SusanneB

This article is part of a series that provides an ongoing analysis of the changes made to Dan Loeb’s 13F stock portfolio on a quarterly basis. It is based on Third Point’s regulatory 13F Form filed on 11/14/2022. Please visit our Tracking Dan Loeb’s Third Point Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q2 2022.

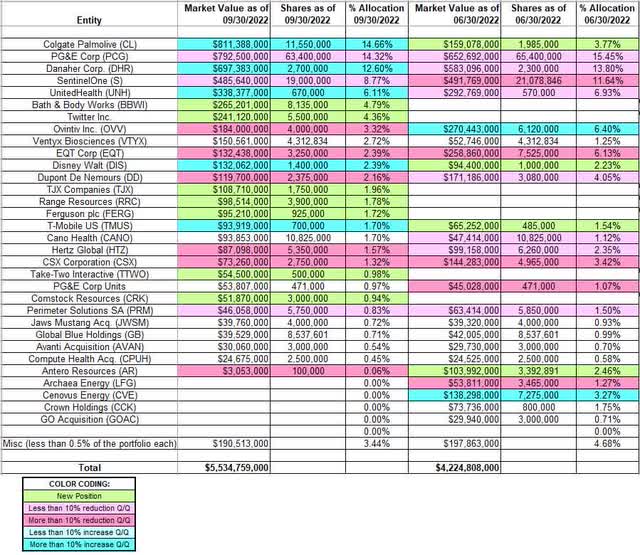

This quarter, Loeb’s 13F portfolio value increased ~31% from $4.22B to $5.53B as they added several new positions. The 13F portfolio is very concentrated with the top three holdings accounting ~42% of the entire portfolio. The number of holdings increased from 58 to 61. 28 of the holdings are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five individual stock positions are Colgate Palmolive, PG&E, Danaher Corp, SentinelOne, and UnitedHealth.

Third Point returned negative 21.10% in 2022 through October compared to negative 17.70% for the S&P 500 Index. Annualized returns since December 1996 inception are at 13.4% compared to 8.5% for the S&P 500 Index. AUM is distributed among several strategies of which the long/short equity portion is roughly ~39%, down from ~55% as of Q4 2021. In addition to partner stakes, Third Point also invests the float of Sirius Point (NYSE:SPNT) and capital from London listed closed-end fund Third Point Offshore (OTCPK:TPNTF). To know more about Dan Loeb’s Third Point, check-out his letters to shareholders at their site. His activist investing style is covered in the book “The Alpha Masters: Unlocking the genius of the world’s top hedge funds”.

Note 1: They have a significant portfolio of investments through their venture firm Third Point Ventures. Q1 2022 letter had a special mention on ConsenSys Software. They invested in the Series C funding round at a valuation of $3.2B and the Series D at $7B valuation.

Note 2: Large equity investments not in the 13F report include Shell plc (SHEL), Glencore plc (OTCPK:GLNCY), Sony (SONY), EssilorLuxottica (OTCPK:ESLOY), and Nestle (OTCPK:NSRGY). The Shell stake was built over the three quarters through Q1 2022 while the Glencore plc position was established during Q1 2022. SONY is a $1.5B investment made in June 2019 when the stock was trading at around $50 per share. It is currently at ~$84. The ESLOY investment was made in early 2019 when the stock was trading at ~$62.50 per share. It currently trades at ~$94. The NSRGY position is from 2017 and the stock has moved from ~$75 to ~$121 now.

New Stakes:

Bath & Body Works (BBWI) and Twitter Inc.: The large 4.79% of the portfolio stake in BBWI was established at prices between ~$26 and ~$41 and the stock currently trades above that range at $43.27. Twitter was a fairly large 4.36% merger-arbitrage stake. It got eliminated as Twitter was taken private at $54.20 per share.

TJX Companies (TJX), Range Resources (RRC), and Ferguson plc (FERG): TJX is a ~2% of the portfolio position purchased this quarter at prices between ~$56 and ~$69 and the stock currently trades well above that range at $79.74. The 1.78% RRC stake was established at prices between ~$23.50 and ~$35 and it is now at ~$28. FERG is a 1.72% of the portfolio position purchased at prices between ~$103 and ~$128 and the stock is now at ~$118.

Take-Two Interactive (TTWO) and Comstock Resources (CRK): These are small (less than ~1% of the portfolio each) new stakes established this quarter.

Stake Disposals:

Cenovus Energy (CVE): The 3.27% CVE stake was built last quarter at prices between ~$16.50 and ~$24.75. The disposal this quarter was at prices between ~$14.60 and ~$20. The stock is now at $19.65.

Archaea Energy (LFG), Crown Holdings (CCK), and GO Acquisition: These small stakes were disposed this quarter.

Note: GO Acquisition was a SPAC that liquidated without doing a deal.

Stake Increases:

Colgate-Palmolive (CL), Walt Disney (DIS), and T-Mobile US (TMUS): CL is now the top position at ~15% of the portfolio. A small position was established last quarter at prices between ~$74 and ~$82. The stake was built this quarter at prices between ~$69 and ~$83. The stock currently trades at $77.75. DIS is a 2.39% of the portfolio stake established last quarter at prices between ~$93 and ~$139 and it now goes for ~$99. There was a ~40% stake increase this quarter at prices between ~$92 and ~$125. The 1.70% TMUS position was purchased at prices between ~$122 and ~$139. The position was increased by ~45% this quarter at prices between ~$132 and ~$147. It currently trades at ~$152.

Note: Colgate Palmolive is an activist stake. Dan Loeb is pushing for a spinoff of its Hill Pet Nutrition business. He believes that unit could have a valuation of ~$20B.

Danaher Corp. (DHR): The top three ~13% DHR stake was established in Q3 2015 at prices between $60.90 and $71.50 and increased by two-thirds in Q1 2016 at prices between $62 and $74. There was a ~20% stake increase in Q1 2019 at prices between $98 and $132 while H1 2020 saw a ~20% selling at prices between $129 and $177. Last two quarters had seen another similar reduction at prices between ~$237 and ~$316. There was a ~17% stake increase this quarter at prices between ~$247 and ~$302. It currently trades at ~$276.

Note: The prices quoted above are adjusted for the Fortive (FTV) spin-off in July 2016.

UnitedHealth (UNH): The large ~6% UNH position was purchased during Q4 2020 and Q1 2021 at prices between ~$305 and ~$377. Q1 2022 saw a ~23% selling at prices between ~$456 and ~$521. The stock currently trades at ~$537. Last quarter saw a ~6% trimming while this quarter there was a ~18% stake increase.

Stake Decreases:

PG&E Corp (PCG) & Units: PCG is currently the second largest 13F stake at ~14% of the portfolio. The position came about as a result of participating in a PIPE (terms for the bankruptcy exit financing in 2020 called for up to $10.50 per share purchase price). Last three quarters have seen minor trimming. The stock currently trades at $15.62.

Note: Third Point is very bullish on PG&E. The Q1 2022 letter had the following: the stock is trading at 12x 2022 earnings compared to 21x for the utility index as a whole and well below its closest comparable, Edison International at 15x. Further, the stock should benefit from the expected reinstatement of cash dividend in 2023 and inclusion in S&P 500 index eventually.

SentinelOne (S): SentinelOne is the fourth largest position at ~9% of the portfolio. The stake goes back to 2015 when they led the Series B funding round at a post-money valuation of $98M. They participated in each subsequent round as well as the IPO and after-market. The stock currently trades at ~$15 at a valuation of ~$3B – their initial 2015 investment has so far returned a stunning 30x. There was a ~10% trimming this quarter in the mid-20s price range.

Note: Regulatory filings since the quarter ended show them owning 15M shares (6.7% of business). This is compared to 19M shares in the 13F report. The reduction happened in the low-20s price range.

Ovintiv Inc. (OVV): OVV is a 3.32% of the portfolio position purchased in Q1 2022 at prices between ~$35 and $55 and increased by ~175% last quarter at prices between ~$42 and ~$62. This quarter saw a one-third reduction at prices between ~$40 and ~$55. The stock currently trades at $54.51.

EQT Corp (EQT), and Hertz Global (HTZ): The 2.39% EQT stake was established in Q4 2021 at prices between ~$18 and ~$23 and increased by ~80% next quarter at prices between ~$20 and ~$36. The stock currently trades well above those ranges at $41.52. Last two quarters have seen a ~65% selling at prices between ~$32 and ~$50. The 1.57% HTZ position was purchased during Q4 2021 at prices between ~$19 and ~$35 and it is now just below the low end of that range at ~$17. Last three quarters have seen a ~10% reduction at prices between ~$16 and ~$25.

Dupont De Nemours (DD): The 2.16% of the portfolio stake in DD was established in Q1 2021 at prices between ~$69 and ~$86 and it is now near the bottom of that range at $70.42. There was a ~11% stake increase in Q4 2021 while last quarter saw similar trimming. This quarter saw a ~23% selling at prices between ~$50 and ~$63.

CSX Corporation (CSX): CSX is a 1.32% of the portfolio position purchased in Q1 2022 at prices between ~$33 and ~$38. It was sold down by roughly one-third last quarter at prices between ~$28.75 and ~$37.50. That was followed with a ~45% selling this quarter at prices between ~$26.50 and ~$34.50. The stock currently trades at $32.68.

Antero Resources (AR): The AR stake was purchased last quarter at prices between ~$30.50 and ~$48. It was sold down to a minutely small stake this quarter at prices between ~$29 and ~$43. It is now at $35.35.

Perimeter Solutions SA (PRM): The very small 0.83% stake in PRM saw minor trimming this quarter.

Kept Steady:

Avanti Acquisition, Cano Health (CANO), Compute Health Acquisition (CPUH), Global Blue (GB), Jaws Mustang Acquisition (JWSM), and Ventyx Biosciences (VTYX): These small (less than ~2% of the portfolio each) stakes were kept steady this quarter.

Note 1: Regulatory filings since the quarter ended show them owning 2.25M shares (~4% of the business) of Ventyx Biosciences. This is compared to 4.3M shares in the 13F report. The reduction happened for an average price of ~$26 per share primarily through a block sale. The original investment was made in 2016 in a Series-B funding round in Opillan at a valuation of ~$20M. Opillan got consolidated into Ventyx.

Note 2: Regulatory filings since the quarter ended show them owning 8M shares (~3.5% of business) of Cano Health. This is compared to 10M shares in the 13F report. The reduction happened in the mid-single-digit price-range. The stock is now at ~$2.

Note 3: Avanti Acquisition was a SPAC that liquidated without doing a deal.

The spreadsheet below highlights changes to Loeb’s 13F stock holdings in Q3 2022:

Dan Loeb – Third Point’s Q3 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment