wdstock/iStock via Getty Images

Tyler Technologies (TYL) is one of the leading public sector management and payment processors. The public sector market has long been underinvested in their software platforms and the global pandemic has caused an accelerated desire to upgrade systems. For example, the company will assist local governments by providing the technology to help enable parking tickets, licenses, utility payments, real estate tax payments (and much more).

The company has consistently posted strong revenue growth and margin expansion, on top of a successful acquisition history. Given the heightened focus on software upgrades, especially in an antiquated public sector market, I believe the long-term growth trends remain very strong for this leading player.

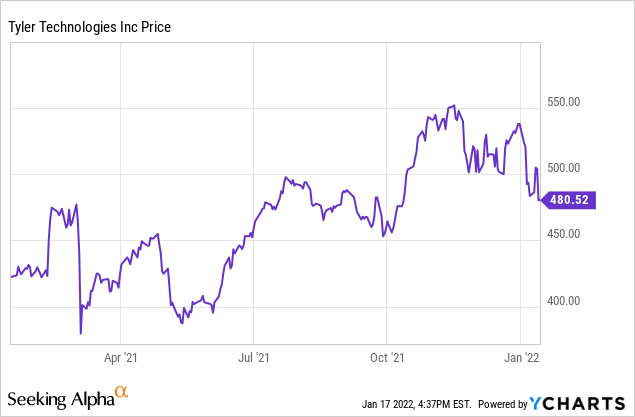

With the company’s stock pulling back nearly 15% in recent weeks, I believe this provides long-term investors a great opportunity to build a position. Tyler recently provided medium-term guidance with revenue growing 10%+ (above their estimated market growth rate of 7-8%) in addition to operating margins expanding to 35%+, from the current ~26% level.

The recent rotation away from growth stocks in recent weeks has hit many companies hard, with several high-growth, high-valuation software companies pulling back over 50%. However, in the case of Tyler, the near-15% pullback seems more rotation-driven than there being concerns around the company’s fundamentals.

For now, I believe long-term investors could see material upside to their holdings given Tyler will likely benefit from local governments resuming, and in some cases accelerating, their technology spending efforts.

Financial Review

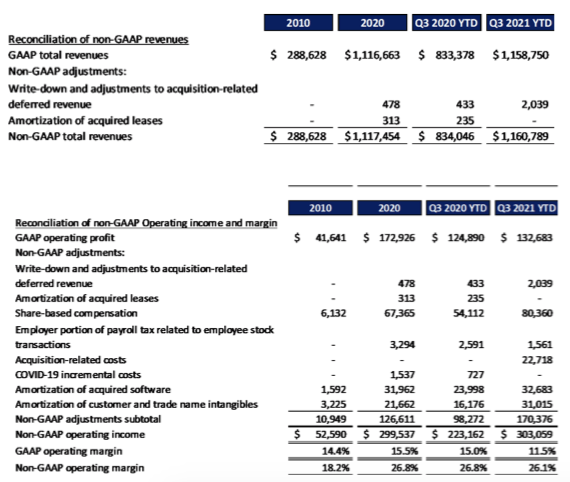

During the company’s recent quarter, they reported revenue growth of 61% yoy to $460 million, which was nearly $35 million above consensus expectations. More impressively, the company’s maintenance and subscription revenue (which represents over 80% of total revenue) grew an impressive 79% yoy.

Admittedly, part of the large revenue beat during the quarter was driven by the company’s recent acquisition of NIC, though the underlying core trends of Tyler Technologies remains very strong. During Q3, the company called out $43.3 million of revenue from NIC’s TourHealth and COVID-related initiatives, which are expected to wind down during the first half of 2022. Backing out these one-time impacts, organic revenue growth for the quarter was still around 8%.

So far this year, the company has posted an impressive non-GAAP operating margin of 26.1%, which is down mildly from the 26.8% margin in the year-ago period. However, in 2021 the company completed the acquisition of NIC, which has caused an increase in investments in order to fully integrate the acquisition.

I continue to believe there remains a lot of margin expansion potential, especially as the company has shifted recurring/subscription-based revenue to over 80% of total revenue mix. Typically the recurring revenue is higher margin and provides more visibility into future forecasting, which tends to result in a higher valuation multiple.

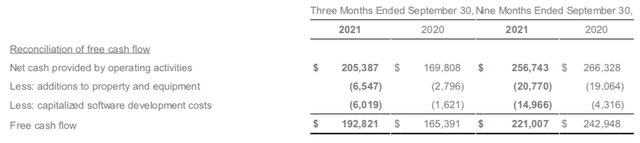

Along with the company’s consistent operating margins, free cash flow during the quarter was $192.8 million, which grew 17% yoy. As described later on, the company has relied on numerous acquisitions over the years to help expand into new end-markets and add new customers. Thus, having strong, consistent free cash flow is essential for future growth opportunities.

Given the company’s recent acquisition of NIC, 2021 and 2022 guidance will include some inorganic contributions. Thus, I believe it’s more prudent to talk about the long-term growth drivers of this industry and Tyler Technologies, thus further demonstrating the many growth opportunities.

Growth Opportunities

For anyone who has ever used their local government/municipality for a tax payment or license renewal, it’s no surprise that the user experience and software platform is likely outdated. But why is this the case?

First, the global pandemic caused local governments to focus on keeping their territory up and running. Given the many complexities caused from various lockdowns, upgrading certain software platforms fell far down a lot of government’s to-do list.

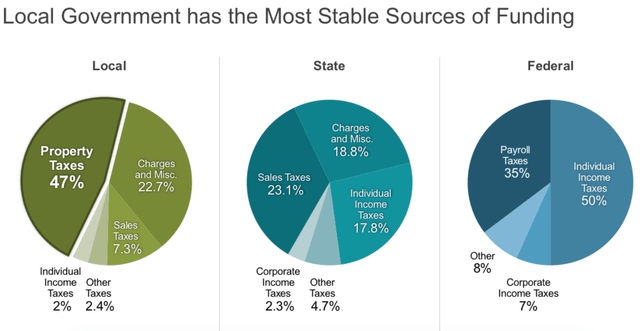

And second, a majority of revenue from local governments is driven by various forms of tax payments. Thus, during the pandemic, some of these tax revenue sources were negatively impacted and/or delayed. Without the consistent revenue stream during the pandemic, this caused local government capex projects to be delayed.

However, now that we are moving beyond the global pandemic with less lockdowns and restrictions, I believe local governments could start increasing their spend on technology investments.

In fact, Tyler Technologies estimates the market is growing at a 7-8% CAGR. While this is not as fast as other areas of enterprise software technology, this growth is very consistent. Given the accelerated shift to the cloud, local governments are likely to increase this type of spending at a faster pace than legacy technology.

In addition, Tyler Technologies has acquired many companies over the years, including Arx, VendEngine, NIC, ReadySub, and DataSpec, which were all completed in 2021. The purpose of these acquisitions (and the reason why free cash flow is very important for Tyler) is to expand the company’s TAM, add new technology/capabilities, and gain access to new clients.

On top of this, Tyler has the opportunity to further penetrate their existing customer base and expand into adjacent markets, such as larger jurisdictions, state, federal, and even international governments.

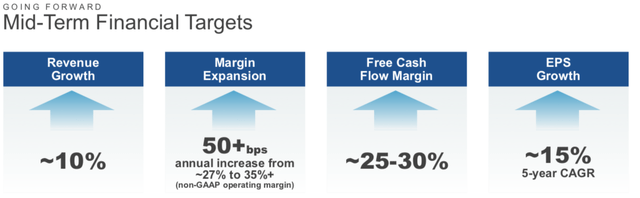

In a recent company presentation, Tyler provided some very encouraging growth metrics over the medium-term. Revenue growth is expected to be around 10%, which is above the overall market growth of 7-8% and does not include any incremental acquisitions. Non-GAAP operating margins are also expected to expand over time to 35%+, up from the current level of around 26%. EPS growth is also expected to grow at a 15% CAGR during this 5-year time period.

On top of this, free cash flow margin is expected to remain very strong at ~25-30%. This free cash flow is essential for the company to generate because it will help with both organic growth investments and future M&A.

One final tailwind to be thinking about is the public sector spending that could result from the American Rescue Plan Act and other potential future stimulus spending bills. With the US Federal government focused on keep state and local governments investing in their communities, public sector funding from the Federal government is consistently a tailwind for growth.

Valuation

In recent weeks, the stock has been down almost 15% as many technology stocks have seen significant rotation. Whether it’s the fear of rising rates or valuations becoming a bit excessive, many investors have pulled funds out of these high-growth, high-valuation names.

Tyler Technologies is unique in that yes, the company’s reported revenue growth screened very high in the recent quarter, but this was largely driven by the NIC acquisition. With organic growth of around 8%, this is very similar to the company’s history and longer-term outlook.

On top of that, the company has very consistent operating margins and free cash flow margins that should expand over time. So in a period where investors are looking for more stable companies, I believe Tyler Technologies is a great long-term investment.

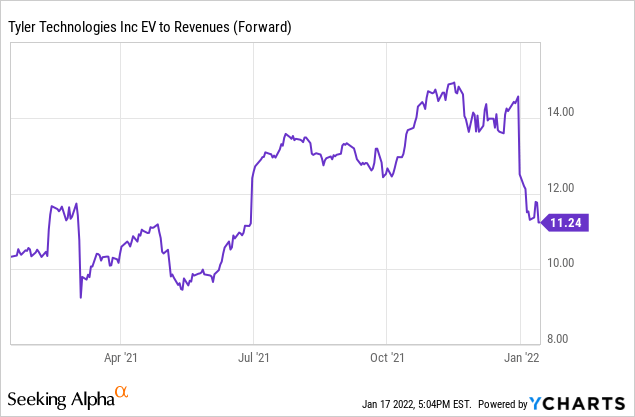

I’ll be the first to admit, the company’s valuation did become a little aggressive when it was trading nearly 15x forward revenue. We are not likely to see revenue accelerate to anything more than 15%+ over time and while margins are strong and expanding, they are not like the non-GAAP gross margins of 80%+ many pure-play software companies have.

The company has a current market cap of $19.7 billion and with just over $1 billion of net debt, Tyler Technologies has an enterprise value of ~$20.7 billion.

For 2022, consensus is expecting revenue of $1.85 billion and assuming growth of 10% in 2023, which is similar to the company’s medium-term outlook, we could see 2023 revenue of ~$2.05 billion. This implies a 2023 revenue multiple of around 10x, which seems pretty reasonable given the consistent revenue growth and margin expansion opportunity.

I believe the recent pullback of nearly 15% combined with local governments likely starting to accelerate their technology spend in coming years will lead to a very good outcome for long-term investors.

One of the biggest risks to Tyler Technologies is local government revenue and spending trends. For example, if tax revenue were to decline significantly due to lower taxes, this could make technology spending more challenging for local governments (thus impacting Tyler’s revenue). Also, if there becomes a significant increase in local government spending, this could spur increased competition in this market, thus potentially pressuring Tyler’s operating margins.

In addition, the company has a successful history of acquiring and integrating companies. However, they have over $1 billion in net debt and if they are unable to execute on their acquisition integrations, this could materially impact margins, free cash flow, and their ability to service their debt payments.

Be the first to comment