Mariusz Pietranek/iStock via Getty Images

I’ll admit it, dear readers. I love to brag. I fully acknowledge that this odious personal trait has had a less than favourable outcome on my social life, but I got to be me. With that out of the way, let’s talk about Warrior Met Coal (HCC). Since I published my bullish article on this name, the shares have returned ~36.5%. It’s also worth noting that the shares are up about 20% since I wrote about them a few months ago. This great stock return is only part of the story, though. The income I’ve earned from selling puts on this name adds another 18% to my return. I sold some puts for $.95, some more puts for $1.8, and yet more puts for $.95. So, in this piece, you absolutely got to know that I’ll be writing about options. In seriousness, if you haven’t explored the risk reducing, yield enhancing potential offered by both put and call options, I’d urge you to do so.

In this piece, I want to focus on the dividend, because I think the dividend is supportive of price, ultimately. I want to revisit the name and focus on a question that I didn’t address in my previous missive: how safe is the dividend, and what are the chances for a dividend increase?

I’ll leap to the point, for those of you who may be too busy or may not have the patience to wade through my infantile attempts at humour this morning. I think the dividend is very well covered, but I wouldn’t add to my position at current prices because the valuation is fairly rich. I note that whenever the dividend yield is as low as it is at present, the shares go on to underperform. It’s for that reason that I’m switching the script a bit today. I’m not selling put options. I’m instead selling call options, because I can’t pass up that 10.7% return in 6 months, especially because I predict more downside than upside from the stock over the short term.

The Dividend

As my regular readers know, I’m a big fan of accrual accounting. I know. That’s odd, and I’m comfortable with that. When it comes to looking at the sustainability of dividends, though, I need to put my accrual accounting aside, and focus entirely on cash. I think the most relevant questions that come up when looking at dividends relate to liquidity and solvency issues. What are the size and timings of the company’s future contractual obligations? How much cash and short-term investments does the company currently have on the balance sheet? How much net cash does the company generate on an annual basis? I answer this last question by looking at cash from operations, and cash used in investing. This last one is most challenging to answer, but I try to make it simpler by asking a secondary question: by what amount will cash from operations have to decline to imperil the dividend? If the answer to that question is “a lot”, the dividend is more safe. If it’s “a little”, we have a problem.

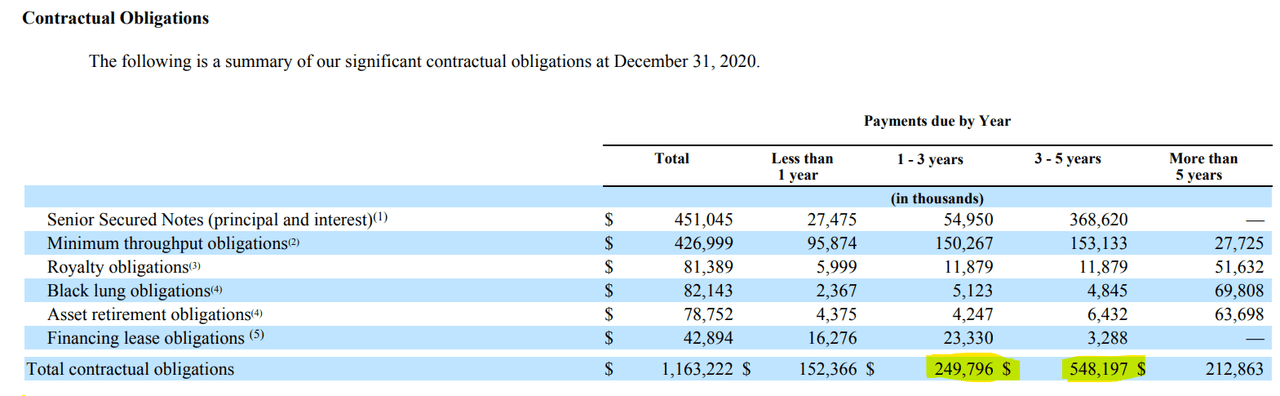

First, the obligations. I’ve gone through the effort of clipping the size and timing of the company’s future obligations for your enjoyment and edification, dear readers. No need to thank me. It’s what heroes do.

Warrior Met Coal Contractual Obligations

Note, the obligations are current as of December 31, 2020. So, the “less than 1 year” column is for the year just ended, so I want to focus on the highlighted columns in the table above. I’m going to assume that the company spends the same amount per year for the relevant column. So, for instance, between December 31, 2021 to December 31, 2023, the company will spend ~$249.8 million, or ~$124.9 million per year. The obligations spike in the next period to $274 million per year.

Against these obligations, the company has cash and short-term obligations on the balance sheet of ~$276.9 million according to the latest 10-Q. In addition, the company has generated an average of ~$401.6 million in cash from operations over the past three years, and has spent an average of $117 million investing over the same period. Thus, my (admittedly crude) measure suggests an average delta of ~$284 million to the good. All of this suggests to me that the dividend is reasonably well covered, and business would have to absolutely tank to imperil the dividend. Thus, I’d be very comfortable adding to my position here at the right price.

The Stock

In my view, a well covered dividend is a necessary, but not sufficient, precondition to making for a “good” investment. This is because an investor’s return is largely a function of the price paid for the stock. The more you pay, the lower will be your subsequent returns, and the lower your purchase price, the better your returns. I can use Warrior Met Coal’s own history to demonstrate this fact. An investor who bought these shares all the way back in mid-April 2019 is still down ~11%. The person who bought exactly one year later is up 115%. The most relevant cause of this 125% swing in returns is the price paid. For that reason, I’m absolutely paranoid about not overpaying for a stock. In point of fact, I’d much prefer to only ever buy a stock when it is “cheap.”

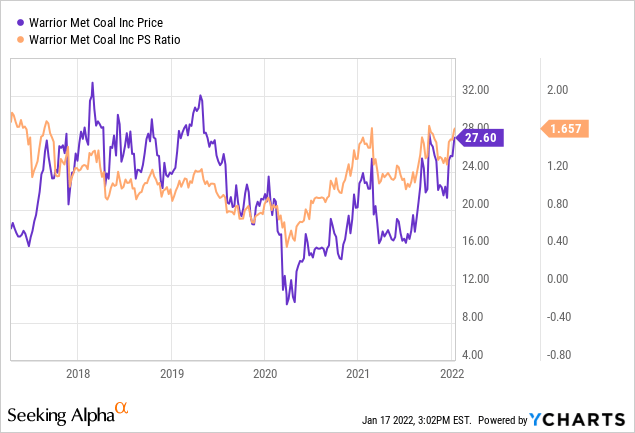

The people who read my stuff regularly for some reason know that I measure the cheapness (or not) of a stock in a couple of ways, ranging from the simple to the more complex. On the simple side, I look at the relationship between price and some measure of economic value, like earnings, sales, book value, etc. On this basis, I want to see the stock trading at a discount to both the overall market, and its own history. To refresh your collective memories, dear readers, the last time I looked at this stock, I decided that it was neither cheap nor expensive per this simple ratio method of valuation. At the time, the price to sales ratio was ~1.376. It’s now 20% more expensive per the following:

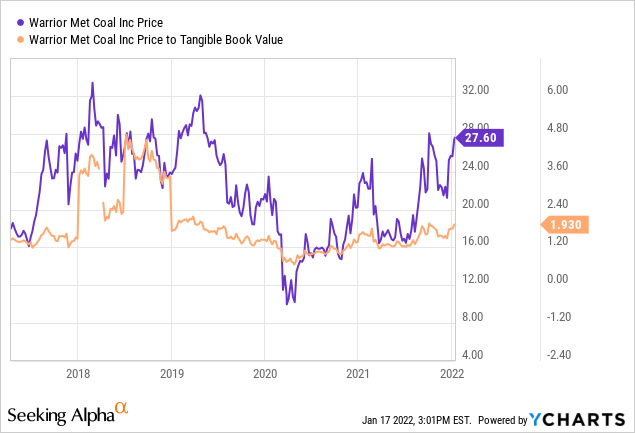

The last time I looked at this name, the price to tangible book was ~1.6. It’s now about 18.7% more expensive, per the following:

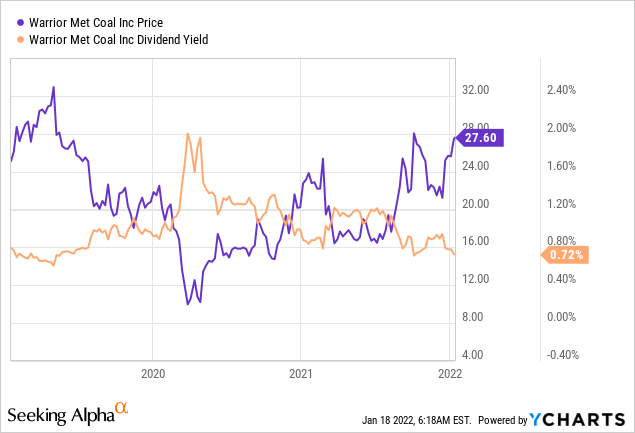

I also think it’s worth exploring the relationship between dividend yield and price. There are a group of investors who will buy a stock for the income, and will therefore eschew stocks that have thin dividend yields attached. This is perhaps one of the reasons we see a reasonably strong negative relationship between yield and price, per the following:

History may not repeat, but it certainly rhymes. With that in mind, we should note that when the yield has gotten to current levels in the past, the shares have gone on to perform relatively badly.

In addition to the relationships between “price” and “value”, I like to try to understand what the market is assuming about a given company’s future. In order to do this, I turn to the work of Professor Stephen Penman and his great book “Accounting for Value.” In this work, Penman walks investors through how they can isolate the “g” (growth) variable in a standard finance formula to work out what the market must be thinking about a given company’s future. Applying this approach to Warrior Met Coal at the moment suggests the market is assuming a long-term growth rate of ~5.4%. That’s a bit rich in my estimation. No single valuation factor leads me to a strong conclusion, but taken as a whole I’m not inclined to add to this position.

A Different Options Strategy

My regular reader-victims know that I’m not a fan of inaction. It’s very frequently the case that although I’m not going to buy a stock at the current price, I’m quite comfortable selling deep out of the money puts on it. I consider these to be “win-win” trades. As an example, although I avoided buying more Warrior Met Coal shares in my previous missive, I did sell the April 2022 puts with a strike of $17.50 for $.95. These look like they’re going to expire worthless. For my part, I’d be happy with that outcome, but I’d also be happy to be “forced” to buy the shares at a net price of $16.55.

I’m doing something much different this time, though. I’m of the view that there’s little upside from here, and the probabilities are higher than 50% that the stock will drop from current levels. For that reason, I’m going to sell covered calls on my position. You read that right, my regulars. Covered calls. I’ll give you a minute to recover from the shock before writing on.

My preferred options to sell at the moment are the July calls with a strike of $30. These are currently bid at $3.20, which I consider to be a very decent return. This trade represents a 10.7% return in six months, which is very hard to pass up in my view. Like short puts, I consider this to be a win-win trade. If my shares are taken from me at $30, I’ll have to console myself with my 78% return on this investment. I think I’ll manage to overcome the pain eventually. If the stock doesn’t reach $30 in the next six months, I’ll add the $3.20 income to the $3.70 earned on puts, bringing the total “options income” to $6.90, or 33.33% of my initial investment. That’ll be Ok also.

I should also write about the risks associated with covered calls, because all investment strategies come with risk attached and covered calls are no different in this regard. The risk of these instruments is obviously that they limit your upside. If the shares skyrocket in price, you’ll be obliged to let them go at the strike price. In my experience dealing with clients, this is actually much harder for people than they assume when entering the trade. Allow me to demonstrate this phenomenon by going through a dialogue I had with a few clients over the years, using this trade as a stand in for the other companies I wrote covered calls on while still “in the business.” In addition to giving you some insight into the risks associated with covered calls, you may gain an understanding of why I don’t work with retail clients anymore.

Adviser: Ok, you’re making 10.7% on your capital over the next six months with these covered calls, but that means that if the shares skyrocket in price, you’ll be forced to let them go at the strike price. You’re not going to get the upside above that strike price. Do you fully understand? Do you have questions about anything?

Client: 10.7%? In six months?

Adviser: Yeah. But if the stock goes above…

Client: 10.7’s really good…

Adviser: Right. But there’s a risk that comes with that return. The risk here is that the stock goes above $30, you don’t see any of that gain.

Client: Sure, but 10.7’s good, and even if it goes above $30 I’m still making a capital gain, so yeah let’s go for it.

Some time after stock climbs to $50

Client: I doubled my money on Warrior Met!

Adviser: No. You’re selling at $30. Remember that conversation about covered calls? I gave you notes about it at the end of our meeting?

…

Client: I hate covered calls.

So, before selling these, please understand that you have a “cold” state and a “hot” state. In the cold state, you’re logical, and very comfortable selling these calls. You can be objective about the great returns on offer. In your hot state, all that logic and reason goes out the window, and the exact same trade may make you miserable. Be aware of this emotional risk, and if you’re comfortable pulling the trigger, I would recommend selling these covered calls.

Conclusion

I continue to really like this company, and I’m happy to own the shares. To borrow a phrase, I’m very happy that I “greedily added when others were fearfully selling” back in the day. I’m also very happy with the returns I’ve earned from covered calls, and I’ve determined that the dividend is reasonably well covered. The problem is that the shares aren’t very attractively priced at the moment. In fact, I think the balance of probabilities is that the shares will decline in price over the next several months. For that reason, I’m comfortable selling some covered calls. These’ll either oblige me to lock in my excellent returns here, or will generate a very decent return. I’m comfortable with either outcome, but I’m aware of the emotional toll covered calls can take.

Be the first to comment