TennesseePhotographer

Introduction

It’s earnings seasons and I was eager to get an update on one of the investments I initiated in the last quarter: Tractor Supply Company (NASDAQ:TSCO).

Tractor Supply is the largest rural lifestyle retailer in the U.S. and it is among the retailers that stand out: in the past 30 years it has achieved always positive revenue growth, along with positive comp transactions, and 29 years out of 30 of positive sales comp dollars, as outlined in the recent Q2 2022 earnings call.

As we will see, the recent Q3 results makes us reasonably expect the company to add yet another year to this positive streak.

Summary of previous coverage

A few months ago I shared my research on Tractor Supply in this article: Tractor Supply Company Deserves To Trade At A Premium.

Right after the article was published, I bought a few shares. Since then the stock has traded more or less flat as it is down 3.75%, not counting dividends.

Among the factors that I liked about the company was a steadily growing trend in net sales, comparable store sales (a 5-year CAGR of 13.4%), net income per share and cash returned to shareholders.

Secondly, I showed how 47% of the company sales last year came from the livestock and pet category which is a non-cyclical since livestock and pets are indeed part of a household and need to be taken care of in any economic conditions.

Thirdly, though one of the risk the company faces is weather as most of its products are thought for outdoors, the company is well spread out across the U.S. and can thus mitigate the risk. In fact, at the end of 2021 the company operated 2,003 stores in 49 states and declared it planned to open 75-80 stores in 2022. However, we saw that in the first half of the year the company had added only 13 new stores. One of the facts that I was interested in knowing about Q3 was exactly this: the number of new openings during the quarter. In fact, the company is also leveraging more and more its stores, introducing garden centers and pet washes. This is why the number of new openings is crucial to forecast the future trajectory of the business.

Finally, I pointed out how the company addresses a customer niche that is made up of home, land, pet and livestock owners. These customers have above average income and below average cost of living. In other words, they won’t feel as much as others the pressure of tough economic conditions because they have both top and bottom line of their household’s income statements above average. This customer base lives in town outlying major metropolitan markets and in rural communities and it prioritizes a rural lifestyle. As one of my readers pointed out in a comment, sometimes Tractor Supply is looked at as a farming enterprise and it is traded according to wheat and corn futures. This is however a mistake as most of its customers are just hobby farmers who don’t rely on commodity futures for their income. These customers make up a TAM of around $180 billion, of which only $12 billion are Tractor Supply’s revenue. Clearly, the company thinks about itself as still at the early stage of eating a larger chunk of this pie.

Q3 2022 Results

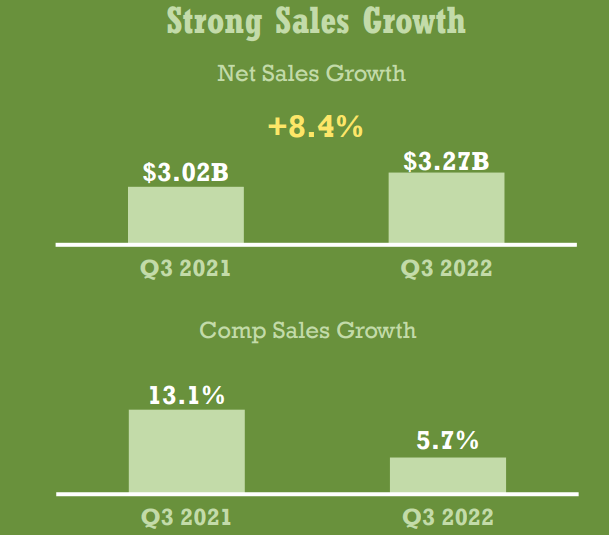

The results Tractor Supply achieved in the quarter show, in my opinion, the health of its business that remains resilient. In fact, as shown in the graph below, net sales for Q3 increased 8.4% to $3.27 billion from $3.02 billion in 2021. Comparable store sales increased 5.7%, as compared to an increase of 13.1% in the prior year’s third quarter. Please take a moment to consider that, although last year’s comparable sales were already up 13.1% YoY, the company managed to increase sales this year too by another 5.7%. So, even if the graph, at a first glance, seems decreasing, total sales are actually increasing and this is a rather outstanding result that prove that Tractor Supply is not just a Covid-winner but it is a business with a growing trajectory of its own. Now, comparable store sales for the third quarter of 2022 were driven by comparable average ticket growth of 7.0%, partially offset by a comparable average transaction count decline of 1.3%, which is a minor decline. Comparable store sales growth reflects continued strength in every day, needs-based merchandise, including consumable, usable and edible (“C.U.E.”) products and year-round product categories.

TSCO Q3 Earnings Presentation

As we move down toward the bottom line we see that gross profit increased 7.4% to $1.17 billion from $1.09 billion in the prior year’s third quarter. We had a minor 32 basis point decrease to 35.6% from 36.0% in the prior year’s third quarter. The gross margin rate decrease was primarily attributable to product mix from the robust growth of C.U.E. products as the Company’s price management actions and other margin driving initiatives were able to offset the impact from significant product cost inflation pressures and higher transportation costs. This is one of the number that I liked most about the report as not many retailers are being able to manage so well their margins against the strong inflationary pressure. Keeping margins almost at the same level YoY shows that the company is both well-managed and that it targets a customer niche that can afford raising prices.

A little impact on margins came from Selling, general and administrative expenses, that increased 9.0% to $859.4 million from $788.1 million in the prior year’s third quarter. As a percent of net sales, SG&A expenses increased 16 basis points to 26.3% from 26.1% in the third quarter of 2021. The increase in SG&A as a percent of net sales was primarily attributable to the Company’s strategic growth initiatives, including depreciation and amortization, and investments in hourly wages and benefits. This is particularly important and I, as a shareholder, am happy to see that Tractor Supply is aiming at improving wages and working conditions. It is for me very important to know that employees are treated well and that they are happy to work for the company, since it is a major cost to have a big turnover of employees.

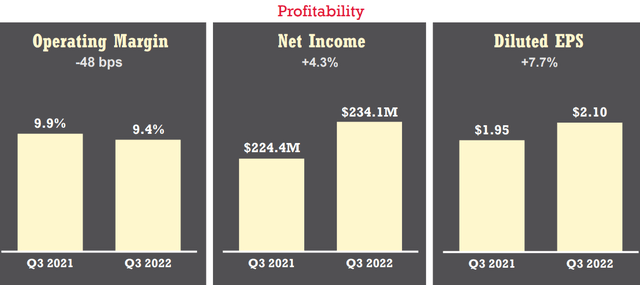

Moving on, we have to acknowledge that Tractor Supply is rather profitable and this quarter its operating income increased 3.1% to $306.4 million compared to $297.2 million in the third quarter of 2021. Accordingly, net income increased 4.3% to $234.1 million from $224.4 million, and diluted earnings per share increased 7.7% to $2.10 from $1.95 in the third quarter of 2021.

What about new stores? Here the Company seems a bit behind its schedule since it opened 11 new Tractor Supply stores and two new Petsense by Tractor Supply stores in the third quarter of 2022. The Company still targets to achieve all the openings schedule, but it knows it will a bit hard to accomplish the goal of 75-80 new stores for this year. However, many new store openings have been delayed due to external conditions of the real estate and construction industries. However, during the earnings call the management stated that it is expecting just a modest reduction in expected openings that should be in the range between 60 and 70.

One last number: Tractor Supply gained more than 27 new million members, a 23% YoY.

Outlook

Just ten days ago, Tractor Supply announced the closing of the acquisition of Orscheln Farm to expand in the Midwest. The Company acquired 81 stores, while it divests the remaining 85 stores to two buyers. The net purchase price is $238 million and this acquisition is anticipated to generate an extra $75 million in net sales just for Q4 2022. However, given the transaction expenses and early implementation costs to be recorded in the fourth quarter of 2022, the impact of the acquisition is expected to be relatively neutral to operating income in the fourth quarter and for the fiscal year.

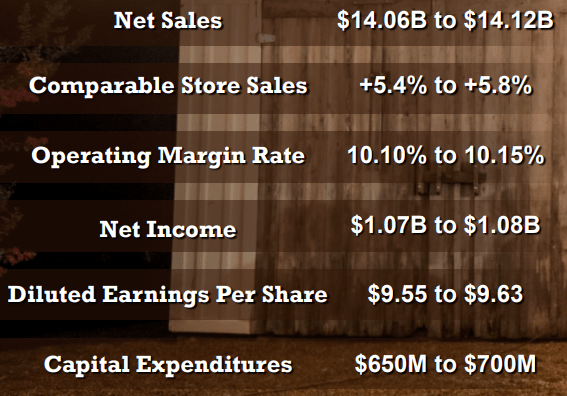

Now, thanks to this acquisition, the company revised upwards most of its full year guidance, as shown below. Only operating margin is expected to move down from 10.20% to 10.10%. Needless to say, it is a very minor drop compared to what other companies are experiencing.

TSCO Q3 Earnings Presentation

Shareholder return

During the quarter, the Company repurchased approximately 0.6 million shares of its common stock for $123.6 million and paid quarterly cash dividends totaling $101.9 million, returning $225.5 million of capital to shareholders in the third quarter of 2022. In addition, the company pays a dividend of $0.92 per quarter, up 76% YoY. The dividend yield is 1.87% and the payout ratio is only around 31%. If we factor in the compounding actions the Company is undertaking with its investments and the excess cash returns, we have all factors aligned to reward shareholders over a long period of time without endangering the business.

Conclusion

The discounted cash flow model I shared in my previous article is still valid, as is the valuation I gave. I argued that, although it may seem the Company is a bit overvalued, a simple discounted cash flow model doesn’t take into account the premium and investor should pay for high quality business models and for moats. Given these factors, the fwd P/E of 20 seems to me a correct multiple to price a business that has a long track record of steady growth into a niche of consumers that wants to live the rural lifestyle and that is loyal to the Company. This is why I reiterate my buy rating and I will pick up here and there some more shares to increase my position.

Be the first to comment