oneillbro/iStock via Getty Images

Investment Thesis

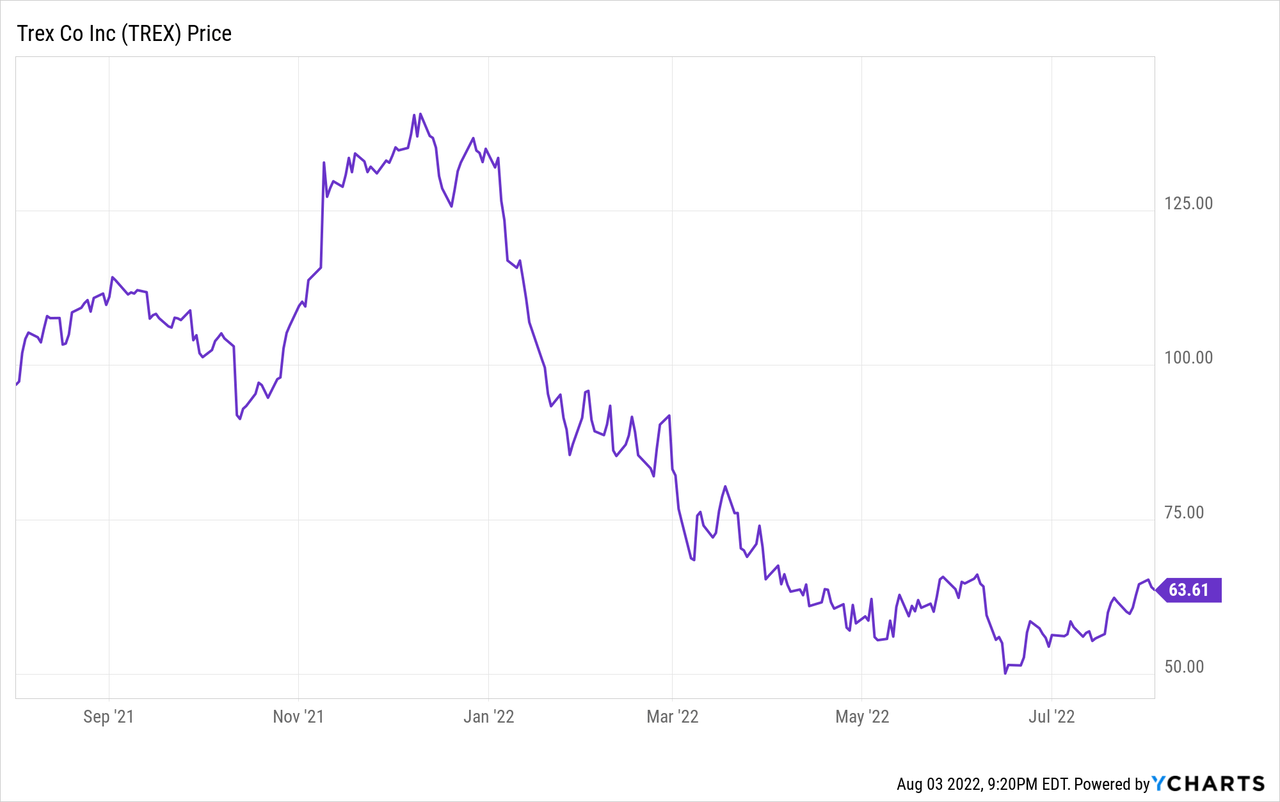

The market has not been kind to Trex (NYSE:TREX) in 2022. The market leader in composite decking is down 53% YTD, compared to the S&P 500’s 13% slide, as a result of a deteriorating housing market spurred by rising interest rates. Trex’s non-GAAP P/E now stands at 27.4 compared to its 5-YR average of 41.9. Trex is one of those companies that consistently trades at a premium, similar to Costco (COST) and Ulta Beauty (ULTA). In my opinion, Trex deserves to trade at a premium because the company offers a superior, sustainable product. With ESG now a top priority for consumers and producers alike, long-term investors may view Trex’s current market woes as an opportunity to pick up shares at a discount to historical valuations.

A Superior Product

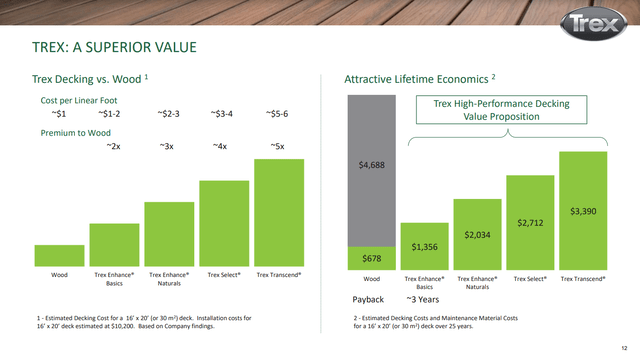

Trex manufactures composite decking primarily used in residential housing. Their composite decking is an alternative to wood and, while more expensive, offers a compelling value proposition over its lifetime.

Anyone who has ever had a wood deck can attest to the fact they can be a pain. Wood decks require routine maintenance to keep them looking decent and to prevent rotting. This includes power-washing, staining, waterproofing, and inevitable replacement. Many of these tasks are often annual. Trex estimates that, over a 25-year lifetime, their composite decking will actually save you money. Even Trex’s most expensive product, Trex Transcend, wins in a head-to-head match-up with wood. Yes, you’ll have to fork out more money up front, but you’ll spend a lot less time (and money) maintaining a composite deck in the long run. And time is money.

Trex vs Wood (Trex IR Website)

I can offer a bit of anecdotal evidence to this investment thesis. My parents built a house around 10 years ago and they installed Trex composite decking. The Trex product just looks good. It’s clean, lasts forever, comes in numerous design styles and colors, and doesn’t warp. Trex decking still requires the occasional power-washing to keep it clean, but not much more than that. I swear, my parents’ 10-year-old deck looks near identical to how it looked on day one.

A Sustainable Product

What’s not to love about a product that looks good, lasts forever, requires little maintenance, and is 95% reclaimed wood and recycled plastics? Ever wonder where all those grocery bags go when they’re recycled? How about all those wooden pallets you see stacked up behind your local grocery store? Yes, these are just some of the items Trex uses to manufacture composite decking.

We live in a world that is increasingly environmentally conscious. Nearly two-thirds of US consumers are willing to pay a premium for sustainable products. Trex offers sustainability and superior value, so when it comes to residential decking, it seems like a no-brainer. Especially considering Trex’s largest competitor is wood, which is not nearly as sustainable, and the value proposition isn’t great.

Valuation

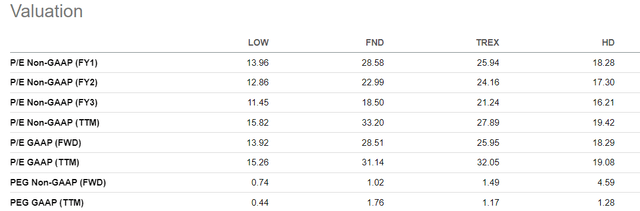

With a current P/E of 27.4, Trex is trading at a 35% discount to its 5-YR average of 41.9. If Trex were to trade nearer its historical P/E of 40, that would put fair value at around $99 (40 x $2.47). While I’m a fan of Trex’s superior, environmentally friendly product, I don’t believe a P/E of 40 is warranted or sustainable. I’m prone to believe an appropriate market multiple is somewhere between 22 and 28, which means that at $63.60, Trex is near fair value. A drop in price below $55 is a strong buy in my opinion. Until then, Trex is GARP. You may not be able to pick up shares at a deep discount to intrinsic value, but I think buying today will get you a fair price.

P/E Comparison (SeekingAlpha.com)

Bear Case

With a superior, sustainable product, it’s difficult to come up with a bear case for Trex, but here goes nothing.

My bear case for Trex is tied to a prolonged recession resulting in a shift in consumer preference. Consumers may shift from preferring sustainable products in good times to preferring cheaper products in bad times. If everyday consumers are forced to pinch pennies to save money, Trex’s revenue and earnings are likely to take a substantial hit due to 1) a major slowdown in residential construction and 2) consumers trading down. I don’t believe this negates the positives Trex has going for it, but it most assuredly would make for a bumpy ride over the next few years.

Additionally, any product defects or quality assurance issues could have a significant impact on Trex’s future performance. Having an environmentally friendly product is great, but not if the product is inferior to a cheaper alternative like wood. Anyone remember paper straws? Good idea in theory, bad idea in practice.

Conclusion

Trex is an excellent company offering a superior, environmentally friendly product. Even with a higher price point, Trex continues to take market share from wood and offers a compelling value proposition to an increasingly environmentally conscious consumer.

Historically, Trex has traded at a premium to the market. I believe the premium is warranted, but I don’t think investors should count on Trex returning to a P/E of 40 anytime soon. At $64 per share, Trex appears to be trading near fair value. In my opinion, a price below $60 is a buy. A price below $55 is a strong buy. Today’s price of $64 – okay.

Be the first to comment