jetcityimage

Introduction

After months of huge sell-offs, a little bit of green seems to have appeared in the last weeks. Red or green the markets may be, it has become clearer to me that I want to look at high quality companies that have large moats and can go through different market cycle conditions. Retailers are sometimes thought to fall out of this category as they are directly affected by consumer spending linked to economic expansions and recessions. However, we all know that not all retailers are the same and there are some that indeed can grow in almost every condition. Tractor Supply (NASDAQ:TSCO) is among the retailers that stand out: in the past 30 years it has achieved always positive revenue growth, along with positive comp transactions, and 29 years out of 30 of positive sales comp dollars, as outlined in the recent Q2 2022 earnings call.

The business

Tractor Supply Company is the largest rural lifestyle retailer in the U.S. We have to pay close attention to this definition as it unveils a very important information: the company addresses a clearly defined niche made up of farmers, ranchers and the ever-increasing number of people who chose to live the rural lifestyle. Very interestingly, the company has been around since 1938 and is thus no recent retailer that tries to ride the rural lifestyle tide that the pandemic surely helped on growing. The company operates stores under three names: Tractor Supply Company, Petsense, and Del’s Feed & Farm Supply.

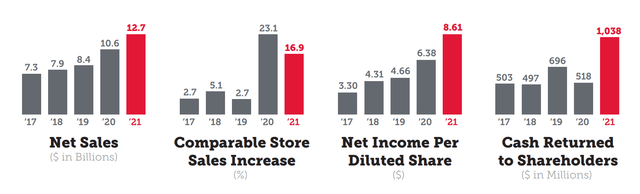

As shown by this quick infographic taken from the last Annual Report, the company was already on a steadily growing path before the pandemic, which was further enhanced by the COVID outbreak.

TSCO 2021 Annual Report

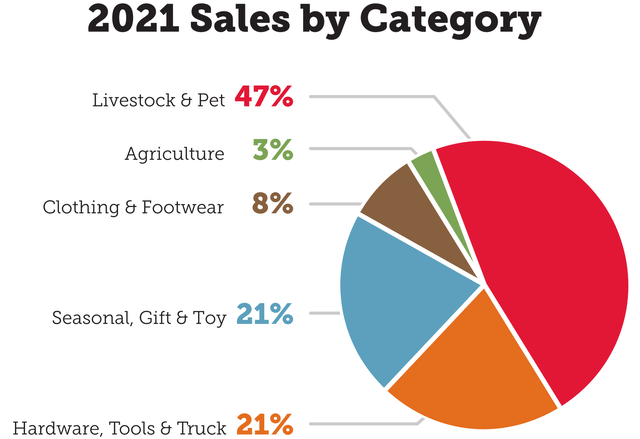

Tractor Supply offers a mix of products necessary to care for home, land, pets, and animals. Just to get an idea of how its sales are divided into different categories, we can look at this pie chart.

TSCO 2021 Annual Report

As we can see, about half of Tractor Supply’s sales come from the livestock & pet category which is one of the most resilient ones. In fact, once people own livestock or pets they can’t just quit or reduce spending as they would do with clothing and footwear during an economic crisis. Livestock and pets are indeed part of a household and they need to be taken care of. Over the past five years, the company has experienced considerable sales growth, resulting in a CAGR of 13.4%.

One of the main risks the company faces is weather. With unfavorable conditions, its customers tend to reduce spending. However, Tractor supply has got a portfolio of geographies. So at times when certain geographies are seeing unfavorable weather, there might be favorable weather elsewhere.

Stores and logistics

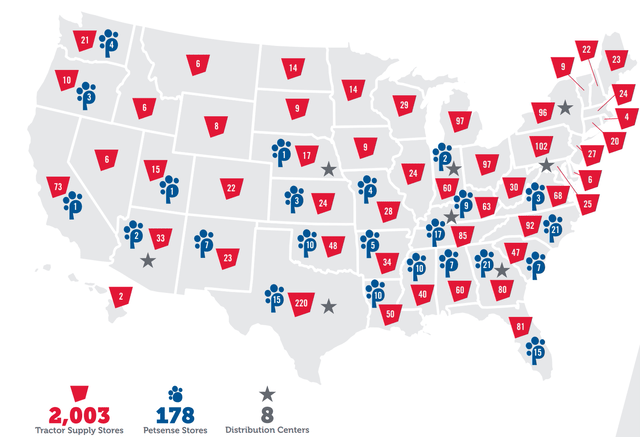

At the end of last year, the company operated 2,003 Tractor Supply stores in 49 states and 178 Petsense stores in 23 states, a customer mobile app and an e-commerce website.

TSCO 2021 Annual Report

Furthermore, Tractor Supply is building a new distribution center in Navarre, Ohio, of 900,000 square feet that should be completed by this fall. In addition, on January 26, 2022, the Company announced it will build another distribution center of 900,000 square feet in Maumelle, Arkansas, that should be built by the end of 2023.

In its last Annual Report, Tractor Supply also declared its plans to open approximately 75 to 80 new Tractor Supply and 10 new Petsense stores in fiscal 2022, a selling square footage increase of approximately 4%. In the first half the company added another 13 Tractor Supply stores, so we will have to see if it will be able to catch up with its initial guidance. In any case, we are before a company that is still growing. Last year, in fact, it did manage to open 80 new Tractor Supply stores and 7 Petsense ones. The year before the openings were the same: 80 Tractor Supply and 9 Petsense.

During the last 11 years, Tractor Supply has pursued massive growth, moving from 1,000 stores to 2,016. Strong tailwinds were, as said, the rural revitalization, a new interest for self-reliance and pet ownership.

Where are these buildings located? Approximately 57% of them are in freestanding buildings and 43% are located in shopping centers. Tractor Supply leases 95% of its stores and owns the remaining 5%.

Now, one of the major improvements the company is undertaking has to do with its stores. In order to scale them better and leverage the revenue per square foot, the company is introducing garden centers and pet washes. Already 230 stores have the former and 600 have the latter. These are all improvements that make Tractor Supply a more contemporary, relevant, farm and ranch-oriented retailer and, in the meantime, help the company increase its sales. Hal Lawton, the company’s CEO, in the last earnings call explained why garden centers are important for Tractor Supply’s expansion strategy. As he said, during spring and summer,

our stores with a garden center significantly outperformed the chain average and are on track with our business case. The expanded assortment of live goods is resonating not only with existing customers, but is a key asset to attracting new customers that skew female and younger. The garden centers have allowed us to gain share and will continue to play a significant role in our merchandising plans across the seasons.

Customer niche

As we briefly saw above, Tractor Supply’s target customers are home, land, pet, and livestock owners. Generally, these customers have above average income and below average cost of living. In other words, they won’t feel as much as others the pressure of tough economic conditions because they have both top and bottom line of their household’s income statements above average. This customer base lives in town outlying major metropolitan markets and in rural communities. As stated by the Hal Lawton in the last earnings call

Our needs-based business model has a track record of growing through varying economic conditions. Our customers and team members are passionate about the Out Here Lifestyle and they prioritize it. Our customers’ over-indexes, homeowners, landowners, animal owners and pet owners, we believe that the structural macro trends that I mentioned earlier are long-term and sustainable. As the market leader, we have substantial advantages. Additionally, our investments in our Life Out Here strategy are reaching critical mass and furthering our competitive advantage. Tractor Supply has never been stronger.

To address this customer base is part of Tractor Supply’s moat where its market leadership makes it the trusted partner to go to in order to keep enjoying a lifestyle that has been clearly chosen. These customers know that at Tractor Supply they will find high quality brands alongside the company’s own brands. In each store they may find from 16,000 to 22,000 products while they will find over 170,000 products online. Very interestingly for investors, the company states that no single product accounts for more than 10% of its sales.

Finally, these customers, according to the company make up altogether a total addressable market of $180 billion, $12 billion of which made up Tractor Supply’s 2021 revenue. Clearly, the company thinks about itself as still at the early stage of eating a larger chunk of this pie.

Q2 2022 Results

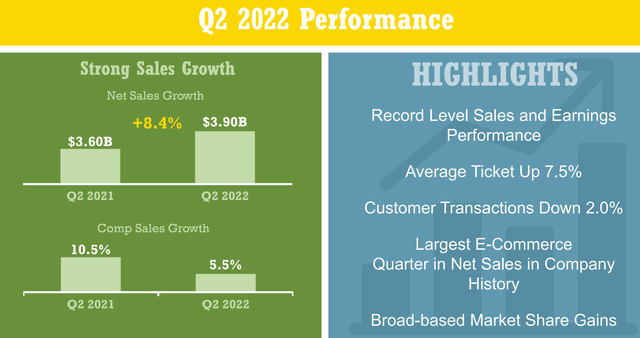

As seen in the slide below, Tractor Supply grew net sales by 8.4%, with comparable store sales up 5.5%. This is a very good result if we consider that the company was facing tough comparables. Last year, during Q2, customers were in fact spending thanks to the stimulus check received.

However, we have to know that comparable store sales growth was driven by strong ticket growth of 7.5%, offset by a decline in transactions of 2%. This means that inflation played a bigger role than customer acquisition. In fact, thanks to inflation the average ticket went up, however, transactions declined meaning that customers either spent more for each visit while diminishing store visits or that less customers went to their stores. In either case, the growth is a sign that the company was indeed able to pass inflationary pressure onto its customers, who, as we have seen, are usually capable of absorbing these increased costs.

TSCO Q2 2022 Results Presentation

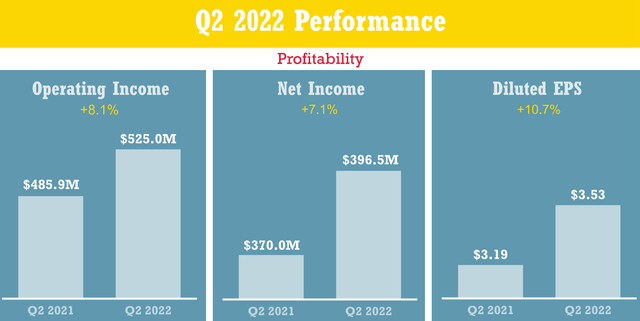

Let’s take a look at the other side of sales, which, as investors, we need to consider closely. How is the company performing on profitability? Both operating income and net income were up respectively by 8.1% and 7.1% with the diluted EPS was $3.53, an increase of 10.7% YoY.

During the quarter, Tractor Supply, as Kurt Barton, the company’s CFO, explained saw its gross margin decline by 24 basis points to 35.5% of sales.

Given the environment we are in, I think this is a very minor decrease compared to what other companies are facing.

TSCO Q2 2022 Results Presentation

Shareholder returns

The EPS result is particularly significant because it is from the EPS that free cash flow, dividends and buybacks come. Tractor Supply is getting its shareholders used to an increasing stream of cash returned to them. During Q2, the company returned $291 million through dividends and share buybacks. In the first half of the year, the total cash returned amounts to $691 million.

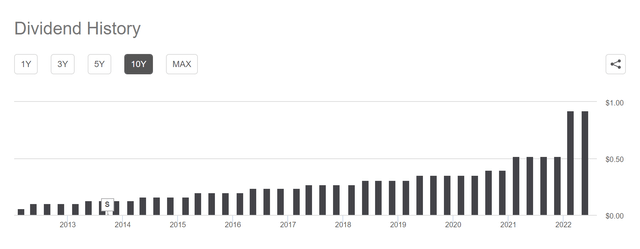

The dividend history is very alluring for investors, as we see that since the dividend was instated it has trended upwards. The current yield of 1.45% is not very high, but a growth like the one shown below is what dividend growth investors look for as they start building a portfolio that will roll out increasing dividends over the long-term.

Seeking Alpha

Guidance

Given the strong results, the company declared that it expects net sales in the range of $13.95 billion to $14.05 billion, with comparable store sales growth of 5.2% to 5.8%. The operating profit margin should be around 10.2%.

Valuation

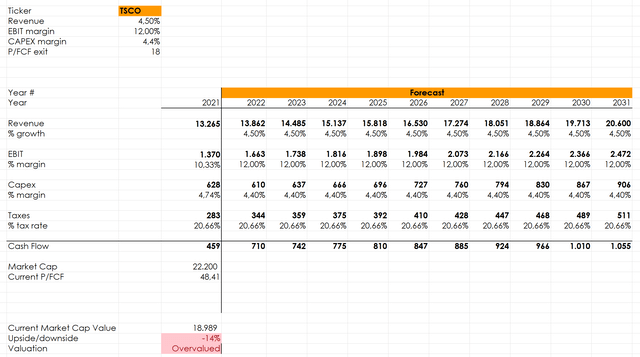

When I plug in my discounted cash flow model with Tractor Supply’s main data taken from Seeking Alpha, I make my forecast assuming that the company will grow its revenue at about 4.5%, given its expansion strategy. The marginality should improve a bit as I expect inflationary pressure to move down a bit. Finally, I take as a P/FCF exit an 18, which in my opinion is fair for a company that has proven to be so reliable.

Author with data from Seeking Alpha

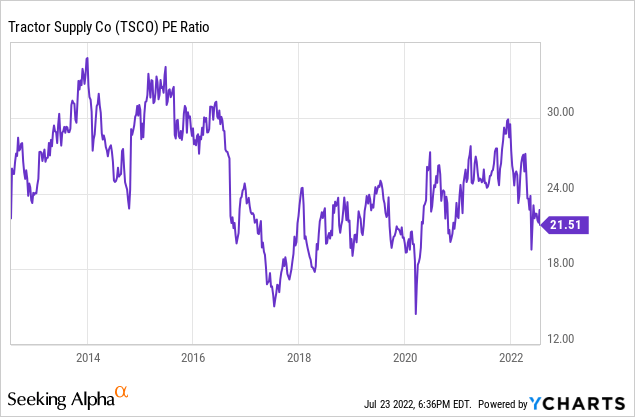

The result is that the company is currently overvalued by 14%. However, these models doesn’t automatically evaluate the quality of a price premium. As we see from the graph below, in the past decade, the company has been trading at a far higher PE than its current 20.

Given the outstanding growth path the company has managed to complete and taking into account that it still has room to grow in the U.S. (and maybe expand to Canada) I believe a 14% premium is fair to recognize its reliability.

Thus, I rate it a buy and I will myself initiate a position in the next few days.

Be the first to comment