ilkercelik/iStock via Getty Images

Almost 6 years ago now, I published an article on Seeking Alpha cautioning investors to avoid being sucked in by high yielders, Beware The BDCs With Sucker Yields.

Those high yield stocks can also be found in other asset classes, in addition to BDCs. For example, many REITs, MLPs, and some CEFs and ETFs offer very high yields that are not sustainable, and investors end up counting more losses than gains over time.

In this article I will examine the recent past performance, make a prediction about the near future, and explain why I believe that Orchid Island Capital (ORC) is not worth investing in at this time for the high yield distribution. If you are looking for a relatively high yield (currently ~10.8%), stable and growing REIT where you can see some growth and potentially realize some capital gains, take a closer look at Ready Capital (RC). I own shares of RC in my No Guts No Glory IRA portfolio and plan to hold for the long term for income and capital gains.

What is Wrong with ORC?

First, let’s look at what ORC does to make money. From the IR website:

Orchid Island Capital, Inc. is a specialty finance company that invests in residential mortgage-backed securities on a leveraged basis.

The business case for ORC is to invest in Agency RMBS, Residential Mortgage-Backed Securities, or loans that are guaranteed by a federal agency like Fannie Mae or Freddie Mac. They make their profits (or losses) on the net interest margins using leveraged short-term borrowings on loans that are then structured as repurchase agreements. The problem that ORC has been experiencing lately, is that the net interest margins have been getting squeezed.

On January 13, 2022, ORC announced the estimated earnings report for Q4 2021, and the results were not good.

- The dividend was cut to $.055 per common share from $.06.

- The estimated total return for the quarter was a loss of -4.5% or -$0.235.

- Dividends paid in the quarter amounted to $0.195

- Estimated book value was $4.34 per share, an estimated decrease of -$0.43 since September 2021.

- Estimated GAAP net loss of $0.27 per share, including a loss of estimated -$0.49 per share on RMBS and derivative realized and unrealized losses.

According to a press release from ORC as summarized on SA:

“The company’s net interest margin has also been impacted by the persistence of longer-term rates remaining at or below levels observed earlier in 2021,” Orchid Island said. “As a result, prepayment rates on the company’s pass-through and interest-only securities remain elevated.”

As I am reading this, I am wondering how can ORC keep paying out such a high dividend yield when the losses are piling up and book value is dropping?

One of the comments that I read on this article thread struck me as a concise summary of the current situation.

Orchid Island Capital stock dips after dividend cut due to margin compression

Comment from theheckwithtech

“… the net interest margin is getting crushed; the prepayments are at high levels, and I assure you that their Book value today is lower than what they reported at the end of December. They will not have any choice but to cut the dividend again probably in the very near future. Trust me because guys aren’t worried about your investment, they are worried about assets under management through Bimini capital.

What About Bimini?

This comment then got me to investigate a little more about Bimini. The day- to- day operations and management services related to the RMBS portfolio are externally managed for ORC by Bimini Capital. They have been managing ORC since 2013 and recently amended the agreement to continue managing their operations. In addition, as part of the amended agreement, Bimini will be taking over the performance of repurchase agreement trading, clearing and administrative services from AVM, who were previously charged with those activities on behalf of ORC. Apparently, Bimini convinced ORC that they can do a better job than AVM, and they are already being paid to externally manage everything else.

On December 1, 2021, Bimini hired Patrick Doyle to lead those services. Here is what the agreement said about Mr. Doyle:

Robert E. Cauley, the Chairman and CEO of Orchid and Bimini, stated, “We are very pleased to welcome Pat to Bimini. Pat has significant expertise and experience in the repo markets, as well as extensive knowledge of the settlement and operations related practices of our business. As a manager of repo funding operations at AVM, Pat has worked with Bimini since 2003. Once these critical functions are being performed by Bimini for Orchid, we will be able to provide them in an efficient and cost-effective manner with the help of one of the funding market’s leading professionals.”

Essentially, Bimini hired away from AVM the main guy who has been responsible for doing all the work for ORC/Bimini, and then fired AVM. I am not one to judge, but that seems a bit Machiavellian to me.

What’s Next for ORC?

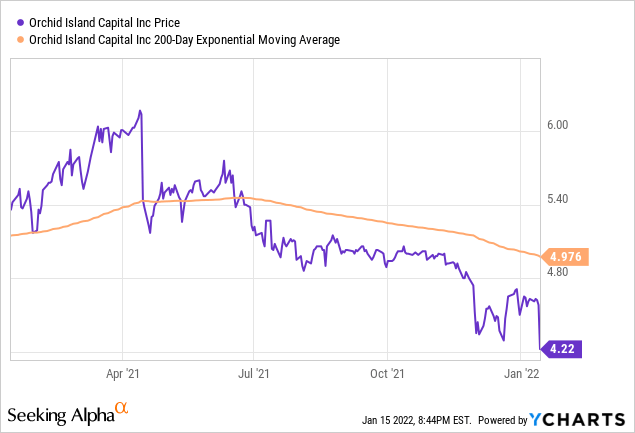

With the Fed announcing the impending removal of monetary policy accommodation, the prospects for ORC to improve margins is not looking too optimistic. The tangible book value has been declining for most of the past year. Back in August of 2021, an SA article by Sensor Unlimited discussed the danger of the declining book value of ORC and cautioned about being drawn in by the high yield. That author made a good call then and that trend does not appear too likely to be reversed in the next few months.

Depending on how quickly the Fed does adjust the balance sheet, the margin squeeze that ORC has been experiencing could get worse before it gets better. This story from CNBC highlights the concerns about the triple threat of the Fed raising interest rates, reducing the balance sheet, and cutting the amount of bonds it buys each month, all of which could have negative impacts to ORC.

Ready Capital – A Better REIT to Consider

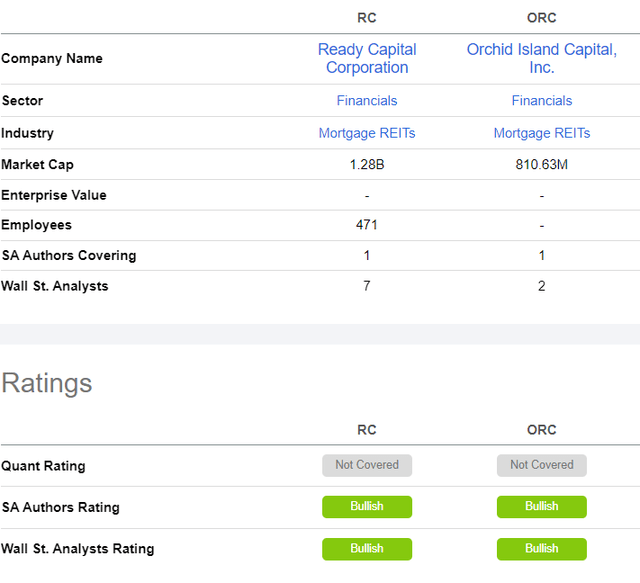

When I look at peers to ORC there is one that I already own, and which operates in a similar business that has been performing well. Ready Capital is another mortgage REIT that offers capital to real estate financing deals. RC has a small market cap like ORC ($1.2B vs $810M) and pays a relatively high yield, currently equaling 10.8% at the current market price of $15.50 as of January 14, 2022. Neither stock is covered by the SA quant ratings so I will have to do my own rating analysis. Wall Street and SA authors are Bullish on both stocks.

SA Comparison of ORC to RC Seeking Alpha

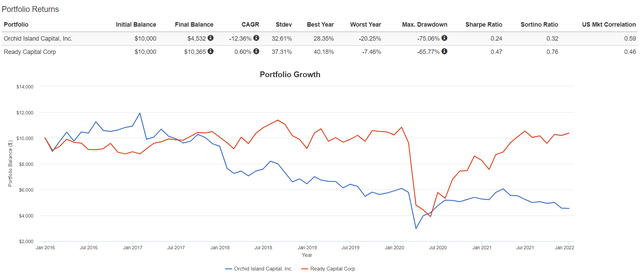

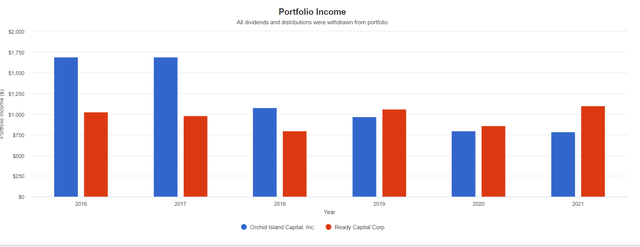

Using the back-test analysis tool from Portfolio Visualizer, I compared total return without dividends reinvested, and income returned to shareholders annually from 2016 to 2021. In that analysis, RC clearly is the better investment in both total return and income distributed (over the past 3 years). Until January 2018, ORC was the better investment, but since that time, and especially since March 2020, RC has clearly outperformed ORC in terms of both total return and income distributed.

Portfolio Visualizer backtest analysis Portfolio Visualizer Income Comparison

Who is Ready Capital?

From the SA Summary page for RC:

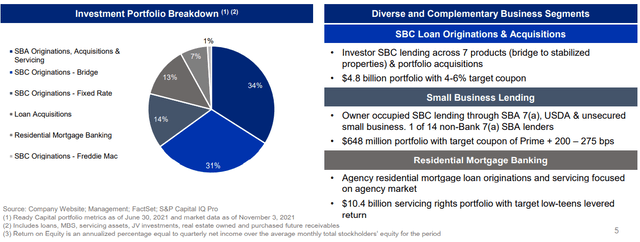

The company originates, acquires, finances, and services small balance commercial (SBC) loans, small business administration (SBA) loans, and residential mortgage loans, as well as mortgage-backed securities collateralized primarily by SBC loans, or other real estate-related investments. It operates through four segments: Acquisitions; SBC Originations; SBA Originations, Acquisitions and Servicing; and Residential Mortgage Banking. The company was formerly known as Sutherland Asset Management Corporation and changed its name to Ready Capital Corporation in September 2018. Ready Capital Corporation was founded in 2007 and is headquartered in New York, New York.

Although RC does operate in the residential mortgage market, they primarily provide SBA and SBC loans to small to medium size commercial businesses. They also offer multifamily, residential, and bridge financing. Like ORC, they are externally managed, and in the case of RC, Waterfall Asset Management provides management advisory services.

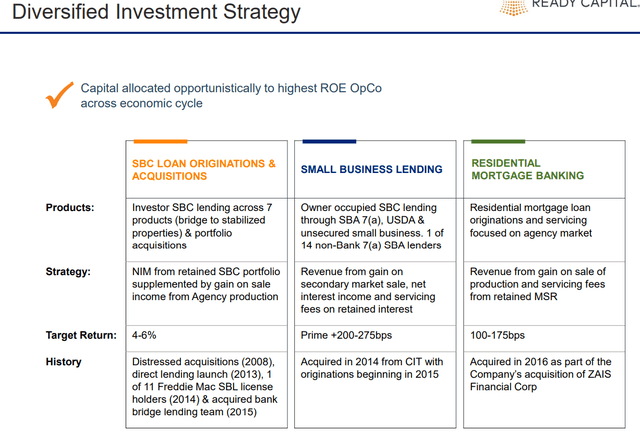

Because RC operates in several different segments of real estate financing, they can leverage the assets from a higher performing segment to fund growth in under-performing ones. This snippet from the Q3 2021 investor presentation from November 4, 2021, illustrates the point:

RC Diversified Investment Strategy

This slide shows the breakdown by portfolio segment.

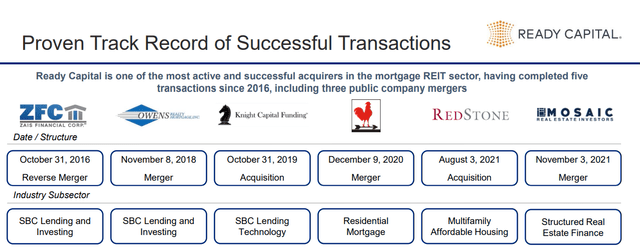

Growing by Mergers and Acquisitions

Back in November 2021, RC acquired some assets from Mosaic Real Estate Credit in a merger transaction. This completes the sixth such M&A transaction in the company’s history since 2016.

Mosaic Real Estate Credit Merger

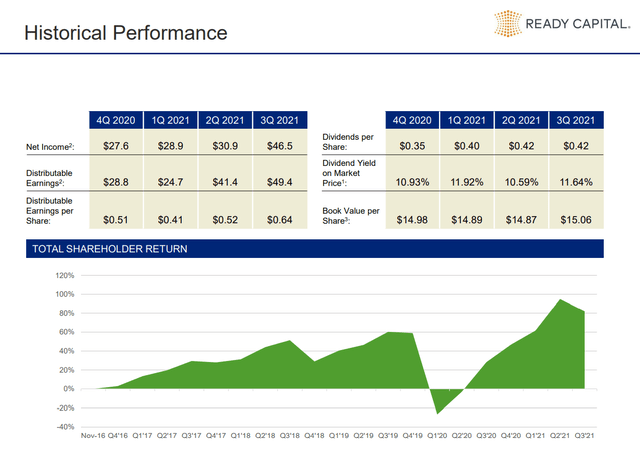

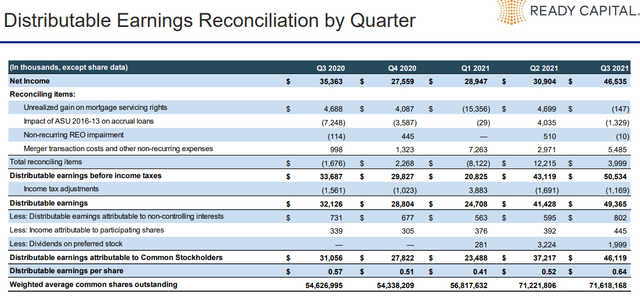

The track record of M&A activity has proven to be successful thus far. The historical performance as indicated in the Q3 2021 investor presentation illustrates the key points – increasing net income, growing distributable earnings, steady to slightly growing book value, and a dividend yield near 11% since Q4 2020:

Q3 2021 Historical Performance

This slide from the investor presentation illustrates the growth in distributable earnings since Q3 2020, which has grown steadily except for the Q1 2021 quarter when they took a loss on unrealized gains on MSRs:

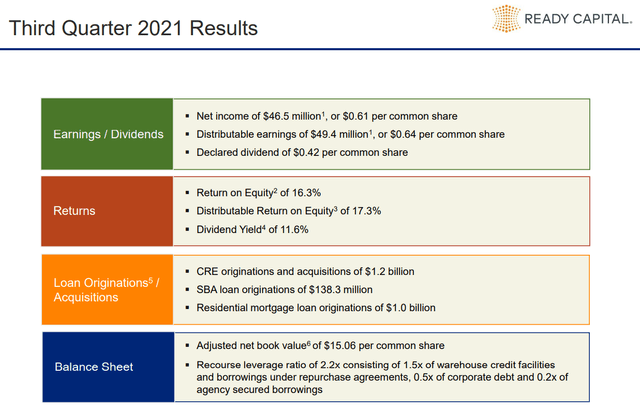

A summary of Q3 results sums up the strong financial position that RC finds itself in at the end of Q3 2021, poised for further growth in Q4 and into 2022. As long as the economy does not suddenly go bust due to inflation, Fed policy actions, or some new pandemic or black swan event, RC is ready for the future of lending capital for real estate transactions, including $1.2B in commercial originations/acquisitions, and $1B in residential mortgage originations. In addition, there are likely to be additional contributions to the bottom line from the Mosaic merger realized in Q4 and beyond.

Net book value is over $15, and the share price is currently trading at a slight premium at $15.50.

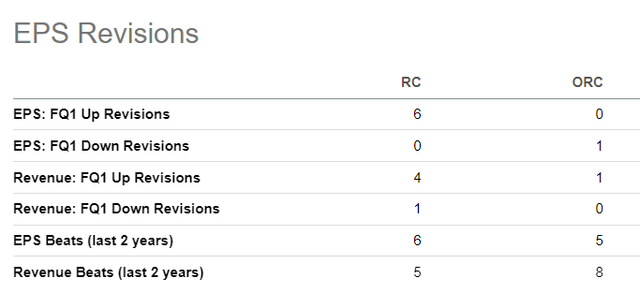

Another interesting point of comparison with ORC is the earnings revisions as noted on SA. As of January 15, 2022, there are 6 EPS up revisions for RC, 0 for ORC but 1 down revision. There are 4 Revenue Up revisions for RC (and 1 down), and 1 up revision for ORC.

Risks to Consider

As evidenced by the downturn in Q1 2021, there is some risk that RC could under-perform in the first quarter of 2022 as well. As mentioned above, there are concerns with inflation, with rising interest rates, and with Fed tightening that could adversely affect credit markets in both commercial and residential financing. There is also some indication based on other economic forces, such as the slowdown in retail sales in December, that the economy may be grinding slower due to the Omicron Covid variant, Russia fears, political discord in DC, and other geopolitical or world events that may be on the minds of investors.

However, based on the recent, upsized stock offering from RC announced on January 11, it looks like at least they are convinced that the economy is moving along just fine, along with the future prospects for lending.

NEW YORK, Jan. 11, 2022 /PRNewswire/ — Ready Capital Corporation (NYSE: RC) (“Ready Capital” or the “Company”) today announced that the Company has priced an upsized underwritten public offering of 7,000,000 shares of common stock for total gross proceeds of approximately $108.9 million. In connection with the offering, the Company has granted the underwriters a 30-day option to purchase up to 1,050,000 additional shares of common stock. The Company intends to use the net proceeds from this offering to originate or acquire the Company’s target assets consistent with its investment strategy and for general corporate purposes. The offering is expected to close on January 14, 2022, and is subject to customary closing conditions.

In the case of ORC, they also appear to be somewhat optimistic regarding the future share price potential by announcing an increase in the stock buyback program.

The remaining authorization under the repurchase program as of September 30, 2021, was 837,311 shares. Today, the Board approved an increase in the number of shares of the Company’s common stock available in the stock repurchase program for up to an additional 16,861,994 shares, bringing the remaining authorization under the stock repurchase program to 17,699,305 shares, representing approximately 10% of the Company’s currently outstanding shares of common stock.

As the share price continues to decline, the buyback program makes sense by reducing the number of shares on the open market. It remains to be seen whether the announced buyback program will have the intended effect. The share price has not risen since the announcement. In fact, on Dec. 9 shares were trading at about $4.55 and the price as of Jan. 14 was $4.22, dropping significantly after the announcement on Jan. 13 of the dividend cut.

Conclusions

To offer a concise summary, my recommendation is to sell ORC if you own shares and buy RC instead. The dividend yield for RC is slightly less at 10.8% versus 15.6% in the case of ORC. It is possible that ORC could cut the dividend again in the next month or two. Of course, the share price has been dropping so the effective yield may not change much. But I would caution new investors to be aware that the yield advertised may not result in the gains you are seeking.

In another article by SA author Scott Kennedy, he rates ORC a Sell based on his analysis.

As of 11/19/2021, I/we currently have a SELL recommendation (overvalued) on the following mREIT stock analyzed above (in no particular order):1) CHMI; 2) IVR; 3) ORC; and 4) BXMT.

The comparison to RC is not totally apples to apples as the market segments that RC lends to include mostly commercial and multifamily, versus residential only for ORC. But if you are looking for a good, long-term investment in the REIT space for some capital appreciation to go along with a high dividend yield, you may want to consider RC.

Please do your own due diligence before investing. And good luck whatever you decide!

Be the first to comment