Do Forensic Algorithms Detect Any iQIYI Financial Fraud?

In my ongoing look at major fraud and whistleblower accusations, I took a brief look at these claims against iQIYI (IQ) to see what if any irregularities were revealed by the top forensic algorithms commonly used by certified fraud examiners. As a certified fraud examiner (CFE) and certified anti-money laundering specialist (CAMS) I routinely check accusations against firms and publish findings using these peer-reviewed algorithmic models.

Most recently, I have examined whistleblower claims against Infosys (INFY):

Top Forensic Algorithms Check Whistleblowers’ Allegations Against Infosys

These findings also were published globally following an interview with a journalist from India. Auditors later concluded there were no acts of fraud by Infosys which further validated the findings from the multiple forensic algorithms applied in the analysis.

Similar checks using multiple forensic algorithms were applied to whistleblower claims against Disney (DIS), General Electric (GE) and others. None of these checks found any serious irregularities or long lasting warning signals.

Top Forensic Algorithms Check Whistleblower’s $6B Claims Against Disney

Running Top Forensic Algorithms On 2012-2019 GE Financials

These models are not foolproof and are only designed to flag certain financial conditions where examiners could look deeper to better assess underlying financials of a company.

The iQIYI Stock Chart from 2018 to 2020

Assessing the Wolfpack fraud claims against iQIYI

On April 7, 2020, the Wolfpack Research team published a 37-page paper alleging numerous fraud claims against iQIYI, Inc. These claims allege fraudulent activity both before the 2018 IPO of the company as well as allegations of ongoing fraud. The report from Wolfpack can be found in the following link:

IQIYI: The Netflix Of China? Good Luckin.

Elements of the claims against IQ make these specific allegations that can be evaluated in the forensic models:

- “We estimate IQ inflated its 2019 revenue by approximately RMB 8-13 billion, or 27%-44%. IQ does this by overstating its user numbers by approximately 42%-60%.”

- “IQ inflates its expenses, the prices it pays for content, other assets, and acquisitions in order to burn off fake cash to hide the fraud from its auditor and investors. “

- “IQ accounts for dual memberships on a gross basis, meaning it records the full amount of revenue and records its partners’ share as expenses. This allows IQ to inflate its revenues and burn off fake cash at the same time. “

- “we found that the deferred revenues reported to the SEC were inflated by 261.7%, 165.5% and 86.2% in 2015, 2016 and 2017, respectively. “

- “IQ’s barter sublicensing revenues are so inflated that they wouldn’t come close to being believable even if IQ bartered every single TV episode produced in China in each of the last three years. IQ’s reported barter sublicensing revenues imply it traded every single TV episode produced in China in 2018 and 2019 for ~RMB 79,000 and ~RMB 64,000 each, respectively.”

Significant claims of revenue manipulation in a multi-billion corporation should become evident in at least one of these top forensic algorithms that apply more than 22 different fundamental ratios across quarterly periods spanning nearly five years of data. There are ways to hide material breaches, but the application of multiple models reduces the chances for sizeable irregularities to go completely undetected.

iQIYI has responded to the fraud allegations with a published statement yesterday:

The Company has been made aware of and reviewed the short seller report published by Wolfpack Research on April 7, 2020. The Company believes that the report contains numerous errors, unsubstantiated statements and misleading conclusions and interpretations regarding information relating to the Company.

The Company emphasizes that it has always been and will remain committed to maintaining high standards of corporate governance and internal control, as well as transparent and timely disclosure in compliance with the applicable rules and regulations of the Securities and Exchange Commission and the Nasdaq Global Select Market.

Forensic Algorithms on iQIYI from 2016 to 2020

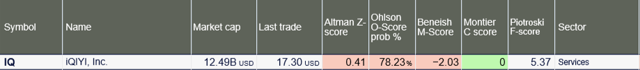

The first check in briefly assessing the claims against IQ is to see what the Altman Z, Ohlson O, Beneish M, and Montier C scores show at the top level. Initially we see three of these four algorithms in adverse scores flagging different types of irregularity related to their test ratios. This is a significant initial adverse result that bears more investigation.

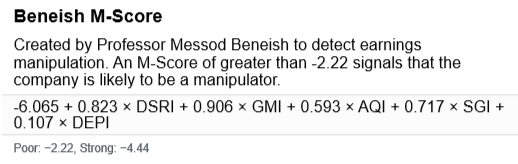

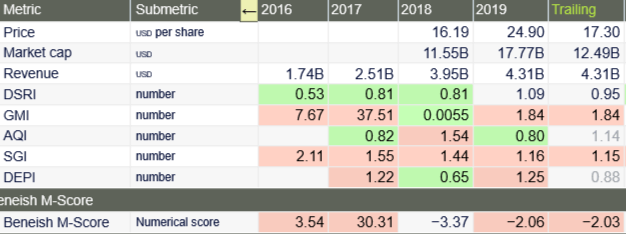

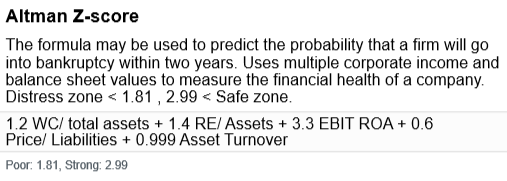

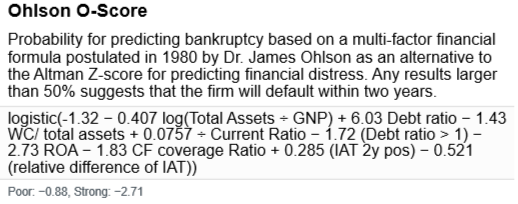

Each of these models will be addressed in more detail later, but briefly Altman uses multiple corporate income and balance sheet values to measure the financial health of a firm and its potential risk of bankruptcy within two years. The Ohlson model uses multifactor financial ratios in an alternative bankruptcy model to Altman with a probability estimate of default within two years. The Beneish model is more specifically focused on earnings manipulations and accounting irregularities than on financial health and bankruptcy risks. Lastly, the Montier score checks additional accounting combinations for irregularities related to falsifying the books.

(UncleStock)

Next we will look at analyzing these top level scores across time to see how they may or may not substantiate any claims in the allegations against IQ. The duration of adverse scores is another important consideration that helps evaluate whether any one-time events created a short-term distortion that was less meaningful and has since been resolved. Multi-year adverse scores and validation across multiple forensic algorithms is of more concern.

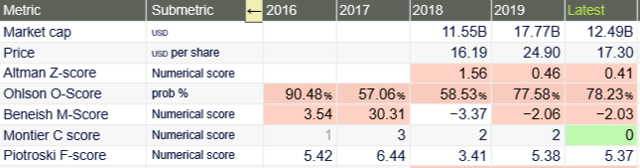

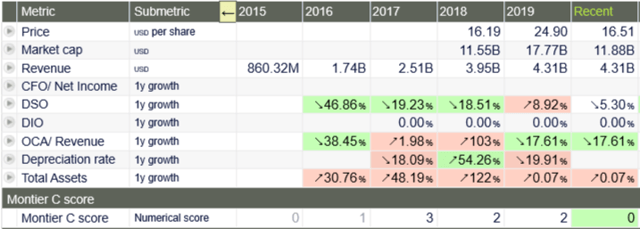

Reviewing the time period from 2016 to 2019 using the Altman Z-score, Beneish M-score, Ohlson O-score probability and the Montier C-scores reveals substantial adverse scoring across both pre and post 2018 IPO dates on all the models except Montier. The Montier score does reveal an ongoing improvement in scores for accounting manipulation from 2017 with none of the scores at an adverse level. Additionally, the most current Montier values are at the most positive possible level of zero, signifying no manipulation.

(UncleStock)

Next I take a brief top level assessment of the different algorithms and summarize the initial findings so far:

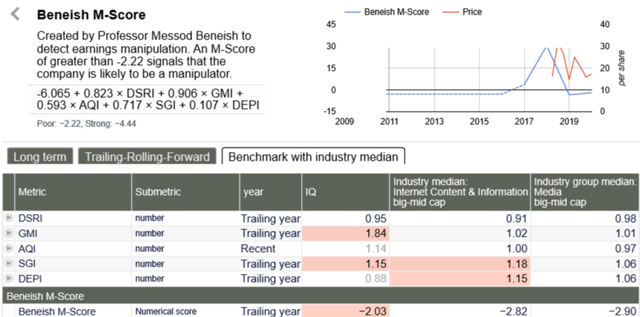

- Looking at the Beneish model that uses eight variables to assess whether any earnings manipulation has occurred we see that only in 2018 during the IPO year did the numerical score return positively. In all other years for which there is data the Beneish M-score has been adverse.

- Second, applying the Altman Z-score for assessing bankruptcy risk along five financial ratios reveals a high level risk rating with scores becoming progressively worse on the scale over time.

- Third the Ohlson probability score of bankruptcy risk over the next two years has remained at a high adverse level over all the periods measured with probabilities higher than the 50% cutoff value for high risk.

- Fourth, the Montier C-score using six criteria to assess the likelihood that a company is cooking their books currently shows the highest positive (lowest chance) score possible for this risk. The score has been improving steadily since 2017 with no signal of any risk for factors tested by the model.

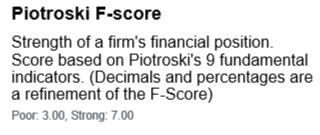

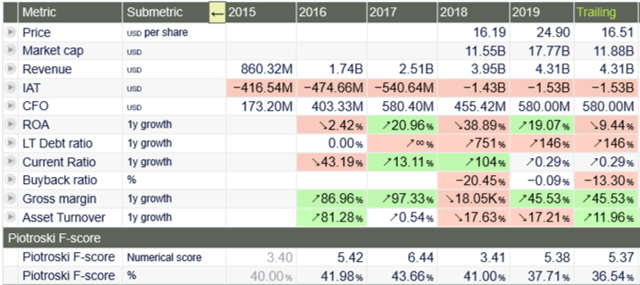

- Piotroski value score remains a steady positive value for good expected returns at current price levels. This is not a forensic measure, but a basic value measure that would be expected to show favorable results if any irregular activity was successfully mitigating a view of financial concerns.

Examining the Forensic Factors in each of Models

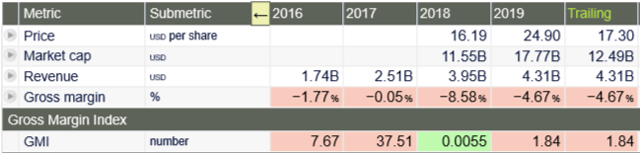

The tables below break down each of the factors and allow us to take a closer look for any financial criteria within each of the forensic and value models that may show some irregularity or distress. Starting with Beneish model we examine the five fundamental components to see what parts of the operational activity are showing irregularities:

Beneish M-Score factors

(UncleStock)

The two segments of the model showing the most adverse scores over time are GMI (Gross Margin Index) and SGI (Sales Growth Index). These two elements both rely on reported corporate revenues. Interestingly, the most positive year across all the Beneish model subcomponents is in 2018 at the initial public offering when the most financial oversight would typically be present. Again with caution that none of these measures are foolproof, but if a company was inflating their revenues in a meaningful way, it would show up most adversely in the GMI and SGI forensic components. Additionally, the longer the duration of these adverse scores continues over the years the less likely that they are caused by a one-time event disruption.

We will go next to a closer look at the GMI scores and patterns.

Gross Margin Index analysis

(UncleStock)

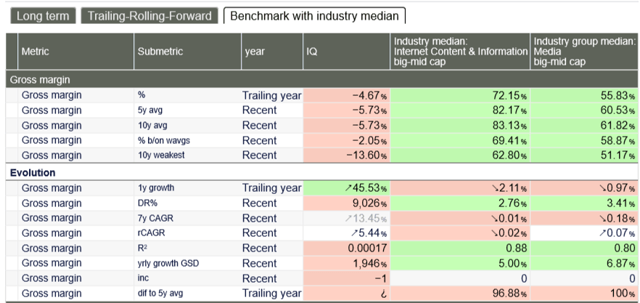

According to the results, the gross margins are negative in each of the measured years at percentages considered irregular with the reported revenues. Again the 2018 IPO year shows the most positive score on the table. We can see this divergence more clearly in comparisons with benchmark industry medians of Internet Content & Information stocks and Media stocks of comparable market cap in the table below.

Gross Margin Industry Comparisons

(UncleStock)

The benchmark industry comparisons of comparable sized firms in the Internet Content and Media industries are very different from the gross margins of IQ as measured in the Beneish GMI component.

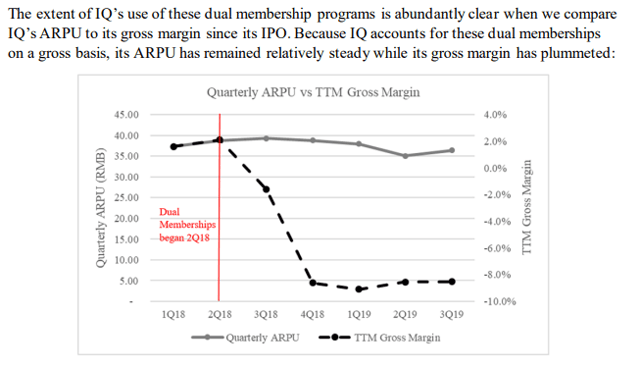

The Wolfpack Research claims on page 13 they produce a graph showing the ratio of Quarterly ARPU (average revenue per user) to IQ’s trailing 12-month gross margins. The gross margins in their chart below are consistent with the gross margin data used in the Beneish model at -8.58% in 2018. It’s not known if their dual membership explanation is correct, but it’s not rejected by the forensic tests as one plausible explanation for the margin deterioration.

The next area we would expect to find discrepancies related to revenue manipulations or irregularities in a firm are in the Beneish SGI component measured below.

Sales Growth Index analysis

(UncleStock)

Measuring all the forensic components of the Beneish model with comparable Internet and Media industry benchmarks we see the largest discrepancies in GMI and SGI. The SGI score of 1.15 may be fairly consistent with the Internet Content firms of the same market cap, but it differs meaningfully from Media firm benchmarks. However, the GMI score for IQ is not close to either industry benchmark levels and poses a significant red flag.

These adverse scores in the Beneish forensic components directly related to revenue irregularities tend to support the related revenue allegations against IQ more than they serve to dispel the claims. The multi-year duration of these adverse scores reduces the chances that noise or a one-time event created an accounting distortion to produce these results.

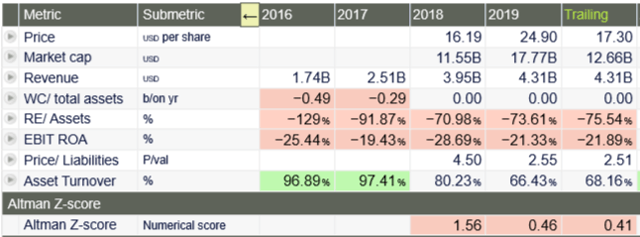

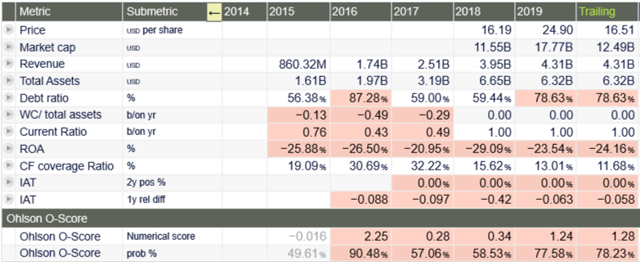

Altman Z-score factors

Next we will look at the Altman Z-score bankruptcy related scores for any irregularities or concerns related to the allegations.

(UncleStock)

The most pervasive negative results across all five years are found in the (Retained Earnings to Assets) and the (EBIT to Return on Assets) ratios. IQ is most at risk for poor margins that lead to very low and actually quite negative retained earnings. Compared to benchmark standards on the table below these results are highly negative and represent financial distress on the Altman model. Likewise the EBIT to Return on Asset ratio also is very poor over the entire five years and well below benchmark industry standards in two closely-related industries. This is another Altman standard showing high financial distress and contributing to an adverse score on their bankruptcy model.

(UncleStock)

Overall, the Altman Z-score shows high levels of financial distress according to the model and particularly in those areas related to earnings and profit margins. If these results related in any way to the alleged claims they might be consistent with high (or inflated) expenses using high (or inflated) revenues that reduced margins and significantly depleted retained earnings.

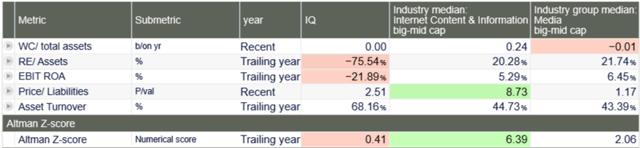

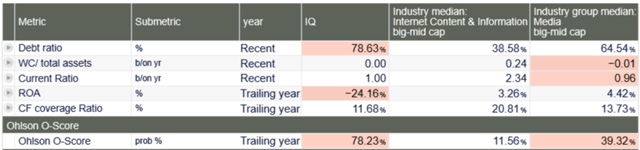

Ohlson O-score factors

Next we will look at the Ohlson O-score bankruptcy related scores for any irregularities or concerns related to the allegations.

(UncleStock)

Here we find the Ohlson O-score distress factors show a number of negative scores and high risk of bankruptcy values. This model is not intended to reveal fundamental accounting manipulations, but it does show areas related to distress that may support other findings about underlying accounting or operational problems. Return on Assets in particular shows long-term underperformance over the years in question and in relation to benchmark levels in the Media and Internet Content industries on the table below:

(UncleStock)

The Ohlson O-score probabilities are highly adverse and signal financial distress independent of any allegations of fraud or financial manipulation. It’s always wise to be cautious with firms significantly underperforming their sectors or industry benchmarks in key financial metrics. Proponents of the alleged claims may find additional support in these values, but the Ohlson model does not reflect any inherently fraudulent activity that may have otherwise resulted from normal operations.

Montier C-score factors

(UncleStock)

Examining the Montier C-score factors for financial statement manipulations we find current scores to be well in the positive range with the highest positive score into 2020. The components of these scores are different from the other algorithms above and the Montier model is the newest and least tested of the algorithms from peer-reviewed financial research. One pattern that’s recurring through all the models is a more favorable change in 2018 scores concurrent with the IQ IPO year. This model provides the strongest support that IQ is not engaged in accounting fraud common to the fundamental variables tested and shows no red flags of concern.

Piotroski F-score factors

Finally, looking at the value categories of the Piotroski F-score may give us some additional insight to value related measures linked to the share price of the stock. The value scores over time have remained fairly positive in the low to mid range of the value ranges set by Piotroski. This does not validate any forensic concerns, but provides a positive picture for the price value of this stock based on this model. A more cynical view of the positive valuation scores would follow that companies that deliberately engage in fraud do so to manipulate valuation models like the Piotroski F-score and others. It might be more exculpatory for IQ if standard financial value models showed underperformance consistent with the forensic models. However, standing alone this is a positive evaluation of IQ using the Piotroski value measures.

Conclusion

According to all the forensic models applied above, there are some areas for concern in the iQIYI financials. Most notably is the multi-year period of adverse scoring in the Beneish M-score factor for GMI and SGI. Both of these forensic components relate to tested revenue manipulation factors and show sustained adverse conditions over the time period alleged in the Wolfpack claims. More information is necessary to corroborate the allegations, but from the Beneish model alone there are meaningful irregularities present. Additionally, the Altman and Ohlson financial distress and bankruptcy models both show multi-year factors of high concern on their scales of risk. Independent of any allegations of fraud, these financial distress concerns are worth further investigation into the areas of weakness. Also significant in these findings was that the test of financial manipulation using the Montier C-score revealed no adverse conditions. In fact, the Montier model produced the most favorable score that IQ is not engaged in any alleged fraudulent activity with their financial accounting.

These models are certainly not foolproof and were designed by academic researchers to improve the chance of detection of irregularities leading to bankruptcy, earnings manipulation, or flag the presence of financial distress.

At the same time, these models are among the best peer-reviewed forensic models in the financial literature and have some significant documented value.

The Beneish model for example has “correctly identified, in advance of public disclosure, a large majority (71%) of the most famous accounting fraud cases that surfaced after the model’s estimation period.” (Beneish, Lee, & Nichols, 2013, p. 57).

I trust the insight from these different forensic and value algorithms will give you added value to your investment goals and objectives in the days ahead.

JD Henning, PhD, MBA, CFE, CAMS

References

Altman, E. I. (1968). The Prediction of Corporate Bankruptcy: A Discriminant Analysis. The Journal of Finance, 23(1), 193-194. doi:10.1111/j.1540-6261.1968.tb03007.x.

Beneish, M. D. (1999). The Detection of Earnings Manipulation. Financial Analysts Journal, 55(5), 24-36. doi:10.2469/faj.v55.n5.2296.

Beneish, M. D., Lee, C. M. C., and Nichols, D. C. (2013). Earnings Manipulation and Expected Returns. Financial Analysts Journal, 69.2, 57-82.

Ohlson, J. A. (1980). Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research, 18(1), 109. doi:10.2307/2490395.

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 500+ outstanding members at Value & Momentum Breakouts

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 500+ outstanding members at Value & Momentum Breakouts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment