BeritK

Tyler (NYSE:TYL) is a cash-generative machine with no dividend policy. The company’s mid-teen revenue growth and profitability make it an attractive stock; however, the price has increased significantly to justify valuations. We expect the stock could correct by as much as 50% and thus might be prudent to exit it.

Business model

Tyler Technologies, Inc. provides information technology solutions to the public sector, focusing on enhancing basic services for citizens. The company has software and service offerings, which can be subscription-based or service oriented. At the end of June 2022, the company had nearly 7,150 employees. Tyler is headquartered in Texas, US.

Market

Per Gartner estimates, government software spending is expected to grow quite nicely.

Gartner, Inc., a leading information technology research and advisory company, estimates @that state and local government application and vertical-specific software spending will grow from $23.6 billion in 2022 to $32.3 billion in 2025. The professional services and support segments of the market are expected to expand from $32.0 billion in 2022 to $38.4billion in 2025. Application and vertical-specific software sales in the primary and secondary education segments of the market is expected to expand from$4.9 billion in 2022 to $6.0billion in 2025while professional services and support are expected to grow from $5.1 billion in 2022 to $6.3 billion in 2025. For the national and international government markets, application and vertical-specific software sales is expected to expand from $38.5 billion in 2022 to $53.8 billion in 2025while professional services and support are expected to grow from $63.1 billion in 2022 to $74.4 billion in 2025.

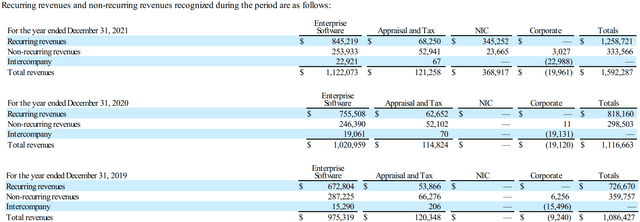

Source: Tyler’s 10K – 2021

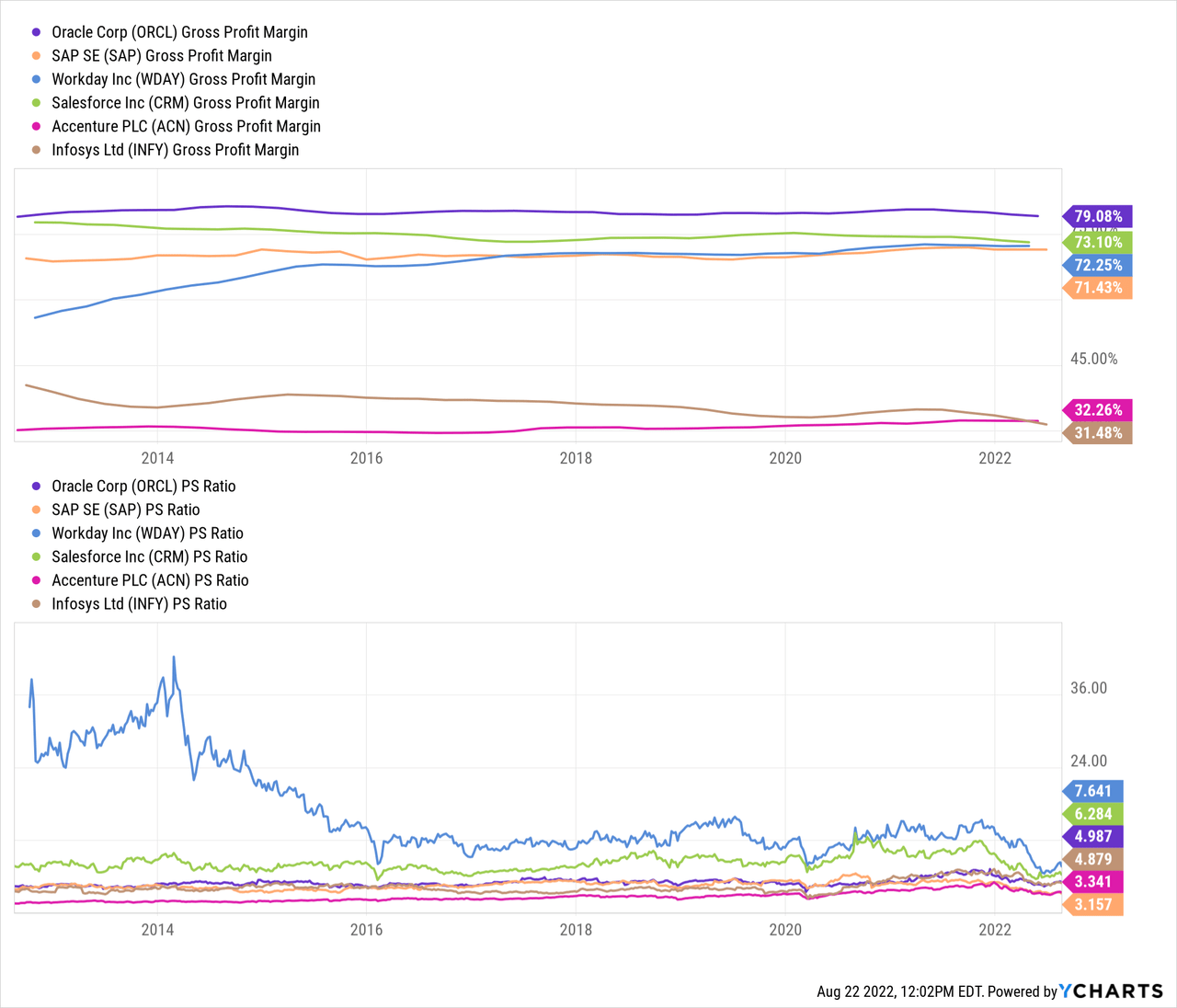

Tyler competes with enterprise software providers such as Oracle, SAP, and other specialized solutions providers such as Accenture etc. The software solutions and migration market is becoming increasingly commoditized with differentiation stemming from domain expertise and customer relationships. Tyler has showcased both and the company is one of the oldest players in property appraisal services since 1938.

Segments

The company operates in nine major areas:

1. Financial management and education2. Courts and justice3. Public safety4. Planning, regulatory and maintenance5. Land and vital records management6. Data and insights 7. Platform technologies

8. Property appraisal and tax, and

9. NIC digital government and payments

Tyler reports its financials in three segments:

- The Enterprise Software (or ES) segment houses software and services revenue for offerings 1 to 7 above

- The Appraisal and Tax (or A&T) division offer technology and services to automate the appraisal of the property, records management and associated services.

- NIC is a new division and offers payment solutions.

Company filings Company filings

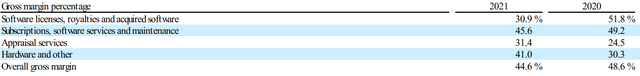

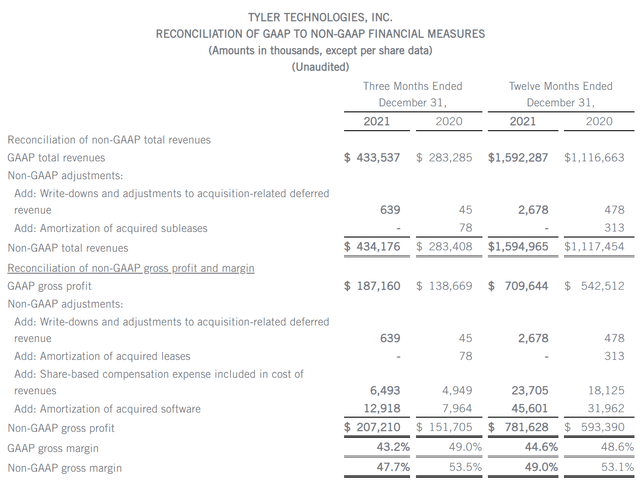

The gross margin decline was primarily due to increased amortization expenses related to acquired software from acquisitions.

Financials

Tyler is FCF positive and generated ~$340 mn in free cash flow or a little over 21% of revenue.

During its Q2 2022 earnings call, the management provided the following guidance for 2022:

- Revenue: $1.835-1.87 billion (versus $1.592 or up 16.4% at the mid-point)

- Non-GAAP EPS: $7.36 to $7.52 (versus $7.02 or up 6% at the mid-point)

Consensus expectations for revenue are $1.87 and $2.09 billion for 2022 and 2023, respectively. Non-GAAP EPS expectations are $7.47 and $8.12. At around 22% FCF margin, based on consensus expectations, Tyler could be expected to generate $410 mn in FCF for 2022 and $460 mn in 2023.

Valuation

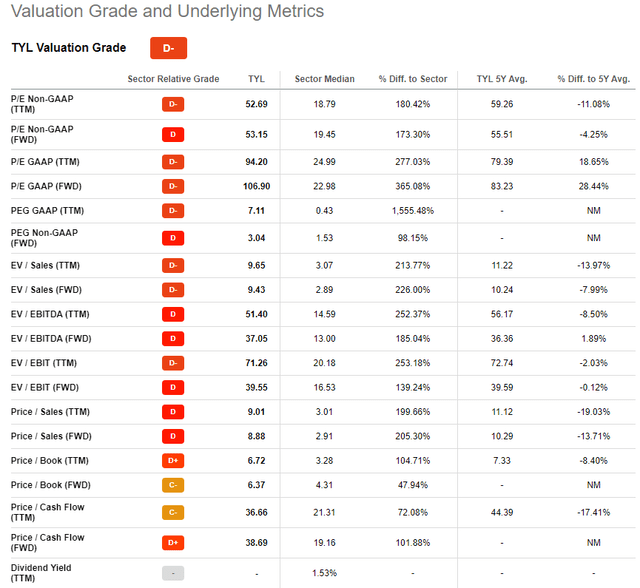

Tyler is an established, profitable, cash flow-positive software company, expected to grow at double digits. It can thus be valued through P/S, P/E and P/FCF.

While the total addressable market for the company is quite large, at over $16 billion, it trades at 9x of its revenue, over 50 times its earnings and 36x of its FCF. These valuation multiples imply that the gross margin of the company should be well above 80-90%, but even at a non-GAAP level that is not the case.

2021 Non-GAAP gross margin was 49%, and even an improvement to 55-60% levels (which is a stretch) does not warrant a P/S multiple of more than 5-7x.

We think Tyler’s valuation is much ahead of its fundamentals, which are undoubtedly strong. However, in an inflationary environment, where yields are hardening towards 3% the P/FCF can also not be greater than 20x or an FCF yield of 5%. We expect a 2% premium above the 10-yr to account for the risk of investing in equities.

To illustrate, at a 6x multiple and 2022 sales estimate of $1.9 billion, we arrive at a market cap of $11.4 billion (=6 X 1.9) or 29% below the current $16 billion levels. On a P/FCF basis, the picture is even bleaker. At an expected FCF of $410 million and a 20x multiple, we arrive at a potential market cap of $8.2 billion (= 410 X 20 / 1,000) or almost a 50% discount to the current price.

Risks to our thesis

Tyler has a long operating history and is a fundamentally strong player on government spending on technology modernization. Thus, there is limited risk to the core operations of the company. The upside risks to the stock (and our thesis) are:

- Government contracts are lumpy – should Tyler land some major wins, sentiment could take the stock higher

- M&A – the company has been acquisitive and that can again lead the stock higher

- Investors continuing to ascribe a premium to the government IT spending proxy status that Tyler has

Conclusion

Tyler is a well-oiled cash-flow machine. However, its valuation has run-up much ahead of the company’s fundamentals. We expect a significant correction in the stock for value to emerge. Coupled with the lack of dividends, we think it might be prudent to sell the stock.

Be the first to comment