8vFanI

Do you own any BDCs? Business Development Companies, known as BDCs, offer retail investors high yield exposure to private companies, and some of them, like Trinity Capital Inc. (NASDAQ:TRIN), focus on companies which are already backed by venture capital firms.

These other firms don’t want to lose their investments, and will continue to support these companies. This has been crucial during and after the pandemic.

Profile:

Trinity Capital Inc. is an internally managed BDC which specializes in venture debt to growth stage companies looking for loans and/or equipment financing. Trinity Capital Inc. was founded in 2019 is based in Phoenix, Arizona with additional offices in Lutherville-Timonium, Maryland, San Diego, California and Austin, Texas. It IPO’d in January 2021, but had a longer prior history dating back to ~2008 in its predecessor funds.

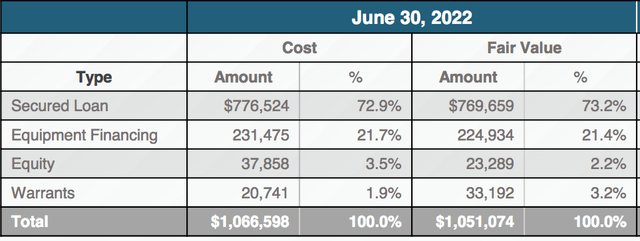

As of 6/30/22, Secured Loans made up ~73% of TRIN’s portfolio, followed by Equipment Financings, at ~22%, Equity, at 3.5%, and Warrants, at ~2%.

TRIN has 125 Warrant Positions in 75 Portfolio Companies, with a GAAP fair value of ~$33.2M.

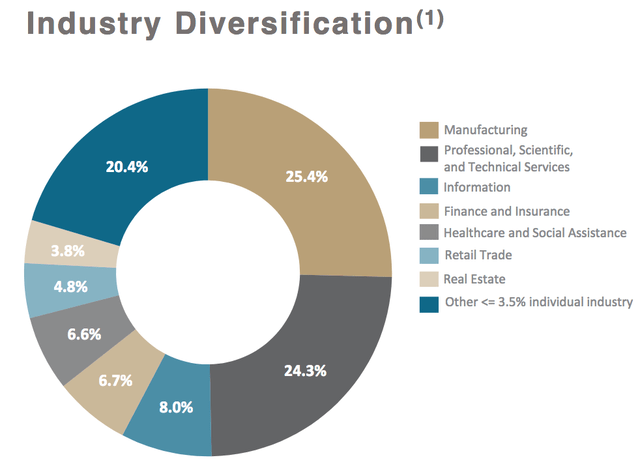

The big difference in TRIN’s holdings vs. other BDCs is that it has more exposure to Manufacturing, which makes sense, given its equipment financing investments. Other than that, its industry exposure seems to roughly follow the norm, with ~24% of its investments in Professional, Scientific and Technical Services companies, and ~20% in Information companies.

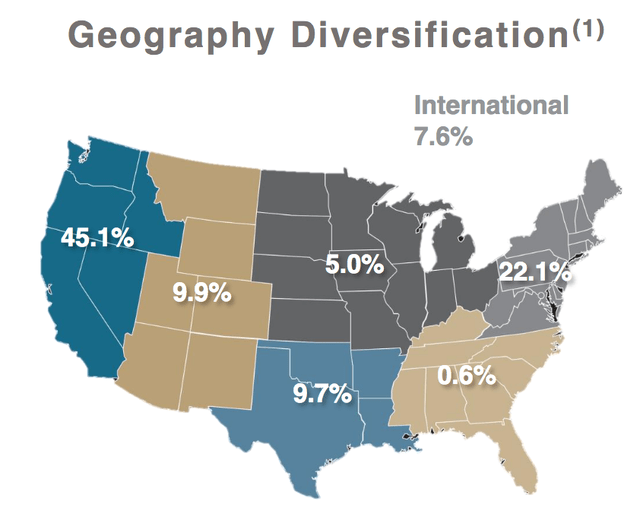

TRIN’s highest regional exposure is on the West Coast, at 45%, followed by the Northeast, 22%, the Rockies and Texas, both at ~10%, and the upper Midwest, at 5%. There’s also some international exposure, at 7.6%:

Portfolio Ratings:

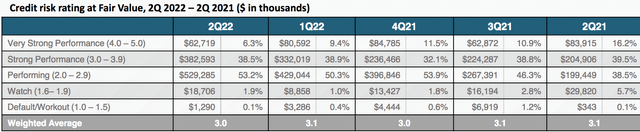

Like other BDCs, TRIN rates its holdings each quarter – they work on a one to five rating system, with five indicating very strong performance. The overall rating has been very consistent over the past 5 quarters, ranging from 3.1X to 3X, as of 6/30/22.

TRIN had 4 portfolio companies on non-accrual with a cost basis of $20.5M and a fair value of $5.9M, as of 6/30/22, representing 0.6% of the fair value of the debt investment portfolio.

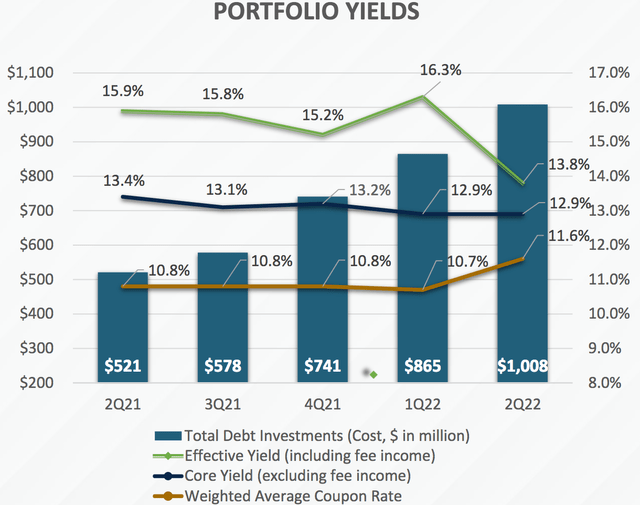

While the total debt portfolio rose 16.5% in Q2 ’22, vs. Q1 ’22, the portfolio’s effective yield declined to 13.8% in Q2 ’22, vs. 16.3% in Q1 ’22, driven mainly by a decrease in non-recurring fee income, which fluctuates based on the investment activity and early repayment activity.

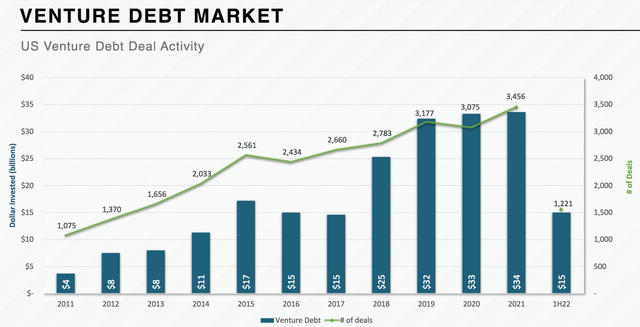

VC Market Trends:

The VC Debt market was very active in 2021, with 3,456 deals done, raising $34B in capital. Things have been more difficult in 2022, with the deal quantity slowing down by 29%, and $15B raised in the 1st half of 2022:

Earnings:

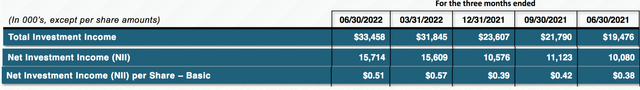

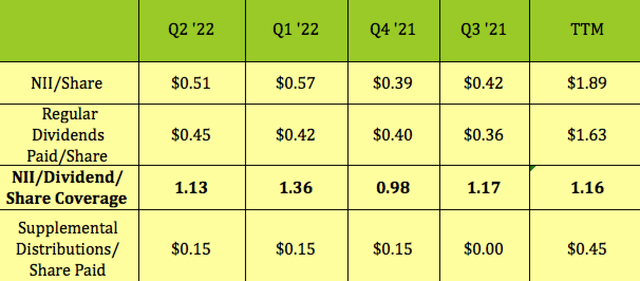

As a relatively new public entity, TRIN is putting up very strong growth numbers. TRIN had a good Q2 ’22, with Total investment income of $33.5 million, up 71.8% year-over-year, and up 5% vs. Q1 ’22. Net Investment Income, NII, was $15.7M, up 55.4% year-over-year, while NII/Share of $0.51 was up 34% vs. Q2 ’21, due to a higher share count in Q2 ’22.

In Q2 ’22, TRIN had total gross investments funded of $193.8M, comprised of $117M across 11 new portfolio companies, and $76.8M across 17 existing portfolio companies. Unscheduled early principal repayments totaled $16.8M.

Its portfolio surpassed $1 billion for the first time in Q2 ’22.

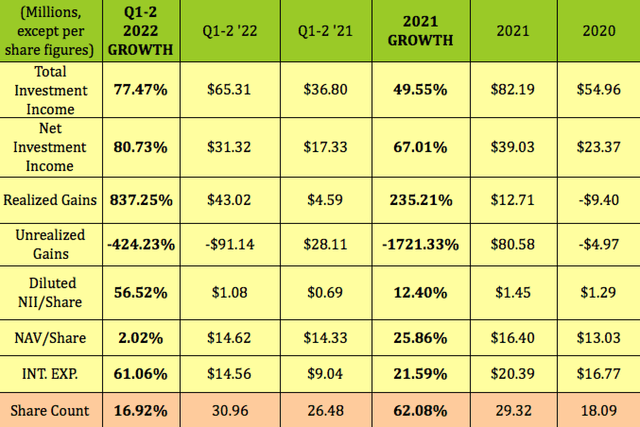

For Q1-2 ’22, TRIN had high double-digit growth in Total Investment Income and NII. Realized Gains, which are lumpy on a quarterly basis in BDC land, jumped 8-fold, while Unrealized Gains dropped 4-fold, due to valuation adjustments relating to 3 underperforming credits, and mark-to-market adjustments in connection with general market volatility.

Diluted NII/Share is up 56% vs. Q1-2 ’21, with Interest Expense rising 61%, due to a larger portfolio and higher rates. The share count rose ~17% year-over-year, as management did a public offering of $50M of TRIN shares at a price of $18.15.

They did another offering in August, selling $55M worth of shares at a public offering price of $15.33/share.

Dividends:

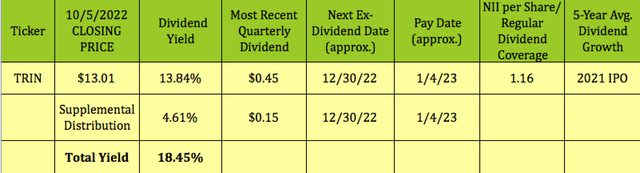

TRIN’s Board most recently declared a $.45 dividend in September, up from $.42 for the previous quarter. They also indicated that a $.15/share supplemental dividend would be paid again in Q4 ’22.

At its 10/5/22 $13.01 closing price, TRIN’s forward dividend yield was 13.84%. The supplemental $.15 dividend adds another 4.61% to the yield, for a total of 18.45%.

Management has increased the base dividend for 6 straight quarters, starting at $.28 in Q1 ’21, and rising to $.45/share in Q3 ’22.

NII/Share covered the regular quarterly distributions by 1.13X in Q2 ’22, with a trailing average of 1.16X. Trinity’s estimated spillover income as of 6/30/22 was $2.15/share, which allows it to continue supplementing its core dividend.

Profitability & Leverage:

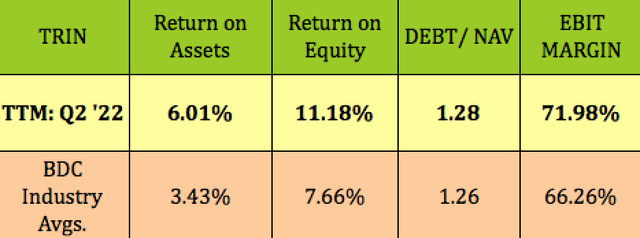

No complaints about TRIN’s trailing ROA and ROE, both metrics outstrip BDC industry averages, as does its EBIT Margin.

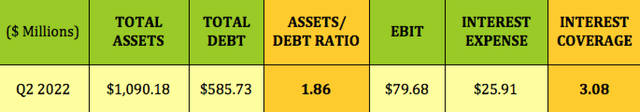

TRIN’s Assets/Debt ratio was 1.86X as of 6/30/22. Its EBIT/Interest Coverage factor was 3.08X, which was roughly in line with other BDCs we’ve covered.

Debt & Liquidity:

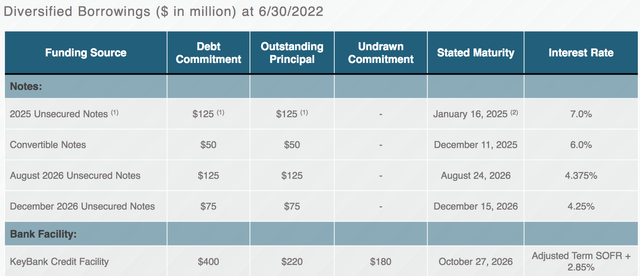

As noted previously, management strengthened TRIN’s liquidity position in Q2 ’22, by selling $57.5M of common stock. They also upsized the KeyBank Credit Facility and availability under the facility by $100M to a total capacity of $400M and availability of $300M. TRIN’s debt is rated BBB, investment grade.

Available liquidity as of June 30, 2022, was ~$93.2M, with ~$13.2M in unrestricted cash and cash equivalents, and a borrowing capacity of ~$80M under the KeyBank credit facility.

TRIN’s earliest maturities are in January and December 2025, when its 2025 Unsecured Notes, and its Convertible Notes come due.

Valuations:

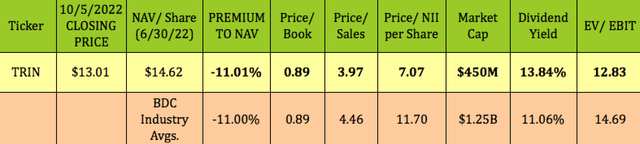

Coincidentally, TRIN is selling at an -11% discount to NAV, which is the BDC industry average. Where we see a large undervaluation in its earnings multiple – it’s selling at a Price/NII of 7.07X, vs. the BDC industry average of 11.70X.

TRIN is a bit cheaper on a Price/Sales basis, in addition to its EV/EBIT of 12.83X being lower than the 14.69X industry average. The market is demanding a much higher than average dividend yield from TRIN of 13.84%, vs. the ~11% industry average, most likely due to TRIN’s shorter track record.

Performance:

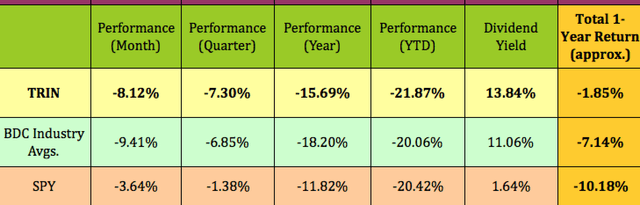

Recession jitters hit the BDC industry heavily in September, with TRIN down -8%, vs. the industry’s -9.4% decline. TRIN has lagged its industry and the S&P 500 on a price basis so far in 2022.

However, although TRIN’s price performance has trailed the S&P’s over the past year, it has outperformed both the S&P and the BDC industry on a total return basis, thanks to its attractive dividend yield.

Analysts’ Price Targets:

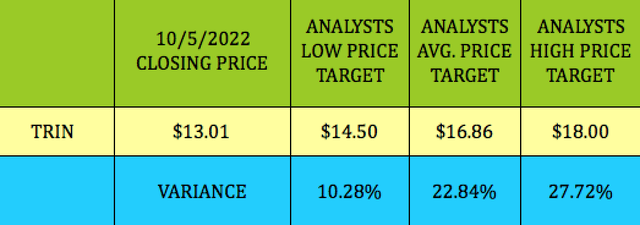

At its 10/5/22 $13.01 closing price, TRIN is ~10% below analysts’ lowest target of $14.50, and ~23% below their $16.86 average price target.

Parting Thoughts:

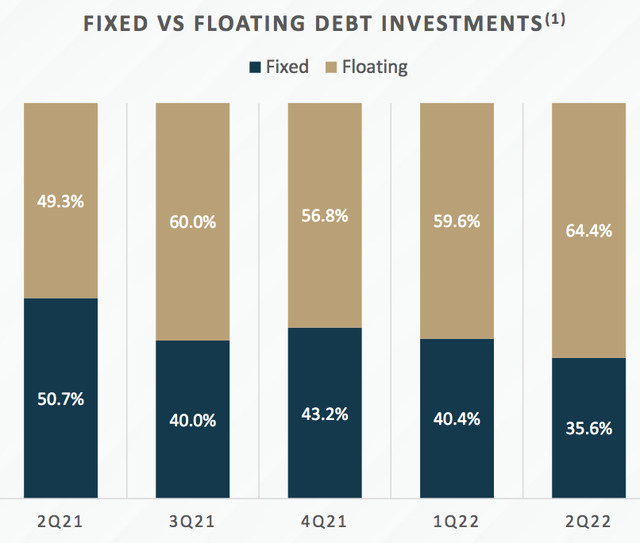

One of the knocks on TRIN may be that it has a lower % of floating rate loan assets. Management has been addressing this, though, increasing the floating rate debt investments to 64.4% in Q2 ’22, vs. ~49% a year ago.

We rate TRIN a speculative BUY, based upon its attractive, well-covered dividend yield, its big UNII/share cushion, and its much lower than average Price/NII. Interestingly, the CEO and CIO both bought more shares at over $15 in August – good to see management with skin in the game.

If you’re interested in other high yield vehicles, we cover them every Friday and Saturday in our articles. All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Be the first to comment