Marcin Jastrzebski/iStock via Getty Images

Golf may be rooted in a tradition dating back to 15th century Scotland aimed at the wealthy. However, recently merged leisure stock Topgolf Callaway Brands Corp. (NYSE:MODG) is rewriting the rules using technology, entertainment and innovation to redefine the boundaries of the sport to bring the game to a broader audience. It has a market cap of $3.99 billion and is priced well below its one-year target estimate of $33. However, the stock has yet to trade particularly well this year, losing 24.27% value. If we take on a long-term perspective, investors have been rewarded with 44.14% in returns over the last five years.

Ten year stock trend (SeekingAlpha.com)

MODG’s diversified business strategy is delivering growing top and bottom-line performance, and it has beaten earning expectations for the last four consecutive quarters. I believe there is a lot more upside potential if we look at the number of new Topgolf venues delivering high return rates, the investment in its scalable technology, premium brands strength, and diverse revenue streams that a wider audience is tapping into as the world returns to attending social and corporate events. Investors may want to take a long-term bullish stance on this company, investing heavily in its long-term growth.

Overview

MODG is a technology-enabled golf and active lifestyle company. In 2021 Topgolf, a leader in technology-driven golf entertainment was acquired for $2.66 billion by Callaway, a leader in golf equipment and apparel, to create the ultimate go-to for all things golf with a modern vision which aims to attract a broader demographic and those that have never been interested in golf to venues across the country.

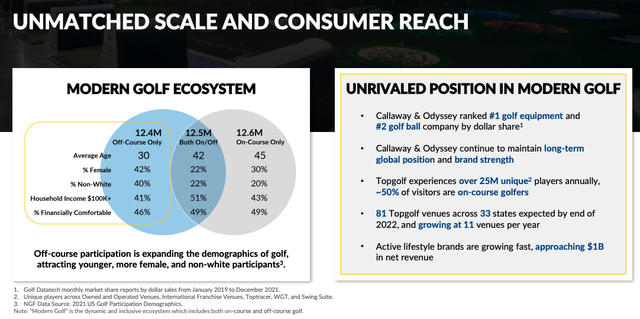

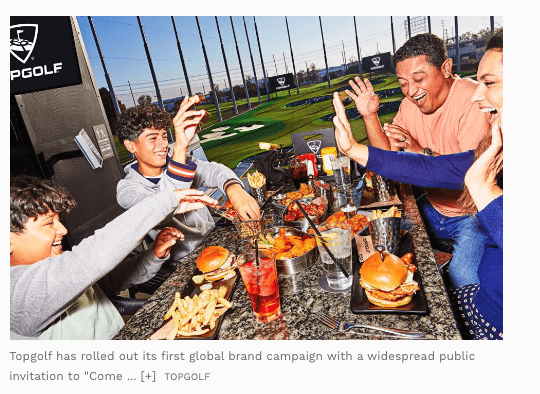

Creating a modern golf space (Investor Presentation) Brand campaign (Forbes.com)

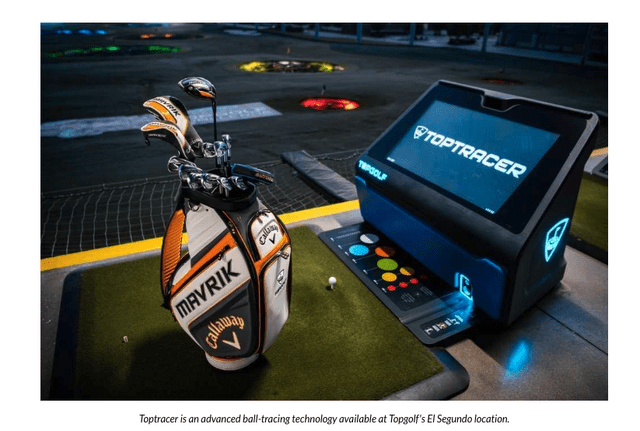

The companies each bring their strengths. Callaway is a global golf equipment and lifestyle apparel leader with a proven ability to deliver strong results. Topgolf has been very successful in the entertainment segment, with much demand for its combination of food, service, and technology, especially as businesses head back into organizing corporate functions. Topgolf is not only attractive for its venue and entertainment that people are familiar with. On top of that, the company has cutting-edge technology within the venue, which could be scaled to other parts of the business. One example is tracer and VR technology to play on actual golf courses.

Technological advancements (Topgolf.com)

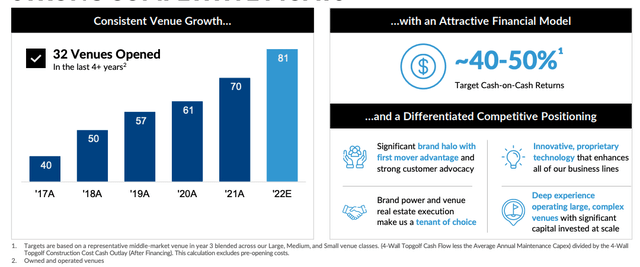

Topgolf is hugely popular as a corporate activity, social event, and meetup location for colleagues and friends. These venues are generating a 50% return on investment, and the company aims to add ten venues a year.

Financials and valuation

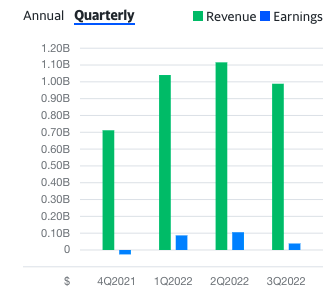

MODG has been able to use its revenue and earnings from its apparel and equipment business to make cash investments into the growth of its Topgolf entertainment side of the business. It has been delivering strong top and bottom-line performance over the last three quarters and is on its way to a robust financial year finish. The company is successfully attracting golf and non-golf activists to its venues with its highly successful food, entertainment and technology combination.

Financial quarterly results (Finance.yahoo.com)

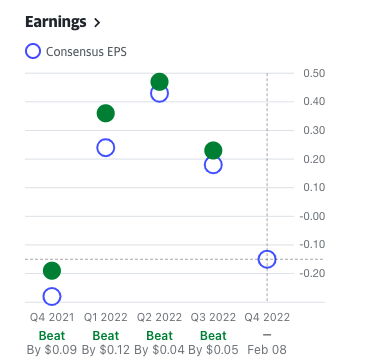

It has beaten earning expectations for the last four consecutive quarters, most recently by $0.05 to reach $0.23 per share. Management expects to finish the fiscal year on just under $4 billion in revenue and around $550 million in adjusted EBITDA, with a healthy margin of 14.1%.

Earnings versus consensus (Finance.yahoo.com)

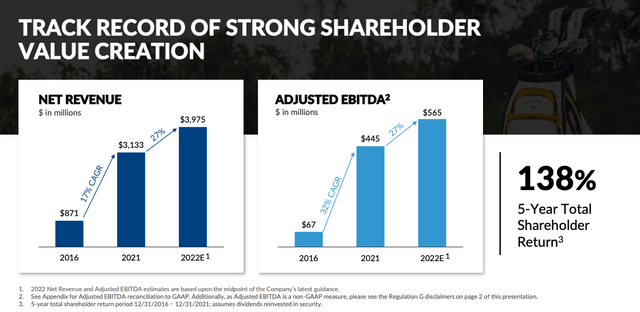

The image below shows the company’s net revenue growth of 27% year-on-year with a CAGR of 17% between 2016 and 2021, furthermore an adjusted EBITDA of $565 million. This is an excellent indicator of the cash flow by taking away non-cash expenses such as amortization or depreciation.

Net Revenue and EBITDA growth (Investor Presentation 2022)

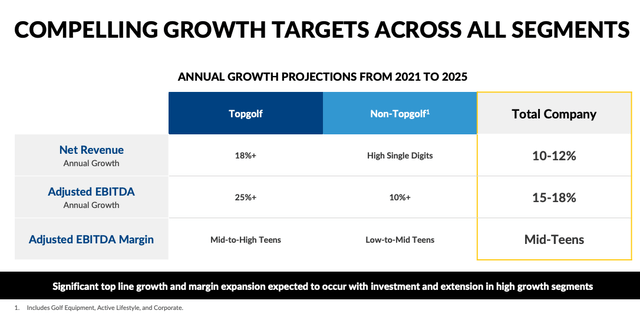

Below we see the projected growth for 2025. Management believes the company can grow 15 to 18% CAGR, which would mean over $800 million by 2025.

Financial Overview (Investor Presentation 2022)

The company aims to finish the year with eighty-one Topgolf venues. The cash-on-cash return for these venues is desirable. Even though the company is leasing many of these properties, it is gaining between 40 and 50 % in returns.

Venue Revenue Growth Potential (Investor Presentation 2022)

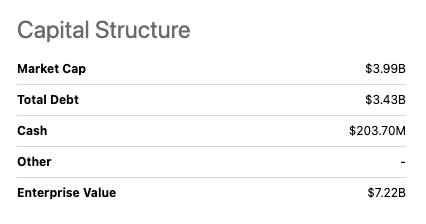

If we look at the company’s balance sheet, we see that it has a very high debt level, which is a concern heading into a potentially weaker economic environment. The company has $203.80 million in cash and $3.43 billion in debt, giving the company a severe negative net cash position. However, Moody’s has given the company an improved rating, from a negative to a stable outlook at B1, due to the company’s revenue and earnings performance.

Capital Structure (SeekingAlpha.com)

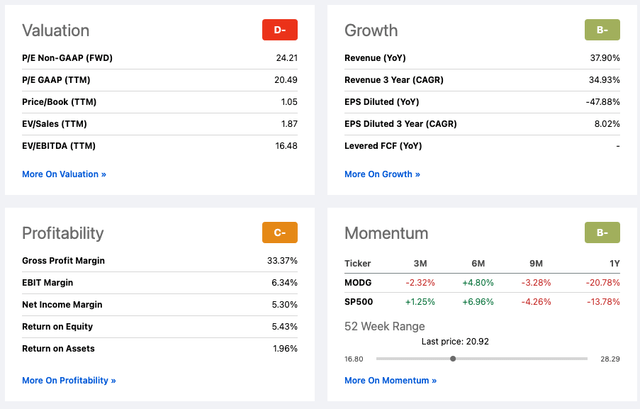

If we look at Seeking Alpha’s Quant rating, the company is graded B- for growth, with an impressive year-on-year increase of 37.90%. It has a price-to-book ratio of 1.05, indicating that the market value is currently similar to its book value. Analysts have mixed reviews on this company, with results leaning towards Buy to Hold ratings. However, there may be more upside as management expects just under $4 billion in revenue and around $550 million in adjusted EBITDA, with a healthy margin of 14.1% for the fiscal year of 2022.

Quant Rating Factors (SeekingAlpha.com)

Risks

The Topgolf part of the business has a high negative free cash flow due to the fast-paced expansion that has been taking place. Its revolver will expire in February 2024, which could put much pressure on its liquidity if the company starts to feel the impact of an economic slowdown and does not achieve the ambitious revenue growth it aims to achieve over the next few years.

Final thoughts

The company has solid, steady apparel and sports equipment business. It is investing in a considerable growth opportunity through the entertainment side of the business with exciting prospects. Although the industry may be less impacted by less demand as consumers become more cautious of their spending in these economically uncertain times, the company fundamentals look set to remain strong. For this reason, I recommend a long-term bullish stance on this company.

Be the first to comment