SochAnam

Rev up your portfolio with TravelCenters of America

Ranked #1 in the Automotive Retail industry, this consumer discretionary stock is the one-stop-shop to watch. The nation’s biggest publicly traded full-service travel center, TravelCenters of America Inc. (NASDAQ:TA), is on an uptrend. With more than 19,000 staff in over 280 travel and trucking centers throughout the U.S. and Canada, TA offers food, drink, and fuel and prides itself on the cleanest shower stalls on the interstate. In addition to the snack offerings of its convenience stores, TA also offers restaurant options, which include popular fast food chains like IHOP, Burger King, and Taco Bell. If that’s not enough to fuel your excitement, despite a market contraction and cost pressures of the inflationary environment, October highlights, according to the U.S. Travel Association, include:

-

Travel spending improved by 6% in September and is now at its highest since the pandemic started and above 2019 levels.

-

Domestic leisure travel has surpassed pre-COVID levels, with domestic business travel expected to reach 81% of pre-pandemic levels for 2022.

-

32% of American travelers indicate leisure travel will be a high-budget priority in the next three months—down from 34% in July.

Since hiring CEO, Jon Pertchik in 2019, TA has seen a complete turnaround, despite market volatility, rising fuel, and food prices, and fear of recession. The consumer discretionary giant could be susceptible to revenue and cash flow declines, and inflationary and labor pressures have posed headwinds. But as we’ve seen with the latest earnings and TA’s overall financials and excellent execution in managing operating expenses, improvements, and leveraging technology and its network and partnerships, the company is resilient.

“Beyond the individual businesses, I think it is important to speak to the resiliency of TA’s business model itself, as we have discussed before, TA has a unique strength in that certain areas benefit from the same conditions that cause a headwind in other areas of the overall business. For example, while we are seeing the consumer motorists segment impacted by inflation, slowing discretionary spending at the c-stores, these same macroeconomic uncertainties have also created a favorable fuel market environment that allows our team to deliver higher CPG margins. This is just one example of the balanced and resilient TA business model.” –Pertchik

Let’s look at how TravelCenters of America could offer upside to a portfolio.

TravelCenters of America

-

Market Capitalization: $948.13M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 11/3): 2 out of 546

-

Quant Industry Ranking (as of 11/3): 1 out of 26

A differentiator in the automotive retail industry, TravelCenters of America is committed to its guest experience, recently announcing the enhanced comfort of truck driver lounges through improvements to the overall facilities. As part of the growth strategy and improving non-fuel business and margins, the CEO of TA, Jon Pertchik, announced:

“We are listening to our guests’ feedback and are pleased to offer what they are looking for – a welcoming and engaging travel center experience- through newly built and refreshed locations…As we continue growing to serve more travelers, we are enhancing their experience by expanding food offerings, supporting guest health, and continuing to update and upgrade our sites.”

Let’s dive into the company’s earnings.

TravelCenters of America Growth & Profitability

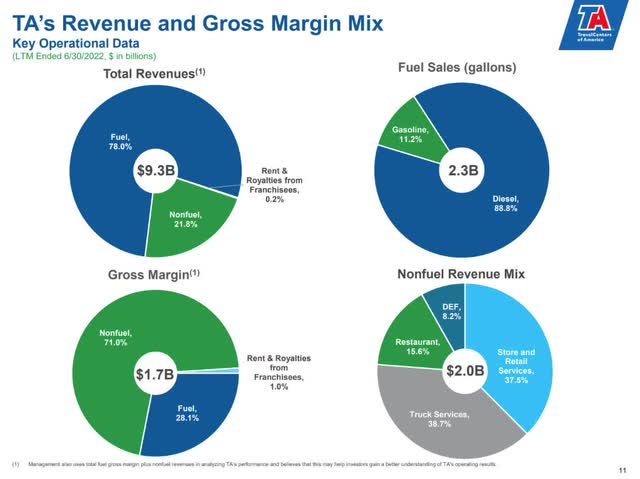

With 78% of its revenue tied to fuel sales, most of which is diesel, margins tend to be smaller. Most of the company’s 71% gross margins come from non-fuel sales, so it improved its processes.

TA’s Revenue and Gross Margin Mix (TA Q2 Investor Presentation)

To increase margins, staff improved buying processes for lower delivery expenses. With the continued strength of diesel fuel, TA is committed to having diesel exhaust fluids (DEF) placed in all TA Petro stations. Where Q2 turned up tremendous results, beating top- and bottom-lines with store and retail service revenues increasing 3.1%, Q3 EPS of $2.54 missed by $0.13. However, revenue of $2.81B beat by $80M, and the company’s continued solid performance in a challenging macroeconomic environment showcases that it continues to innovate. Not only did TA improve its net income by 67%, but EBITDA also experienced a 36% improvement, and there was a 57% increase in its adjusted trailing 12-month EBITDA to $320M. “I believe that TA’s continued strong performance during what remains a challenging and uncertain environment provides further evidence that solid results like these are sustainable and repeatable moving forward…We are just beginning to hit our stride with growth and innovation,” said Pertchik.

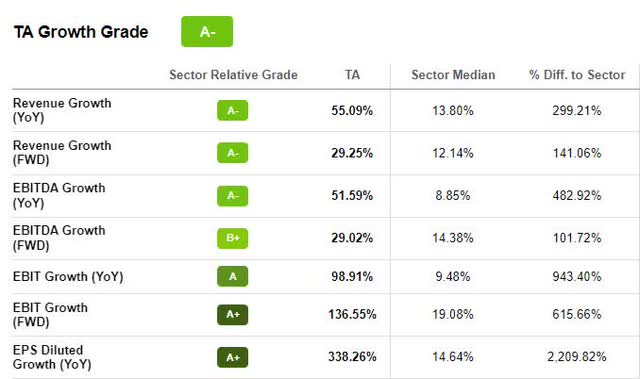

TA Growth Grade (Seeking Alpha Premium)

TA maintains its baseline guidance of $0.15 to $0.17 and outlook. With an A- growth grade and a C profitability grade, the retail giant has taken a proactive approach to increase prices and counteract increasing input costs, mitigating pricing pressures in the near term. Solid earnings and growth have resulted in three analyst FY1 Up revisions over the last 90 days. TA maintains $205.92M in cash and is well-positioned to capture market share. TravelCenters is working hard to impress customers with shiny, clean facilities and completing over 50 new refreshment sites, including renovated restrooms, upgraded showers, new light fixtures, and more. Although the consumer discretionary sector showcases that spending is down with (XLY) -32.90% YTD, TA has figured out how to reset, offering a tremendous balance sheet that allows for continuous expansion as more people return to the road. Despite advance estimates from the U.S. Retail and Food Services for September indicating flattening of figures, TA’s retail and food sales continue to grow. Not only is the company attempting to scale, but its continued momentum and discounted valuation also make it very attractive for portfolios.

TA Stock Valuation & Momentum

Trading at approximately $52 per share, near its mid-52-week and an A- valuation grade, TA comes at a great value. TA’s forward P/E ratio of 5.53x compared to the sector median of 13.67x and a trailing PEG of 0.02x compared to the sector’s 0.22x are a significant difference to the sector, -59.56% and -92.54%, respectively, adding to why this stock is quant rated a strong buy.

TA Momentum Grade (Seeking Alpha Premium)

In the current environment with rising fuel prices and people traveling again, TA is one of my Top Stocks by Quant, given its favorable Factor grades, which rate investment characteristics on a sector-relative basis. In addition to trading at a discount, TA has tremendous momentum, as showcased above, with A+ grades that showcase quarterly price performance outpacing its peers. On a longer-term bullish trend, TA’s momentum is an excellent indicator for predicting stock price performance for investors wanting to hold long-term. As a company focused on its growth strategy, new initiatives that involve its maintenance division, new technology, and diversified footprint should help improve its already unique and differentiated business for a healthier return on invested capital, continuing to make this a strong buy according to the quant ratings.

TA is A Top Growth Stock With Value

As a result of high fuel volumes and high-quality travel centers that offer numerous food, fuel, and rest amenities, TravelCenters of America has recently experienced tremendous growth amid increasing road travel across North America. The company continues to grow as it expands its network through acquisitions, franchising, and new construction. In October, TA announced the completion of over 50 travel center upgrades, creating great traveling destinations for consumers.

In this inflationary environment, in addition to capitalizing on pricing competition, TA continues to partner with popular restaurant chains while expanding its network with an emphasis on the guest experience. Fundamentally sound with great momentum while trading at a discount, TA offers a great potential return on investment. TA is a Seeking Alpha quant-rated strong buy that is a good consideration for portfolios, or we have a vast choice of more Top Growth Stocks that our investment research tools have helped select to ensure you are furnished with the best resources to make informed investment decisions.

Be the first to comment