DenisTangneyJr/E+ via Getty Images

On Tuesday, April 19, 2022, property and casualty insurance giant The Travelers Companies, Inc. (NYSE:TRV) announced its first-quarter 2022 earnings results. Travelers has long been one of the better companies in the insurance space by virtue of its generally conservative underwriting culture and a municipal bond-heavy investment portfolio that allows it to ride through pretty much any economic disruption. The company’s latest results generally illustrated this, as it posted fairly strong year-over-year growth, although the reaction of analysts and the market to the results was generally mixed. Travelers also continued its long streak of raising its dividend annually, which is incredibly nice today considering the inflation that has been plaguing the economy for a while now.

First Quarter Earnings

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Travelers’ first quarter 2022 earnings results:

- The Travelers Companies reported total revenues of $8.809 billion in the first quarter of 2022. This represents a 5.97% increase over the $8.313 billion that the company reported in the prior-year quarter.

- The company reported a core income of $1.037 billion during the reporting period. This compares very favorably to the $699 million that the company reported during the year-ago quarter.

- Travelers achieved a combined ratio of 91.3% during the most current quarter. This represents a dramatic improvement over the 96.6% combined ratio that the company achieved during the equivalent quarter of last year.

- The company had a book value per share of $106.40 at the close of the quarter. This represents a 5.35% decline over the $112.42 per share that the firm had at the end of last year’s first quarter.

- The Travelers Companies reported a net income of $1.018 billion in the first quarter of 2022. This represents a 38.88% increase over the $733 million that the company reported in the first quarter of 2021.

The Travelers Companies is often thought of as a business insurance company for a very good reason. After all, the company’s business insurance unit generates the overwhelming majority of the company’s revenue. We can see this by looking at the unit’s net written premiums, which is an insurance industry measure that refers to the amount of premiums that the company’s customers paid under their policies minus any premiums that the company paid to a reinsurance company.

During the first quarter of 2022, Travelers’ business insurance unit reported net written premiums of $4.502 billion, which represents an 8.43% increase over the $4.152 billion that it had in the prior-year quarter. This business segment accounted for 53.81% of the company’s $8.367 billion total during the quarter, obviously substantially larger than any other business unit was able to generate.

The nicest thing here, though, was obviously the year-over-year growth, which the company credits to an increase in new policies being written compared to a year ago as well as an increase in policy renewals. Approximately 87% of the company’s customers whose policies expired during the first quarter chose to renew, as opposed to 83% in the prior-year quarter. This represents a continuation of the company’s recent track record of achieving very high renewal rates on its business insurance policies over the past year.

| Q1 2022 | Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | |

| Retention Rate | 87% | 85% | 85% | 84% | 83% |

This is something that is quite nice to see, since it shows that the company’s customers are in aggregate quite pleased with the overall quality of service that they are receiving from the company. This serves as a source of recurring revenue and income for the company, which is always nice because it is much cheaper to keep an existing customer than it is to attract a new one. In addition, there is no guarantee that the company will actually be able to attract new ones to replace any that it loses. Since any lost customer results in lost revenue, a low renewal rate could be a very real problem. Thus, the company’s high retention rate is very nice to see.

Although Travelers’ business insurance segment is by far its largest, it did not have the highest growth rate during the period. That honor belongs to the company’s bond and specialty products business, which increased its net written premiums by 22.00% year-over-year, going from $723 million a year ago to $882 million in the most recent period.

There were two major reasons for this, which are an increase in new business and the fact that the company was able to significantly increase the prices that it charges its customers that opted to renew their policies during the quarter. Travelers did not provide any particular reason for the price increase, but it seems very likely that the high inflation rate currently plaguing the United States played a role in this, since inflation means that Travelers will have to pay out more money on any claims against its policyholders.

The increase in new business is quite nice to see and could very easily be a sign that the economy is continuing to recover from the devastating effects of the coronavirus and the lockdowns that accompanied the outbreak of the pandemic. We can see signs that this is the case elsewhere in the economy as well. Naturally, as business activity increases, there is an increased need for surety bonds, and, as Travelers is one of the largest issuers of these products in the United States, it is fairly easy to see how it is going to benefit from this.

Travelers also saw its personal insurance segment deliver strong results. This business reported net written premiums of $2.983 billion during the quarter, a 12.27% increase over the $2.657 billion that the business unit achieved in the year-ago quarter. This is the line of business that most readers are likely to be familiar with, so it stands to reason that the causes of this improved performance are going to be obvious. After all, it currently costs much more to repair a house or a car than it did a year ago, so Travelers was forced to raise the prices that it charges its customers under its policies in order to compensate.

Despite the increased premiums, though, Travelers was able to achieve an 84% retention rate, which is generally in line with what it was able to achieve over the past year. This is likely a sign that the company was very reasonable about its price increases, particularly considering that personal insurance customers tend to be more price-sensitive than customers of other business segments.

One of the most important measurements to use in order to evaluate the performance of an insurance company is its combined ratio. This ratio tells us what percentage of its collected premiums the company had to use in order to pay out all of the claims against it. Travelers reported a combined ratio of 91.3% during the first quarter, as noted in the highlights. This is quite nice to see, since it means that Travelers collected more in premiums than it had to pay out in claims and was thus able to add money into its reserves. This is also a sign of Travelers’ conservative underwriting culture.

One thing that we see some insurance companies do is deliberately price their policies below the level that would be needed to cover their expected claims in an effort to win customers. These companies are essentially hoping that they can earn a large enough return by investing their reserves to make up the difference, which is of course by no means guaranteed. Travelers does not do this, however, and it aims to always collect more in premiums than it has to pay out and thus build up its reserves over time. This is, therefore, a much more conservative strategy than some of its peers use, but it is overall better for the long term because it allows the company to ride through both good and bad economies with ease. This is something that we do overall like to see in an investment.

Valuation

Travelers’ conservative nature also shows itself in the company’s investment portfolio. As is the case with all insurance companies, Travelers invests the policy premiums that it collects from its customers that are in excess of the money that it needs to pay claims. The accumulation of all of this money over time is the company’s reserves, and it is these reserves that account for the majority of the company’s book value.

As noted in the highlights, Travelers saw its book value per share decline year-over-year, despite the fact that the company’s diluted weighted average shares outstanding decreased by 10.4 million over the trailing twelve-month period. The reason for the decline is that Travelers invests its reserves primarily into bonds, with municipal bonds being a major part of this. As everyone reading this is no doubt well aware, bond prices move inversely to interest rates, and the Federal Reserve has finally begun to raise rates after cutting them to essentially zero when the pandemic broke out. This caused the value of the bonds in the company’s portfolio to decline, essentially reducing the value of its reserves.

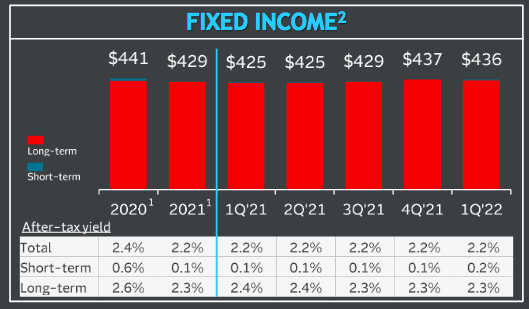

Fortunately, though, that did not have a significant impact on the actual investment income that the company receives from the bonds that it owns. During the first quarter of 2022, Travelers received $436 million from its bonds, up from $425 million last year.

Travelers Q4 2022 Earnings Presentation

Overall, the decline in book value is probably not a problem unless Travelers begins to sell the bonds in its portfolio and realizes a capital loss. The company does not seem especially likely to do this. As already stated, the majority of these are high-quality municipal bonds, so the default risk is likely to be very low even if the economy takes a turn for the worse. In addition, Travelers is making an underwriting profit off its policies as shown by the combined ratio being under 100%. As such, it does not actually need its reserves to pay out the claims against it and thus is not being forced to sell for that reason.

The Federal Reserve has already stated that it is planning more rate hikes over the remainder of this year, so it seems likely that we will continue to see the company’s book value decline. However, this is not a concern because the company’s underwriting culture ensures that it is not dependent on its reserves. Overall, there is nothing to worry about here.

Conclusion

In conclusion, Travelers’ conservative culture continues to be a source of strength for the company. It is this conservative culture that allows the company to ride out the rising interest rate environment without needing to worry about the unrealized capital losses that it is suffering from its bond portfolio because it is not dependent on this portfolio. The company also enjoys very high customer loyalty which is allowing it to raise prices in order to compensate for the inflation that we are seeing today.

Overall, Travelers continues to be a conservative anchor for a portfolio. The company is unlikely to deliver the gains that some other investments might be able to, but it is one that an investor can rely on over the long term.

Be the first to comment