Falcor

It’s been a rough year thus far for the Gold Miners Index (GDX), with the ETF down over 30% year-to-date, reversing to underperformance vs. the major market averages. Unfortunately, this bear market environment has made it very challenging for investors in the space to generate positive returns, given that miners are selling off on good news, great news, or mediocre news. This is exacerbated by tax-loss selling as we near year-end and certainly not helped by the declining gold price.

For Torex Gold (OTCPK:TORXF), this has made it a frustrating year, given that even though the company is on track to beat production guidance and meet cost guidance, the stock has found itself down 35% year-to-date. However, for those willing to look past the turbulence, this continued selling pressure has left the stock at its most attractive valuation in years. In fact, Torex now trades at less than 0.50x P/NAV and less than 3x forward cash flow, a valuation reserved for a producer struggling to make ends meet. So, while Torex may be a higher-risk bet being a single-asset producer, I would view any further weakness as a buying opportunity.

El Limon Guajes Operations (Company Website)

Torex Gold’s Q3 Production & Sales

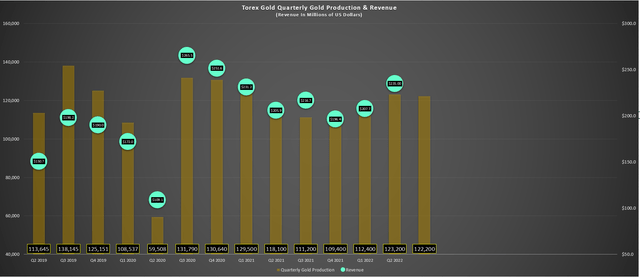

Torex Gold released its preliminary Q3 results last week, reporting quarterly gold production of ~122,200 ounces, a 10% increase from the year-ago period. The increased production was driven by higher plant throughput and grades, helped by another very strong quarter from El Limon Guajes (ELG) Underground, with a more than 20% increase in ore tonnes mined (~140,000 vs. ~113,000) on a year-over-year basis. Given these strong results, the company sold just shy of 120,000 ounces of gold in the period and is heading into Q4 with the potential to meet the upper end of guidance (470,000 ounces). Torex has produced ~357,800 ounces year-to-date, translating to ~79.5% of its guidance mid-point.

Torex Gold – Quarterly Production (Company Filings, Author’s Chart)

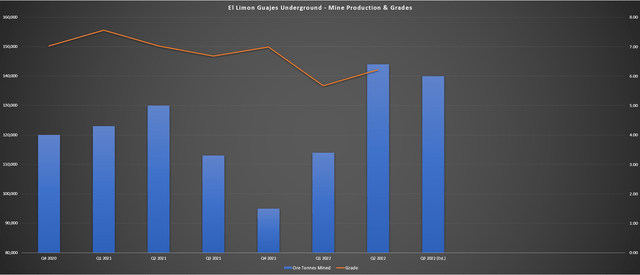

Looking at underground mine production below, we can see that tonnes of ore mined continue to trend higher, and these figures are significantly outperforming planned levels. In fact, the company has now mined an average of 130,000 tonnes of ore on a trailing-nine-month basis, up from ~100,000 tonnes per quarter in 2019. Notably, Torex is evaluating opportunities to increase mining rates to 2,000 tonnes per day, translating to over 180,000 tonnes of ore mined per quarter to help supplement the ELG Pits and Media Luna post-2024. So, with consistent reserve growth net of depletion and increasing mining rates, ELG Underground continues to be an exciting part of this story.

Torex Gold – Underground Tonnes Mined/Grades (Company Filings, Author’s Chart)

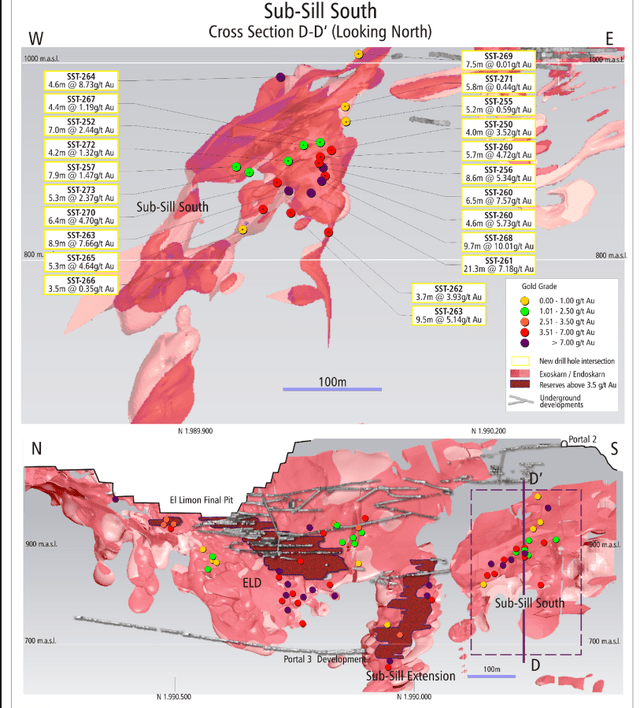

While on the topic of the underground, Torex reported impressive step-out drilling results in Q3, intersecting 21.3 meters at 7.18 grams per tonne of gold, 9.7 meters at 10.01 grams per tonne of gold, and 8.9 meters at 7.6 grams per tonne of gold at Sub-Sill South. The company also reported drilling success at El Limon Deep, hitting high-grade mineralization more than 100 meters below the current reserve envelope, intersecting multiple high-grade intercepts. This bodes well for continued reserve growth at ELG Underground, which could ultimately support underground production well past 2027 and help to fill the mill in the later years of the mine life.

ELG Underground Drill Results (Company Filings, Author’s Chart)

Finally, moving over to development, Torex noted that Portal #3 ramp development to the lower areas of ELD and Sub-Sill is now complete, with this helping to reduce costs due to shorter underground haul distances. It will also allow for more effective infill/step-out drilling at ELD and Sub-Sill. At Media Luna, the company’s next mine, the Guajes Tunnel has been advanced 2,660 meters, and breakthrough on the south side of the Balsas River remains on track for Q1 2024. Meanwhile, the South Portal Lower has been advanced to 1,055 meters. Overall, development rates have lagged estimates slightly on a year-to-date basis but are trending higher.

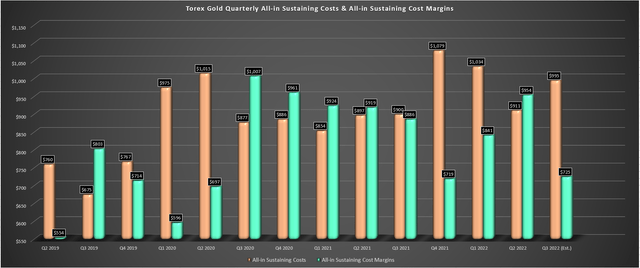

Costs & Margins

Looking at costs and margins, Torex has been one of only a handful of producers that didn’t adjust its cost guidance due to worse-than-expected inflationary pressures. This is evidenced by the company maintaining its cost guidance of $980 – $1,030/oz for FY2022, with these costs set to come in more than 20% below the estimated industry average ($1,270/oz). Based on the better-than-expected production levels in Q3, we should see all-in-sustaining costs come in below $1,000/oz this quarter, translating to AISC margins of $700/oz or higher.

Torex Gold – Costs & Margins (Company Filings, Author’s Chart)

Unfortunately, this would result in significant margin compression vs. Q3 2021 levels ($886/oz), but this is hardly company-specific. The good news for Torex is that while it’s seeing some margin compression, it still has very healthy AISC margins at a $1,700/oz gold price (~41%), and its hedges will help to maintain its margins in Q4 2022 and 2023. In fact, Torex has hedged just over one-third of production in Q4 at $1,910/oz and roughly one-quarter of FY2023 production at $1,924/oz. So, even if we assume that the gold price averages just $1,730/oz next year, Torex will benefit from a gold price closer to $1,800/oz due to its hedges.

Let’s take a look at the valuation and see whether this margin compression is priced into the stock.

Valuation

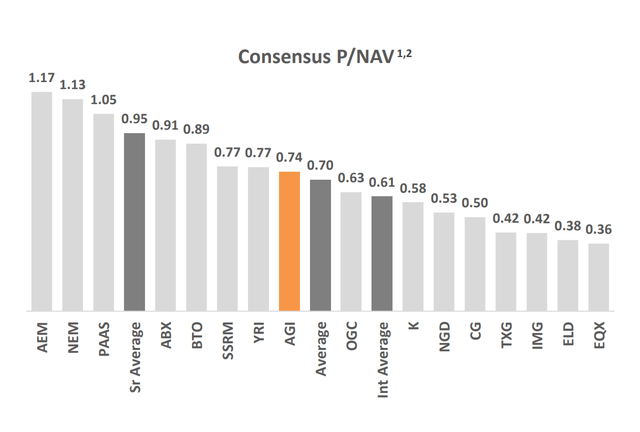

Based on ~86 million fully diluted shares and a share price of US$6.95, Torex trades at a market cap of ~$600 million, which is a very attractive valuation for a mid-tier producer. Even based on a more conservative estimated net asset value of ~$1.20 billion based on $1,725/oz gold and $3.75/lb copper and $130 million in corporate G&A, Torex trades at 0.50x P/NAV. This is one of the lowest multiples sector-wide, and it assigns a limited value for exploration upside on a very prospective land package. As the chart below shows, a few names are more undervalued than Torex, and most of them are much higher-cost or have a spotty track record of meeting guidance.

Torex P/NAV Multiple vs. Peers (Alamos Gold Corporate Presentation)

Obviously, Torex deserves some discount due to being a single-asset producer in one of Mexico’s least favorable mining jurisdictions and having some execution risk when it comes to switching from one mine to another in 2025. That said, I would be much more worried about the execution risk if Torex was a company that struggled to meet guidance, and this is clearly not the case. To summarize, I see the risks more than priced into the stock with Torex trading at a P/NAV multiple of ~0.50x and a cash flow multiple of ~2.7x (FY2023 estimates of $2.60).

Summary

Torex continues to execute near flawlessly from both a safety and production standpoint, and it’s hard to find a producer that’s been more consistent over the past three years. Given that the stock is the cheapest it’s been in years, I see Torex as a Speculative Buy below US$6.45. That said, I prefer to position my portfolios more conservatively, and with diversified producers paying mid-single-digit dividend yields, buying back stock, and also trading at deep discounts to net asset value, this is where I remain focused. So, while I am long-term bullish on Torex, this explains my Neutral rating, given that I expect the stock to be a market performer until Media Luna nears completion.

Be the first to comment