Olivier Le Moal

Are energy stocks still a good buy in this volatile market?

I know many of you are thinking, “Wow! Energy stocks near their all-time highs. Is now a good time to buy?” Commodities have experienced a significant rally over the past year, with advantages stemming from inflation, supply chain constraints, and geopolitical headwinds. Oil and gas companies benefited tremendously on the heels of these macro headwinds, where many were undervalued. Pricing competition and substantial shortages made them the #1 S&P 500 companies post-pandemic through YTD 2022. Although some energy stocks have fallen, and many valuations have stretched, I believe the short-term pain and volatility should not trump my picks’ forward expectations. Stocks with excellent balance sheets and strong cash on hand can pay monster yields. Where I pride myself on picking Top Dividend Stocks as a determinant for quality, investors should look not just at the yields but beyond the yield level and dive into the consistent performance and characteristics of a stock. There’s a correlation between solid dividend growth and strong equity returns. My two top-rated stock picks have a market capitalization of over $1B, high yields ranging from 9.79% to 12.29% to help eat away at inflation and the raging cost of fuel, and are rated Strong Buys.

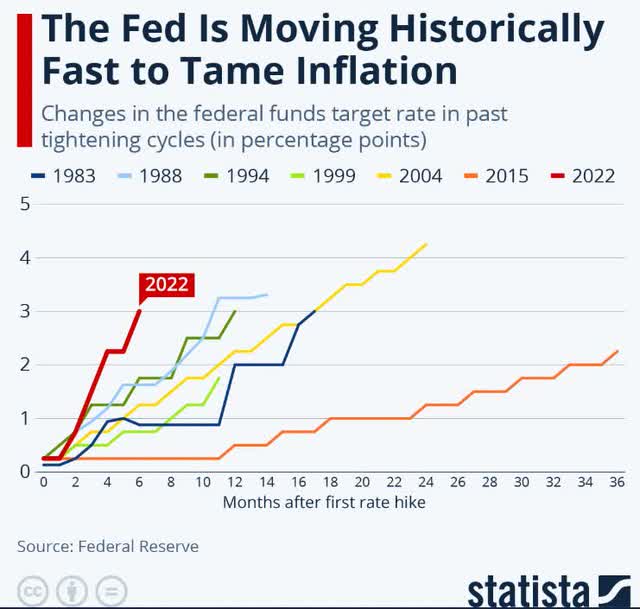

Changes Fed Funds Chart Post Fed Hike (Federal Reserve – Statista)

Although the Fed’s aggressive actions to tame inflation are coming at a time following one of the lowest interest rates in history, “Restoring price stability will take some time and requires using our tools forcefully…“[It’s] the unfortunate costs of reducing inflation,” said Fed Chair Jerome Powell said in August. Where monetary and fiscal policy are hot topics, with the right combination of value, growth, and yield, passive income stocks can help ease some of investors ‘pain’ and concerns.

2 High Yield Stocks to Invest In

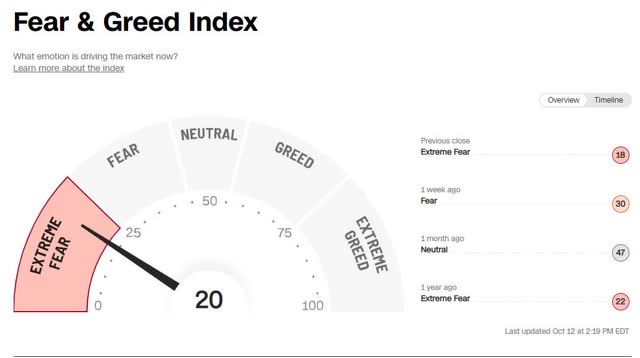

I’ve said it many times, not all dividend stocks are created equal, and presently, we’re in times when the cost of goods and services is sky-high, and extreme fear is moving the markets.

CNN Fear & Greed Index (CNN Fear & Greed Index)

Where slowing in the economy can result in poor performance for many stocks, and rising prices and slow growth are the recipe for stagflation, consider these two stocks that not only come at a discount but showcase solid financials that complement their high yields.

1. Kimbell Royalty Partners, LP (NYSE:KRP)

-

Market Capitalization: $1.18B

-

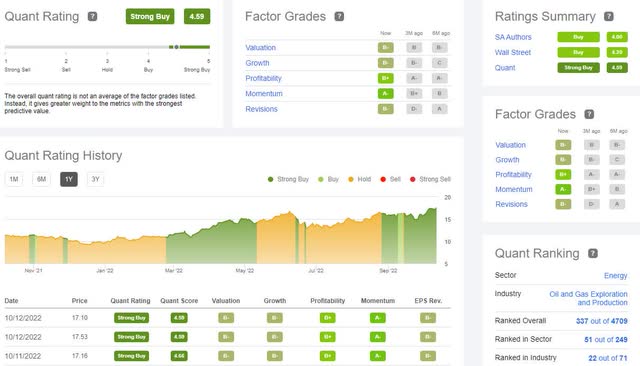

Quant Rating: Strong Buy

-

Forward Dividend Yield: 12.29%

-

Industry Rank (As of 10/11/22): 9 out of 71

On a longer-term uptrend, Kimbell Royalty Partners, LP continues to outperform the S&P 500 and industry peers, ranking nine out of 71 in oil and gas exploration and production. Together with its subsidiaries, KRP acquires and owns mineral and royalty interest throughout the United States, with interest above 11.4 million acres throughout 28 states.

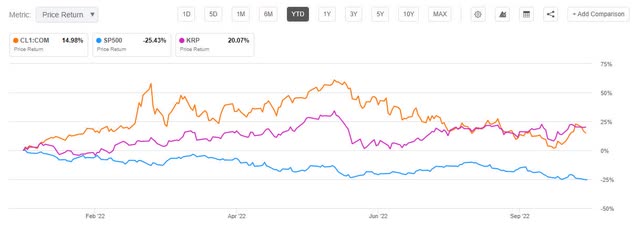

KRP vs. Crude Oil Futures (CL1:COM) vs. S&P 500 YTD Performance

KRP vs. Crude Oil Futures (CL1:COM) vs. S&P 500 YTD Performance (Seeking Alpha Premium)

Despite the decline in crude oil price [CL1:COM] since May, KRP’s valuation comes at a relative discount. Its continued momentum is allowing its executive team to anticipate a stock buyback or increase its dividends to shareholders, as expressed in its latest earnings statement.

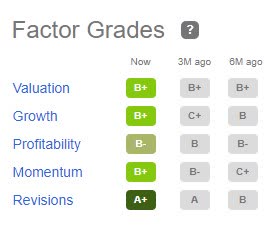

Valuation & Momentum

Offering solid B+ valuation and momentum grades, KRP showcases a great entry point opportunity for this stock. Although the visible underlying metrics for valuation, like forward P/E of 12.39x and forward E/V Sales of 5.19x, indicate the stock is overvalued, in combination with the A+ trailing dividend yield and hidden metrics used in our proprietary algorithm, the weighting tips the scale, making this stock attractive as a discounted pick.

KRP’s YTD and one-year price increases of +20%, coupled with the momentum that has outperformed its peers over three-, six-, and twelve months, make clear why the Factor Grades indicate KRP has excellent potential.

KRP Factor Grades

KRP Factor Grades (Seeking Alpha Premium)

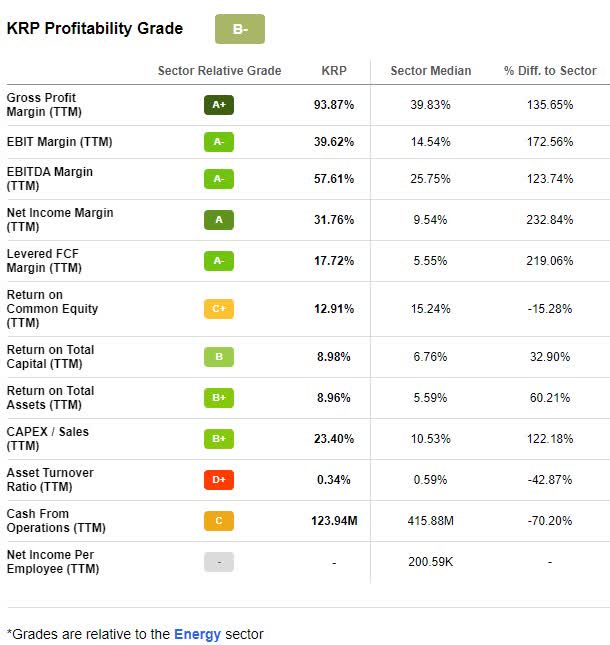

Seeking Alpha Factor grades rate investment characteristics on a sector-relative basis. Above, the Profitability and Revisions Grades indicate that KRP has excellent potential and is fundamentally sound compared to the sector. With A+ Earnings Revision, solid growth, and profitability, KRP is one of the most profitable companies in its sector.

KRP Growth And Profitability

Kimbell Royalty has experienced substantial growth with tailwinds from increasing costs and demand upswings, resulting in 4% organic production growth and $0.55 per unit distribution. KRP ended its second quarter with EPS of $0.49, that beat by $0.05, and revenue of $72.71M with a whopping 182.65% year-over-year beat.

With record oil, natural gas and NGL revenues increasing 21% from Q1 and a total EBITDA of $53.5M, an increase of 22% was also a record from the previous quarter. The company is focused on paying down debt, which includes a debt pay-down of $63M since May 2020.

“We are extremely proud of the strength of our business model that continues to perform very well in the highly cyclical energy industry. And we are also very pleased with our record performance, which is largely the result of seeds planted many years ago when we completed several acquisitions when commodity prices were much lower. We remain highly focused on our goal of generating long-term unitholder value for years to come,” said Davis Ravnaas, KRP President & CEO, at the Q2 2022 Earnings Call.

KRP Profitability Grade (Seeking Alpha Premium)

This company possesses a strong growth outlook, priding itself on shallow declines and a deep inventory with a strong upside. Offering a diversified asset base across multiple producing basins and an attractive tax structure, its unique offering is why investors looking for a high-yielding growth stock should look no further.

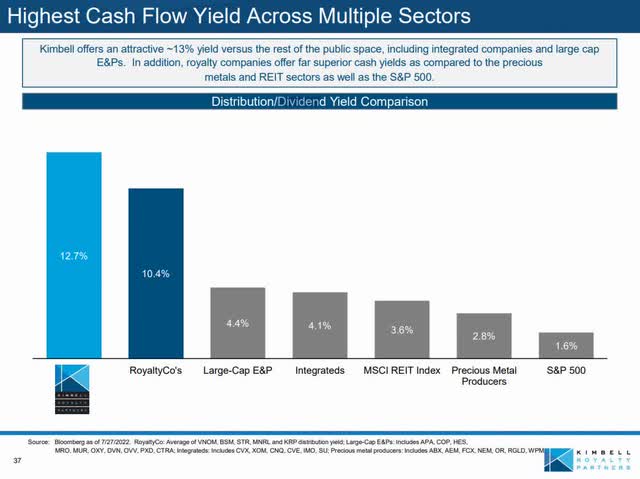

KRP Stock Dividend

Like many companies during the pandemic, KRP experienced a decline that cut its dividend by nearly 24% to $0.13. Post-pandemic, with tremendous growth and energy tailwinds, KRP has steadily increased its share price and, subsequently, its yield and dividend. Offering an attractive 12.29% yield, KRP has one of the highest cash flow yields across multiple sectors, as showcased below.

KRP Cash Flow Yield Across Sectors (KRP Fall 2022 Investor Presentation)

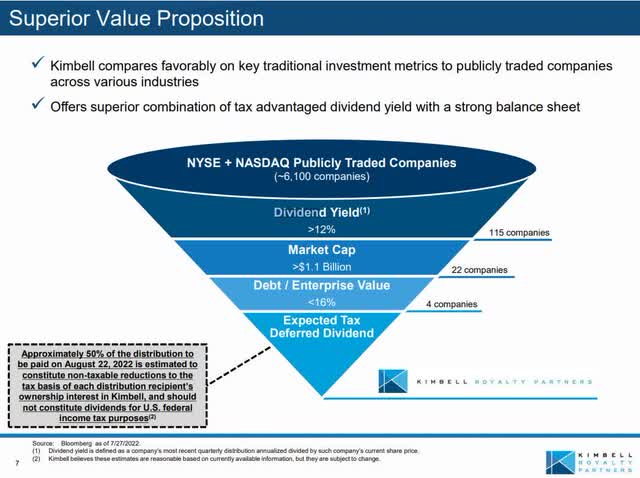

Compared to other publicly traded companies’ key traditional investment metrics, according to KRP, they offer a superior combination of tax-advantaged yield and a strong balance sheet.

KRP Dividend Value Proposition ( KRP Fall 2022 Investor Presentation)

With its robust balance sheet, relatively discounted valuation, and outstanding growth outlook, Kimbell is sitting pretty, along with the next strong buy pick.

2. Black Stone Minerals, L.P. (NYSE:BSM)

-

Market Capitalization: $3.60B

-

Quant Rating: Strong Buy

-

Forward Dividend Yield: 9.79%

-

Industry Rank (As of 10/11/22): 22 out of 71

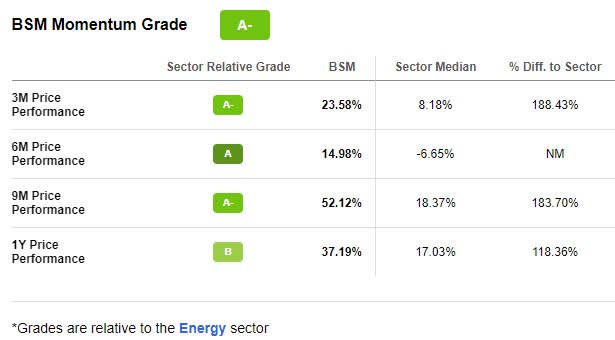

Black Stone Minerals, L.P. has been on a tear! Trading just below its 52-week high of $17.68 per share, the stock is +59% YTD and +37% over the last year, with its most robust earnings results ever, prompting a $0.42 dividend payout, a 5% increase from the prior dividend and a 68% increase from Q2 of last year, BSM has record results.

Black Stone Minerals Price Performance Chart (Seeking Alpha Premium)

Together with its subsidiaries, BSM owns and manages oil and natural gas mineral interests located in 41 states. Consolidating on a longer-term uptrend, BSM is extremely bullish while trading at a discount.

Black Stone Valuation & Momentum

Like KRP, whose stellar dividend yield and hidden underlying metrics tips the weighting scale for its valuation metrics that indicate the stock comes at a premium, overall, BSM has a B- valuation grade.

Quarterly, as evidenced by the below momentum grades, BSM’s price performance is substantially better than the sector median peers.

BSM Momentum Grade (Seeking Alpha Premium)

“We had a lot of tailwinds from commodity prices in the second quarter, with crude averaging over $100 and natural gas averaging around $7. Overall, our realized prices were up 32% for the quarter. That was helpful for a quarter with relatively low production volumes, especially compared to what we see coming in 2023 and beyond…We feel pretty good about our production outlook. We’ve made a strategic decision to focus on organic growth centered around our existing acreage to maintain our balance sheet strength and to take advantage of rising prices in this environment…In short, we believe oil and gas have a good run ahead, as the world looks to transition to more environmentally sound ways to meet increasing energy demand of a growing evolving global economy.”-Tom Carter, Chairman & CEO, Black Stone Minerals.

BSM Growth & Profitability

Looking at Black Stone Minerals’ Quant Ratings and Grades below, the picture illustrates quite the argument for the stock’s strong buy rating.

BSM Quant Ratings & Factor Grades (Seeking Alpha Premium)

For many who love the energy sector, especially those who invested this year, Top Energy Stocks continue to dominate performance. Factor Grades compare a stock’s value, growth, profitability, momentum, and EPS revisions relative to its sector peers. With a 9.79% forward dividend yield, BSM is making shareholders happy. Although Black Stone also took a hit during the pandemic and slashed its dividend, its dividend growth continues to improve while still having paid a consecutive dividend for six years.

Continued growth fueled by the energy crisis abroad and spiking prices over the long term, BSM is optimizing its operations, updated guidance, and has decreased its debt balance by more than $30M in Q2. In adding optimism to this stock rated a strong buy, as evidenced by its fundamentals, quant ratings, and factor grades, KeyBanc analysts recently rated BSM Overweight.

“We see no major distribution risk across our coverage group and believe [Black Stone Minerals] will deliver healthy income to investors…Our ratings reflect idiosyncratic catalysts, balance sheet flexibility, and strategic clarity,” said Tim Rezvan, KeyBanc analyst.

Management’s positive outlook comes along with impressive Q2 2022 earnings. EPS of $0.41 beat by $0.01, and revenue of $180.37M beat by $41.53M, 208.63% year-over-year. Despite BSM expecting its overall 2022 production to come in at the low end of its guidance, its balance sheet and overall financial performance remain strong to help support its quarterly distributions of approximately $0.475 to $0.50 through 2023. Although energy can be volatile, and we’ve seen the swings in fuel prices, key indicators like momentum, profitability, and analyst upward revisions indicate a solid outlook for this stock. Not only are both of my stocks rated strong buys according to our quant ratings, but in the current inflationary environment and their discounted price, consider them for your portfolio if you’re seeking high-yielding stocks with great fundamentals.

Conclusion

Investors are incredibly fearful of the future and how to keep their portfolios safe. Finding the best mix of income-producing stocks at a discount while also thriving when the markets rise or fall is ideal. My top two rated stocks not only possess monster yields, but they also offer strong fundamentals, analyst upward revisions, and will not sacrifice quality or growth.

With solid forward growth outlooks and a steady income stream in this highly volatile market, KRP and BSM’s industry provides them excellent cash for operations that benefits the shareholders and ensures these stocks remain uptick. Check out the grades by setting up a Ratings Screen on your favorite stocks and evaluate them using our tools to help you make tactical investment decisions that ensure you stick with strong dividend income that stands to increase over time.

Be the first to comment