’s Pride Corp. (PPC) | 6.2 | 7.4 | 4.9 |

Takeaway

Although food may not be the sexiest place to put your money, the fact of the matter is that Tyson Foods looks to be trading on the cheap, both on an absolute basis and relative to similar firms. Given these factors and the likelihood that a return to normalcy will still allow the company further upside, I do feel very comfortable rating it a solid ‘buy’ at this time. Of course, this picture could change based on financial results for the final quarter as well as guidance for the 2023 fiscal year. In addition to that, it will be interesting to see what happens with CFO John Tyson following his arrest for public intoxication and criminal trespassing. The 32-year-old son of the company’s chairman could be an indicator of bigger internal issues. But of course, until we see evidence of that, it is purely speculative to say so.

Be the first to comment