Neilson Barnard/Getty Images Entertainment

This article is part of a series that provides an ongoing analysis of the changes made to Carl Icahn’s 13F portfolio on a quarterly basis. It is based on Icahn’s regulatory 13F Form filed on 2/14/2022. Please visit our Tracking Carl Icahn’s Portfolio series to get an idea of his investment philosophy and our previous update for the fund’s moves during Q3 2021.

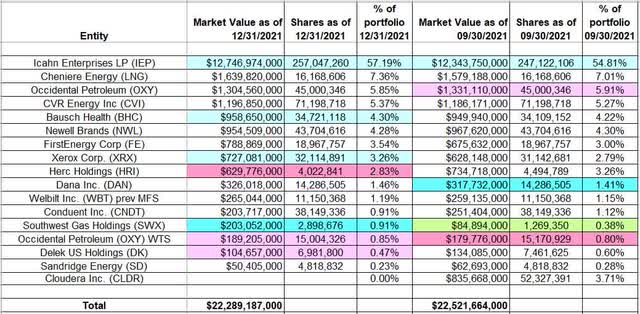

This quarter, Icahn’s 13F portfolio value decreased marginally from $22.52B to $22.29B. The number of holdings decreased from 17 to 16. The portfolio is very concentrated with the largest five positions accounting for ~80% of the entire holdings: Icahn Enterprises, Cheniere Energy, Occidental Petroleum, CVR Energy, and Bausch Health.

Carl Icahn is best known for building sizable stakes in businesses and then pushing for changes to increase shareholder value. To learn more about his investing style and philosophy check out “King Icahn: The Biography of a Renegade Capitalist“.

Note: Icahn’s 13F filing is a consolidated report and so should not be viewed as a single portfolio. Specifically, Icahn Enterprises holds several of the businesses and the entities in turn hold Icahn Enterprises. For an idea on the business structure, check-out Icahn Enterprises Investor Presentation (Slide 5).

New Stakes:

None.

Stake Disposals:

Cloudera: The 3.71% of the portfolio position in Cloudera was purchased in Q3 2019 at a cost-basis of ~$5.41. His ownership interest was just under ~20%. Cloudera was acquired in a $16 per share all-cash PE deal announced in June. The transaction closed in October.

Stake Decreases:

Herc Holdings (HRI): HRI is a 2.83% of the portfolio position established in Q2 2016 as a result of the spinoff of Herc Holdings from Hertz Global Holdings. There was a ~4% stake increase in Q3 2017 at ~$38.50. The stock started trading at ~$33 and currently goes for ~$156. This quarter saw a ~11% trimming at prices between ~$180 and ~$190.

Note: They have a ~13.5% ownership stake in the business.

Occidental Petroleum (OXY) and wts: It is a top three 6.70% of the portfolio position established in Q2 2019 at ~$52 per share. Q3 2019 saw a ~23% selling at prices between $42 and $53 and that was followed with a ~15% reduction in Q1 2020 at prices between $37.25 and $44.50. The pattern reversed in Q2 2020: ~300% stake increase at an average cost of ~$14.60. Next quarter saw the position increased further through the purchase of 19.3M warrants (strike 22, 8/3/2027 expiry) for ~$2.75 per warrant. There was a ~40% selling in Q2 2021 at prices between ~$23 and ~$33. That was followed with a ~8% trimming last quarter. The small warrant stake also saw a ~20% selling. The stock is now at $57.79. Their overall cost-basis is ~$22 per share. This quarter saw marginal trimming in the warrants.

Note: Regulatory filings since the quarter ended show them owning 32.59M shares (3.44% of business) of Occidental Petroleum. This is compared to ~45M shares in the 13F report. The reduction happened at ~$47 per share.

Delek US Holdings (DK): DK is a very small 0.47% of the portfolio position. It came about as partial consideration of the special dividend paid by CVR Energy (0.1048 shares of DK for each CVI and the rest in cash). The stock currently trades at ~$22. They have a ~9.4% ownership stake in the business.

Note: Regulatory filings since the quarter ended show them owning 3.48M shares (4.93% of business) of Delek US Holdings. This is compared to 6.98M shares in the 13F report. They sold ~3.49M shares back to the issuer at $18.30 per share in a Stock Purchase and cooperation Agreement with the company.

Stake Increases:

Icahn Enterprises (NASDAQ:IEP): IEP position has seen consistent increases over the years. The position size increased from ~98M shares to ~102M shares in 2013, to ~109M shares in 2014, to ~117M shares in 2015, to ~130M shares in 2016, to ~158M shares in 2017, 175.4M in 2018, 197M in 2019, 222M shares in 2020, and 257M shares (~89% of business) in 2021. The stock currently trades at $52.81. IEP Book Value per share is ~$12 per share.

Note: The stake increase over the years is primarily due to them taking the dividend consideration in additional shares rather than cash.

Bausch Health (BHC): The 4.30% of the portfolio BHC position was purchased in Q4 2020 at prices between ~$15.30 and ~$21 and increased by ~575% next quarter at prices between ~$21.25 and ~$34.40. The stock currently trades at $23.63. This quarter saw a marginal increase.

Note: They own 34.7M shares (~10% of the business). Two Icahn nominees are on the board.

Xerox Holdings Corporation (XRX): XRX is a 3.26% of the portfolio position established in Q4 2015 at prices between $24 and $32. The four quarters through Q2 2021 had seen a roughly one-third stake increase. Their overall cost basis is ~$25 and they have a ~16% beneficial ownership stake in the business including forward contracts. The stock is now at $19.50.

Note 1: In December 2017, Icahn launched a proxy battle nominating four new board members in an effort to stop the Xerox-Fujifilm deal announced earlier. In May 2020, Xerox scrapped the deal with Fujifilm in a settlement with Icahn and Darwin Deason (another activist alongside Icahn).

Note 2: Icahn’s activism earned him three board seats in 2016. Xerox spun off Conduent and that transaction closed in January 2017. That was followed with a 1:4 stock-split in June. The prices quoted above are adjusted for these two transactions.

Southwest Gas Holdings (SWX): SWX is a 0.91% of the portfolio position established over the last two quarters at prices between ~$63 and ~$72. The stock currently trades at $80.73.

Note: Including forward contracts, Icahn’s stake is at ~2.9M shares (4.9% of the business). The position was made public on October 4th in a regulatory filing when they said they were opposed to Southwest’s acquisition of Questar Pipeline, Dominion Energy’s (D) transportation and storage business. A proxy contest and a $75 per share tender offer for all outstanding shares soon followed on October 14th. A motion to block the Quester Pipeline deal was denied in December. Southwest’s board unanimously rejected the tender offer in January.

Kept Steady:

Cheniere Energy (LNG): LNG is a large (top three) 7.36% portfolio position. The bulk of it was purchased in Q3 2015 at prices between $47.50 and $70.50. Q4 2015 saw a ~15% increase at prices between $36 and $54. There was an about turn in Q2 2018: ~28% reduction at ~$65. Q4 2020 saw another ~20% selling at prices between ~$46 and ~$61. The stock currently trades at ~$141.

Note: Regulatory filings since the quarter ended show them owning 12.13M shares (4.77% of business) of Cheniere Energy. This is compared to 16.17M shares in the 13F report. The reduction happened at prices between ~$132 and ~$139.

CVR Energy, Inc. (CVI): CVI is a top five 5.37% of the 13F portfolio position first purchased in Q4 2011. The bulk of the current position (71.2M shares: ~71% of the whole business) was purchased through a $30 per share tender offer in H1 2012. The stock currently trades at $26.25.

Note: Two MLPs were carved out since the 2012 tender: CVR Refining the refining portion and CVR Partners (UAN) the nitrogen fertilizer unit. CVR Energy had majority ownership stake in both. In August 2015, CVR Partners agreed to merge with Rentech Nitrogen. Q2 2018 saw a tender offer whereby new CVR Energy shares were exchanged for CVRR at a valuation of $24.26 per common unit (0.6335 shares of CVI for one CVRR). ~22M new shares were issued.

Newell Brands (NWL): NWL is a 4.28% of the portfolio position established in Q1 2018 at a cost-basis of $27.40 per share. The stock is now at $21.75. Q2 2018 saw a ~10% stake increase at prices between $23 and $28 and that was followed with a ~15% increase next quarter at prices between $20.50 and $28. Overall, their cost-basis is ~$25.60. Q1 2020 also saw a ~6% stake increase.

Note 1: Regulatory filings since the quarter ended show them owning 34.64M shares (8.35% of business). This is compared to 43.7M shares in the 13F report. Around 11M shares were sold at $25.86 per share in a repurchase agreement with the company.

Note 2: In April 2019, rival activist Starboard Value came to an agreement with Carl Icahn whereby they now together control Newell’s board.

FirstEnergy Corp. (FE): FE is a 3.54% of the portfolio position purchased in Q1 2021 at prices between ~$29.50 and ~$35.60 and the stock currently trades at $46.31.

Dana Inc. (DAN): The 1.46% DAN stake was established in Q4 2020 at prices between ~$13.25 and ~$20 and increased by ~200% next quarter at prices between ~$19 and ~$27. Last quarter also saw a ~20% stake increase at prices between $20.90 and $24.60. The stock currently trades at $17.24.

Note: Icahn controls ~10% of Dana Inc.

Welbilt, Inc. (WBT), previously Manitowoc Food Service: The small 1.19% of the portfolio WBT stake was established as a result of the spin-off from Manitowoc. The spin-off terms called for one share of WBT for each share of MTW held. Icahn held 10.58M shares of MTW for which he received the same number of WBT shares. Regular-way trading started in early March 2016 with WBT at $13.41. It currently trades at $23.74 compared to Icahn’s overall cost-basis of ~$13. There was a ~18% stake increase in Q1 2020.

Note: Icahn controls ~9.5% of the business.

Conduent Inc. (CNDT): The small 0.91% portfolio stake came about as a result of Conduent’s spinoff from Xerox that closed in January 2017. Terms called for Xerox shareholders to receive Conduent shares in the ratio 1:5. Icahn owned 99M shares of Xerox for which he received 19.8M shares of Conduent. CNDT started trading at ~$15 and currently goes for $5.14. Q2 2019 saw a ~60% stake increase at around $9 per share. That was followed with a ~20% increase in Q4 2019 at ~$6.50 per share.

Note: Their ownership interest in Conduent is at ~18% of the business.

SandRidge Energy (SD): SD is a 0.23% of the portfolio activist stake established in Q4 2017 at prices between $16 and $21 and the stock is now at $16.82.

Note: Icahn has a ~13.5% ownership stake in the business. He lobbied the board and succeeded in ending the Bonanza Creek acquisition on December 28, 2017. In June 2018, Icahn gained control of Sandridge’s board by winning a proxy battle.

Note: Icahn also owns significant stakes in the following OTC stocks: ~36M shares (48.6% of business) of Enzon Pharmaceuticals (OTC:ENZN) at a cost-basis of ~$2.70, and ~89% of Viskase Companies (OTCPK:VKSC). He is also known to have a position in Fannie/Freddie (OTCQB:FNMA) (OTCQB:FMCC). The Enzon position saw a substantial increase in Q4 2020 as they participated in a rights offering.

The spreadsheet below highlights changes to Icahn’s 13F stock holdings in Q4 2021:

Carl Icahn’s Q4 2021 13F Report – Q/Q Comparison (John Vincent (author))

Be the first to comment