jetcityimage/iStock Editorial via Getty Images

One area of the U.S. equity market being held back by rising gas prices and worries about consumer retail spending is the restaurant industry. Typically, during similar economic circumstances in the past, spending on prepared food takes a hit. However, one restaurant stock has been sneaking into my computer screens as a buy idea, with decent accumulation trends. The company has an interesting business model of acquiring small restaurant chains and brand names from bankruptcy or on the cheap. It is quickly growing its sales and presence without using much debt, a big plus in my book.

The name is BBQ Holdings, Inc. (NASDAQ:BBQ), which today owns, runs and franchises brands including Famous Dave’s, Village Inn, Clark Crew BBQ, Granite City, Tahoe Joe’s Steakhouse, Bakers Square, and Real Urban Barbecue. It operates largely in the Midwest/Central and Southeastern U.S, based in Minnesota.

Company Website

Growth Opportunity

One of the reinventions taking place is the leading Famous Dave’s sit-down casual theme is being rolled out as a fast food, drive-thru concept, with the first opening of a test location in Salt Lake City during March 2022. The company’s goal is to reach a larger franchise audience/opportunity with higher margins on sales, while separate concerns actually run each restaurant.

Company Website

Other avenues to enhance sales include using ghost kitchens for home deliveries, often utilizing different brand locations to cook food for its other restaurant names. Management is also pushing $5 burgers and $30-$40 family meal deals. Getting into the big box retailers to sell gift cards is a great idea to drive traffic and collect higher-margin revenue upfront. Details of these efforts are found below, in the 2021 Annual Report, 10-K filing made a few weeks ago,

Value Proposition and Guest Frequency – We remain competitive with our value offerings across our brands and are committed to offering consistent, quality products at a compelling everyday value. We offered Famous Deals throughout fiscal year 2021 at Famous Dave’s and Granite City. The value offerings are intended to drive weekday dine-in traffic. Not only did the offers increase traffic, but we were also able to successfully maintain check averages and profit by requiring the purchase of a beverage with the purchase of a Daily Deal. Daily Deals were also instrumental in driving traffic back to Granite City locations in 2021. The Daily Deals promotion featured $5 burgers and many other food and drink specials. Granite City’s guests quickly responded to the offers and guest counts steadily increased. Daily Deals averaged well over 9,000 units per week sold and we have continued to maintain that volume into fiscal year 2022. All our brands benefited from the rollout of family-style meal options. Each of these promotional offers was built around value and convenience, allowing guests to feed a group of four for as little as $29.99. Bundled meal deals, 2-for-$20 offers, free delivery, and free dessert promotions were also used across the brands in fiscal year 2021 to further reinforce our value message. Daily Deals will be evaluated and updated quarterly to provide new product news to our guests and protect margins.

BBQ Holdings successfully launched a virtual concept, $5 Burgers, in all Company-owned Famous Dave’s locations in 2021. Village Inn and Bakers Square offer Village Bowls, a delivery-only virtual concept. This added incremental revenue at over 100 locations systemwide. Granite City and Johnny Carinos locations served as ghost kitchens for Famous Dave’s, resulting in over $8,000 in average weekly sales at top performing locations. Virtual concepts and ghost kitchens will be instrumental in 2022 to maximize revenue and improve operating margins for each brand.

In fiscal year 2021, Famous Dave’s and Granite City aggressively pursued additional gift card sales through retail expansion. Major retailers, such as Target, Amazon and Costco are now offering branded gift cards for both brands. Gift card sales increased 282% and 276% respectively, over 2020. Village Inn gift cards will be rolled out to retail locations in 2022 through strategic partnerships with Blackhawk Networks, Incomm, Costco and Sam’s Club.

Conservative Financial Setup

Management is very cost-conscious and risk averse. BBQ uses limited debt, and was ready to take advantage of the pandemic when it acquired a variety of its brands in 2020-21 at fire sales or giveaway valuations. Total system-wide restaurant counts rose from 145 to 316 during fiscal 2021, increasing total revenue 70% without much equity dilution. The company even reported net cash flow additions in both years on the business transactions, listed as “Gains on Bargain Purchase” of $3 million in FY2021 and $13 million in FY2020. Color me impressed.

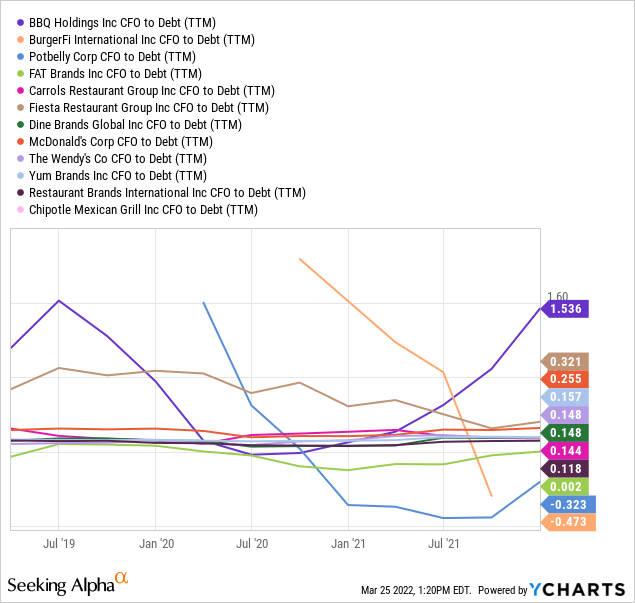

To highlight just how conservatively the balance sheet has been run at BBQ, we can review the cash flow to debt ratio vs. peers and competitors. Below is a graph over three years, before and during the pandemic, comparing BBQ Holdings to a variety of restaurant competitors in the casual dining and fast-food categories. The organization’s $15 million in total debt (outside of building lease obligations) is extremely low vs. $24 million in operating cash flow for 2021.

YCharts

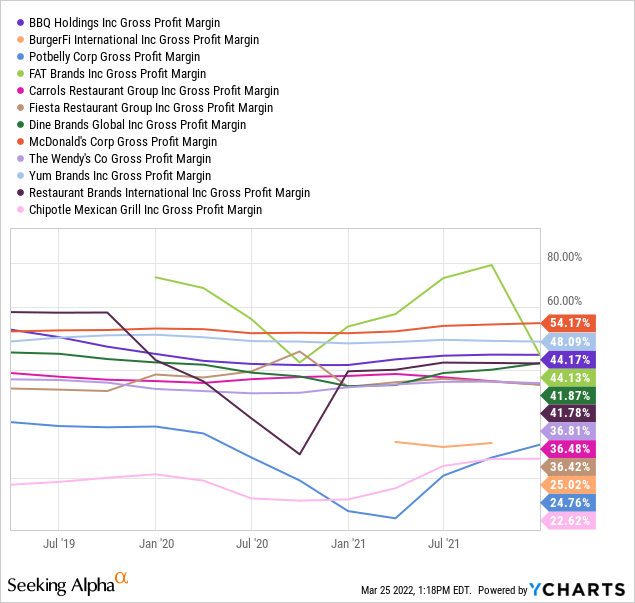

More good news, because assets have been bought on the cheap, and debt levels are nearly nonexistent, operating margins are near the top of the industry. Gross margins are drawn below vs. competitors.

YCharts

Low Valuation

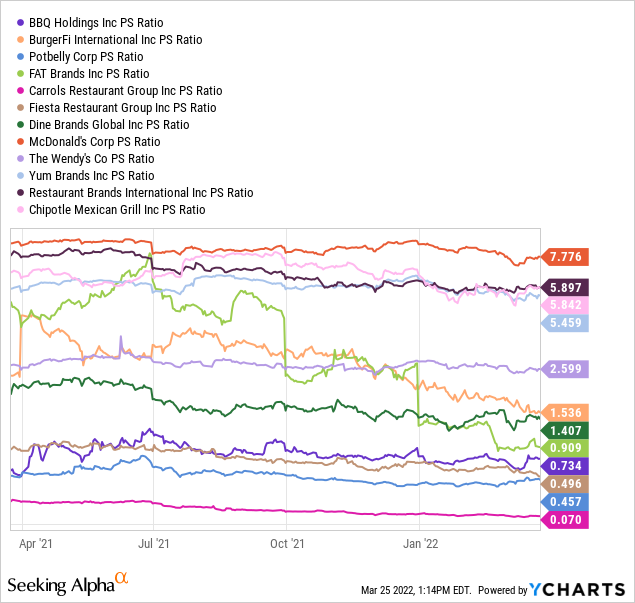

So, if growth in sales and income are coming, while the balance sheet is exceptionally strong, we would expect the valuation of the business to be on the high side vs. peers. Wrong! With limited investor knowledge or exposure to this rapidly-growing restaurant business, smart players can commit capital to BBQ at a bargain valuation, closer to the bottom of the pack. This disconnect presents a real opportunity for outsized gains for those paying attention.

Price to trailing sales is in the bottom quarter of the peer group, pictured below. And, the median average price to sales ratio of 1.5x is roughly double BBQ’s 0.73x number today. (Another comparison is the S&P 500 is priced closer to 3x trailing sales presently.)

YCharts

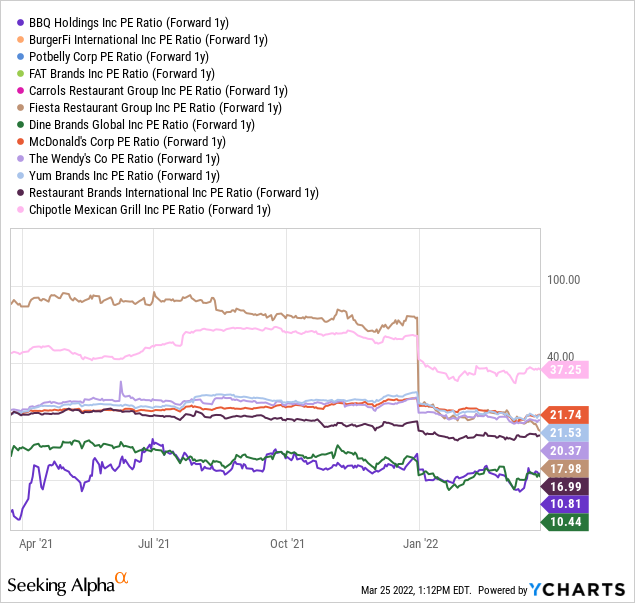

What about earnings? Well price to forward EPS estimates for 2022-23 are near the bottom of the barrel, looking at those with actual income projections for next year. 10.8x earnings on a forward 1-year basis is amazingly cheap, with a group average closer to 20x. (The S&P 500 is in the 18x to 20x range for 1-year forward income estimates.)

YCharts

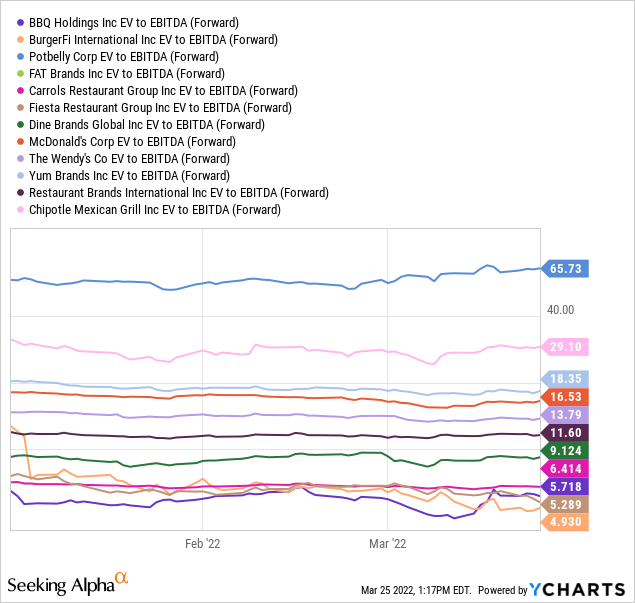

Lastly, when we include its super-low debt level and look forward to 2022 results, enterprise value to Wall Street projected earnings before interest, taxes, depreciation and amortization is absolutely demanding more research into the buy proposition. At 5.7x EV to EBITDA, BBQ Holdings is again priced at a better than 50% discount to the industry norm of 12x on a median average basis. (For another comparison, the blue-chip S&P 500 index is selling for roughly 16x “trailing” EV to EBITDA.)

YCharts

Technical Momentum

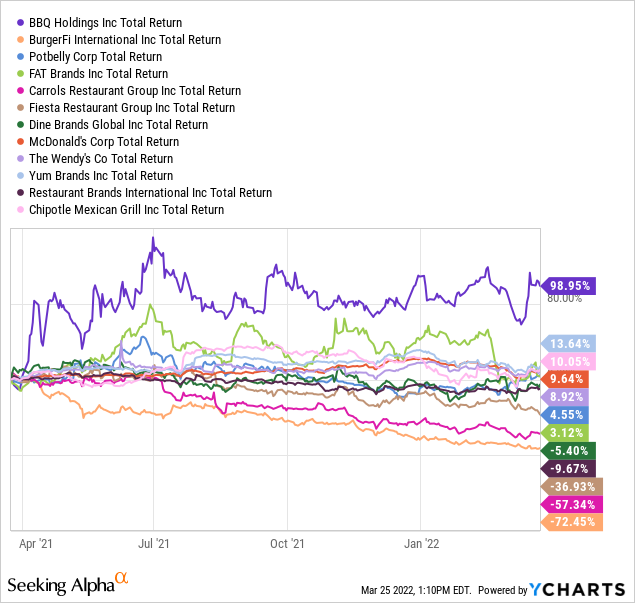

When I tell you BBQ’s stock performance has been leading its peers/competitors over the past 12-months, you shouldn’t be surprised. The +99% total return (price gain only for the company as it has no plans to pay a regular dividend) has roundly trounced the flat to fading gains in the restaurant industry since March 2021.

YCharts

The best news of all on the technical trading front is shares looks to still be under serious accumulation. After scoring very well in my momentum formulas vs. 4000+ other equity alternatives in the middle of February, the Russia/Ukraine war and fears over spiking gasoline prices in America dumped its price for several weeks. But, volume buying has allowed the quote to come roaring back into late March, boxed below in green.

On the 7-month chart below of daily price and volume trading activity, BBQ continues to outperform the S&P 500 index on Wall Street, by almost +15% over this span. The Negative Volume Index, a record of buying/selling trends on low volume days, has performed better than most restaurant concerns. And, a truly bullish signal from my perspective, On Balance Volume has been in a steady upmove for years. The heavy volume buying in March is clearly visible in this indicator.

Author Reference Point, StockCharts.com

Lastly, on the 5-year chart below of “weekly” trading action, we can review the low volatility, Average Directional Index scores of late 2021 and early 2022, circled in green. Using a 4-week average, two of the last three instances of ADX readings near 20 have proven great times to buy BBQ shares. To a degree this indicator marks an exhaustion of intermediate-term selling pressure.

Author Reference Points, StockCharts.com

Final Thoughts

The real upside story might be revealed later this year, if the Russia/Ukraine war can be ended with some sort of compromise. Assuming oil/gas prices recalibrate at far lower levels, and consumer confidence snaps back quickly, restaurant demand could be quite strong (if COVID-19 issues have ended of course). Under this scenario, BBQ sales and income could crush current estimates, and the stock quote might rise another 50% to 100% by early 2023.

My bullish target zone for the stock of $20-25 by the end of this year is almost entirely a function of raising today’s low valuation to a range more representative of the industry. Unexpected operating business growth would serve to spike the upside, in my view.

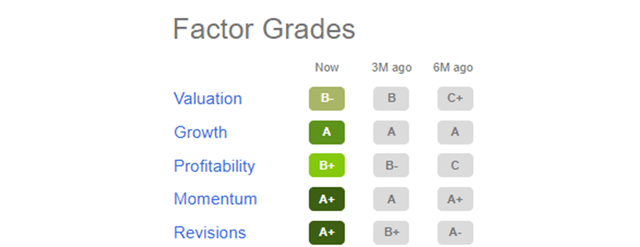

Seeking Alpha’s computers agree with my positive outlook for the stock. The Quant Ranking is superb right now, in the top 5% of restaurants and 6% of its sorting universe. SA Quant scores review actual technical momentum swings and earnings revisions by analysts vs. thousands of other equities.

Seeking Alpha Table – March 25th, 2022

Again, the BBQ Holdings Factor Grades table from Seeking Alpha highlights a company setup with “A” and “B” ratings vs. peers across the board. I believe this offers some margin of safety to offset the company’s still small size in an ultra-competitive industry.

Seeking Alpha Table – March 25th, 2022

What could go wrong for investors? I think the biggest risks to the operating business are mostly macroeconomic in nature. If oil/gas prices continue to rise and war news dominates the airwaves through summer, consumer spending at restaurants will likely lag. If labor remains difficult to find and food costs continue to spiral higher, currently projected operating income gains may not occur. Last but not least, rising interest rates could put the wealth effect into reverse, as equities, bonds and real estate could begin to decline instead of rise like during 2020-21. Such would be rotten news for consumer spending.

A final risk is the U.S. equity market could decline rapidly in a recession scenario, which would also serve to knock BBQ’s stock price lower. Even with all the positive motivations and decisions by management that are shareholder friendly, a weakened economy and Wall Street backdrop could pull this stock under $10 a share for a spell.

Weighing all the pros and cons, I believe a price around $15 per share may be well worth the investment risk. I am modeling potential upside to $30 in a best-case scenario, with downside to $9 in 12-18 months if the macroeconomic picture falls apart. With odds favoring some sort of advance, using valuations alone on static operating performance, 100% in upside potential vs. 40% downside seems to be an equation tilted in favor of longs and bulls. I rate the stock a Buy, and purchased a small position over the last week in my brokerage account.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment