Stockbyte/Stockbyte via Getty Images

Introduction

It’s time to talk about one of my favorite stocks in the aerospace & defense industry. The TransDigm Group (NYSE:TDG) just reported its 3Q22 earnings, which came in higher than expected with strength in all commercial segments. While its special dividend came in below estimates, we’re seeing that new orders are strong as inventories are being re-filled again driven by higher demand. Moreover, margins are coming back and free cash flow generation is supportive of debt reduction and new M&A activity. Not only that but the company’s debt load is protected against higher rates, which gives the company an edge in a still very uncertain economic environment.

In this article, I will walk you through the details and explain why TransDigm remains one of the best aerospace stocks on the market.

So, bear with me!

What TransDigm’s Results Mean

I care for these numbers for two reasons. Number one is obviously that it tells everything we need to know about TransDigm. Reason number two is that the company is such a large player, that it also reveals a lot about the aerospace industry in general. That’s both commercial and defense.

What makes TDG so special is that its business model is nothing short of genius. With a market cap of $35.2 billion, the company is a supplier of almost every single aerospace program in the western world.

To answer the question of what exactly they sell, allow me to quote the company as they sell pretty much everything:

[…] include mechanical/electro-mechanical actuators and controls, ignition systems and engine technology, specialized pumps and valves, power conditioning devices, specialized AC/DC electric motors and generators, batteries and chargers, engineered latching and locking devices, engineered rods, engineered connectors and elastomer sealing solutions, databus and power controls, cockpit security components and systems, specialized and advanced cockpit displays, engineered audio, radio and antenna systems, specialized lavatory components, seat belts and safety restraints, engineered and customized interior surfaces and related components, advanced sensor products, switches and relay panels, thermal protection and insulation, lighting and control technology, parachutes, high performance hoists, winches and lifting devices, and cargo loading, handling and delivery systems.

It does not sell large products like engines, but smaller parts without a lot of competition. In fact, 90% of the company’s sales do not have competition. Let me repeat that. The company is the sole source provider of 80% of its net sales.

What this means is that the company has pricing power. As its highly engineered components are needed in major projects, it can hike prices rather easily. First of all, its products are not *that* expensive compared to suppliers of i.e., engines, which makes hiking prices easier. Second, there are no competitors. And if that were the case, the company would try to acquire them.

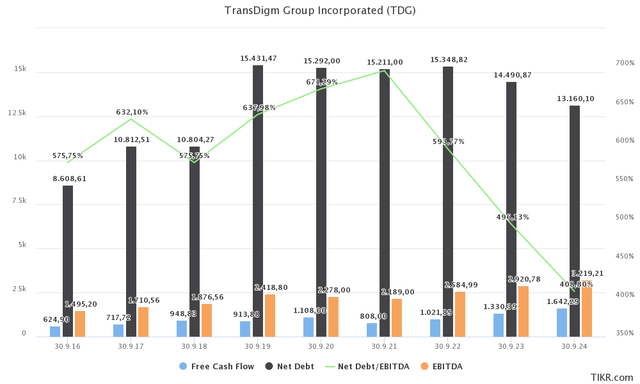

The graph below somewhat shows how great its business model is. EBITDA has grown from $1.5 billion in 2016 to $2.2 billion in 2021. That’s 6.6% growth and it includes two pandemic years. That’s a third of that time period. Free cash flow has improved from $625 million to more than $1.0 billion. That’s in a pandemic year with weak order flows. Net debt has increased to more than $15.0 billion as a result of high acquisition volumes. Yet, if the company refrains from buying new companies, the net debt ratio is expected to drop by almost 3 points in less than four years. But more on that later.

With that said, one of the biggest issues facing TransDigm and its peers is that major customers stopped ordering parts when the pandemic hit. Even after that, the order flow was weak as manufacturers worked through the existing inventory to finish deliveries.

Also, it didn’t help that supply chains were a total mess – and they still are to some extent. Labor, electrical parts, rare earths, you name it. It all saw higher prices and shortages in available supply.

The list below is a quote from the most recent ISM report, which shows materials that are in short supply. The number in brackets indicates the number of consecutive months that something has been in short supply:

Adhesives and Paints; Aluminum; Electrical Components (22); Electronic Components (20); Hydraulic Components (3); Labor – Temporary (15); Plastic Resins (3); Resin Based Products; Rubber Based Products (2); Semiconductors (20); and Steel Products (4).

Now, let’s look into TDG.

The company did $1.4 billion in quarterly sales. In this case, we’re talking about the third fiscal quarter of 2022. Revenue came in $10 million below expectations (we can ignore that) and 14.8% higher compared to the prior-year quarter.

Roughly 50% of sales were generated in the company’s defense segment. Prior to the pandemic, defense sales accounted for roughly 29% to 37% of total sales. I expect defense sales to return to these levels in the years ahead.

25% of sales were commercial OEM sales. The remaining 25% were commercial aftermarket sales. Total aftermarket sales account for 75% of total EBITDA, which is fantastic news as TDG not only benefits from new planes, but an ever-growing installed base of planes in need of maintenance.

Adjusted EPS came in at $4.85, $0.42 higher than expected.

The company didn’t give guidance due to a volatile market environment.

TDG mentioned unfavorable factors like demand for air travel, which remains depressed. The company did benefit from domestic air traffic, but long-haul demand remains an issue. I expect that to remain the case until at least 2024 for the following reasons (among others):

- High inflation makes long-haul travel even more expensive.

- China is still restricting traffic and one of the major travel nations.

- The pandemic is still an ongoing issue in a lot of places in the world.

- Global geopolitical uncertainty including sanctions pressure demand.

Yet, there’s some good news according to the company:

With softened or fully lifted travel restrictions in majority of countries and the summer travel season upon us, passenger travel demand has been strong. China domestic air traffic remains low but is making progress from its most recent sharp drop-off due to strict Zero-COVID policies limiting travel. International traffic in China is finally starting to improve off of COVID lows.

As a result, EBITDA margins improved to 49.8% (up from 45.9% in 3Q21) with a strong operating cash flow of $300 million, which boosted total company cash to $3.8 billion. Hence, the company bought back $245 million in shares.

The company also announced an $18.50 special dividend per share, payable on August 26.

TDG also bought DART for $360 million in cash. This company is a leading provider of highly engineered unique helicopter solutions servicing mainly civilian aircraft.

Needless to say, the company is looking for new M&A opportunities, yet it did not comment on anything specific, which makes sense as that would be irresponsible.

With regard to the aforementioned full-year guidance, the company expects to reinstate guidance during its November 2022 earnings call when it will discuss the FY2024 outlook. So far, the company mentioned the following:

We remain encouraged by the recovery we have seen in our commercial OEM and aftermarket revenues and the strong bookings received for both thus far in fiscal 2022. We continue to expect COVID-19 to have an adverse impact on our financial results compared to pre-pandemic levels in our final quarter of fiscal 2022 under the assumption that both our commercial OEM and aftermarket customer demand will remain depressed due to lower worldwide air travel, although recent positive trends in commercial air traffic could impact us favorably.

Moreover, the company is not expecting to grow its defense sales in FY2022 (flat growth). The company sees shipment delays as a result of limited supply chain shortages and delays in the US government defense spending outlays. Please bear in mind that defense sales are volatile in general as they depend on a number of bigger ticket projects. Or as the company calls it, the “end market can be quite lumpy”.

Prior to its earnings call, the company expected low-single-digit revenue growth in this segment.

TDG Balance Sheet & Valuation

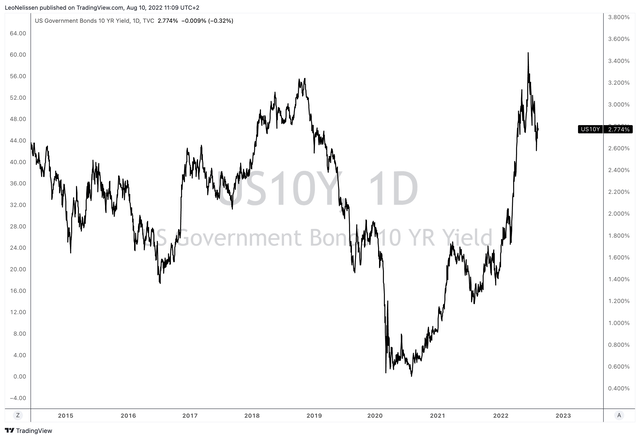

Borrowing costs have risen. The US 10-year government bond is yielding 2.8%. The three-month LIBOR rate is 3.44% using CME’s Eurodollar futures. That’s up from less than 0.2% prior to the surge in rates.

TradingView (10-Year Bond Yield)

This applies to every company with debt. However, it especially applies to TransDigm due to its debt-fueled acquisition strategy. As of July 2, 2022, the company has $19.9 billion in gross debt. $13.2 billion of this is secured debt. The average weighted interest rate on its debt was 5.5%.

On its $819 million revolver debt facility, the company pays LIBOR +2.50%, which isn’t very low, but it’s fair given the company’s balance sheet.

The good news is that the company has managed variable interest risks. 85% of its debt is fixed rate debt through the calendar year 2025, which buys a lot of time as I do not believe that rates will be this high next year. And even if I’m wrong, most of its debt will still be hedged.

An increase of 2.2% in the LIBOR rate will increase the company’s pre-tax interest rate by just 300 basis points, which is very important.

However, refinancing risks remain an issue. In 2025, the company has close to $7 billion in debt maturities. It would be favorable to get rates down prior to that.

Hence, I would not be surprised if the company were to refrain from large M&A projects unless it sees massively undervalued opportunities, which would make taking on higher-interest debt more attractive.

With regard to the valuation, we’re dealing with a company that is expected to lower net debt to $14.5 billion in FY2023 excluding major M&A. This is provided by $1.3 billion in expected free cash flow. This implies a 3.7% FCF yield, which supports aggressive debt reduction if the company decides to go for that instead of M&A.

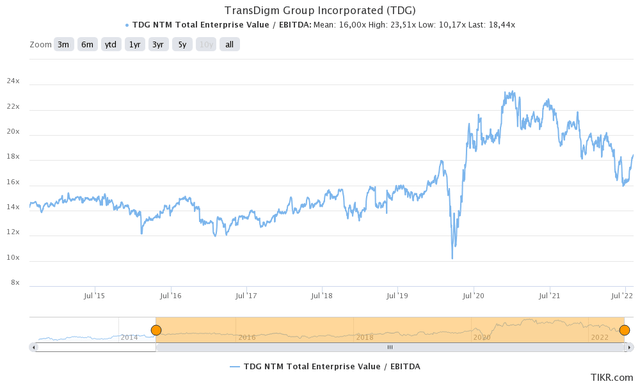

When adding $14.5 billion in expected net debt to the company’s $35.2 billion market cap, we get an enterprise value of $49.7 billion. That’s 17.1x 2023 EBITDA of $2.9 billion.

This valuation erases the post-pandemic surge in valuations, which was mainly caused by lower EBITDA growth.

I would make the case that this is a “fair” valuation. While I expect EBITDA to accelerate after 2023, I did include an expected decline in net debt in my valuation as well as next year’s EBITDA estimates. So, I am pricing in growth here.

Takeaway

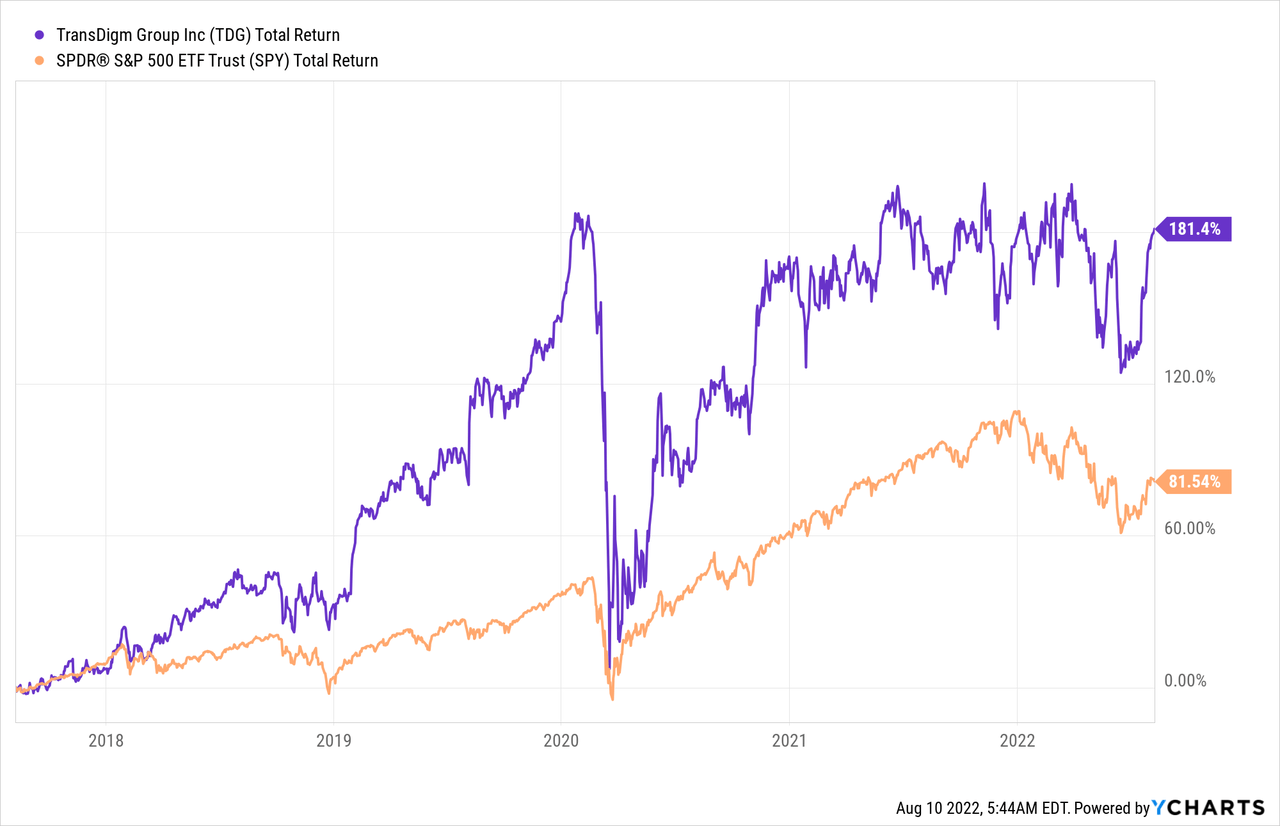

I remain bullish on TransDigm. The company is back on track and in a good spot to accelerate its EBITDA and earnings after 2023. Domestic travel has rebounded with steady support from aftermarket sales.

However, long-haul is still an issue and I do not expect that to change until China gives up on zero-COVID on top of the fact that it will take some time for global travelers to adjust to what hopefully becomes a true post-COVID world.

That said, even as demand remains somewhat slow versus pre-pandemic levels, TDG is in a good spot to generate value thanks to its business model. It’s the sole supplier in almost every sales category, it has strong pricing power, and M&A activity shows that this unique footprint is only growing.

Given the fair valuation, TDG remains a fantastic long-term investment. However, investors need to be aware of volatility and the fact that dividends are irregular.

Other than that, I am fairly sure that TDG will continue to deliver outperforming long-term total returns.

(Dis)agree? Let me know in the comments!

Be the first to comment