RiverNorthPhotography

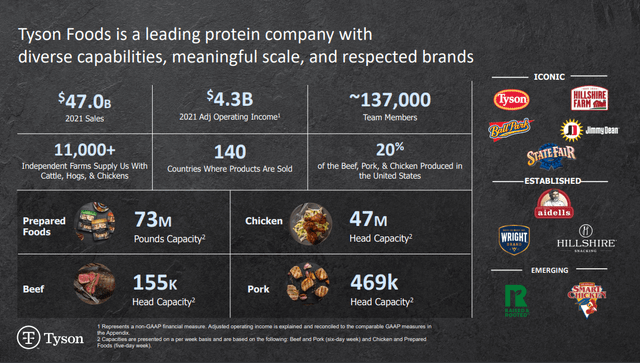

Tyson Foods Inc. (NYSE:TSN) is a big supplier in the global food market. They sell beef, pork, and chicken as well as their own packaged foods with brands like Tyson, Jimmy Dean, Hillshire Farm, and Ball Park. They also have many other brands and international brands as well for their retail products. The company is part of the consumer defensive sector this means that as a company that operates in food production it will always be in demand. In times of economic recession when some companies would see their demand disappear because consumers do not have the extra money to buy their products.

Companies in the consumer defensive sector though will be in demand because people still have to eat so it can’t really be cut out of a budget. The company is in what many would consider a boring industry because they sell processed proteins and it will always have demand but not sky high growth rates. These are the kinds of companies I like because you don’t have to worry about profits one quarter and then losses next quarter because the business is not consistent and steady in their results. The dividend yield of 2.14% is a decent amount to be paid every year while you own this company and wait for the company to appreciate in value over time.

Tyson Foods Inc. Investor Presentation 2022

Introduction

Tyson Foods, Inc., together with its subsidiaries, operates as a food company worldwide. It operates through four segments: Beef, Pork, Chicken, and Prepared Foods. The company processes live fed cattle and live market hogs; fabricates dressed beef and pork carcasses into primal and sub-primal meat cuts, as well as case ready beef and pork, and fully cooked meats; raises and processes chickens into fresh, frozen, and value-added chicken products; and supplies poultry breeding stock; sells specialty products, such as hides and meats. It also manufactures and markets frozen and refrigerated food products, including ready-to-eat sandwiches, flame-grilled hamburgers, Philly steaks, pepperoni, bacon, breakfast sausage, turkey, lunchmeat, hot dogs, flour and corn tortilla products, appetizers, snacks, prepared meals, ethnic foods, side dishes, meat dishes, breadsticks, and processed meats under the Jimmy Dean, Hillshire Farm, Ball Park, Wright, State Fair, Aidells, and Gallo Salame brands. The company also offers its products under Tyson and ibp brands. It sells its products through its sales staff to grocery retailers, grocery wholesalers, meat distributors, warehouse club stores, military commissaries, industrial food processing companies, chain restaurants or their distributors, live markets, international export companies, and domestic distributors who serve restaurants and food service operations, such as plant and school cafeterias, convenience stores, hospitals, and other vendors, as well as through independent brokers and trading companies. The company was founded in 1935 and is headquartered in Springdale, Arkansas. – Source: Seeking Alpha

Numbers/Outlook

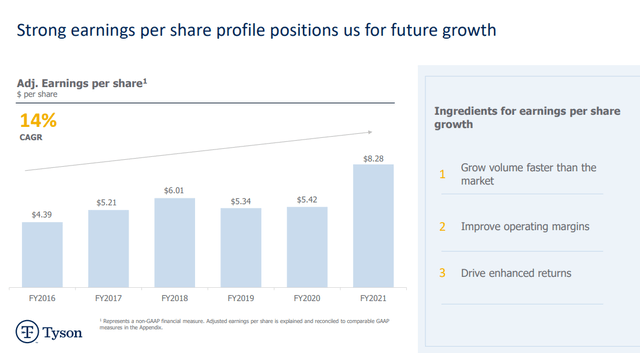

In 2021 Tyson Foods Inc. had full year results of $47B in revenues and net income of $3B which comes out to $8.28 EPS diluted. The company has also reported for the first two quarters of 2022 with results of $26B and net income of $1.95B or $5.35 EPS diluted. The financial results for 2022 are good and the company anticipates strong performance throughout the rest of the year. The company currently pays a dividend of $1.84 per year which is a 2.14% yield on the current share price.

For the outlook in 2022 the United States Department of Agriculture (USDA) indicates that domestic protein production (beef, pork, chicken and turkey) should be relatively flat compared to the prior year. The company expects their margins for these different segments of the business to stay strong even without a significant growth in production for this year. The company expects full year revenues to be between $52B and $54B for fiscal 2022.

Tyson Foods Inc Investor Presentation 2022

The company is well positioned for continued earnings growth in the future. They are the market leader in many key retail categories and have room to grow in these product areas. They also have 2 of the top 10 growth brands in all of the retail food categories with the brands Tyson and Jimmy Dean. They have plans to open 12 plants within the next 2 years to increase capacity by around 1.3B pounds. Most of these plants are in international markets where the companies can see further growth opportunities in the future. As well as a few domestic plants coming online in the United States.

Tyson Foods Inc. Investor Presentation 2022

Potential Risks

The company has potential for risk with fluctuations in the availability of raw materials especially feeds for the various animals that they raise. These inputs if they rise dramatically can have a negative impact on the company’s earnings.

Another potential risk factor for Tyson is if they are unable to attract, hire or retain key employees. They compete with other companies to hire highly skilled employees and the inability to do so could increase costs and hamper operations.

Valuation

Tyson Foods Inc. has a current market capitalization of $30B and a price to earnings (P/E) ratio of 7.59. This P/E ratio is low for the industry. Their competitors have ratios in the 12-15 range which if applied to Tyson would come close to doubling the share price. The true value of the company should come to be recognized at some point and that will come with an increased share price. When you take into account growth for the company and an increased net income over time then the situation gets even better. Tyson Foods seems to hold some good potential value and it will be reflected in the price it is just a matter of time.

The company has current liabilities of $4.6B and long term debt of $8.2B. The company should not have a problem paying for debt payments with cash flow from current operations. If the company did struggle with their cash flow then, they do have current assets of about $9B with about $1.1B of that being cash and cash equivalents.

Investor Takeaway/Conclusion

Tyson Foods Inc. is a great company and stock. The company is one of the largest in the industry in which it operates. There is a large barrier to entry for any company trying to break into this industry. It is expensive for any company to build the plants and infrastructure necessary to process these various meat products. Also the brand recognition that they enjoy for their retail packaged products puts them at the top of many of the food segments that they operate in. With the low P/E ratio that the company has, I think that there is some significant amount the stock could rise to get to a level equal with other companies in the industry. I think that a P/E between 12 and 15 would be normal for the company and this would get investors almost a doubling in the share price which any investor would be happy about and you get the nice dividend while you wait for that to come to fruition. Even through any potential economic uncertainty that we could have this company should continue to be steady and maintain its current profitability if not growth with the added capacity coming online this year. I think this stock is a great option for investment and is likely to make you some money.

Be the first to comment