Justin Sullivan/Getty Images News

On April 4, Elon Musk disclosed a 9.2% stake in Twitter (NYSE:TWTR), becoming the largest shareholder (~$3.4 billion market value) of the social media company. The move triggered a wave of retail activity and sent the stock up 30% in just two days with the biggest intraday increase since Twitter’s IPO in 2013.

But is Twitter a better company because of Elon’s ownership? If so, is the recent pullback a buying opportunity? The short answer is no, and investors who bought into the hype should be very concerned about their investment.

No doubt that Must is a big Twitter personality with over 80 million followers, and that his ownership and influence have brightened the mood for Twitter stockholders. Prior to the ownership disclosure, Musk created a Twitter poll on March 25 asking whether the platform is doing a good enough job protecting free speech. “Free speech is essential to a functioning democracy. Do you believe Twitter rigorously adheres to this principle?” More than 70% of the 2 million+ respondents said no.

Perhaps this is what gave investors the confidence that Twitter is set to take a new direction after Musk became a major shareholder and will likely join the board to initiate further changes in the company. Unfortunately, this is not the case as Twitter CEO Parag Agrawal just announced that Musk will not become a board member. Many are speculating Musk is purposely staying out of the board because as a board director he could not own more than 14.9% of Twitter’s stock.

Regardless of whether Elon is intending to take over Twitter or take Twitter to the moon, Twitter’s ability to achieve revenue of >$7.5 billion and mDAU of >315 million by FY23 remains a big question to investors. To reach these targets, Twitter will need to grow its users at a 2-yr CAGR of 20% from 2021 to 2023 vs. 19% CAGR from 2019 to 2021. Considering users initially benefited from Covid with a 26% growth in FY20 which subsequently slowed down to 13% in FY21, I believe the FY23 target mDAU of 315 million seems aggressive.

On the revenue side, the >$7.5 billion target by FY23 will also require a 22% 2-yr CAGR from 2021 to 2023 vs. a 21% CAGR from 2019 to 2021. Given user growth is likely to slow down in a post-pandemic world, Twitter will need higher ARPU to meet its FY23 revenue target. In my view, this seems like an uphill battle as today’s market is likely to demand growth in all aspects of the business including growth in revenue, users and earnings.

Of course, the biggest risk to my thesis is that Elon Musk buys out Twitter (which may explain why he did not join the board) and re-engineers the platform to his liking. This could easily trigger a zealous response from retail investors, potentially helping the stock set another intraday record. A secondary source of risk is that Twitter posts better-than-expected numbers in the new few quarters, demonstrating the ability to surpass its 2023 targets.

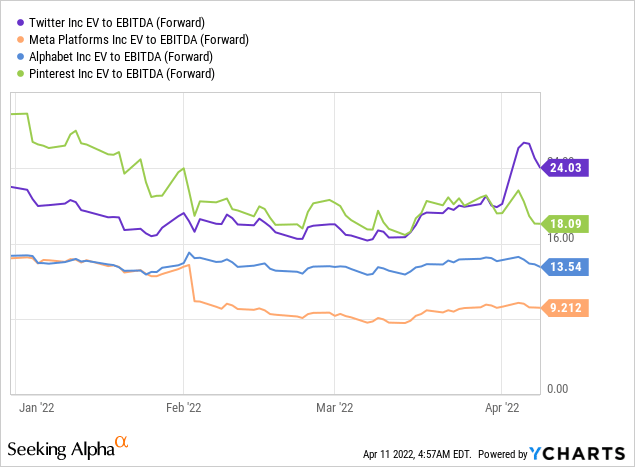

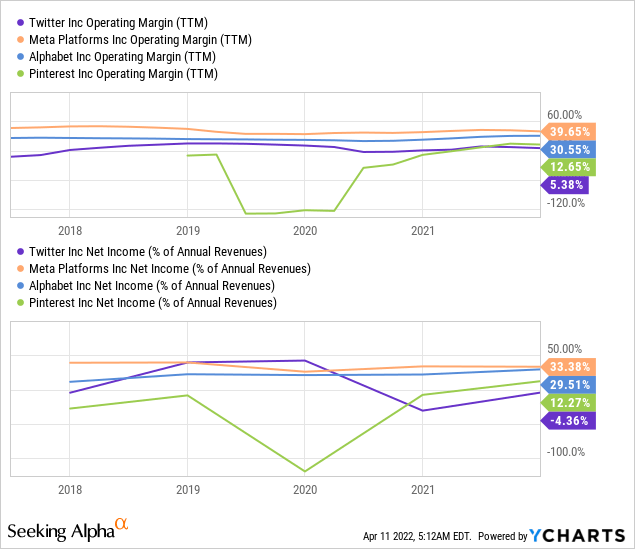

From a valuation standpoint, Twitter currently trades at a premium to social media leader Meta Platforms (FB) at 24x forward EV/EBITDA. Given the lofty valuation and a more challenging environment post-Covid, I believe the stock will likely trade sideways or even revisit pre-Musk-ownership levels as markets are especially sensitive to highly valued stocks with a questionable growth trajectory. In addition, Twitter has historically not been a very profitable enterprise relative to peers. As markets become increasingly nervous due to inflation and rising 10-year yields, it’s my view that investors in Twitter stock should take profit and get out of the hype. In digital advertising, Alphabet (GOOG) remains my top pick based on Google’s dominant position in search advertising, solid profitability and a reasonable valuation that provides downside protection.

Be the first to comment