juffy/iStock via Getty Images

Introduction

Topicus.com Inc. (OTCPK:TOITF) reported Q2 earnings this week and they were pretty strong. In the article we wrote on its Q1 earnings titled “Topicus Q1: Looking ahead,” we said that Q2 was shaping up to be a strong quarter and investors shouldn’t judge this company based on quarterly numbers. We believe Q2 was a perfect illustration why investors must zoom out when it comes to Topicus or any other serial acquirer.

Without further ado, let’s start by looking at the market’s reaction.

The market’s reaction

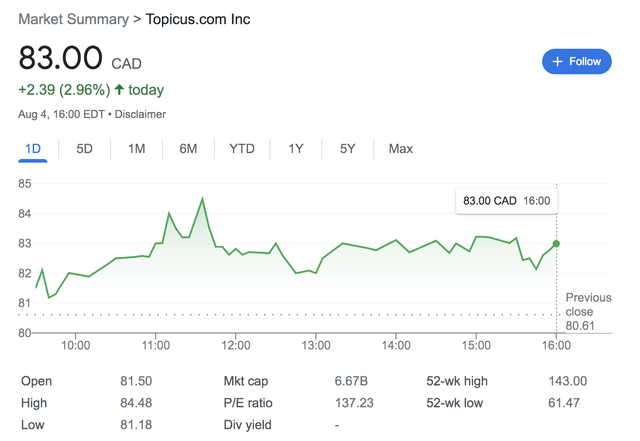

The market seemed to like the results as Topicus’ stock increased almost 3% to CAD 83:

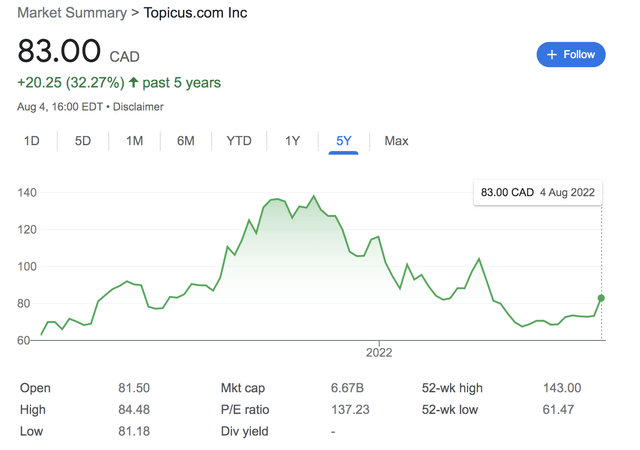

However, if we zoom out a bit we can still see how the stock is considerably off ATH, so there’s a bit of ground to cover still:

Now, let’s look at the numbers!

The numbers

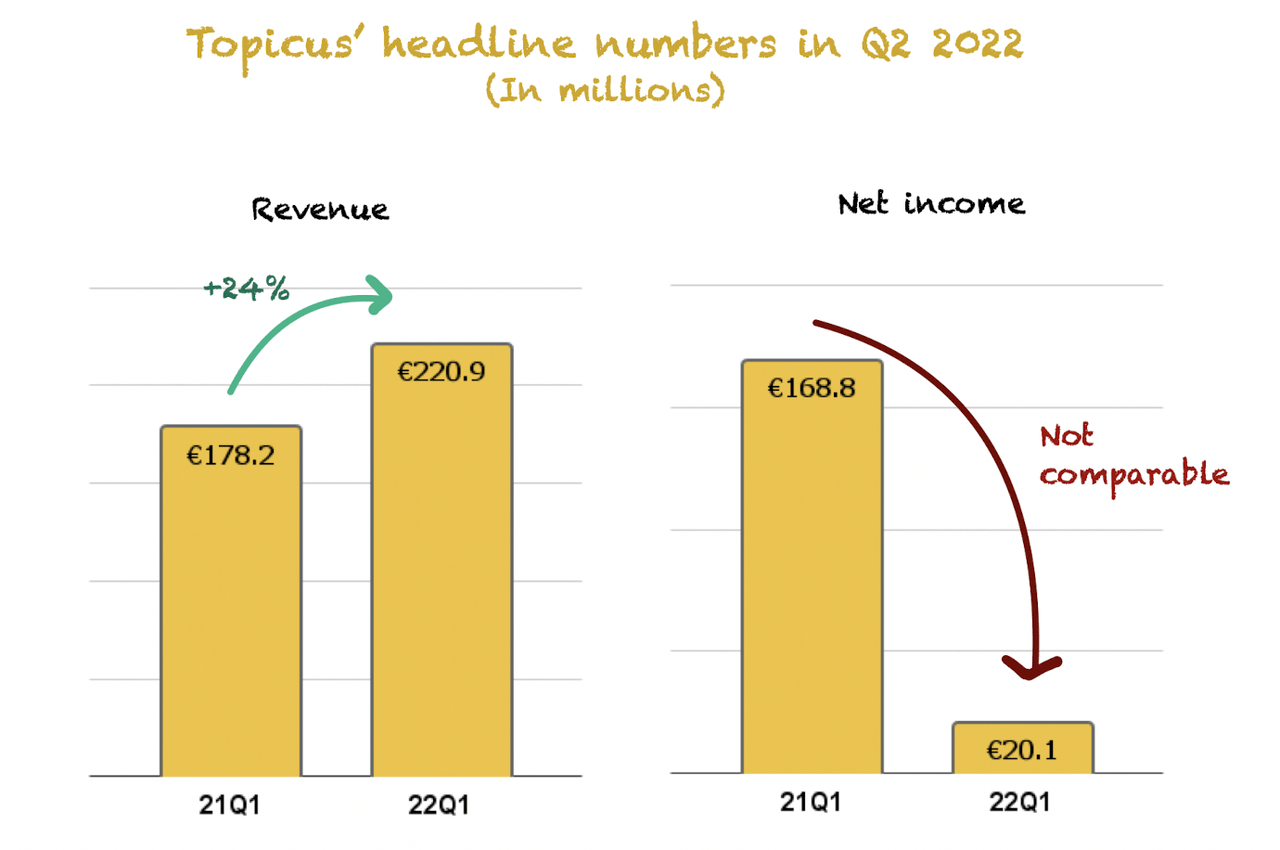

Headline numbers for Topicus were pretty good, but the bottom line needs some context as it appears to be terrible at first sight.

Revenue grew 24% Y/Y to €220.6 million, while net income decreased considerably to €20.1 million:

Made by Best Anchor Stocks

Last quarter we had the situation where the bottom line had increased significantly due to the conversion of the redeemable preferred shares, and we argued it was not comparable. This quarter the same thing happened but in the opposite direction: Topicus saw its net income decrease significantly due to a redeemable preferred securities gain it enjoyed in Q2 2021. So once again, quarters were not comparable on the bottom line, but it’s expected to be the last quarter where we have this “inconvenience.”

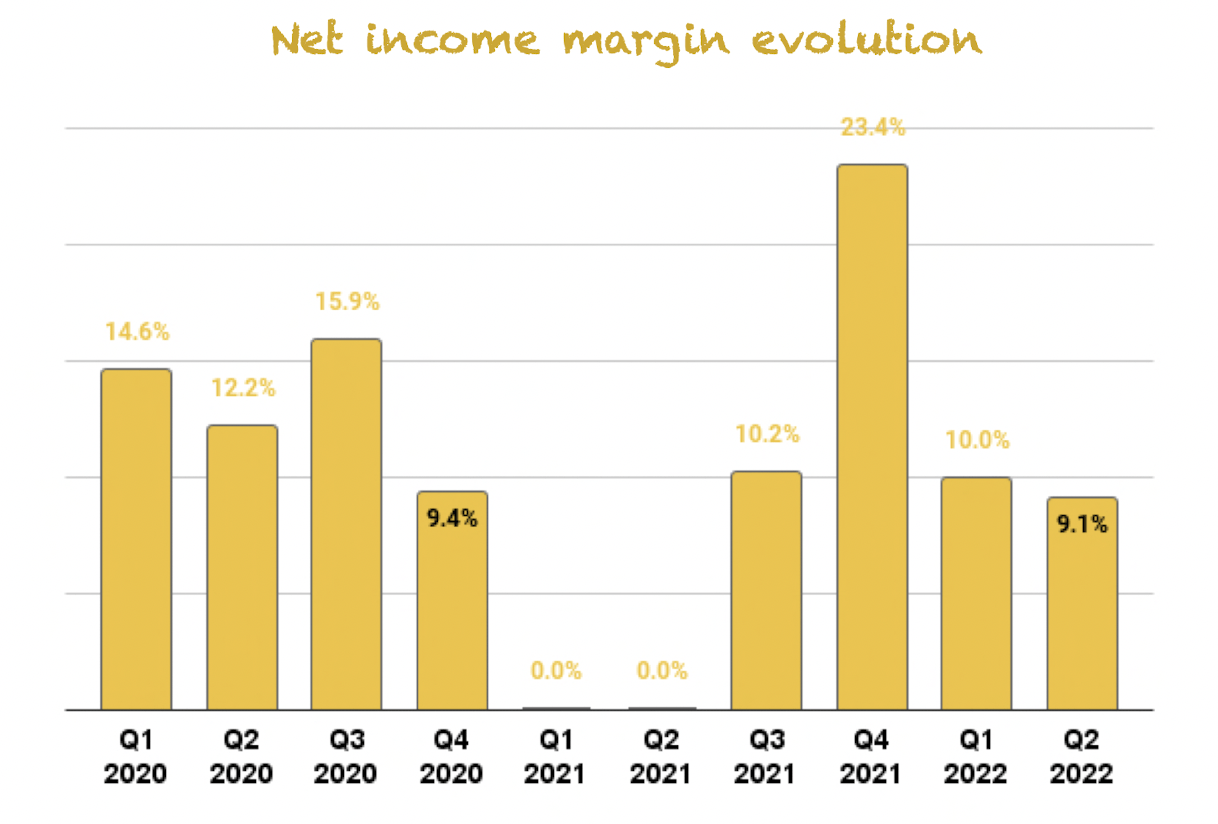

Net income margin for the quarter came in at 9.1%, which was obviously a year-over-year margin contraction (for the reason mentioned above). However, if we plot it against all quarters, it doesn’t appear to be that bad. Admittedly, it’s the lowest net income margin that the company has posted in a while, but this is something to be expected when acquisitions are ramping up:

Made by Best Anchor Stocks. Note how we avoided the net income margin for Q1 and Q2 last year. This is because they carry the impact of the redeemable preferred shares, which are non-recurring.

Topicus and Constellation Softwafe (OTCPK:CNSWF) don’t always buy high-margin businesses. Instead, their bread and butter is buying out-of-favor companies in which they believe there is a return to be made by turning it around or exploiting the synergies with other portfolio companies.

A high-margin business is great, and we doubt Topicus or Constellation prefer a low-margin business, but they focus on return, so they also have to consider their price. This said, it really doesn’t make much sense to focus on profitability now because the company is in growth mode. There will be time to focus on margin expansion in the future once the company has scaled and synergies/efficiencies start to kick in.

Digging deeper into the top line

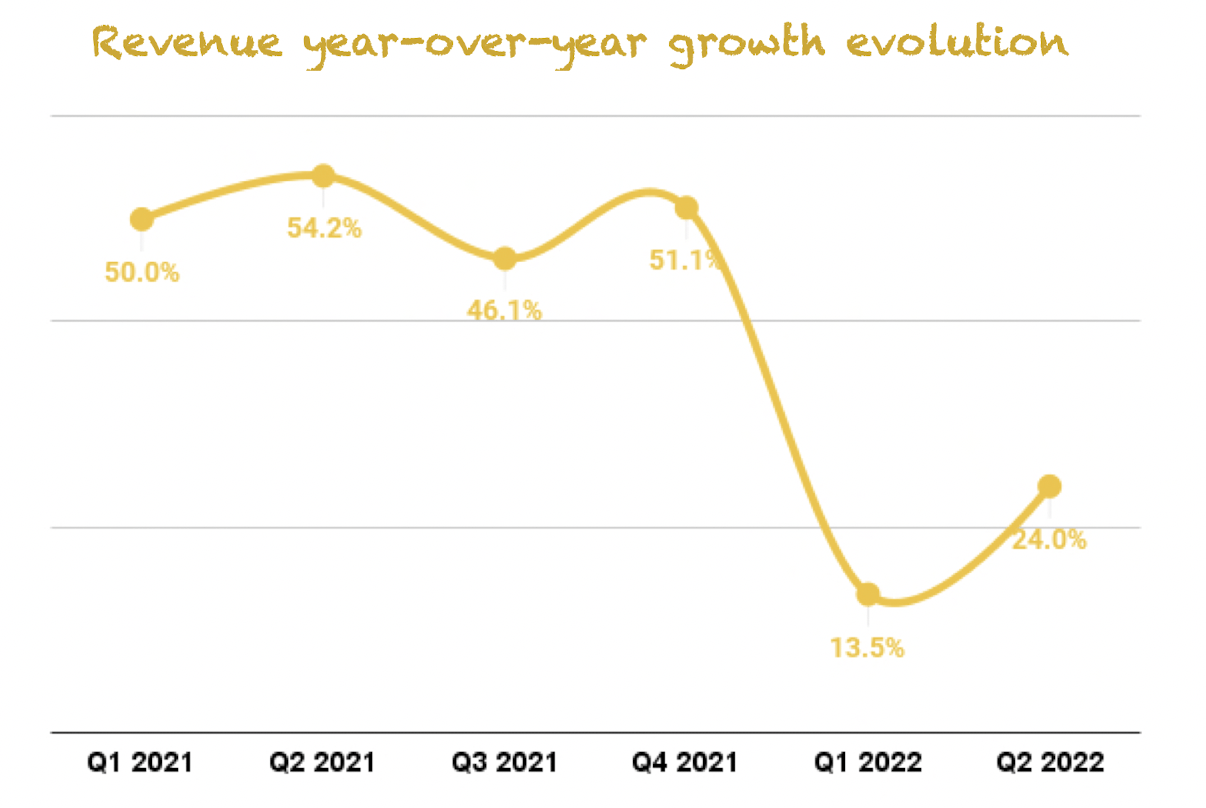

Last quarter Topicus’ revenue decelerated significantly from 51% to the low-teens, and we wrote the following in our Q1 review:

This abrupt decrease would certainly be a warning sign if it were any other type of company. However, when it comes to Topicus or Constellation, this is something that we are comfortable with because the timing of acquisitions matters quite a bit.

This quarter again showed us why we should expect volatility in revenue, especially while Topicus is small. Due to its size, timing of acquisitions impact its growth rate significantly.

Revenue accelerated in Q2 despite tough comps, although it still lays far away from what the company had us used to:

Made by Best Anchor Stocks

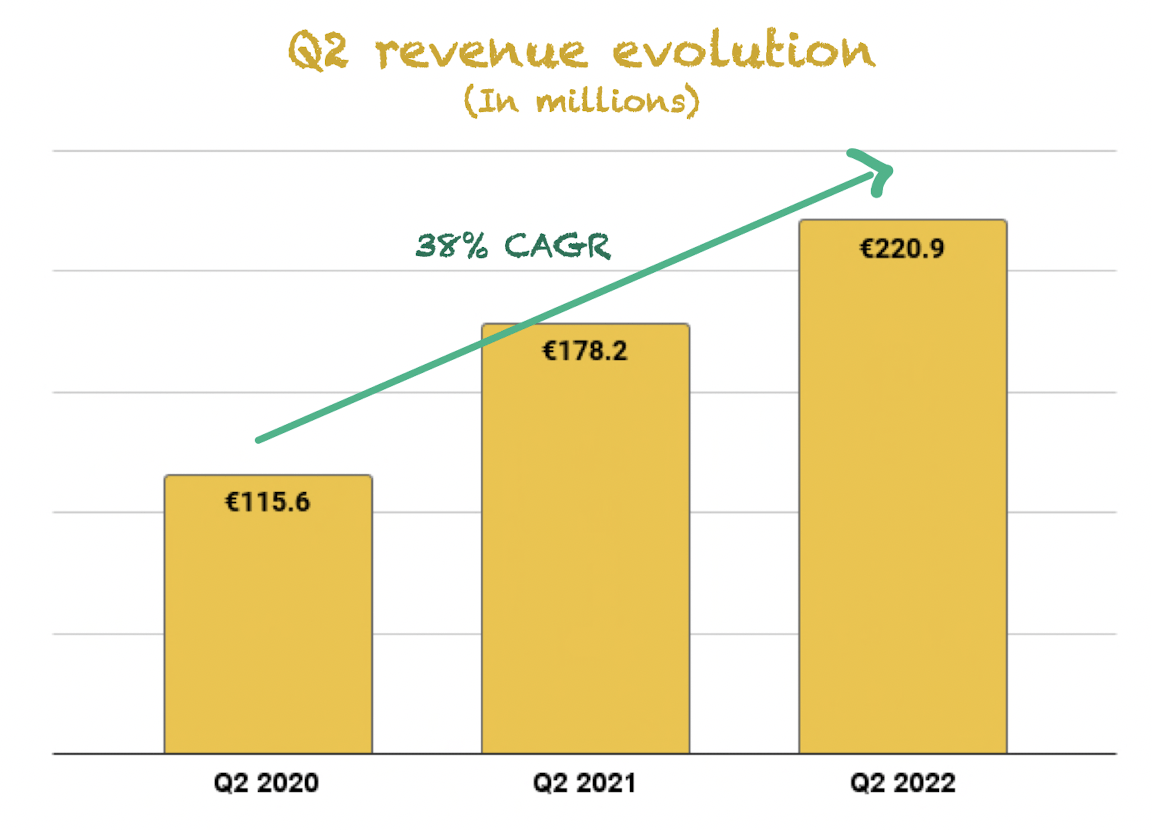

However, like we did last quarter, we should zoom out to see how Q2 revenue has evolved over the last couple of years. Topicus has managed to compound Q2 revenue at a 38% CAGR from 2020, which is pretty good if you ask us:

Made by Best Anchor Stocks

Topicus is a serial acquirer, so the long-term trend is of utmost importance when valuing the company’s performance. In case the company would’ve made fewer acquisitions and revenue growth would’ve come in at 10%, should we have been worried? We don’t think so, it’s just difficult to time acquisitions, and we don’t expect growth to be smooth at this point. For the first 6 months of 2022, revenue increased 19% Y/Y.

Organic growth was a pleasant surprise, especially in the current market environment. Remember, it’s one of Topicus’ strengths, and Constellation’s goal is ultimately to share organic growth best practices with the rest of the operating groups to help them achieve similar organic performance.

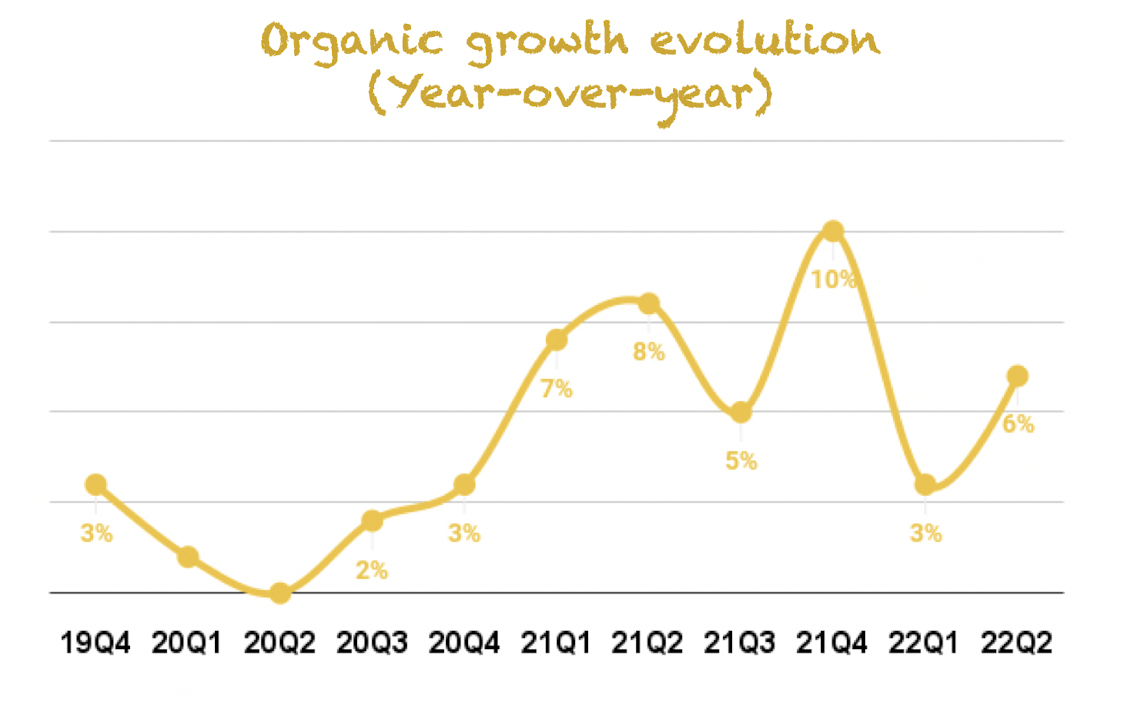

Organic revenue grew 6% Y/Y, and comps were not precisely easy:

Made by Best Anchor Stocks

The comparable period (’21Q2′) didn’t have easy comps (8%), so that makes it even better. If we make an average, we see that the average organic growth rate for the periods presented in the chart has been 4%, so this quarter came in above average.

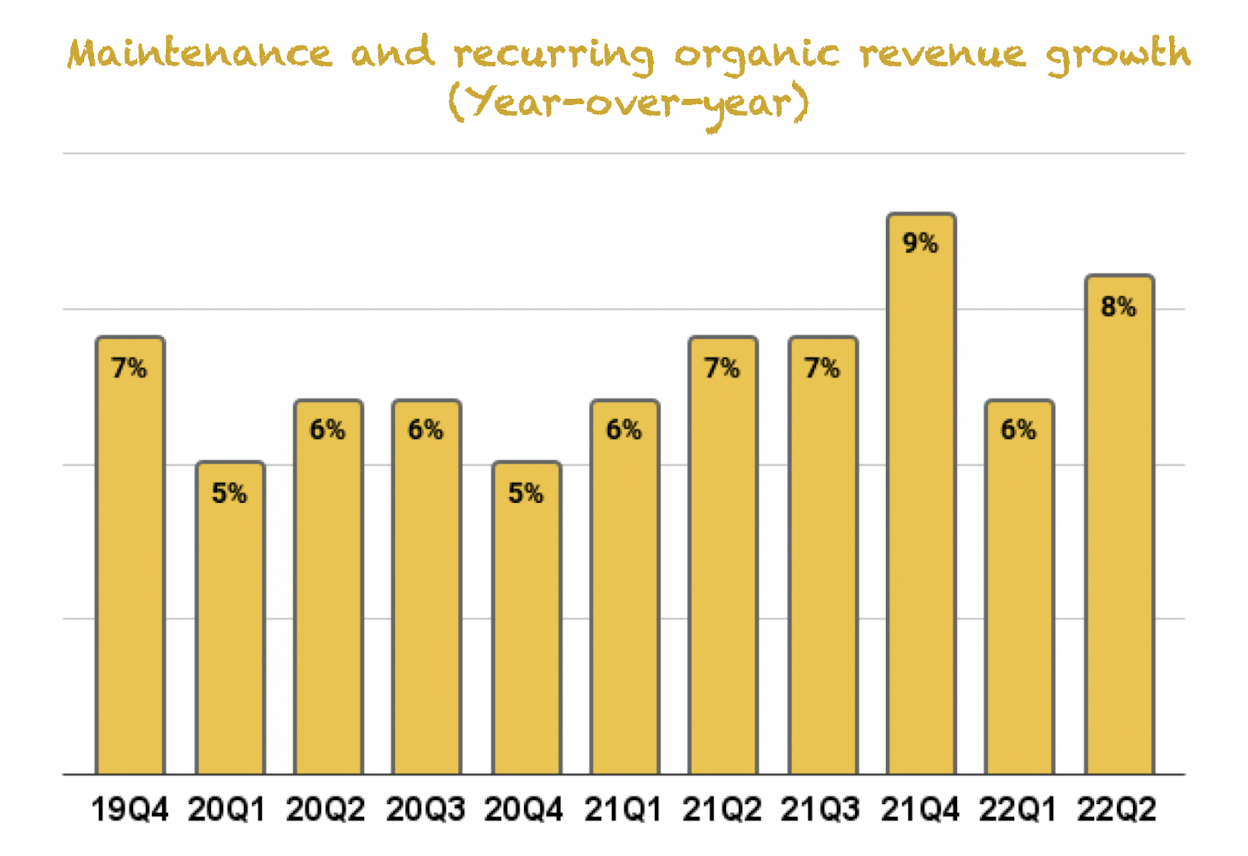

If we dig deeper into organic growth, we see that maintenance and other recurring organic growth came in at 8%, which is excellent, considering this is the revenue stream that both Topicus and Constellation are more interested in due to its predictability and resiliency:

Made by Best Anchor Stocks

Again, it was an above-average result despite not coming against easy comps. Most of Constellation’s revenue is maintenance and other recurring, so there’s little doubt that this is the metric that Constellation is after for the rest of its operating groups.

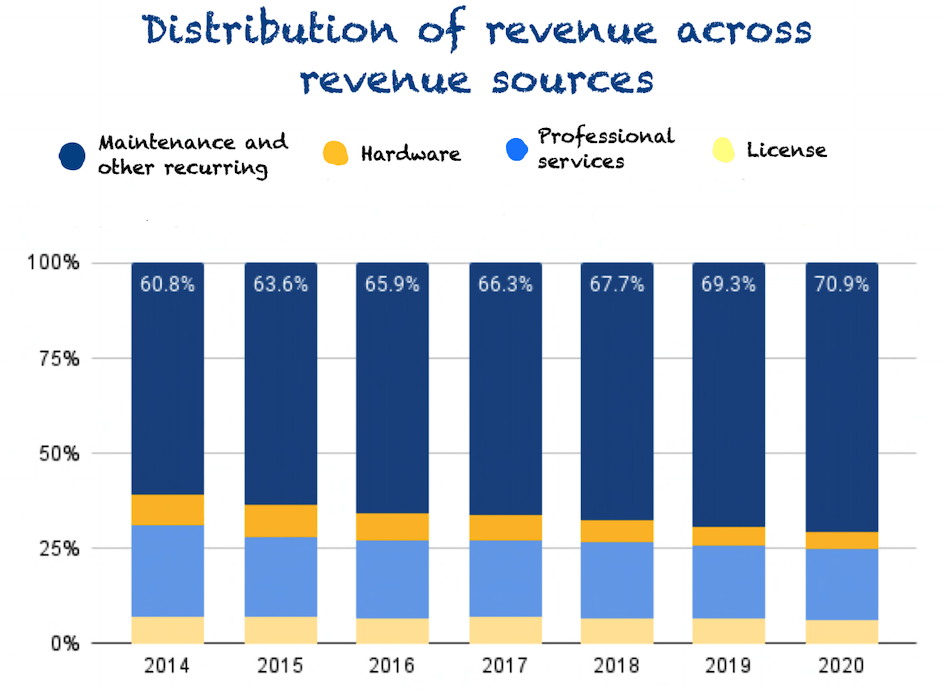

Made by Best Anchor Stocks

Maintenance and other recurring also makes up the majority of Topicus’ revenue, and it’s increasing in size as quarters go by. This quarter was no exception, as maintenance and recurring total revenue grew faster (+26% Y/Y) than overall revenue (24% Y/Y).

Looking at quarterly metrics is a bit misleading, so we’ll have to wait until Topicus has some more years under its belt to see how closely Topicus is tracking Constellation’s performance in its early days. Up to now, nothing makes us think that Topicus doesn’t have the potential to be the next Constellation, but it’s still very soon to tell, and it won’t be easy.

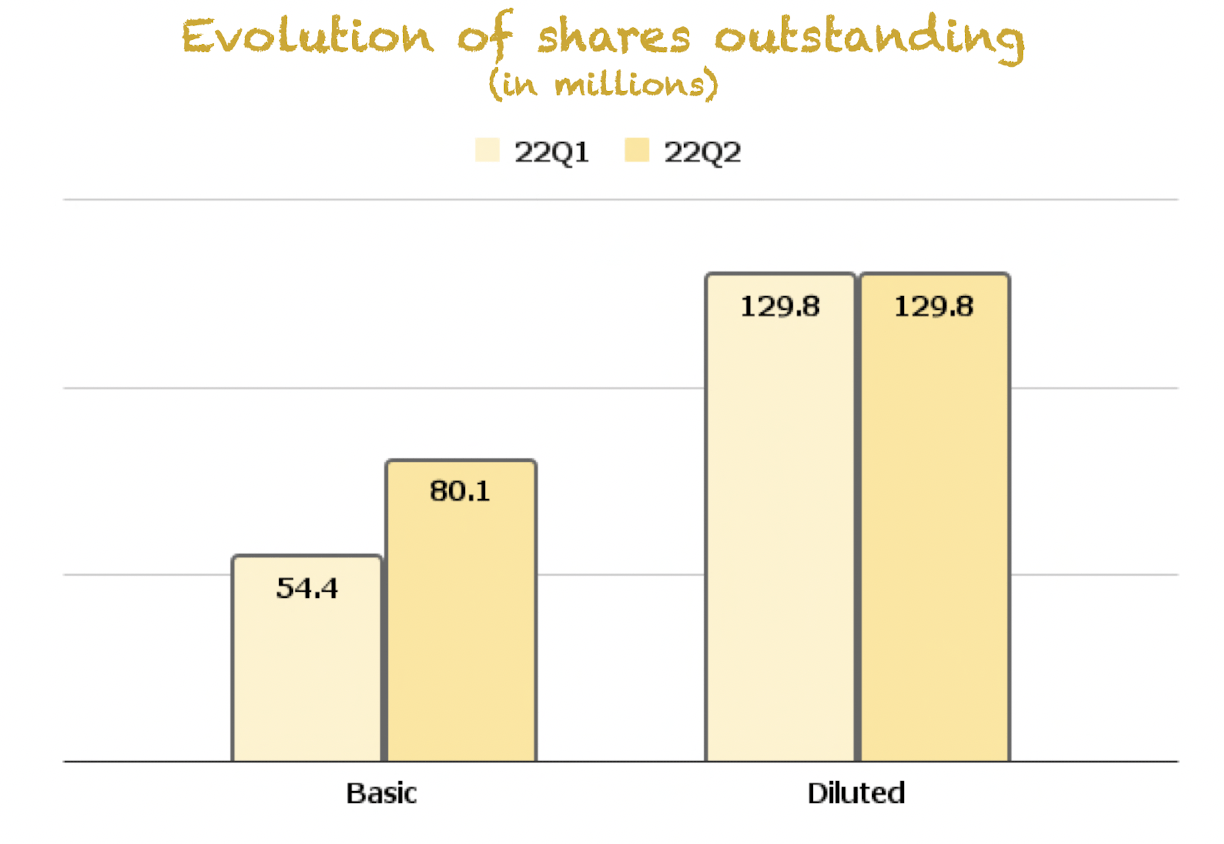

EPS and shares outstanding

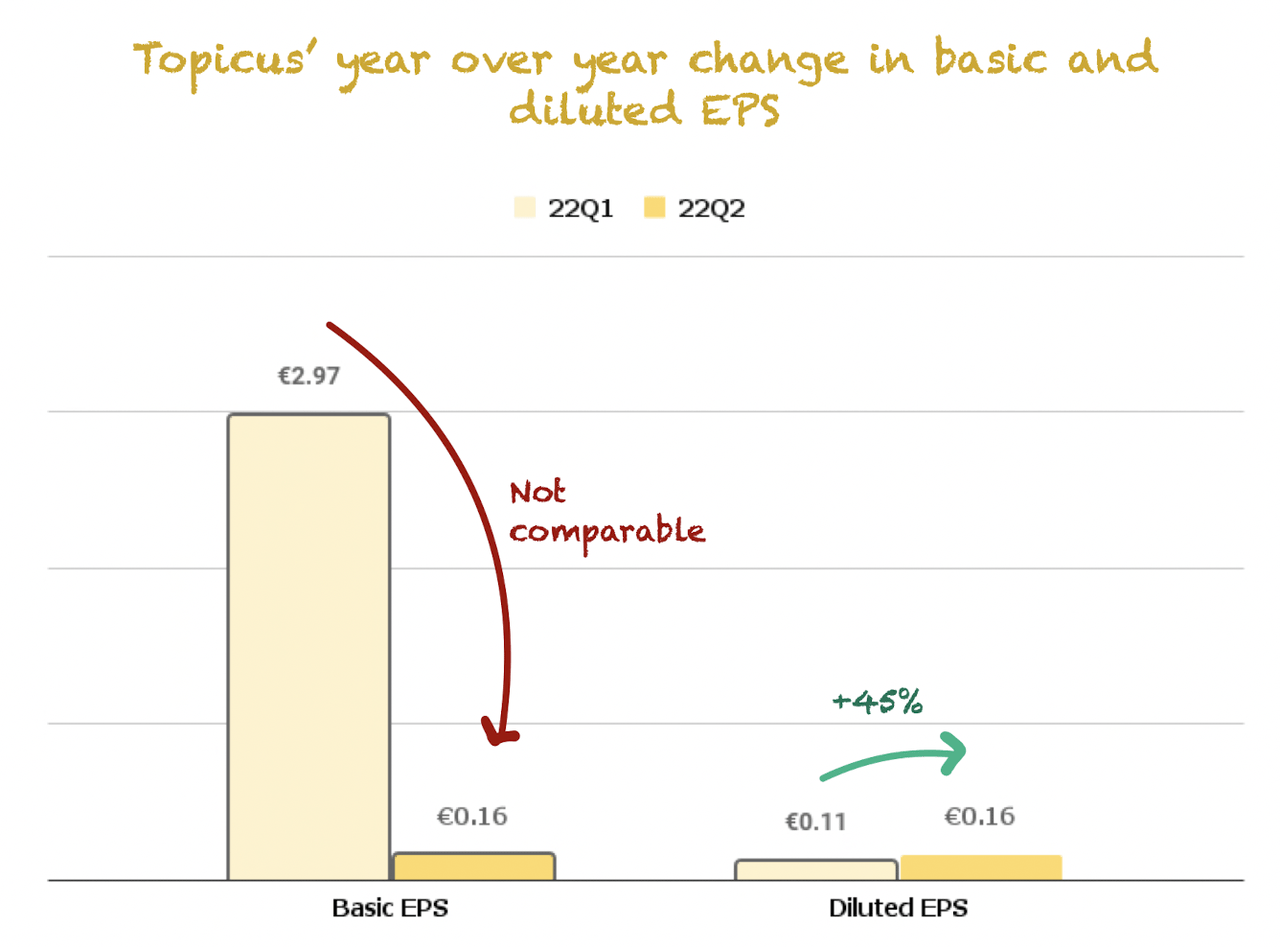

EPS was a mixed bag, depending on where you looked at. If you looked at basic shares, EPS decreased substantially from €2.97 to €0.16. However, if you looked at fully diluted shares, EPS actually increased 45% Y/Y from €0.11 to €0.16:

Made by Best Anchor Stocks

The divergence between both comes from (once again) the redeemable preferred shares. In the comparable quarter, diluted shares outstanding were 120.8 million, the same as this quarter. On the other hand, basic shares were not remotely similar as conversion took place between both periods:

Made by Best Anchor Stocks

This means that net income during Q1 2021 was distributed across a much smaller number of shares, thus why it came out so high.

When it comes to net income per diluted share, it seems strange that after such a sharp drop in net income, it came out 45% higher, right? Well, we believe this to be caused by the fact that Topicus “ignored” the gain on the redeemable shares in Q1 2021 so that comparisons would be apples to apples:

Topicus has reflected this capital reorganization as if it had occurred on the starting date of the earliest period presented for purposes of Topicus’ basic and diluted earnings per share calculation.

Source: Topicus Q1 2021 MD&A

All in all, we should expect basic shares to end up close to the diluted share number as we expect all involved parties to convert their shares.

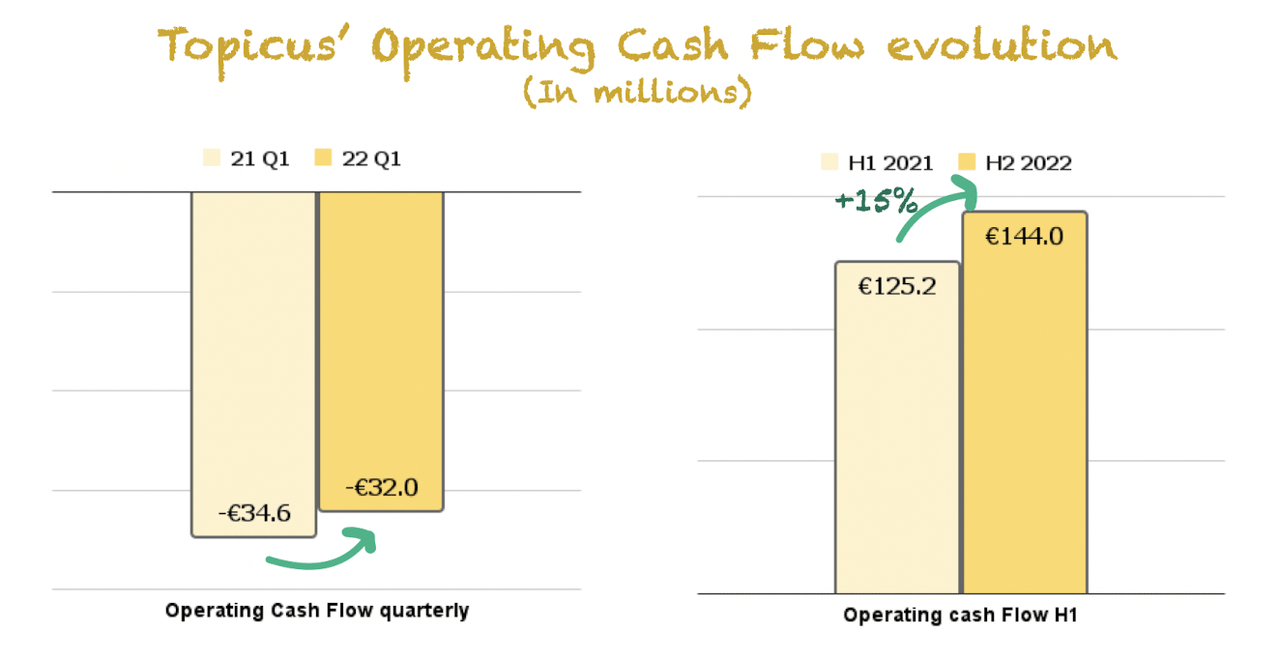

Looking at cash flows, the key metric

Cash flows for serial acquirers are critical because it’s the fuel that powers the flywheel. Therefore, these companies should aim to maximize cash flows that can be later deployed into more acquisitions.

Made by Best Anchor Stocks

Last quarter both Operating Cash Flow and Free Cash Flow came in positive, and this quarter they both came in negative. This is normal because Topicus invoices most of its customers for annual maintenance fees in Q1, so there’s a disproportionate amount of inflows during that quarter. Revenue isn’t impacted because it’s recognized throughout the year, irrespective of when those services have been invoiced.

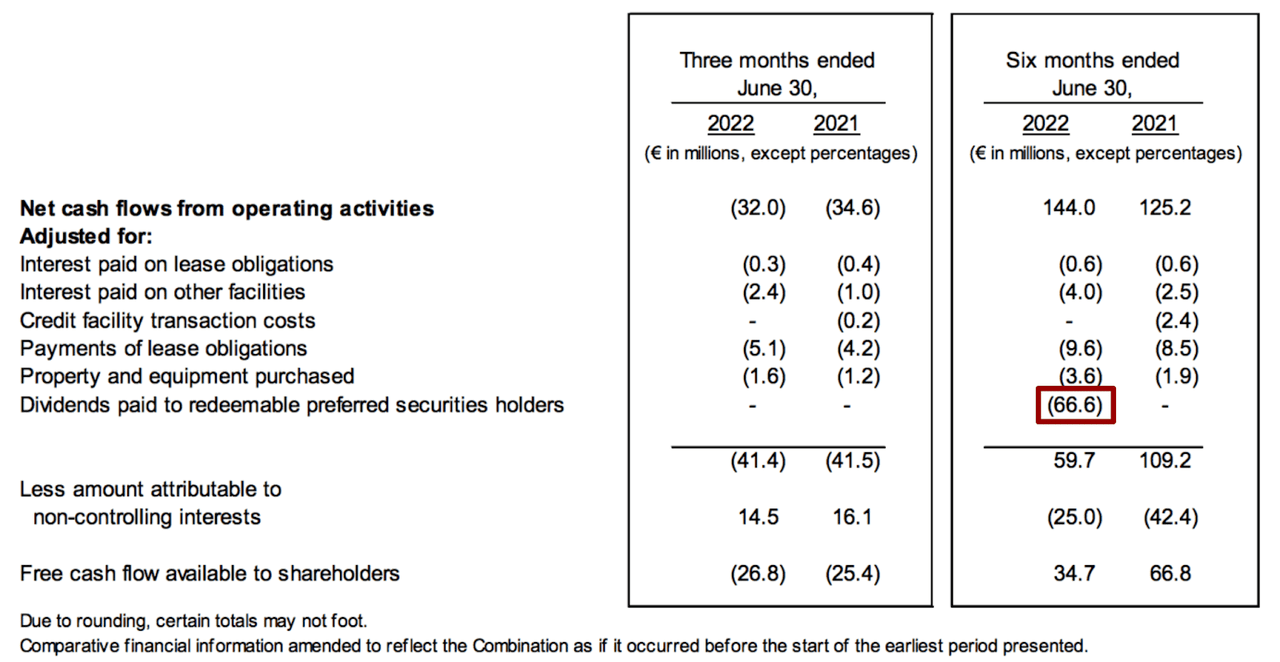

Despite being in negative territory, Operating Cash Flow improved slightly from negative €34.6 million to negative €32 million. However, the way to look at this so it makes sense, is to look at the first 6 months because this period also includes Q1’s inflows. For the first six months of 2022, Operating Cash Flow increased 15% Y/Y to €144 million:

Made by Best Anchor Stocks

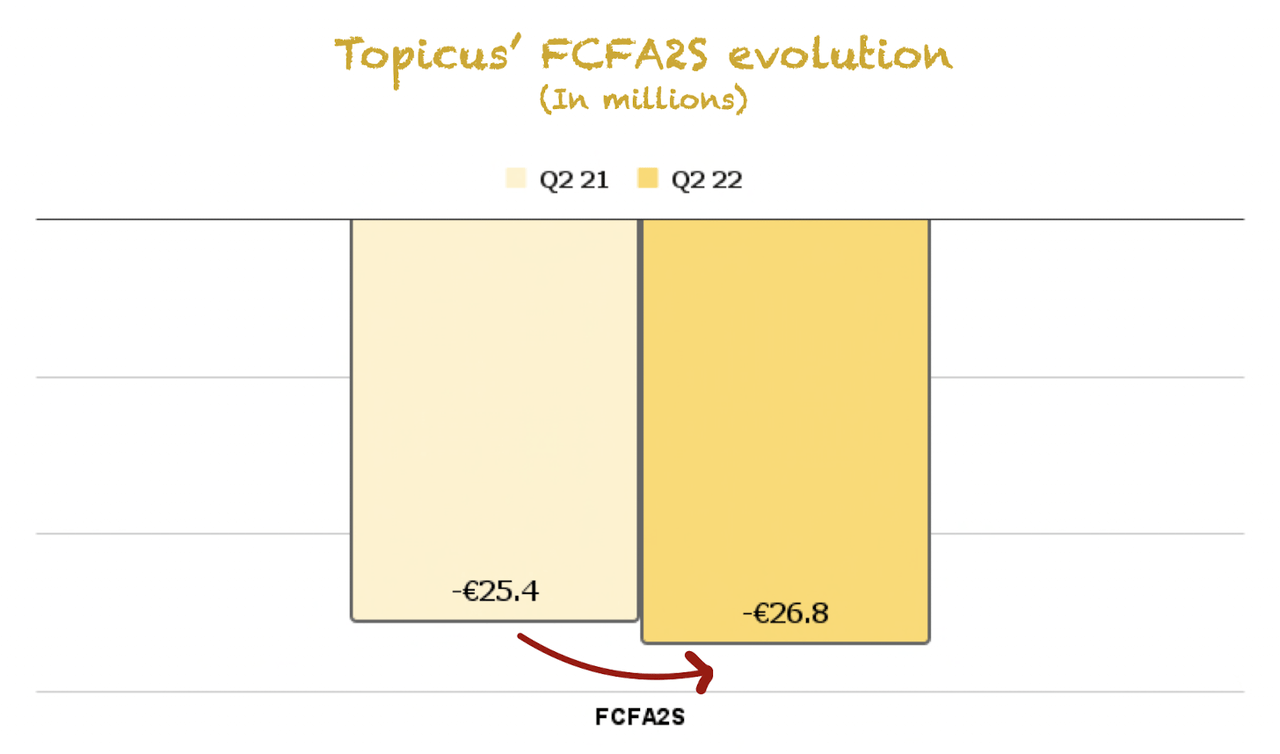

Free cash flow available to shareholders decreased slightly from negative €25.4 million to negative €26.8 million:

Made by Best Anchor Stocks

There’s not much we can conclude from these numbers, and we can’t zoom out to the first 6 months as we did with operating cash flow because there’s noise. Last quarter, FCFA2S decreased significantly because Topicus had to pay a €66 million dividend as part of the redeemable preferred shares. For this year, we should forget about making YTD conclusions for FCFA2S.

The good news is that this dividend payment is behind us, so Topicus will be able to spend this money on additional acquisitions.

Topicus MD&A

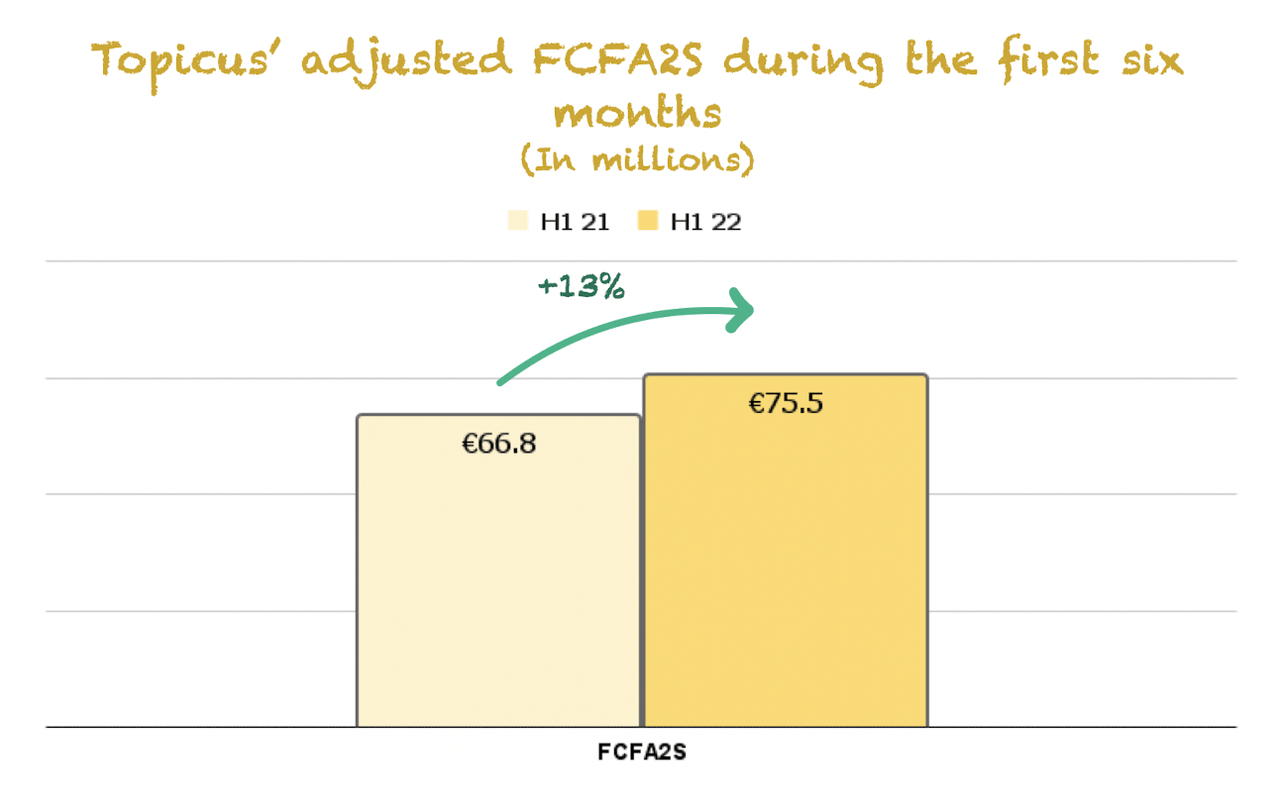

What we did do last quarter was adjust FCFA2S for this dividend, which made us end up with €102.3 million of “adjusted” FCFA2S instead of the €61.4 million reported. Adding this up to Q2’s FCFA2S, we would end up with €75.5 million in FCFA2S during the first six months, a 13% Y/Y increase compared to the first six months of 2021:

Made by Best Anchor Stocks

We believe that this adjustment helps us understand actual fundamental performance by tuning out the noise. This said, this should only be taken as an exercise to normalize results, not as “real results.” During the first six months, reported FCFA2S decreased by 48%, period. The dividend was indeed paid out, and, like it or not, that money didn’t flow into Topicus’ cash position.

Acquisitions – Very strong Q2 as expected

Topicus had a weak Q1 when it comes to acquisitions, and we said the following in our Q1 article:

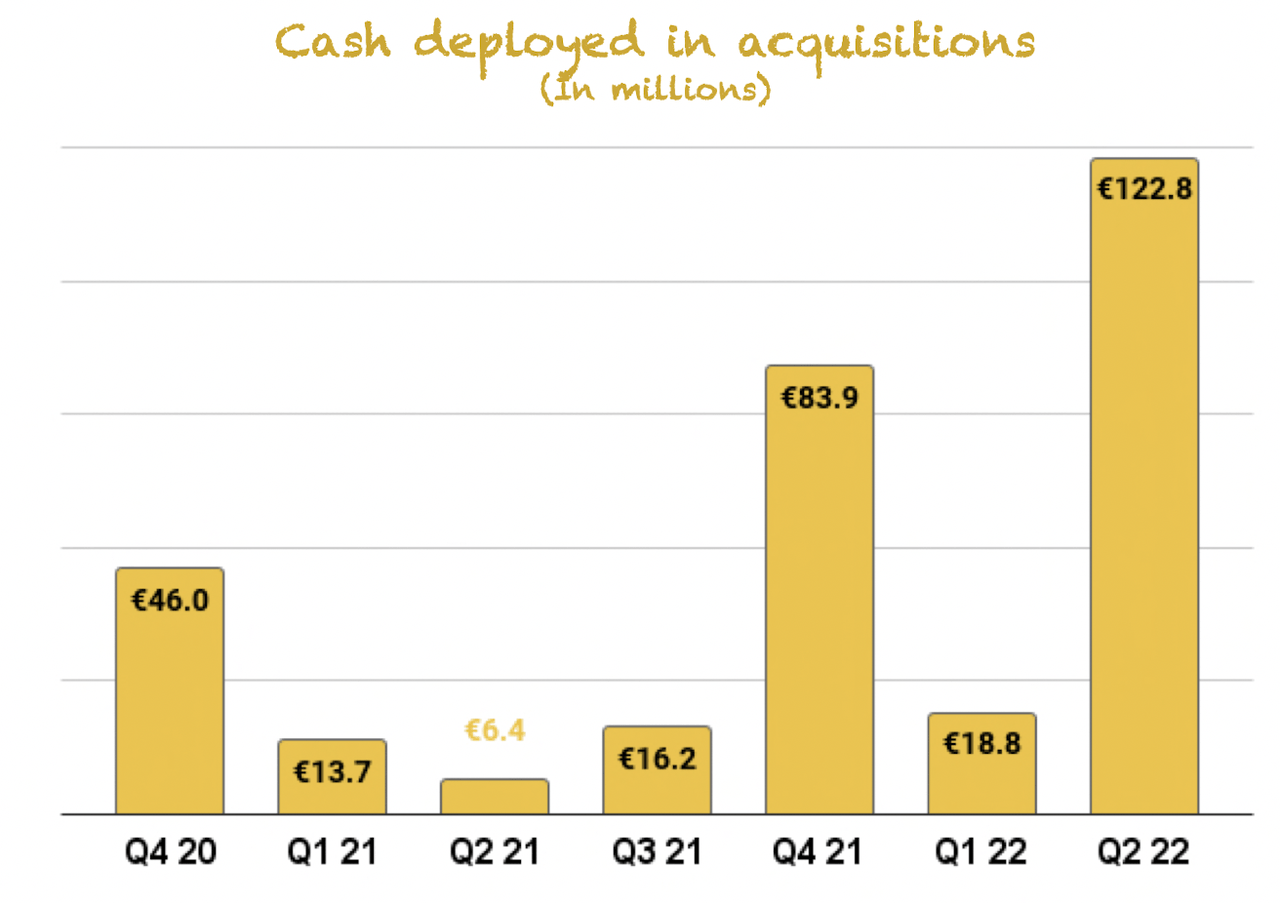

In just one month in Q2 (April), Topicus has deployed 2.3x more capital in acquisitions than in Q1. Of course, we don’t know what the next two months will bring, but it’s definitely shaping into a strong Q2.

As anticipated, Q2 was a solid quarter from an M&A perspective. Topicus deployed €122.8 million in acquisitions during the quarter, a new quarterly record:

Made by Best Anchor Stocks. We took out from Q1 2021 the purchase of Topicus from Ijsell

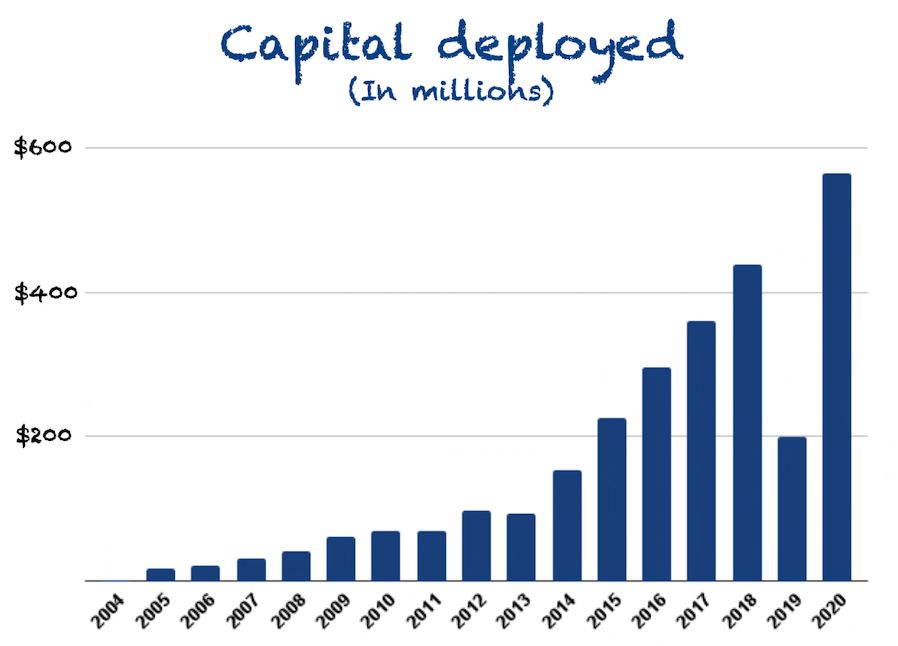

The graph above also portrays an important lesson: we can’t analyze capital deployed on acquisitions on a quarterly basis. The rationale is that capital deployment is tough (if not impossible) to time, and even if management is able to find opportunities during the quarter, the closing of the transaction is not too dependent on them. We have had some excellent quarters from an M&A perspective and some very weak ones, but what really counts is the long-term trend. Yearly numbers might not even be enough in such a short history such as Topicus’, but if we look at Constellation’s long-term annual numbers, the trend is obvious:

Made by Best Anchor Stocks

For Topicus, we’ll just have to wait and see how the graph shapes up once we have more years of data.

Q3 is also shaping up to be a relatively strong quarter from an M&A perspective:

Subsequent to June 30, 2022, the Company completed or entered into agreements to acquire a number of businesses for aggregate cash consideration of €29.5 million (which includes acquired cash). Deferred payments associated with these acquisitions have an estimated value of €0.9 million resulting in total consideration of €30.4 million.

We don’t know if it will be another record quarter, but it definitely has the potential to be close.

Can we measure Topicus’ effectiveness in M&A?

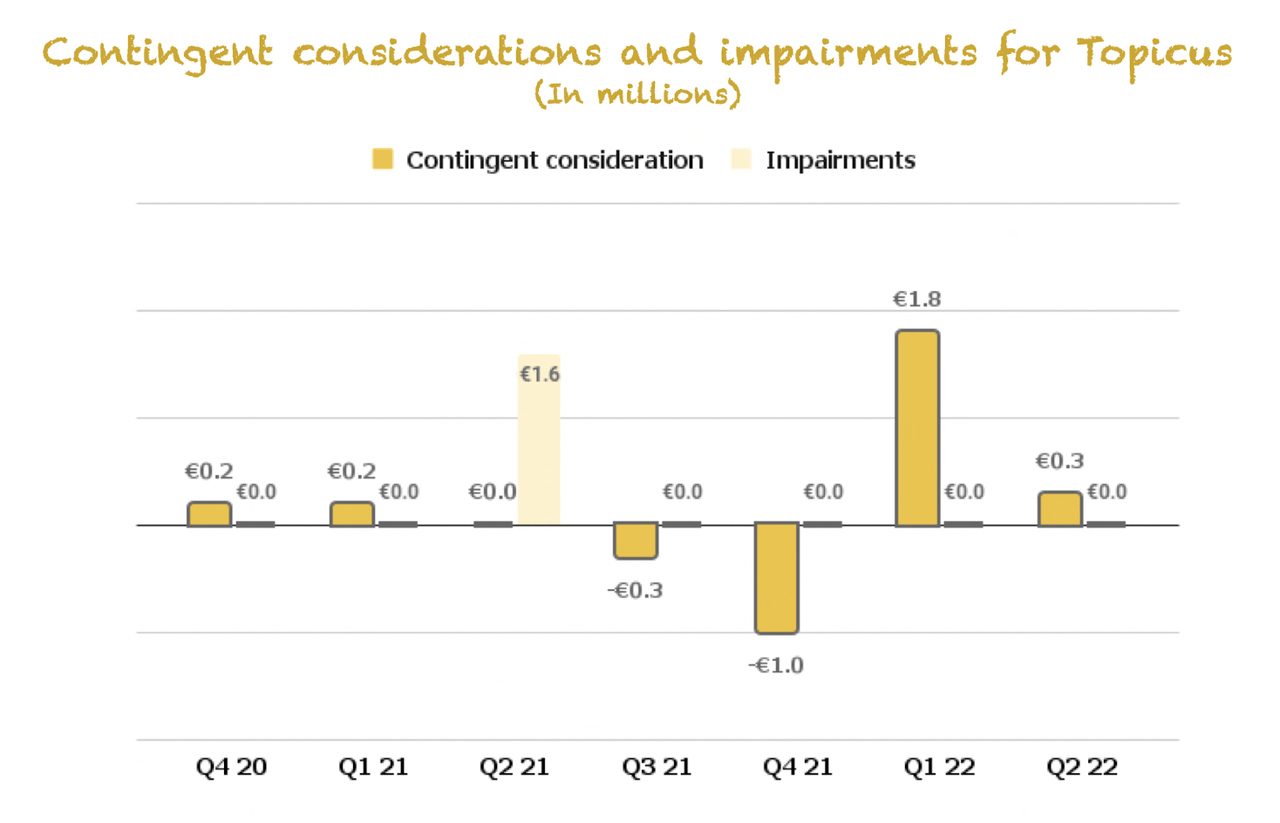

It’s still too soon to judge if Topicus’ M&A activity is going well, but there are two metrics in the financial statements that should help us see how it’s going on average: contingent consideration and impairments.

Contingent considerations basically measure additional payments Topicus has to make related to above-expected performance:

The contingent consideration expense amounts recorded for the periods above relate to an increase (decrease) in anticipated acquisition earnout payment accruals primarily as a result of increases (decreases) to revenue forecasts for the associated acquisitions.

Source: Topicus MD&A

It might be a bit counterintuitive, but a higher contingent consideration expense is not bad at all, despite being an expense! If this number is negative, it means certain acquisitions have not met management’s expectations.

To analyze if acquisitions are not going as expected, we can also look at impairments:

The 2021 (impairment) expense relates to a business acquired in 2020 that was unable to achieve the goals established in the associated investment thesis.

Source: Topicus MD&A

Simply put, when an acquisition doesn’t meet management’s target, and the investment thesis deteriorates, the company takes an impairment. However, if we look at how these metrics have evolved, it’s challenging to make conclusions:

Made by Best Anchor Stocks

The limitation is that we simply don’t know how many of the company’s acquisitions bypass contingent considerations because they don’t have such clauses in the contracts.

Financial position – Cash and debt

Topicus also has a good deal of dry powder to continue scaling M&A. As of quarter end, the company had €160 million in cash. Most of its businesses operate with negative working capital because they invoice almost everything during Q1, so we don’t foresee management needing this cash for operations. This means that this cash will almost likely be deployed in acquisitions entirely. We don’t know when, though.

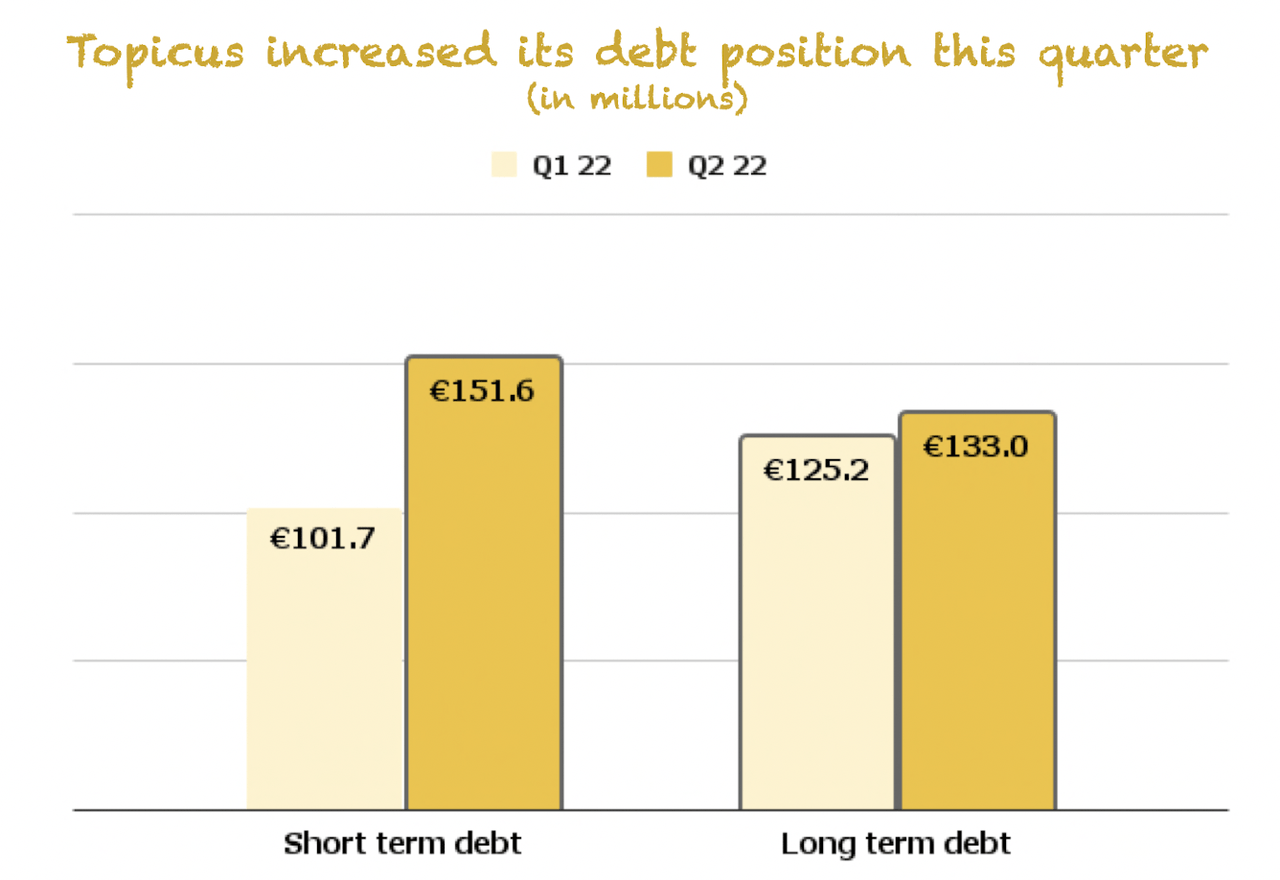

When it comes to the debt side, Topicus’ increased its short and long-term debt when compared to Q1 2022:

Made by Best Anchor Stocks

We don’t think the increase is worrying, and we don’t see why Topicus would not take on a bit of debt to fund some of its acquisitions. This said, it must be monitored closely just in case the company’s financial position deteriorates to unsustainable levels.

Conclusion

All in all, it was a strong quarter for Topicus, portraying once again that we shouldn’t focus too much on quarterly metrics. Instead, the long-term trend is what matters and what management focuses on (as it should be). The M&A flywheel seems to keep spinning, and we remain optimistic about what Topicus can achieve over the long term!

In the meantime, keep growing!

Be the first to comment