Alistair Berg/DigitalVision via Getty Images

It’s been about 15 months since I wrote a bullish article on Turtle Beach Corporation (NASDAQ:HEAR), and in that time, the shares have returned about 5% against a gain of about 20% for the S&P 500. I want to point out that my longer term performance on Turtle Beach over the years has been rather good. For instance, I bought in July of 2019 and the shares are up about 109% since, handily outperforming the S&P 500. I took profits nearly exactly one year later, and since then, the shares have underperformed the market. I write this not to brag- though that’s a handy perk-but to point out the power of buying cheaply and selling when assets become too expensive. I didn’t do anything “special” here, other than impose a discipline to buy when assets are cheap, and sell when the market gets ahead of itself. I’ll be reviewing the investment again through the same lens.

I want to review the investment to see if it makes sense to buy more, hold, or sell. As is frequently the case, I’ll make this determination by looking at the recently published financial history, and by looking at the stock as a thing distinct from the company. Finally, I added to my returns last year by selling some put options, so I’m champing at the bit to write about that. I’d like to tell you people that I’m writing about this as a way to educate you on the risk reducing, yield enhancing potential of short put options, but really the section on put options is a thinly veiled excuse to brag.

Welcome to the ‘thesis statement” paragraph, dear readers, where I give you the “gist” of my argument. I write this in case you skimmed past the title, missed the bullet points above, and ignored the first 286 words of this article and landed here. If that’s you, I’ve got you covered. I will be taking my Turtle Beach chips off the table today, because I think there’s more downside than upside in the stock. I don’t like the combination of relatively poor financial performance, and expensive stock. In my experience, this rarely works out well for investors. Additionally, I did well selling puts on this name before, but unfortunately that avenue is closed to me today. The premia on offer for reasonable strike prices are too thin to make the enterprise worth it. While some people may want to buy this stock because of rumours surrounding “some kind of deal”, I consider such behaviour to be more “speculation” than “investing.” I don’t recommend it. So, if you’re considering buying Turtle Beach, my recommendation would be to wait for shares to drop in price before considering. If the shares become cheap again, I’d be happy to buy back in, but that time isn’t now.

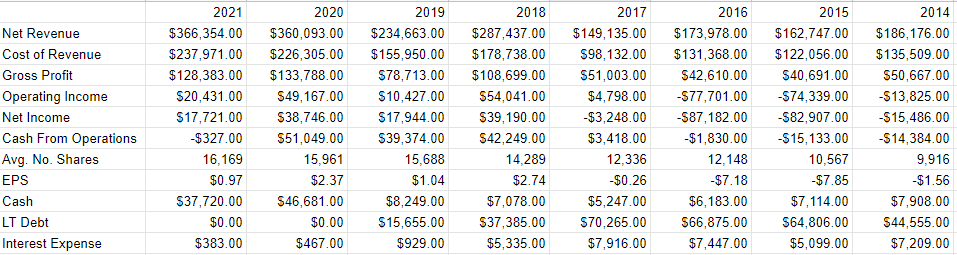

Financial Snapshot

I think the most recent financial year wasn’t particularly good for the company. Sales in 2021 were barely higher than they were in 2020, and net income was down by about 54% from the previous year. This happened in spite of the fact that income tax expenses in 2021 were about $11.3 million lower than they were in 2020. The primary culprit for this collapse in net income was the $23.3 million uptick in operating expenses. “Selling and marketing”, “R&D”, and “general and administrative” expenses were higher by 25.6%, 42%, and 23.5% respectively. I’m much more forgiving of more typically “one off” increases in expenditures. These increases in R&D and the like seem to me to be more systemic, and that’s troubling for me.

On the bright side, the company remains well-capitalized, with virtually no debt. In fact, cash itself represents about 42% of total liabilities, so the balance sheet is very strong in my view. Given that the company remains profitable, I’m comfortable holding assuming the valuation isn’t too egregiously bad.

Turtle Beach Financials (Turtle Beach investor relations)

The Stock

Some of you who follow me regularly for some very strange reason know that it’s at this point in the article where I turn into a real “Debbie Downer” because I start blathering on about how interesting companies can be terrible investments at the wrong price. This is because this business is an organization that sells stuff, hopefully for a profit. The stock is a proxy whose changing prices reflect things like the mood of the crowd, alternating perceptions of the long-term prospects for the firm, or speculations about buyout potential and the like.

At the risk of boring you even more than I usually do, I’ll belabor this point by using Turtle Beach itself as an example. The company released its annual results on March 2. If you bought this stock that day, you’re down about 4.5% since then. If you waited five days, you’re up about 14.5%. Obviously, not much changed at the firm over this exceedingly short span of time to warrant a 19% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

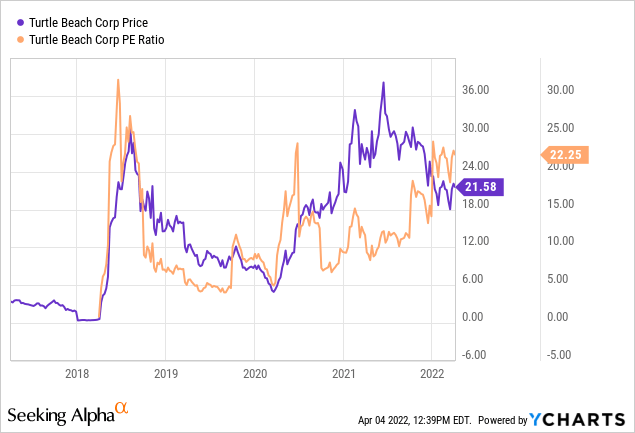

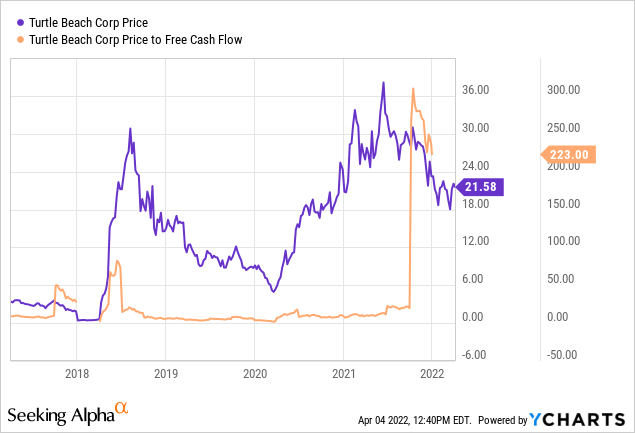

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on this name, I got excited by the fact that the shares were trading at a price to free cash flow of ~8.5 times, and the shares were changing hands at a PE of just under 8. We see from the below that these valuations have exploded higher.

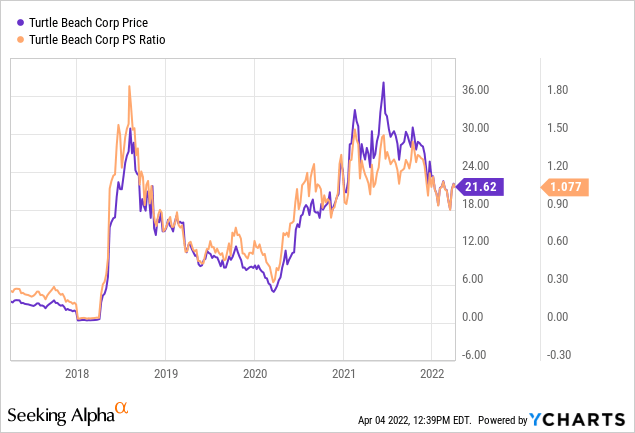

At the same time, the shares are trading at a price to sales ratio that’s also on the high side relative to the company’s history, per the following. Please note that the last time the shares traded at these valuations, they went on to underperform. While history may not repeat, it can certainly “rhyme” and that’s not a great result in this case.

Given the above, I’m taking my Turtle Beach chips off the table once again. The risk of underperformance is just too great for my blood. While I think there’s a risk that a deal may happen over the next few weeks that’ll drive shares higher, I’m willing to take that risk in order to preserve capital.

Options As Alternative

In my previous missive I sold the April 2021 puts with a strike of $15 for $.80 each. These expired worthless, which brought my total options premium to $2 for this stock. This enhanced the returns I have earned on the stock by a great deal. In addition, these premia reduced the risk in a few ways. First, the money earned from selling puts, reduced the downside risk from the stock. Second, if I were exercised at my previous strike prices, it would have been at much lower prices, which is, definitionally, lower risk than those who happen to take the market bid on a given day. This is why I’m a fan of selling put options.

While I like to repeat success when I can, I see no way of doing so in this case, I’m afraid. The shares are so expensive relative to sales, profitability, and the like that the premia on offer for reasonable strike prices are non-existent. For example, according to the graphic above, a more typical price to sales ratio might be about .6 times. That works out to a price of ~$12. Unfortunately, $14 is the lowest strike price that currently trades, and the November put with a strike of $14 is bid at $.45, which I consider to be too thin an offer to make the exercise worthwhile. I think short put options are wonderful tools, but only if you get reasonably compensated for selling reasonable strike prices. That’s not possible in this case yet, I’m afraid.

Conclusion

I think Turtle Beach has had a troubled year, and in spite of that, the shares are quite expensive at the moment. This is a bad combination in my view. I’m not willing to continue to risk capital on the hope of a pop from a deal announcement or rumour. If you’re just joining us, I think you’d be wise to eschew these shares until price falls to match value. If you’ve been with me for a while here, I think you’d be wise to take profits until price falls to match value. While I normally like to repeat success with short put options, I can’t in this case. I have to wait for price to fall to more closely line up with value, just like everybody else.

Be the first to comment