Kirill Gorshkov/iStock via Getty Images

TransGlobe Energy (NASDAQ:TGA) is an oil exploration and production company, headquartered in Canada. From 31 December 2021 to 8 June 2022, the stock’s price increased from $3 to $5.30. However, since 8 June 2022, TGA dropped to below $3.5 per share. Due to the crude oil prices of more than $100 per barrel and the ongoing war in Ukraine, TGA is well-positioned to benefit from the market condition for the rest of 2022. Analyzing the company’s capital structure shows that TransGlobe has a healthy capital structure. I evaluate that the stock is worth more than $5 per share. It is time to buy the dip.

Q1 2022 Highlights

In its Q1 2022 financial results, TransGlobe Energy reported petroleum and natural gas sales of $81.5 million, compared with Q1 2021 sales of $42.3 million, up 93%. Net of royalties, the company’s sales increased from $18 million in Q1 2021 to $53 million in Q1 2022, up 193% YoY. TGA reported funds flow from operations of $27 million, compared with Q1 2021 funds flow from operations of $81,000. TGA reported Q1 2022 net earnings of $48.8 million, or $0.66 per diluted share, compared with Q1 2021 net loss of $11 million, or $0.15 per diluted share. In the first quarter of 2022, TGA’s average production and sales volumes increased by 2% (YoY) and 23% (YoY) to 12446 boe/d and 11964 boe/d, respectively. The company’s average realized sales price increased from $48.47 in Q1 2021 to $75.70 in Q1 2022.

Q2 2022 Netbacks Estimation

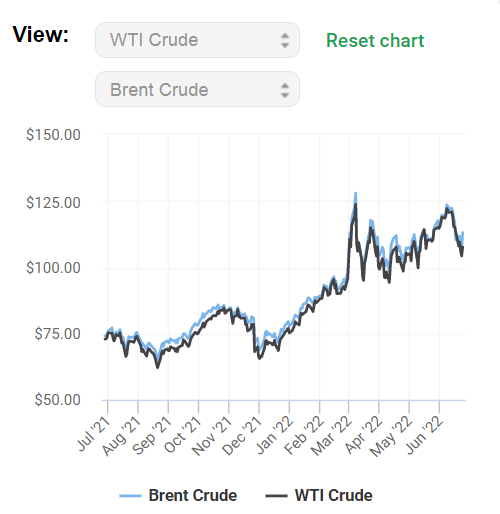

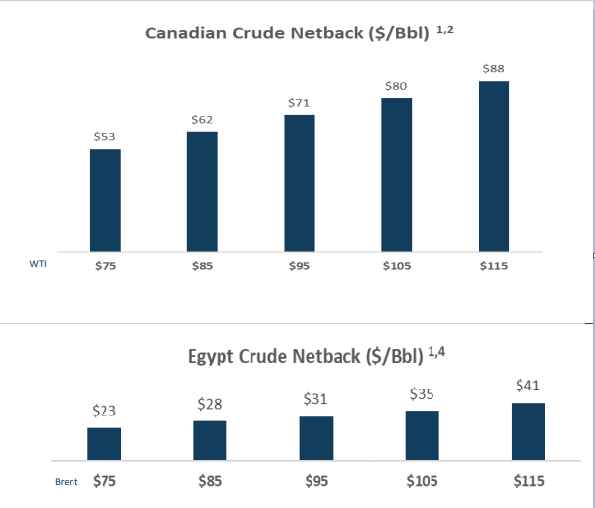

From 31 December 2021 to 31 March 2022, WTI and Brent Crude Oil prices increased from $75 per barrel to $100 per barrel, up around 33% (see Figure 1). In March 2021, oil prices rose to more than $120 per barrel. In the first quarter of 2022, TGA’s crude oil average realized price was $82 per barrel. With WTI and Brent Crude Oil prices of $75 per barrel, the company estimates 2022 Canadian crude and Egypt crude netbacks of $53 and $23 per barrel, respectively. With WTI and Brent Crude Oil prices of $95 per barrel, the company estimates Canadian crude and Egypt crude netbacks of $71 and $31 per barrel, respectively. With WTI and Brent Crude Oil prices of $115 per barrel, the company estimates Canadian crude and Egypt crude netbacks of $88 and $41 per barrel, respectively (see Figure 2). Compared to Q1 2022, I expect the company to report higher crude netbacks for Q2 2022. Why?

Figure 1 – Crude oil prices

oilprice.com

Figure 2 – Canadian and Egypt crude netbacks

1Q 2022 presentation

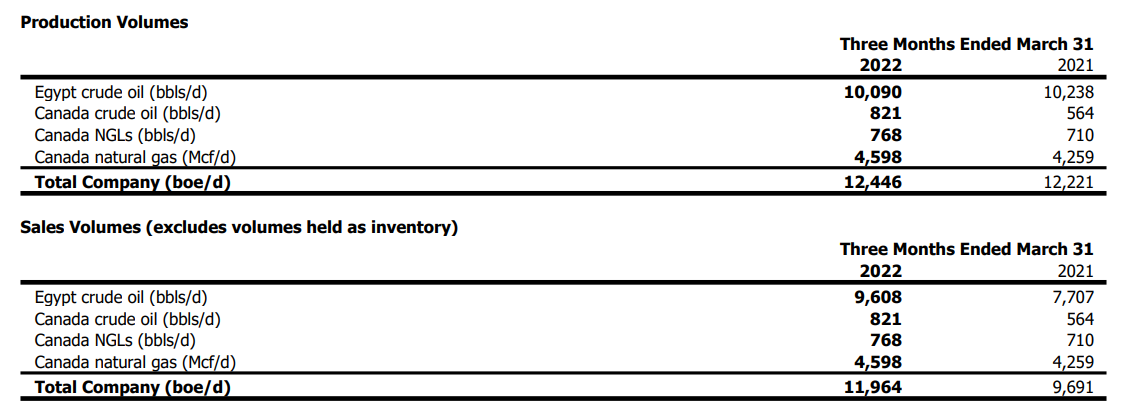

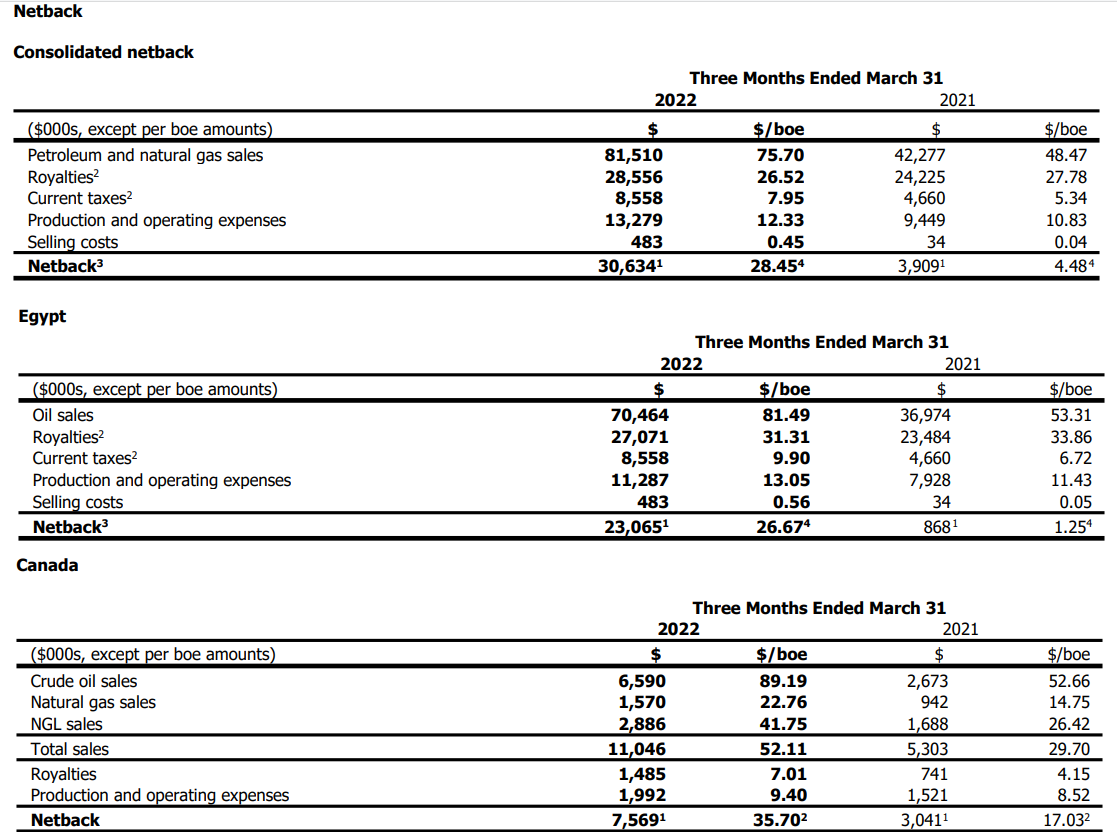

In the first quarter of 2021, TGA reported Egypt oil sales and netback of $70.5 million and $23.1 million, respectively (at an average realized price of $81.49 per barrel). Also, in the first quarter of 2022, the company reported Canadian crude oil sales, Natural gas sales, NGL sales, and a netback of $6.6 million, $1.6 million, 2.9 million, and $7.6 million, respectively (at crude oil average realized price of $89). Moreover, in the first quarter of 2022, TGA’s Egypt crude oil and Canada crude oil production volumes were 10,090 and 821 bbls/d, respectively (see Figure 3). Also, in Q1 2022, Egypt crude oil and Canada crude oil sales volumes were 9,608 and 821 bbls/d, respectively.

From 31 March 2022 to 24 June 2022, crude oil prices increased from $100 to more than $110 per barrel. On 20 June 2022, the company announced 2Q 2022 (to 11 June) Egypt crude production of around 10,385 bpd and Canada crude production of around 630 bpd. In the first quarter of 2022, Egypt crude oil netback was $26.67 per barrel of oil equivalent (see Figure 4). I estimate 2Q 2022 Egypt crude oil netback of more than $35 per barrel of oil equivalent. Furthermore, in the first quarter of 2022, Canadian sales (crude oil, natural gas, NGLs) netback was $35.70 per barrel of oil equivalent. Controlling natural gas and NGLs sales, I estimate Q2 2022 Canadian crude netback of more than $80 per barrel of oil equivalent. Due to the continuing war in Ukraine and US sanctions against Iran oil, I expect oil prices to remain high for the rest of 2022. Thus, I estimate higher than Q1 2022 crude netbacks for Q3 and Q4 2022.

Figure 3 – TGA’s production and sales volumes

1Q 2022 financial report

Figure 4 – TGA’s netbacks

1Q 2022 financial report

TGA Performance Outlook

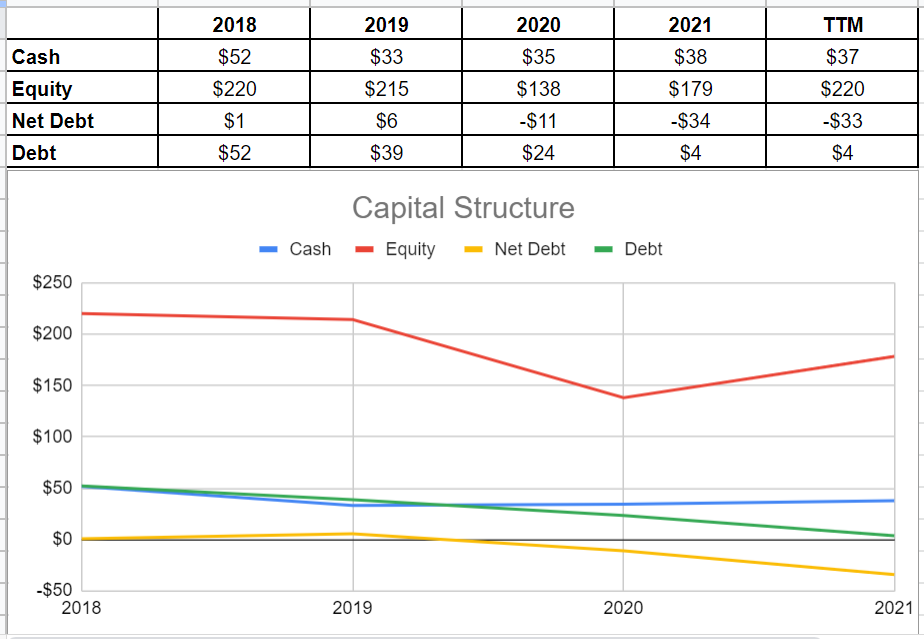

Scratching beneath the surface and analyzing the company’s capital structure shows that after a severe drop in total equity in 2020, down 35% from $215 million in 2019 to $138 million in 2020, it increased back to $179 million during 2021 and $220 million TTM. Also, we observe that TransGlobe’s net debt shrank to $(34) million in 2021 versus its level of $(11) million at the end of 2020. TGA’s current total debt is well beneath its cash balance of $37 million, which indicates that the company is using the cash it generated to grow shareholders’ value by declining the amount of debt. Thus, by analyzing the company’s capital structure, TransGlobe’s healthy position could be seen (see Figure 5).

Figure 5- TransGlobe capital structure (in millions)

Author (based on SA data)

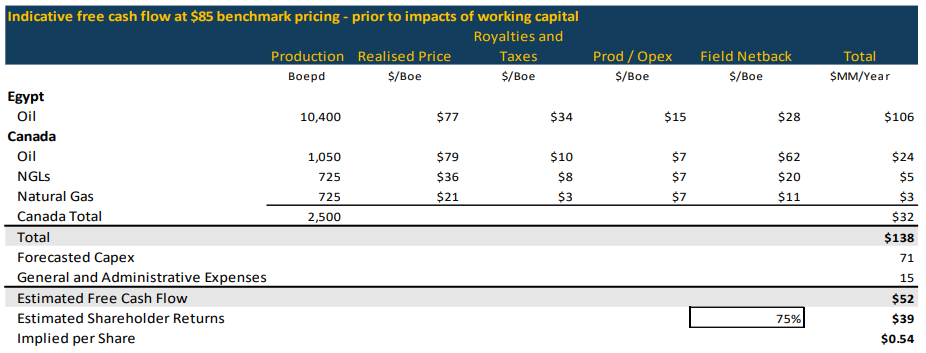

Notwithstanding the volatility of this market due to the volatility of oil prices, the company could estimate a forecast for 2022. ATG’s free cash flow at $85 benchmark pricing is forecasted to be $52 million in 2022. It is from a decline of $86 million in capital expenditure and general expenses from $138 million of expected cash generation. The company is targeting to devote 75% of its free cash flow to its shareholders, which is equal to $39 million (see Figure 6).

Figure 6 – 2022 forecasted free cash flow

1Q 2022 presentation

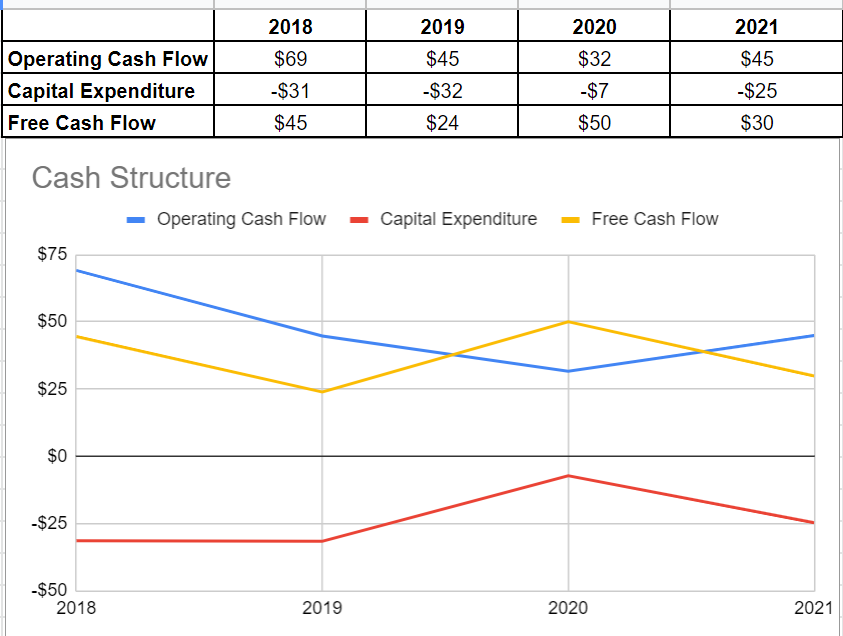

With analyzing the company’s cash position, it is observable that TGA is able to generate and devote its free cash flow to the shareholders: its cash operation grew by 40% in 2021 to $45 million compared with the amount of $32 at the end of 2020. Combined with $25 million of capital expenditure at the end of 2021, TGA’s free cash flow sat at $30 million in 2021, a 40% decline compared with 2020. As the company announced in its presentation, if the price of oil declines by $10, its free cash flow would decline by circa $20 million and vice versa (see Figure 7).

Figure 7- TransGlobe cash structure (in millions)

Author (based on SA data)

TGA Stock Valuation

Analyzing TransGlobe Energy’s financial condition indicates that the stock is a good scope for investment, with healthy and well-performed cash and capital conditions. Albeit fairly volatile due to the fabric of the industry, I consider TransGlobe stock undervalued. Even if the oil price declines, the company will be preserved because of the company’s free cash flow generation ability. Moreover, the management’s strategy of reducing the debt amount will help them to be conserved from unpredictable downturns in oil prices in the future.

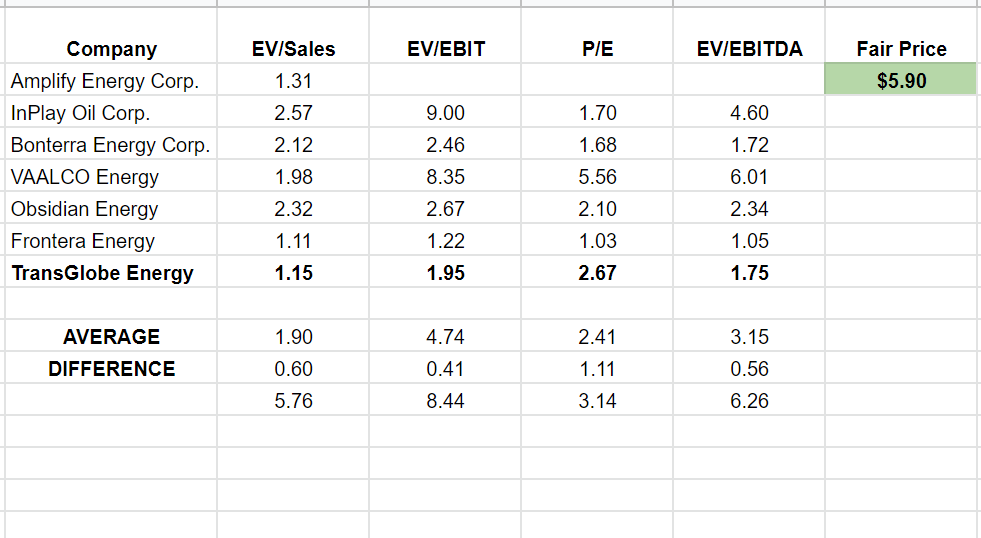

Apart from the company’s performance analysis, I used Comparable Companies Analysis to evaluate the stock’s fair value. The CCA model indicates that the stock is undervalued and has an upside potential to reach about $5-$6 (see Table 1).

Table 1- TransGlobe stock valuation

Author (based on SA data)

Summary

Compared to Q2 2021 and Q1 2022, the company’s netbacks will be significantly higher. I estimate Q2 2022 Egypt crude oil netback of more than $35 per barrel of oil equivalent for TGA. Also, I estimate Q2 2022 Canadian crude netback of more than $80 per barrel of oil equivalent for the Canadian company. Moreover, analyzing the company’s cash position shows that TGA is able to generate and devote its free cash flow to the shareholders. The CCA model indicates that the stock is undervalued and has an upside potential to reach about $5-$6. I am bullish on TGA.

Be the first to comment