Pet owner finds better insurance quotes while King Charles Cavalier Spaniel looks away concerned.

gzorgz/iStock via Getty Images

I rate Trupanion (NASDAQ:TRUP) a Strong Sell.

In addition to my background leading a pricing strategy advisory and a CFA / M&A / buy-side experience, I have an additional source of insight evaluating Trupanion: my wife is a veterinarian, who has been an early proponent of pet insurance and has held policies for our own pets for years. Our current provider is Nationwide, the dominant player in the space and Trupanion competitor.

I generally only write on Seeking Alpha when a company makes a pricing strategy change that can have dramatic upside or downside impact on the company’s results. This typically requires that the company have a very high concentration, with ideally one or two products affected by the pricing decision driving the company’s financial fortunes. Trupanion, having recently raised prices / premiums to the tune of 18%, fits the bill perfectly.

Will Trupanion’s price increase save its already money-losing business, or compound its troubles?

Trupanion’s Basic Business Model

Think of Trupanion as an investment vehicle. Each quarter, it acquires an asset portfolio of several tens of thousands of newly issued policies (last quarter, it acquired ~70K new pets). Then each cohort generates fixed monthly cash inflows (premiums which are set and known), and cash outflows (payouts of veterinary invoices submitted). Some pets drop off through canceling policies (last quarter ~32K across all existing cohorts, resulting to ~38K net adds).

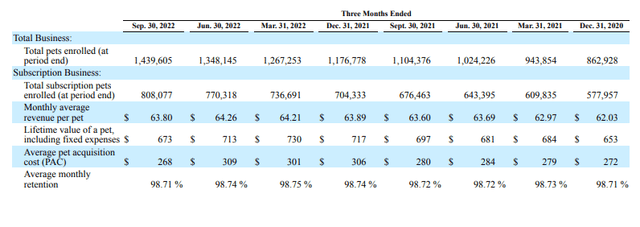

Trupanion’s latest 10Q summarizes the basic metrics of the portfolio inflows (we focus on the Subscription business which drives the company’s business).

Trupanion’s Quarterly Business Metrics (Trupanion 10Q)

We calculate, using the latest retention rate, an average expected life of 77 months for each policy. (per the 10Q, “Implied average subscriber life in months is calculated as the quotient obtained by dividing one by one minus the average monthly retention rate”).

Based on this, the “unit economics” appear to be:

- Outflow: $268 PAC “upfront investment”

- Inflows: $4,912 (roughly 77 months x the $63.80 monthly revenue average per pet). At the company’s claimed 37% underwriting IRR, this monthly cash stream would be worth: $1,870 in NPV.

- Outflows: $ paid out in veterinary invoices over 77 months life (heavily back-ended as Trupanion does not pay for pre-existing conditions and tends to enroll younger, healthier pets). At recent loss ratio of 73.5%, this would translate in $4,912 * 73.5% = $3,610 (before discounting for time value).

- Resulting NPV (“Lifetime value of a pet) = $673.

I struggle to make the math work.

$673 (NPV of pet) = $1,870 (NPV of inflows) – $268 (PAC of pet) – $? (NPV of $3,610 of outflows).

Implies NPV of $3,610 of future veterinary invoices = $1,870-$673-$268= $921. This would require some VERY back-ended outflows over the 77 month life.

That NPV Killer: Stock-Based Compensation

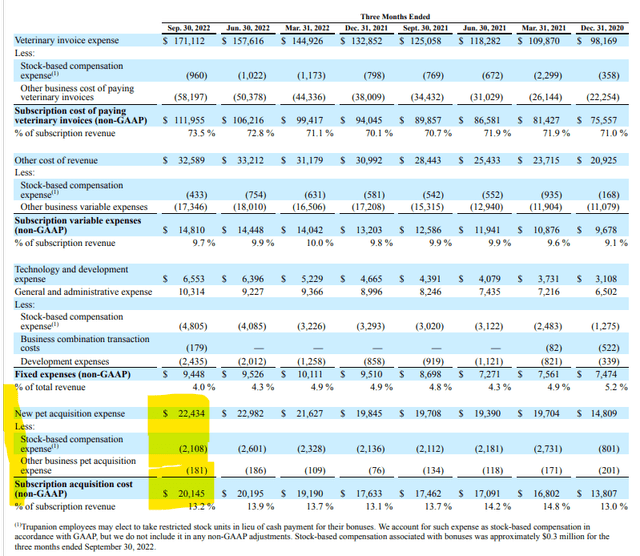

Trupanion does NOT include SBC in the calculation of pet lifetime value. But it should, as the true scope of its SBC profligacy is revealed in comparing it vs it’s PAC and unit economics. After making all its “non-GAAP” adjustments, it arrives at ~$20M in PAC per recent quarter (divided by roughly 70K new pets, this gets close to.

From Trupanion’s 10Q (Trupanion’s 10Q)

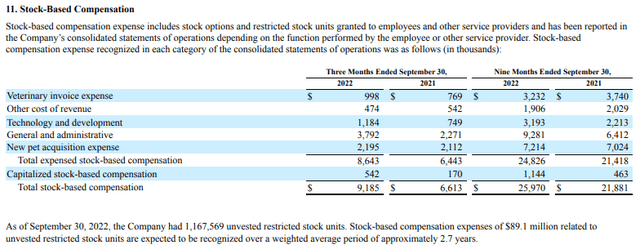

Against $20M spent acquiring pets, the company spent $9.2M in SBC last quarter, increasing its effective “upfront investment” in the portfolio of assets acquired by roughly 46%.

From Trupanion’s latest 10Q (Trupanion 10Q)

Differently put, this adds ~$131 / pet to the effective PAC. Using the unit economics above, this now leaves just $790 in current day dollars (the $921 from above, less $131 SBC impact), to fund $3,610 of future veterinary invoices (Trupanion does not disclose assumptions of growth rate / inflation assumed in its projections of veterinary invoices. But it does disclose that they came above expectation for latest quarter, with loss ratio of 73.5% way over the 71% target).

Now you can see why the company already sported a 20%+ Short ratio before the recent run-up of last week. The math didn’t work before, and the stock run-up makes it even more compelling to bet on math.

Price Increases To The Rescue?

Trupanion is increasing prices not because it can, but because it has to. It announced consecutive 11% and 7% increases still flowing through into the portfolio of policies.

Given that its loss ratio in the 70%+ is much higher than its peers, it is losing money, and veterinary invoices have been rising, something’s gotta give. Trupanion can either decrease coverage, or increase premiums, deductibles, etc. Even if this would work without considerable uptick in its churn (decline in retention rate already occurred, in a small tick, this quarter), we’d still face a less competitive offering over time, weighed down by that excessive SBC.

But our educated guess is that it won’t work, at least not without some uptick in churn and PAC / pet, or reduction in growth rate, or all of the above.

We arrive at this through some substantive inquiries showing:

- Many veterinary practices report some slowing of demand in recent months (partly seasonal, but partly some reversion to the mean post-COVID bump, and in reaction to price increases throughout the veterinary industry)

- Trupanion’s new premiums compare unfavorably with arch-competitor Nationwide on multiple hypothetical pet scenarios we looked at (caveat: it is extremely difficult to compare truly apples to apples, as Trupanion uses an “innovative” concept of charging deductibles once per each (lifetime) condition, instead of annually.

- The pet parents’ willingness to pay for insurance was already a tenuous experiment in the US (evidenced by exceptionally low penetration vs other countries). It has never been tested with a double-digit price increase before, against trends of a softening economy, likely recession, and reversion to the mean post Covid.

Steep price increases to cover steep cost increases are of course nothing new in the economy. But they are, at the end of the day, a cost-plus mentality, unless a company can make the case that its offering has increased in value, leading to higher consumer (pet parent) willingness-to-pay (WTP). Trupanion has a good argument that higher veterinary costs increase the value of insurance. But its policies don’t cover routine checkups, preventative, etc. … only care for health conditions when they develop. Given that most new pets it insures tend to be young, pet parents may not see real payouts until those very backended years in the 77-month average life … while the pinch of potential recession and certain inflation in all other areas of their budget is here and now.

Using behavioral economics terminology, for pet parents the pain of paying (policy premiums) is now, and the gain of avoiding those expensive invoices is far into the future (delayed further by those per-condition deductibles). That does not bode well for a warm reception of the steep price increase.

Conclusion

I rate Trupanion a Strong Sell. And based on comparisons with other competitive offerings available, you may rate your own policy from them a Switch or Skip (self-insure).

As long as the outlandish SBC levels massively reward increasingly consistent failure, it feels like pet parents and investors alike are asked to ship their cash straight to the padded compensation of Trupanion’s inner circle.

Be the first to comment