Marko Geber

Introduction

Turtle Beach Corporation (NASDAQ:HEAR) is a company that sells gaming accessories, primarily headsets. Founded in 1975 as a maker of synthesizers and other digital audio equipment, it branched into gaming headsets (headphones with a microphone) in 2006.

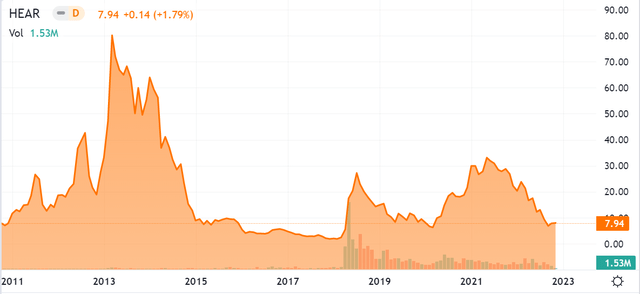

Entering the public markets via a merger with a public company called Parametric in 2014, the combined entity took on Turtle Beach’s name and started to trade under its current ticker HEAR. The stock experienced significant volatility during this period, with shares first rising to $80 during the course of the merger and then depreciating significantly over the next several years. Worth noting is that this chart includes Parametric Sound’s stock prior to its merger with Turtle Beach and subsequent rebranding in April 2014.

seekingalpha.com HEAR 11.6.2022

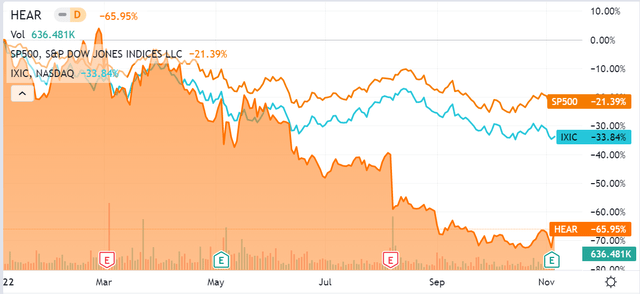

The stock’s performance this year is as interesting as it has been dismal. While the markets have been down overall, HEAR has depreciated 66%, well in excess of either the S&P 500 Index (SP500) or the NASDAQ Composite (COMP.IND).

seekingalpha.com HEAR 11.6.2022

More so, this year-to-date performance is after the stock appreciated 24% in the market’s response to its latest Q3 earnings report. Beating on non-GAAP earnings as well as revenue, clearly, investors liked what they saw.

Within this article, we will look into HEAR’s latest earnings report and other relevant metrics.

Earnings

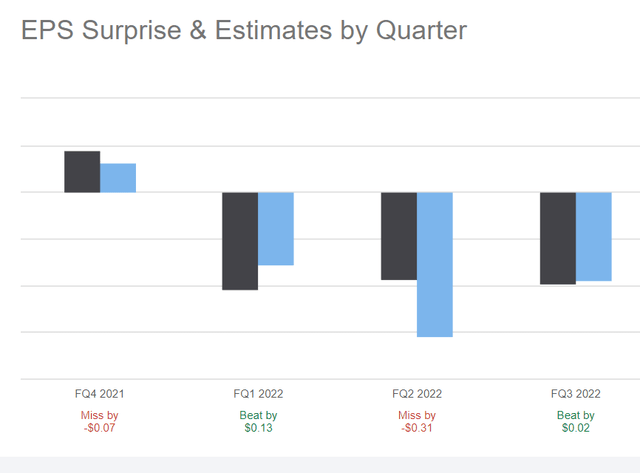

Although HEAR beat analyst estimates and experienced appreciation as a result, the unfortunate reality is that it is not a profitable company at present.

seekingalpha.com HEAR 11.6.2022

While posting a profitable quarter as recently as Q4 2021, it has now had 3 quarters of negative earnings – with Q2 2022 coming in significantly below Wall Street’s estimates.

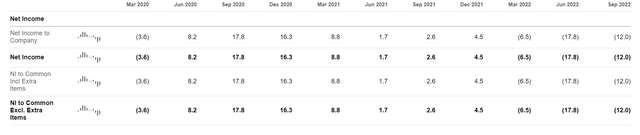

With that being said, Turtle Beach has had profitable quarters in the past, albeit within a volatile overall picture:

seekingalpha.com HEAR 11.6.2022

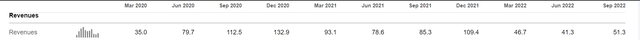

The company’s performance is a function of the market in which it operates (gaming headsets), which was down significantly in 2022. As per the earnings call transcript, the market overall took a nosedive in Q2 2022 and was down 27% YoY. Q3 was only down 17% YoY. The upcoming holiday season, while difficult to predict, will likely be down from last year as well – in line with the overall consumer spending picture.

The volatile revenue picture makes this clear. Turtle Beach can turn a profit when it has the revenues to do it but has too many costs to do so at lower levels of revenue.

seekingalpha.com HEAR 11.6.2022

The company has been aware of this, lowering their cost footprint in response to market challenges. As per the Q3 earnings call transcript, Q3 2022 recurring operating costs were down 16% YoY:

seekingalpha.com HEAR 11.6.2022

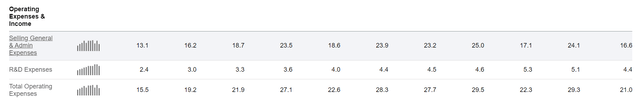

Thinking through the big picture, this company has previously proven profitability and is suffering significantly from consumer headwinds. The question we must then ask is if it can return to a profitable state – and if it has the cash position to even allow for this.

Looking into the cash and debt position of the firm, the company has returned its current ratio to within historical norms. While free cash flow is negative, and within a steep downcycle, this is also something that appears natural to the business itself. Cash and equivalents are at historical norms, as well.

However, the company has taken on a lot of debt in order to maintain operations in 2022:

seekingalpha.com HEAR Q3 Earnings Presentation

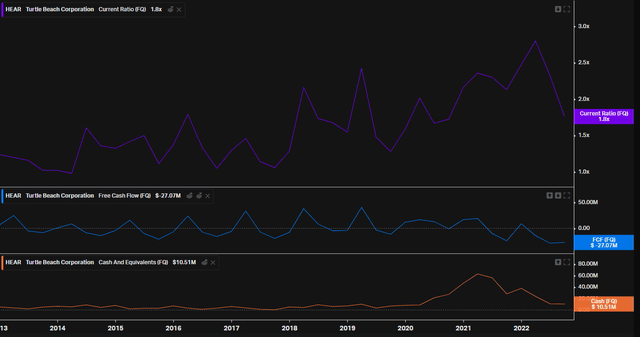

The company also has record levels of inventory at present:

Together this is what makes the current ratio chart sensible – the firm has both high debt and high assets at the moment. The firm’s inventory at least keeps the door open to the firm increasing its earnings in the near term. If the holiday season goes well, HEAR will be able to meet readily meet demand.

Conclusion

Overall, the company’s financial picture is not ideal for fundamental investment. Record debt, record inventory, negative cash flow, and declining revenues all add up to what is a disconcerting picture. Additionally, the company faces secular challenges. Slower consumer spending, increasing interest rates, and the elastic & durable nature of the products that it sells are all additional red flags.

With that being said, expectations are already quite low for this stock. The on-hand inventory is there in case the U.S. holiday season turns out unexpectedly strong. It is fair to believe that results will come in very close to estimates next quarter. Additionally, the company has a robust position in its market (40% as per the Q3 earnings presentation) and could come back from its current situation if it maintains its market position. If that were to occur, however, it would be well into 2023 and not in the near term – it will take more than a strong quarter for this firm’s financial picture to stabilize.

Since Turtle Beach Corporation has already depreciated so much but has proven that it can tread water through these tough times, I would feel comfortable rating HEAR stock a hold.

Be the first to comment