Abstract Aerial Art/DigitalVision via Getty Images

Investment Thesis: The company has seen a recovery across Markets & Airlines revenue along with a strengthening cash position. However, higher fuel costs and air ticket prices, as well as a potential lag in recovery across the cruise sector means that the stock could see limited growth in the short to medium-term.

Back in January, I made the argument that TUI AG (OTCPK:TUIFF) could see a recovery over a longer-term period, but that high levels of debt coupled with volatility in air ticketing revenue could see pressure on the stock in the short-term.

At the time, my assessment did not account for the subsequent situation in Ukraine and the significant rises in energy prices that have resulted – coupled with significant disruption to long-haul travel as a result of the closure of Russian airspace to Western airlines.

The purpose of this article is to evaluate the prospects of TUI AG in light of recent developments, as well as taking performance from the most recent quarter into account.

Tourism Prospects

To start with the obvious, higher energy prices will invariably lead to higher fuel costs for TUI AG – which in turn is expected to be passed on to customers in the form of higher fuel prices.

As a company, TUI Airways flies mainly to destinations across Europe as well as a number of destinations across the Middle East and Latin America. With that being said, the company does partner with airlines to offer package holidays for Asian destinations including Thailand, Sri Lanka, Indonesia and the Maldives. Flights from Europe to Asia will now need to reroute to avoid Russian airspace – meaning longer flight times and higher ticket prices. In this regard, the higher costs of holiday deals for Asian destinations may deter potential customers.

Aside from higher fuel prices potentially derailing the recovery in the travel industry – there have been numerous reports of flight disruptions across Europe as staff shortages across airports have resulted in longer queues and even passengers missing flights as a result.

From this standpoint, there is always the possibility that would-be travellers over the summer months may decide to further postpone travel to 2023 – when the industry would be anticipated to have made a further recovery.

Performance and Looking Forward

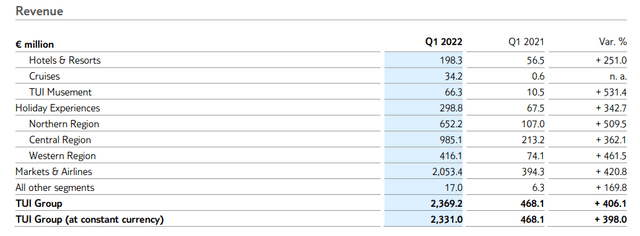

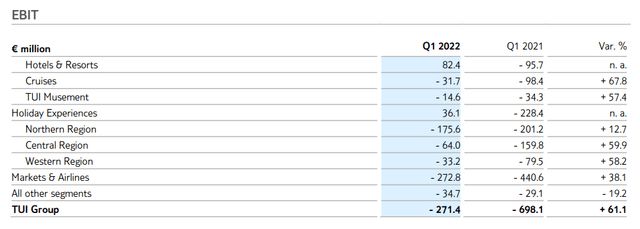

In the company’s most recent interim report, we can see that while revenue (particularly across Markets & Airlines has seen strong growth – EBIT as a whole still remained negative in spite of the improvement from last year.

TUI Group Interim Report Q1 2022

TUI Group Interim Report Q1 2022

With that being said, the company did reduce its net debt over the past year while concurrently increasing its cash to assets and cash to net debt ratios – meaning that TUI AG is in a better position to meet its liabilities as compared to the same period last year.

| Period | December 2020 | December 2021 |

| Cash and cash equivalents (in € millions) |

1,250.5 | 1,649.3 |

| Net debt (in € millions) | 7,177.0 | 5,069.6 |

| Total assets (in € millions) | 14,155.7 | 14,422.9 |

| Cash to assets | 8.83% | 11.43% |

| Cash to net debt | 17.4% | 32.53% |

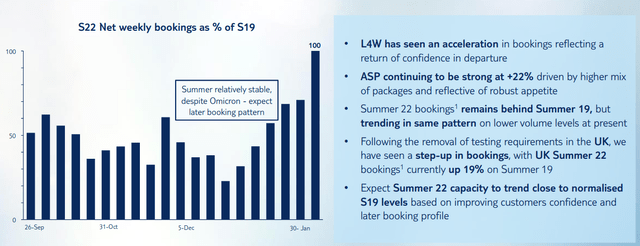

Additionally, results for FY22 Q1 show that while Summer 2022 bookings had taken a temporary dip due to Omicron last December – bookings have since recovered significantly and UK summer bookings are now up 19% on Summer 2019 figures:

FY22 Q1 Results: 8 February 2022

While the recovery across Markets & Airlines and Hotels & Resorts has been significant, it is possible that the Cruises segment could continue to see a stall in recovery.

Google Trends data shows that the number of searches for the term “cruise holiday” worldwide still remains substantially below that of pre-2020. While potential customers are eager to travel again after COVID – cruise ships still appear to be perceived as being of higher risk with regards to concerns over further COVID outbreaks.

Moreover, while the threat of COVID is broadly receding, there is still the possibility of cruise cancellations due to outbreaks – as occurred on a Marella Discovery ship last January.

Conclusion

Ultimately, TUI AG is showing signs of recovery and a strengthening cash position. My view is that the company could see upside over the longer-term, but higher fuel costs and airline prices, as well as a potential lag in recovery across the cruise sector means that the stock could see limited growth in the short to medium-term.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions. The author disclaims all liability for any actions taken based on the information contained in this article.

Be the first to comment