YouraPechkin/iStock via Getty Images

Investment Thesis

Transphorm, Inc. (NASDAQ:TGAN) was founded in 2007, and has been a public company since February 2020, trading on NASDAQ since Feb 2022.

TGAN is among the leading developers of gallium nitride (GaN) technology and components for power electronics, with an emphasis on higher power applications. They believe they are well positioned to capitalize on the secular shift from silicon to GaN technology, and have a notably strong patent portfolio.

They have successfully attracted and retained significant investors and partners, and shipped real products in volume.

TGAN also owns and operates, via a joint venture, a GaN semiconductor wafer fabrication facility, to meet its own needs and supply wafers commercially to others.

Revenue for FY 2022 was $24 million, an increase of 89% over the previous year. TGAN is targeting 50% CAGR revenue growth over the next five years, into an estimated $6 billion addressable market.

TGAN faces significant competition, and is yet to achieve positive cash flow, but for investors with a 5+ year time horizon, it has the potential to provide well above market returns.

Introduction

I wrote an article a few weeks ago on Navitas (NASDAQ:NVTS), another company active in the GaN power electronics space, and a direct TGAN competitor. Based on discussion in the comments there, I decided to look into TGAN as well.

Relative to silicon-based devices, GaN devices offer advantages including higher switching speeds, higher breakdown voltages and lower resistance. This allows more efficient (up to 40% less wasted energy) and smaller, lighter, cooler, and eventually lower cost power system. GaN adoption appears to be at an inflection point, and is expected to enjoy rapid growth.

In this article, we will discuss the Transphorm story so far, technology, manufacturing, targeted markets, financial status, competitors, valuation, risks, and some implications for investors. Their most recent May 2022 Investor Presentation is here.

The TGAN Story So Far

TGAN is a semiconductor company launched in 2007 by founders Professor Umesh Mishra (now 64) and Dr. Primit Parikh (51).

They previously co-founded Nitres, Inc. in 1996, which developed GaN LEDs and transistors, and was acquired by Cree [now Wolfspeed (NYSE:WOLF)] in 2000; this is not their first rodeo.

Transphorm merged with Peninsula Acquisition Corporation on 12 February 2020, with Transphorm being the surviving name. It appears the merger was a “become a public company” mechanism rather than a funding vehicle; Peninsula’s 30 June 2019 10-K indicated $2,475 in assets.

It you really want to get into the weeds, there are a couple of hundred pages of related contracts here with lots of detail.

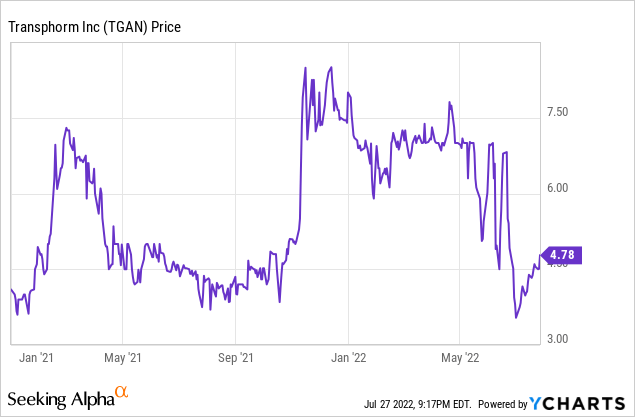

Initially trading over the counter, TGAN began trading on the NASDAQ on 22 February 2022, closing at $6.92.

Their January 2021 slide deck provides a snapshot of their plans and projections at that point, see here.

As of March 31, 2022, TGAN had a total of 108 employees, of which 88 are U.S.-based. Note that in April 2021, TGAN changed their fiscal year end to 31 March, which you will see repeatedly reflected below.

Fujitsu – Bringing a Wafer Fab to the Party

In 2014, TGAN established Transphorm Japan, a wholly owned subsidiary, and entered a partnership agreement with Fujitsu Limited and Fujitsu Semiconductor Limited “FSL”.

In connection with this agreement, TGAN entered into a manufacturing partnership for AFSW, FSL’s 6-inch silicon wafer fabrication plant in Aizu Wakamatsu, Japan. TGAN also acquired a patent portfolio from FSL and a license to a separate portfolio from Fujitsu.

AFSW GaN Semiconductor Fab (Semiconductor Today)

In 2017 this agreement evolved into a joint venture with FSL for AFSW, in which TGAN had a 49% interest.

GaNovation – China Distribution, Less Fab

In December 2020, TGAN entered into a joint venture agreement (see contract here) with JCP Capital Management, LLC Limited (controlling party with 75% ownership as of March 31, 2022) to create GaNovation Pte. Ltd., a joint venture company in Singapore, to engage in the business of distribution, development and supply of GaN products and any business relating to the businesses of AFSW.

At that time, GaNovation became TGAN’s exclusive distributor in Greater China, with rights to procure processed GaN wafers and other components from TGAN, rebrand and resell packaged products purchased from TGAN, and customize and develop mutually-agreed-upon products.

In August 2021, GaNovation acquired AFSW from the TGAN-FSL joint venture, ending FSL ownership and reducing the TGAN stake to 25%. See this Semiconductor Today article for further detail on this deal.

As of March 31, 2022, AFSW is GaNovation’s primary business, and TGAN holds a 25% interest in GaNovation.

KKR Phorm Investors – Just Money

In 2015, KKR Phorm Investors L.P., an affiliate of Kohlberg Kravis Roberts & Co. L.P., made an investment of $70 million to support the commercialization of existing GaN power products. As of 31 March 2022, Phorm is TGAN’s largest stockholder.

Yaskawa – Money and Robots

In 2017, TGAN entered into a partnership with YASKAWA Electric Corporation of Japan (OTCPK:YASKY), a global leader in motion control products and industrial robots.

In October 2017, Yaskawa loaned TGAN $15.0 million, and in October 2021, converted the debt to equity, receiving 3,120,000 shares of common stock.

In December 2020, Yaskawa agreed to provide $4.0 million over three years to fund developments supporting industrial power conversion applications, with an initial focus on customized GaN devices for servo motor drives. As of March 31, 2022, Yaskawa has provided $1.8 million of this commitment.

Nexperia – Money and Cars and More

Nexperia is a semiconductor component manufacturer headquartered in the Netherlands, and a leader in semiconductors for automotive products. Formerly part of NXP Semiconductor, it is a subsidiary of Chinese company Wingtech Technology, which is about 30% state owned.

In 2018, TGAN established a five-year multi-element cooperation agreement with Nexperia with the goal of establishing a second source (Nexperia’s Hamburg fab) for GaN products and better positioning to penetrate the automotive market with GaN products in the long term.

This included a combination of equity ownership, a loan agreement, technology development projects, and licensing of TGAN’s wafer-fabrication process and certain products; TGAN secured ~ $25 million in funding from Nexperia.

In May 2021, the agreement was amended with a view towards a longer term supply relationship with Nexperia.

Marelli – Money and Cars

In 2020, TGAN established a relationship with Marelli, a large automotive supplier spun out of Fiat, for long term development of automotive power management and inverter products. As of December 2021, Marelli, owned by KKR since 2018, is reportedly being restructured. As of March 31, 2022, Marelli has made $5 million of equity investments in TGAN.

Technology

TGAN view themselves as a technology and market leader in the area of GaN power electronics field for high voltage power conversion applications.

Relative to silicon-based devices, GaN devices offer advantages including higher switching speeds, higher breakdown voltages and lower resistance. This allows more efficient (up to 40% less wasted energy) and smaller, lighter, cooler, and eventually lower cost power system.

TGAN is vertically integrated; this includes device design, GaN materials growth, device fabrication, packaging, circuit design, and application support.

TGAN has evolved their products over the years, with Gen-1 and Gen-2 prior to 2016, Gen-3 in 2018, Gen-4 in 2020 and the current Gen-5 SuperGaNTM.

TGAN’s FET products currently support up to 900 volts, with a 1200 volt device demonstrated. Current products support applications from 30 watts to 30 kWatts, and are available in PQFN packages for lower power and TO and surface mount equivalent packages.

They claim a number of industry milestones, including the first:

- GaN on silicon device

- 600 Volt GaN device JEDEC qualification

- high voltage GaN automotive qualified product under the AEC-Q101 standard

- high temperature (175C) rated GaN product

TGAN enjoys a large intellectual property portfolio with access to over 1,000 world-wide patents covering materials, devices, fabrication, circuits, applications, and packaging (see table below). The value of owned and exclusively licensed patents has been estimated at $200+ million.

| Transphorm Patent Portfolio | |||

|---|---|---|---|

| Number | Source | Status | Fees and Royalties |

| 332 | Transphorm | owned | n/a |

| 350 | CREE | non-exclusive | royalty |

| 172 | Fujitsu | non-exclusive | royalty free |

| 150 | Furukawa | sole license |

$200K annual fee + royalty |

| 27 | UC Santa Barbara | exclusive | royalty |

Manufacturing

Through their GaNovation joint venture (see above), TGAN owns and operates a wafer engineering and manufacturing facility, AFSW, in Aizu Wakamatsu, Japan.

This fully depreciated 6-inch production fabrication facility has been running GaN processes since 2012, with commercial production since 2015. Subsequently all production wafers, for internal use or sale, have been sourced from AFSW.

AFSW has a capacity of 14,000 wafers per month. Capacity could be increased with additional capital investment.

Post fabrication processing, packaging, and testing is subcontracted, and performed at various sites in Asia. Multiple sites produce PQFN packages, one site produces TO247, TO220 and D2Pak packages.

In June 2022, TGAN negotiated a manufacturing and supply agreement with GlobalWafers Co., Ltd. in Taiwan for GWC to manufacture GaN products (see the contract with some redactions here).

Markets

TGAN identifies two business segments – GaN power products and GaN epi wafers.

GaN Power Electronics Components

TGAN’s initial target markets for GaN power products have emphasized areas with a requirement for higher voltage and power, where the intrinsic GaN advantages over silicon produce significant efficiency gains, e.g. electric vehicles.

Perhaps reflecting TGAN’s technology orientation, they organize their markets by power levels.

| Power | Target Applications | ||

| Low Power | 30w -300w |

|

design-ins > 55 in production > 20 |

| Medium Power | 300w – 3Kw |

|

design-ins >35 in production > 15 |

| High Power | 3Kw – 5+Kw |

|

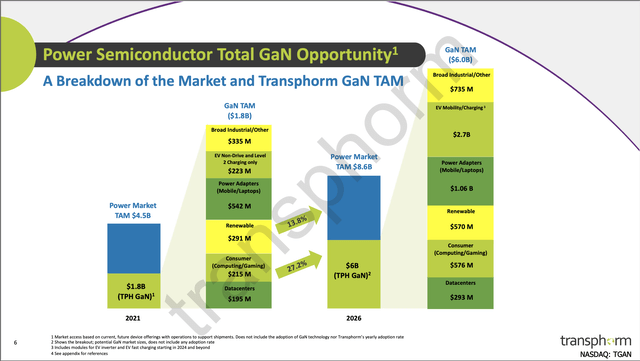

TGAN estimates the GaN power semiconductor market at $4.5 billion in 2023, growing to $8.6 billion in 2026, with the total addressable market for GaN to be $1.8 billion in 2023, growing to $6.0 billion in 2026. Note that almost half of the 2026 TAM is from EVs, the higher power market that has been TGAN’s focus. In any case, there is a lot of room for growth.

Power Semiconductor Market (Transphorm)

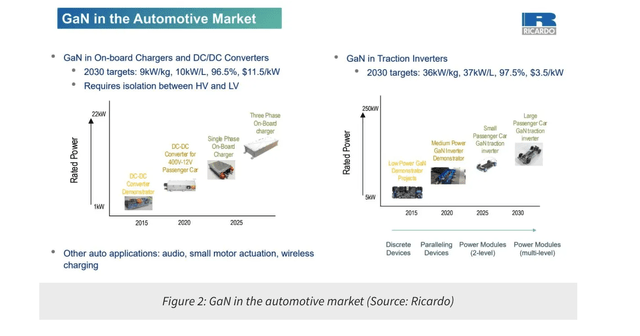

This October 2021 article in Power Electronics discusses GaN in power electronics in general and in EVs in particular (figure below), and this article in Charged provides detail on the implications of moving from 400V to 800V for EV battery packs.

GaN in the Automotive Market (Power Electronics)

In the medium power market, TGAN cites an example of its success with Corsair, a leading supplier of high performance gaming equipment, who successfully introduced its AX1600i series of 1600 watt GaN-based power supplies. Anandtech reviewed the product in 2018, concluding:

The Gallium Nitride (GaN) parts are smaller, lighter, and significantly more efficient than their classic silicon-based counterparts. Their use allowed Flextronics (and ultimately Corsair) to design a platform that combines better overall performance and higher output into a smaller chassis. The end result is a PSU that is no larger than most 800W designs and yet is capable of delivering twice that power output without flinching. GaN parts are greatly more expensive than their silicon-based counterparts but the final product’s cost was partially offset by the reduction in size and cooling requirements, allowing Corsair to maintain the price of the AX1600i at relatively reasonable levels.

GaN Epi Wafers

A major area of expertise and a second line of business is GaN epiwafer (GaN on silicon and other substrates) for the RF/microwave/millimeter wave market and “certain strategic customers” in the power market. The objective here is to be a U.S.-based supplier for advanced GaN epiwafer products for both the U.S. Department of Defense and commercial applications.

In June 2019, the Office of Naval Research exercised a $15.9 million option on a $2.6 million base contract, with work expected to be completed by June 2022. The Microwave Journal reports that “through the ONR program, Transphorm will establish epi capability on multiple platforms, including SiC, Si and sapphire substrates from 4 to 6 in. — ultimately 8 in. For RF and mmWave applications, Transphorm will be a “pure play” epiwafer supplier of GaN materials.”

On 12 October 2021, TGAN won a $1.4 million contract from the Defense Advanced Research Projects Agency to and fabricate GaN on sapphire wafers, with transistor fabrication subcontracted to UC Santa Barbara. EE Power reports that the goal is to assess the performance and cost and of building RF components for both military and commercial use.

Transphorm CTO and Co-Founder Umesh Mishra said:

The contract is an opportunity for the company to build on its position as a premium RF epiwafer supplier, its second business vertical.

The goal now is to take that foundation and enable our RF epi customers to achieve more efficient RF power for the dollar.

TGAN is supplying GaN epiwafers on various substrates, including silicon carbide, sapphire and silicon, ranging from 4 to 6 inches in diameter, for RF/microwave/millimeter wave device markets.

They note that they serve as a pure-play epiwafer foundry for those markets, as they do not make RF device products. Epiwafer sales have been made to Department of Defense customers and Nexperia.

TGAN has estimated the epiwafer component is about 15-20% of the $800 million GaN RF military and telecom market, i.e. potentially $120-$160 million, which might be viewed as a maximum with 100% market share. There are other competitors in this market, and I have not found any data on their current or projected market share.

Customer Concentration

TGAN has been reliant on a few customers for the majority of their revenue.

Three customers – Nexperia B.V., the U.S. government, and one other overseas customer – together accounted for 78.1% of revenues for the year ended March 31, 2022. Each of these three customers accounted for more than ten percent of revenues.

Financial Status

TGAN has operated at a net loss each year since inception. The AFSW wafer fabrication facility has operated at a loss for the duration of TGAN’s involvement and is expected to continue to do so. TGAN does not currently, or expect, to pay dividends.

The financial highlights from the 24 May 2022 earnings release and call, and slide deck (note the full fiscal year now ends 31 March 2022); non-GAAP:

- moved to NASDAQ

- $24.1 million revenue (full year, up 89%)

- $4.9 million revenue Q4 (up 104% from FY21 Q4)

- $4 million product revenue (Q4 FY22, up 190% from Q4 FY21)

- ninth quarter in a row of record product revenue

- $4.0 million net loss Q4 (vs. $5.2 loss Q4 FY21)

- $4.6 million operating expenses (vs. $4.5 million Q4 FY21)

- $1.6 million R&D

- 48% gross margin FY22

- converted $15 million Yaskawa loan to equity, October 2021

- $33 million cash at 31 March 2022 ($45 million as of 03 June 2022)

and have:

- order for 500,000 Gen4 FETs TO247 for 3Kw power supplies; at a “multi-dollar” ASP

- order for 50,000 units for 65 watt laptop power converters

- 35 design-ins and 15 product in production in 300 watt to 4 Kw range

and expect or target:

- 50% 5 year revenue CAGR

- 90% of revenue from products in 2023

- cash flow positive CY 2024

- target 40%+ gross margins

- target 20%+ operating margins

- GlobalWafer capacity expansion on-line mid calendar 2023

- AFSW fab capacity expansion in mid-2022 and 2023

Stockholders

When TGAN went public on 12 February 2020, about 28,200,000 shares of TGAN were issues to various stockholders of the precursor company. The stockholders of Peninsula Acquisition received 1,650,000 shares. TGAN identified a number of subsequent private placements, selling 23.1 million shares and netting $99.7 million, some of which can be identified.

| Date | Shares | Price / Share | Gross (Millions) | Net (Millions) |

| February 2020 | 5,380,000 | $4.00 | $21.5 | $19.7 |

| December 2020 | 5,000,000 | $3.00 | $15.0 | $13.6 |

| March 2021 | 250,000 | $4.00 | $1.0 | $1.0 |

| August 2021 | 1,000,000 | $5.00 | $5.0 | $5.0 |

| November 2021 | 6,600,000 | $5.00 | $33.0 | $32.1 |

| December 2021 | 1,673,152 | $7.71 | $12.9 | $12.6 |

| June 2022 | 3,200,000 | $5.00 | $16.0 | $15.7 |

| with warrants | 666,668 | $6.00 | ||

Immediately subsequent to the merger with Peninsula Acquisition Corp, Transphorm raised $21.5 million in private equity financing, led by existing investors including an affiliate of Kohlberg Kravis Roberts & Co L.P. (KKR), a new strategic investor Marelli, and new institutional investors, as reported here 04 March 2020 by Semiconductor Today.

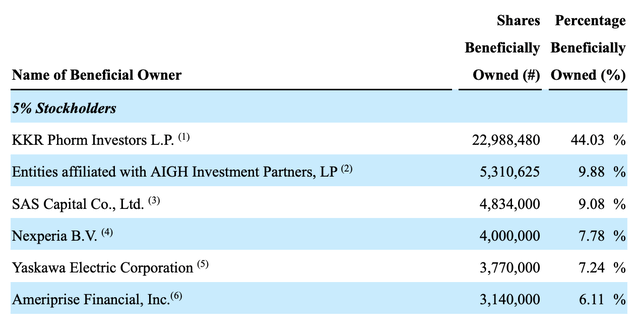

The 24 November 2021 TGAN proxy notes that as of 19 November 2021, there were 51,393,770 shares of common stock outstanding, and the major holders (> 5%) beneficially owned 84.1%, and were:

Transphorm Stock Ownership (Transphorm)

See the proxy for the footnotes. In addition, the officers and directors as a group beneficially owned about 1.6 million shares, or 3%.

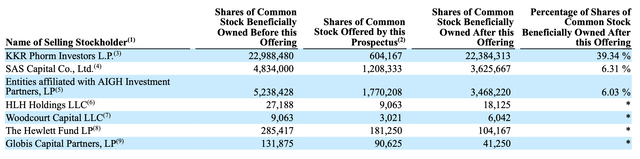

On 13 June 2022, TGAN filed a shelf registration covering the potential resale of about 3.9 million shares of stock by current holders as detailed below.

Transphorm Shelf Registration (Transphorm)

Competitors

TGAN has identified competitors in the power electronics market, sorted by the technology used in their products. They include:

| Silicon Based | Silicon Carbide Based | GaN Based |

|

|

TGAN belies that legacy Si products may currently offer a 2X cost advantage for some components. At high voltage (1200 volts or more), SiC currently offers some performance advantages. Differentiation with other GaN competitors is via quality, reliability, ease of use, and price.

No specific competitors have been identified for the GaN episode wafer business, but the focus here is to be a U.S. based supplier, for both military and commercial RF markets.

Valuation

We can make a back of the envelope estimate for potential valuation. Assume:

- Targeted 50% CAGR revenue growth achieved; $24 million FY 2022 base

- –> $182 million revenue FY 2027, $615 million FY 2030

- 60 million shares outstanding (current plus outstanding options)

- $3/share revenue FY 2027, $10/share revenue FY 2030

- P/S ratio between 2.5 and 7 (TGAN currently 8.7 per Seeking Alpha)

- $7.5-$21 share price circa FY 2027, $25-$70 circa FY 2030

What do the professionals think? They have sold a lot to stock to sophisticated investors in the $4-5 dollar range, each tranche reflecting their assessment of value, over the past couple of years. According to Stock Analysis, the median 12 month price target of 10 analysts is $9.18.

Risks

Several potential risks to the investment thesis deserve mention.

TGAN probably has enough cash; about $45 million in cash as of 03 June, a $4 million per quarter current burn rate, and a target to be cash flow positive in 2024. However, they may be stretched to respond to either problems or opportunity without raising additional cash.

Nexperia, TGAN’s largest customer, may also be or become a direct competitor. Among 15,000 other semiconductor products, since at least 2020 Nexperia sells high power GaN FETs. In November 2021 Nexperia demonstrated a 35 kW GaN power module for EVs, jointly developed with Shanghai Automotive Electric Drive Co., LTD.

TGAN faces geopolitical risks, similar to other firms with the bulk of their business in China or with firms controlled by China.

As the market for power electronics for EVs grows, this is likely to attract intense competition, which may erode margins and make it more difficult to capture and hold market share.

Investor Takeaway

Transphorm appears to have excellent technical capabilities, a strong patent position, a 15 year history, and has successfully attracted and retained significant investors and partners. They have shipped real products in volume.

As do their competitors, they see a large opportunity in applying GaN technology in the power electronics space.

They have prioritized higher power GaN products and appear to enjoy a lead in getting those products to market. In the very high volume lower power chargers market, they appear to be playing catchup.

Their wafer business may not turn out financially significant in the longer term, and in fact may be a distraction.

My holistic assessment is that as GaN products capture a larger market share in power electronics, they will become an increasingly attractive acquisition candidate for one of the larger firms – Infineon, Nexperia, Texas Instruments (TXN) – seeking market share or technology.

For investors with a 5+ year time horizon, I think there is a better than even chance that TGAN at current prices will provide better than market returns.

Personally, I now own a small position in TGAN, and have a larger limit order in at a price below the current price. I view this as a speculative 10+ year investment, with a potential 6-10X return over than time.

Be the first to comment